India Luxury Cosmetics Market Size, Share, Trends and Forecast by Product Type, Type, Distribution Channel, End User, and Region, 2025-2033

India Luxury Cosmetics Market Overview:

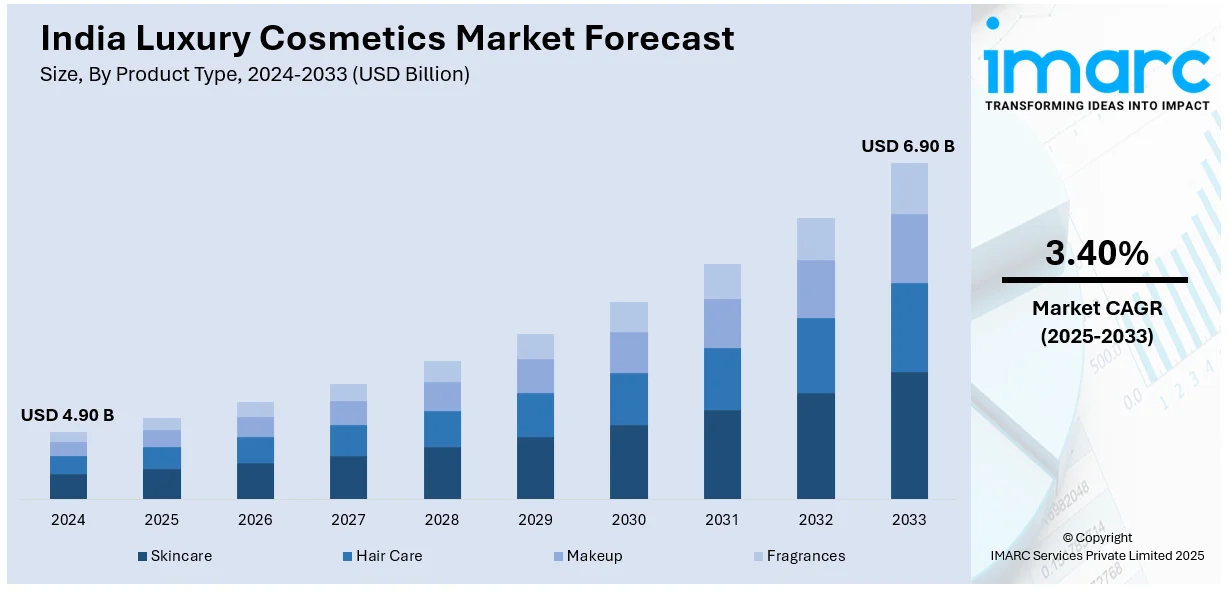

The India luxury cosmetics market size reached USD 4.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.90 Billion by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. The market is driven by the rising disposable income, growing urban demand, clean beauty trends and digital adoption. Additionally, the increasing popularity of premium skincare, makeup and grooming products across metros and tier 2 cities, and boosting brand investments and innovations are also contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.90 Billion |

| Market Forecast in 2033 | USD 6.90 Billion |

| Market Growth Rate 2025-2033 | 3.40% |

India Luxury Cosmetics Market Trends:

Increasing Population of Upper Middle Class

India’s expanding upper-middle class and affluent urban population are reshaping the luxury cosmetics landscape. As incomes rise and lifestyles become more aspirational premium beauty products are gaining widespread acceptance. This shift is significantly driving India luxury cosmetics market growth as consumers increasingly prioritize quality, brand prestige and exclusivity. According to a report published by IBEF, India’s middle class is expected to rise from 31% in 2020-21 to 61% by 2047, growing from 432 million to 1.02 billion. By 2030-31, it will reach 715 million. This shift will drive demand for quality products and necessitate job creation and education opportunities. Urban professionals particularly in metro and tier 1 cities are investing in high-end skincare, makeup and fragrances as part of their daily grooming routines. Luxury cosmetic brands are leveraging this trend by introducing targeted campaigns, personalized services and exclusive launches. The influence of global beauty standards, travel exposure and social media is further accelerating demand. With more consumers willing to pay for efficacy, ingredients and packaging the market is moving beyond functionality toward indulgence and self-expression. This upward trend is playing a critical role in expanding the overall India luxury market share.

To get more information on this market, Request Sample

Clean and Sustainable Luxury

Clean and sustainable luxury is becoming a major purchase driver in India’s premium beauty segment. Consumers especially millennials and Gen Z are increasingly prioritizing cruelty-free, organic and ecofriendly formulations. Luxury cosmetic brands are responding with products free from parabens, sulfates and synthetic fragrances often using ethically sourced plant-based ingredients. For instance, in September 2023, EO Naturals launched by Siddhayu International introduced a premium skincare range that blends natural ingredients with luxury. The brand is dedicated to environmental sustainability and offers holistic products including body lotions and foaming face washes all designed to enhance self-care while supporting local communities. Packaging is also shifting toward recyclable, refillable and minimalistic designs to reduce environmental impact. Certifications like vegan, non-toxic and sustainable sourcing are gaining consumer trust and brand loyalty. This shift is not limited to international players Indian brands are also launching high-end clean beauty lines to tap into this evolving preference. Social media and influencer advocacy for conscious beauty are further accelerating awareness and demand. As sustainability becomes central to brand value clean beauty is expected to play a defining role in shaping the India luxury cosmetics market outlook.

India Luxury Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, type, distribution channel, and end user.

Product Type Insights:

- Skincare

- Hair Care

- Makeup

- Fragrances

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skincare, hair care, makeup and fragrances.

Type Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes organic and conventional.

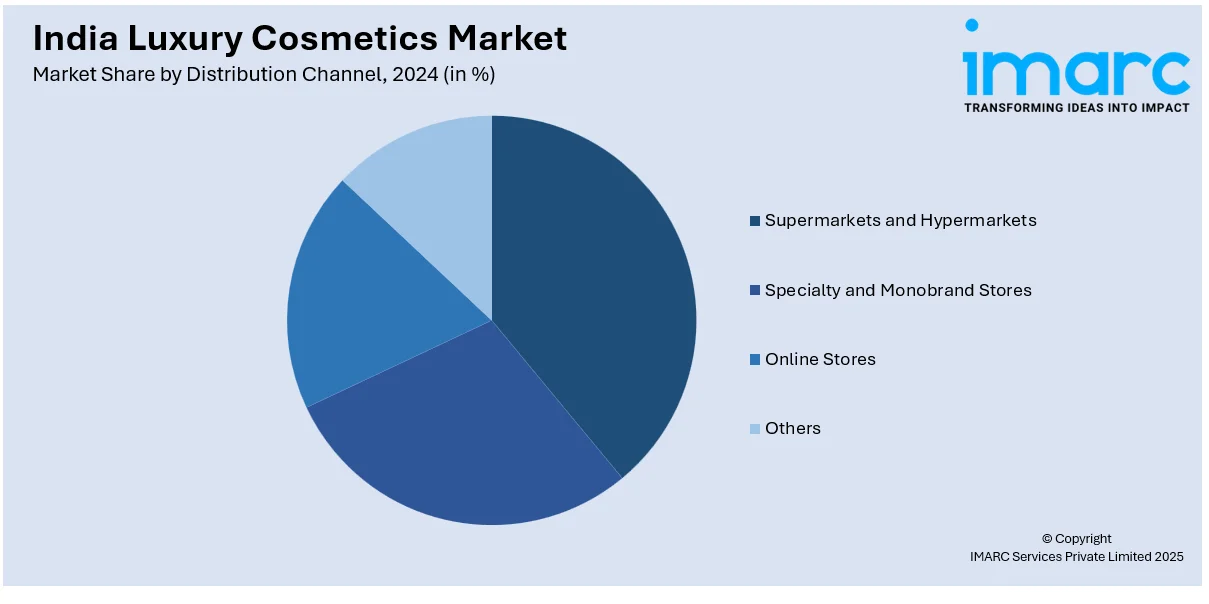

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty and Monobrand Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty and monobrand stores, online stores and others.

End User Insights:

- Male

- Female

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes male and female.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Luxury Cosmetics Market News:

- In October 2024, Reliance's beauty platform Tira launched the luxury skincare brand Augustinus Bader in India featuring innovative TFC8 technology. The collection is exclusively available online and in select stores in major cities. Tira aims to cater to India's beauty connoisseurs by offering high-performance skincare options tailored to individual needs.

- In July 2024, Cosmus Skincare launched in India, offering innovative solutions for local skin concerns using advanced technology and natural ingredients. The brand emphasizes holistic, effective treatments tailored for Indian skin, focusing on long-term health rather than trends. Their unique formulations include turmeric and rice extracts for targeted results.

India Luxury Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skincare, Hair Care, Makeup, Fragrances |

| Types Covered | Organic, Conventional |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty and Monobrand Stores, Online Stores, Others |

| End Users Covered | Male, Female |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India luxury cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India luxury cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India luxury cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury cosmetics market in India was valued at USD 4.90 Billion in 2024.

The India luxury cosmetics market is projected to exhibit a CAGR of 3.40% during 2025-2033, reaching a value of USD 6.90 Billion by 2033.

Rising disposable incomes, increased beauty consciousness, and growing influence of global fashion trends are key factors driving the India luxury cosmetics market. Urban consumers are increasingly opting for premium skincare and makeup products, supported by expanding retail presence, e-commerce accessibility, and celebrity-driven brand endorsements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)