India Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2026-2034

India Luxury Fashion Market Summary:

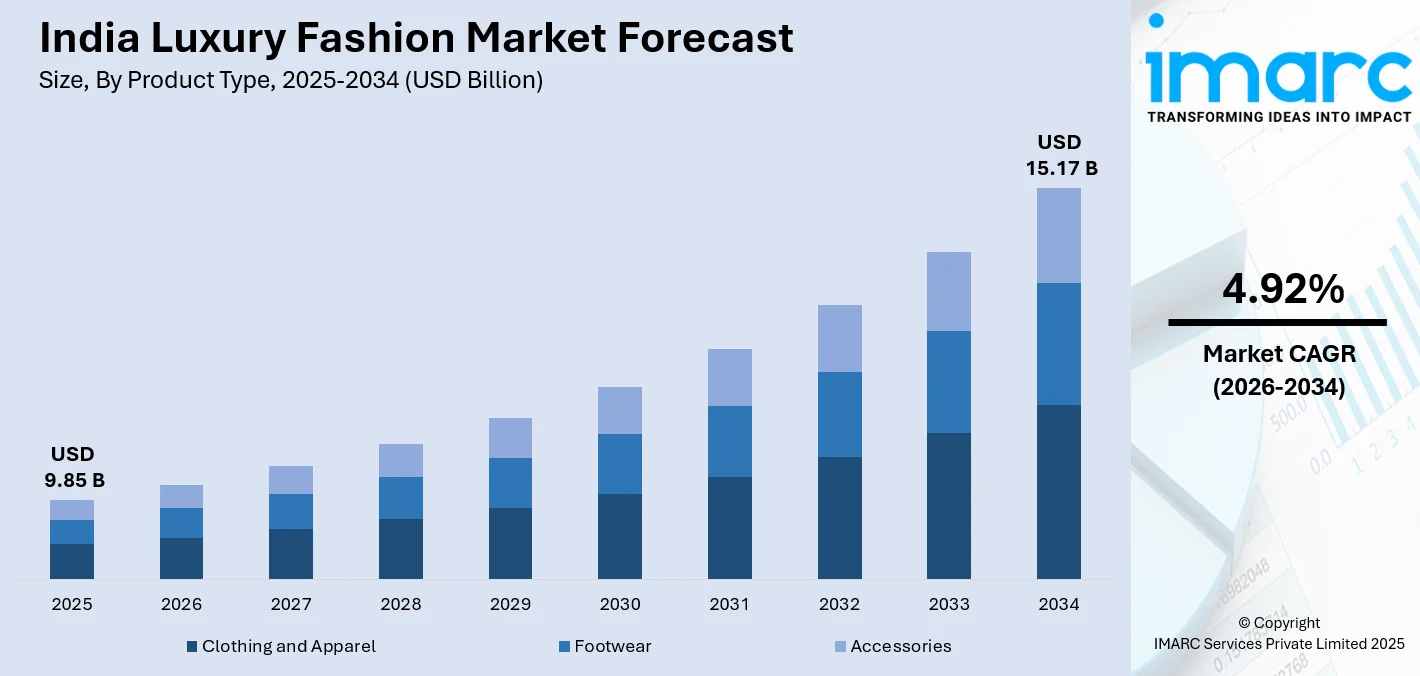

The India luxury fashion market size was valued at USD 9.85 Billion in 2025 and is projected to reach USD 15.17 Billion by 2034, growing at a compound annual growth rate of 4.92% from 2026-2034.

The India luxury fashion market is experiencing robust expansion, driven by rising affluence among urban consumers, evolving lifestyle preferences, and increasing brand consciousness across metropolitan areas. Growing exposure to global fashion trends through digital platforms and social media influencers is reshaping consumer aspirations, while the expansion of premium retail infrastructure is enhancing accessibility to luxury apparel, footwear, and accessories throughout the country.

Key Takeaways and Insights:

- By Product Type: Clothing and apparel dominate the market with a share of 61% in 2025, due to a robust consumer inclination towards designer clothing, rising demand for high-quality ethnic and western apparel, and surging wedding-related expenditures fueling sustained growth across the segment.

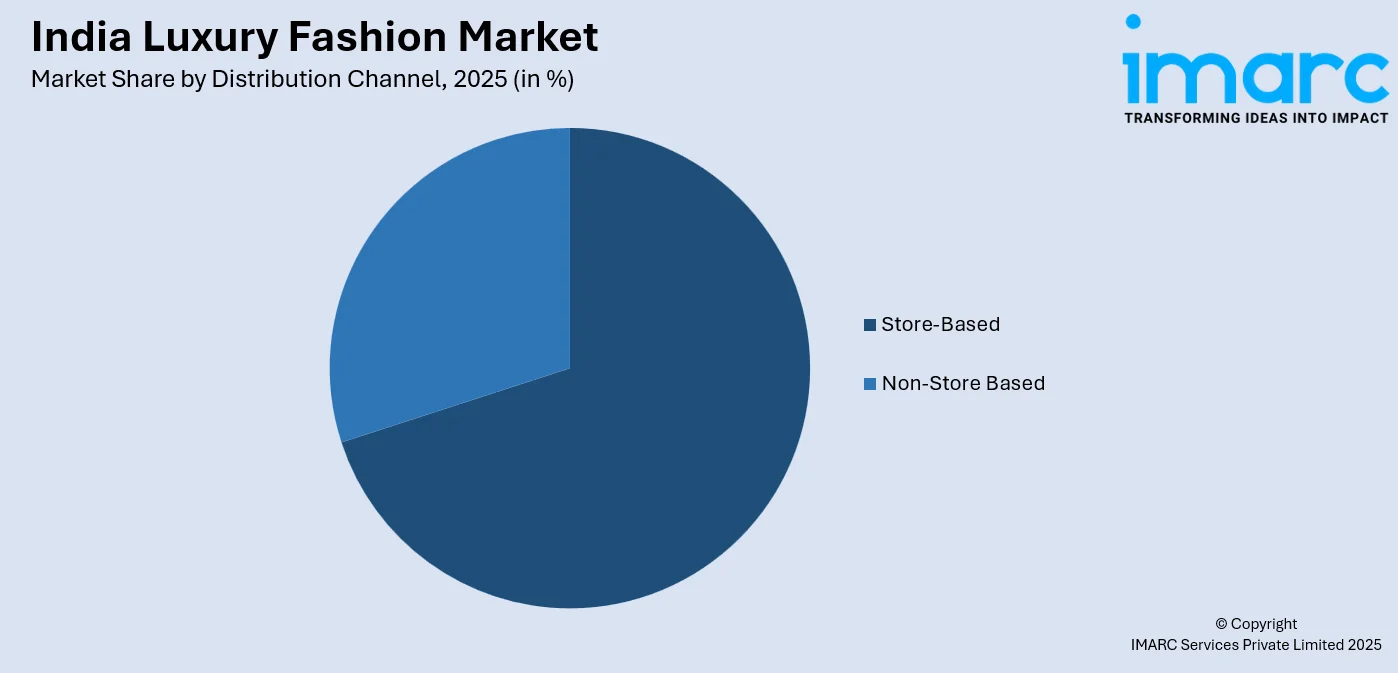

- By Distribution Channel: Store-based leads the market with a share of 70% in 2025. This dominance stems from user preference for tactile experiences, customized styling services, unique in-store collections, and the upscale atmosphere provided by luxury retail stores.

- By End User: Women exhibit a clear dominance in the market with 52% share in 2025, reflecting strong purchasing power among female consumers, growing workforce participation, rising fashion consciousness, and significant demand for designer wear across occasions.

- By Region: North India represents the largest region with 30% share in 2025, driven by concentration of affluent consumers in Delhi-NCR, Chandigarh, and Lucknow, presence of premium retail destinations, and strong wedding-related luxury fashion consumption.

- Key Players: Key players drive the India luxury fashion market by expanding retail footprints across metropolitan and tier-two cities, introducing exclusive collections tailored for Indian consumers, and strengthening omnichannel capabilities. Their investments in digital platforms, influencer collaborations, and experiential flagship stores enhance brand visibility and consumer engagement across diverse demographic segments.

To get more information on this market Request Sample

The India luxury fashion market is witnessing transformative growth, propelled by fundamental shifts in consumer demographics and spending patterns. The expanding affluent population, characterized by rising disposable incomes and heightened aspirations for premium lifestyle products, is driving substantial demand across luxury apparel, accessories, and footwear categories. As per a report named “The rise of ‘Affluent India’” published by Goldman Sachs Research, the affluent consumer cohort in India is expected to grow from 60 Million in 2023 to 100 Million by 2027, representing significant expansion in the potential customer base for luxury brands. Urbanization and metropolitan development have created concentrated pockets of high-net-worth individuals seeking exclusive fashion offerings that reflect their social status and personal identity. Digital transformation has revolutionized brand discovery and engagement, with social media platforms enabling luxury houses to connect with fashion-conscious consumers through immersive content and influencer partnerships. The cultural significance of fashion in celebrations, weddings, and social gatherings continues to sustain robust demand, while evolving preferences towards sustainable and ethically produced luxury items are reshaping market dynamics.

India Luxury Fashion Market Trends:

Rising Demand for Sustainable and Ethical Luxury Fashion

Indian consumers are increasingly prioritizing sustainability in their luxury purchases, driving demand for ethically produced garments and eco-conscious fashion choices. Affluent buyers are seeking transparency in supply chains, favoring brands that utilize organic materials, traditional handloom techniques, and fair labor practices. This shift reflects broader environmental awareness among millennial and generation Z consumers who view responsible consumption as an extension of personal values and social identity, thus fueling the market expansion.

Digital Transformation and Omnichannel Retail Evolution

Luxury fashion brands are embracing digital technologies to enhance customer engagement through virtual try-on experiences, augmented reality (AR) features, and personalized recommendations powered by artificial intelligence (AI). As per IMARC Group, the India AR market size reached USD 2.8 Billion in 2024. The integration of online and offline channels enables seamless shopping journeys, with consumers discovering products digitally before experiencing them in physical stores. Social commerce and influencer-driven marketing are reshaping brand visibility and purchase decisions among digitally native consumers.

Expansion into Tier-Two and Tier-Three Cities

Luxury fashion consumption is expanding beyond traditional metropolitan markets into emerging urban centers across India. Rising prosperity in secondary cities is creating new consumer segments with aspirations for premium products and designer brands previously accessible only in major metros. This geographical diversification is prompting brands to establish retail presence and develop targeted marketing strategies for consumers in tier-two and tier-three cities. Improved digital connectivity is further accelerating luxury brand awareness and demand across these emerging urban centers.

Market Outlook 2026-2034:

The India luxury fashion market demonstrates strong growth potential, driven by favorable demographic transitions, rising affluence, and evolving consumer preferences towards premium lifestyle products. The increasing number of high-net-worth individuals and expanding upper-middle-class population present substantial opportunities for luxury brands seeking market expansion. The market generated a revenue of USD 9.85 Billion in 2025 and is projected to reach a revenue of USD 15.17 Billion by 2034, growing at a compound annual growth rate of 4.92% from 2026-2034. Digital innovations, omnichannel retail strategies, and experiential marketing approaches will shape competitive dynamics, while sustainability considerations and personalization capabilities increasingly influence consumer brand preferences. The continued development of premium retail infrastructure and expansion of international brands into new geographic markets will further accelerate growth trajectories throughout the forecast period.

India Luxury Fashion Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Clothing and Apparel |

61% |

|

Distribution Channel |

Store-Based |

70% |

|

End User |

Women |

52% |

|

Region |

North India |

30% |

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

Clothing and apparel dominate with a market share of 61% of the total India luxury fashion market in 2025.

Clothing and apparel command the largest share of the India luxury fashion market due to their strong cultural and lifestyle relevance across diverse consumer segments. Luxury garments play a central role in weddings, festivals, business events, and social gatherings, where appearance and status are highly valued. Designer ethnic wear, premium western outfits, and couture collections attract affluent consumers seeking exclusivity and superior craftsmanship. Frequent demand for occasion-based clothing ensures repeat purchases, making apparel a core revenue generator for luxury fashion brands operating in India.

The segment also benefits from rising fashion awareness, growing disposable incomes, and exposure to global trends among urban consumers. Indian buyers increasingly value premium fabrics, intricate detailing, and limited-edition designs that reflect individuality. The coexistence of international luxury labels and established domestic designers strengthens market depth and choice. Additionally, expanding luxury retail networks and personalized in-store experiences encourage higher spending on apparel, reinforcing its dominant position within the India luxury fashion landscape.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Store-Based

- Non-Store Based

Store-based leads with a share of 70% of the total India luxury fashion market in 2025.

Store-based maintains dominant position in the India luxury fashion market, as consumers prioritize tactile experiences, personalized styling consultations, and the premium ambiance offered by physical boutiques. Flagship stores in premium destinations provide exclusive collections and immersive brand experiences that reinforce customer loyalty. In March 2025, Luxury fashion label Bhawna Rao launched its flagship store in Chhattarpur, Delhi, providing a unique, tailored shopping experience. Created for women who value classic sophistication, the store merges opulent Baroque-style decor with tailored couture offerings, transforming the luxury shopping experience.

The expansion of luxury retail infrastructure across India has significantly enhanced store-based distribution capabilities, with dedicated malls and high-street locations offering concentrated access to premium fashion brands. Luxury department stores and multi-brand outlets provide curated selections that enable cross-category shopping while maintaining brand prestige. Personal shopper services, alteration facilities, and exclusive previews available through physical retail channels continue to differentiate store-based experiences from online alternatives, sustaining consumer preference for in-person luxury fashion purchases.

End User Insights:

- Men

- Women

- Unisex

Women exhibit a clear dominance with a 52% share of the total India luxury fashion market in 2025.

Women represent the primary consumer segment in the India luxury fashion market, driven by strong purchasing power, increasing workforce participation, and growing fashion consciousness across age groups. According to the Periodic Labor Force Survey (PLFS) 2023–24, the Female Labor Force Participation Rate (FLFPR) in India was 41.7%, an increase from 23.3% in 2017–18. The segment benefits from diverse consumption occasions, including bridal wear, professional attire, and social event dressing that create multiple purchase opportunities throughout the year.

Women increasingly view luxury fashion as a form of self-expression and confidence building rather than occasional indulgence. Exposure to global trends through digital media, fashion influencers, and celebrity endorsements has elevated brand awareness and aspirational buying behavior. Luxury brands are responding with wider product assortments, inclusive sizing, and collections tailored to Indian tastes, blending contemporary styles with traditional aesthetics. Growing preference for premium handbags, footwear, and accessories further boosts average spending per consumer.

Regional Insights:

- North India

- South India

- East India

- West India

North India represents the leading segment with a 30% share of the total India luxury fashion market in 2025.

North India dominates the luxury fashion market due to concentration of affluent consumers in Delhi-NCR, presence of premium retail destinations, and strong cultural emphasis on fashion during weddings and celebrations. The region hosts major luxury shopping destinations, including DLF Emporio and Chanakya mall that attract high-net-worth individuals seeking exclusive fashion offerings. Consumer spending patterns in North India reflect strong preferences for designer ethnic wear, luxury accessories, and premium western fashion across both traditional and contemporary categories.

Cities like Chandigarh, Lucknow, and Jaipur are emerging as significant secondary markets with growing demand for luxury fashion products among affluent populations. The region's vibrant wedding industry sustains year-round demand for designer bridal wear and celebration attire, while corporate presence in Delhi-NCR drives professional luxury fashion consumption among business executives and entrepreneurs. Delhi was anticipated to witness more than 4.5 lakh marriages during November-December 2024, based on information from the Confederation of All India Traders.

Market Dynamics:

Growth Drivers:

Why is the India Luxury Fashion Market Growing?

Rising Affluence and Expanding High-Net-Worth Population

The India luxury fashion market is experiencing sustained growth, driven by the rapid expansion of the affluent consumer segment and increasing purchasing power among upper-middle-class populations. Economic development has created significant wealth accumulation across metropolitan areas and emerging urban centers, enabling greater discretionary spending on premium fashion products. Indian private consumption has demonstrated robust growth trajectory, expanding consumer capacity for luxury purchases beyond essential categories. The growing number of entrepreneurs, corporate executives, and professionals with substantial disposable incomes has created a sizeable customer base for high-end fashion brands seeking market expansion. Young affluent consumers exhibit strong brand consciousness and willingness to invest in quality apparel that reflects their social status and personal identity. Urbanization continues to concentrate wealth in metropolitan areas while simultaneously creating prosperous consumers in tier-two cities who aspire to luxury lifestyles. This demographic transformation fundamentally reshapes market dynamics by expanding addressable audiences for luxury fashion offerings across diverse geographic markets.

Digital Transformation and Social Media Influence

Digital platforms have revolutionized luxury fashion discovery, engagement, and purchasing behaviors among Indian consumers, creating unprecedented opportunities for brand visibility and customer acquisition. Social media channels enable immersive storytelling that connects emotionally with fashion-conscious audiences while influencer collaborations amplify brand reach across diverse demographic segments. The integration of AR and virtual try-on technologies enhances online shopping experiences by enabling consumers to visualize products before purchase, reducing hesitation associated with premium price points. E-commerce platforms have democratized access to luxury brands beyond traditional metropolitan markets, enabling consumers in smaller cities to explore and purchase designer products previously unavailable locally. As per IBEF, in FY25, the India e-commerce industry reached a GMV of around INR 1.19 lakh crore (USD 14 Billion), indicating a 12% year-over-year increase. Live commerce and video shopping experiences create engaging purchase journeys that replicate aspects of in-store consultations while offering convenience and accessibility. Digital marketing capabilities enable precise targeting of affluent consumer segments through data-driven personalization that enhances relevance and conversion rates.

Expansion of International Brands and Premium Retail Infrastructure

Global luxury fashion houses are accelerating their entry and expansion strategies in India, recognizing substantial growth potential and favorable consumer demographics compared to mature markets. The development of premium retail destinations, including dedicated luxury malls and high-street boutiques, provides appropriate environments for brand positioning and customer experience delivery. International brands are establishing flagship stores, franchise partnerships, and joint ventures with local retail groups to navigate regulatory requirements while accessing distribution networks and market expertise. Strategic collaborations enable brands to introduce exclusive collections tailored for Indian consumers while maintaining global brand standards and prestige positioning. The presence of diverse international labels across fashion categories creates competitive dynamics that elevate overall market sophistication and consumer expectations. Luxury retail spaces are evolving beyond transactional environments into experiential destinations featuring personalized services, exclusive events, and brand immersion opportunities.

Market Restraints:

What Challenges is the India Luxury Fashion Market Facing?

High Import Duties and Tax Burden

Luxury fashion products in India face substantial taxation, including elevated import duties and goods and services tax rates that significantly increase retail prices compared to international markets. These cost differentials encourage affluent consumers to make luxury purchases during international travel to destinations like Dubai, Singapore, and London where prices are comparatively lower. The tax burden creates pricing challenges for brands attempting to attract aspirational middle-class consumers who represent potential growth opportunities.

Counterfeiting and Grey Market Challenges

The prevalence of counterfeit luxury fashion products poses significant challenges for legitimate brands seeking to protect intellectual property and maintain premium positioning in the Indian market. Sophisticated replicas available through physical markets and online platforms undermine brand equity while reducing potential sales from consumers who accept lower-quality alternatives at reduced prices. Grey market channels involving parallel imports and unauthorized distribution create pricing inconsistencies and warranty complications that affect consumer confidence.

Price Sensitivity and Limited Luxury Awareness Among New Consumers

Despite rising incomes, a large share of Indian consumers remains highly price-conscious, which slows the adoption of luxury fashion beyond elite segments. Limited exposure to luxury craftsmanship, brand heritage, and value propositions in non-metro markets restricts deeper market penetration. Brands must invest heavily in consumer education, storytelling, and marketing to justify premium pricing, increasing customer acquisition costs and extending the time required to build a loyal luxury consumer base.

Competitive Landscape:

The India luxury fashion market exhibits a moderately fragmented competitive structure, characterized by diverse international luxury houses alongside established domestic fashion brands. Market participants pursue differentiated strategies encompassing exclusive flagship retail, department store partnerships, franchise arrangements, and direct-to-consumer digital channels. Competition centers on brand heritage, design innovation, customer experience excellence, and omnichannel capabilities that enable seamless engagement across physical and digital touchpoints. Participants invest substantially in experiential retail environments, personalized styling services, and exclusive collections tailored for Indian consumer preferences. Strategic partnerships with local retail conglomerates facilitate market access while enabling navigation of regulatory frameworks and distribution complexities.

Recent Developments:

- In February 2025, Parisian fashion brand Maje officially entered the Indian market with the opening of its first flagship store at Jio World Drive, Mumbai, in partnership with Reliance Brands Limited (RBL). The brand offered its unique mix of modern fashion and accessible luxury to Indian shoppers.

- In September 2025, Brand Concepts Ltd. collaborated with the high-end streetwear brand Off-White to introduce the label in India, signaling the company's foray into the luxury fashion market. This tactical move sought to leverage the growing interest in global luxury brands among Indian shoppers.

India Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India luxury fashion market size was valued at USD 9.85 Billion in 2025.

The India luxury fashion market is expected to grow at a compound annual growth rate of 4.92% from 2026-2034 to reach USD 15.17 Billion by 2034.

Clothing and apparel dominated the market with a share of 61%, driven by strong consumer demand for designer garments, premium ethnic wear, and growing wedding-related purchases across metropolitan and emerging urban markets.

Key factors driving the India luxury fashion market include rising affluence among urban consumers, digital transformation enabling broader brand access, expanding retail infrastructure, and increasing brand consciousness driven by social media influence and celebrity endorsements.

Major challenges include high import duties and taxation increasing retail prices, prevalence of counterfeit products undermining brand equity, limited premium retail infrastructure in secondary cities, consumer price sensitivity, and competition from duty-free shopping during international travel.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)