India Luxury Interior Design Market Size, Share, Trends and Forecast by Type, Material, Style, Distribution Channel, Application and Region, 2025-2033

India Luxury Interior Design Market Overview:

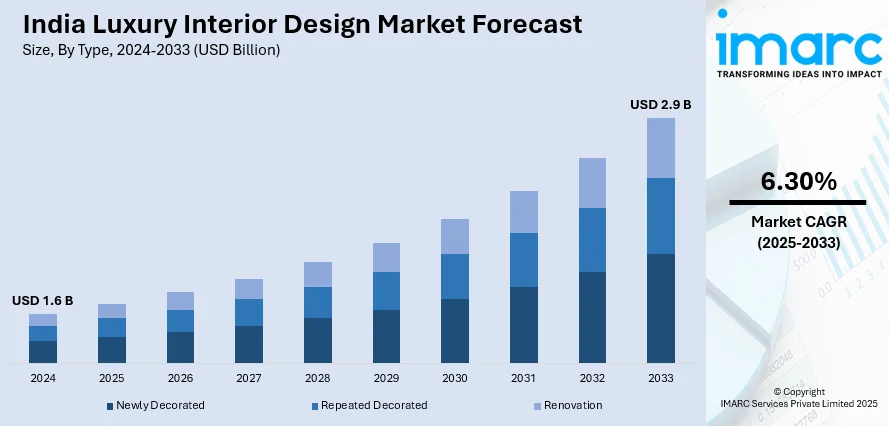

The India luxury interior design market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. The market is driven by increasing disposable incomes, rapid urbanization, and growing upper-middle and high-income class. The need for customized, high-end living areas drives demand for high-end materials, custom-made furniture, and global design influences. Technological innovation, such as smart home integration, impact of social media and international travel is also influencing consumer preferences, driving luxury upgrades. While real estate development, especially in urban regions, increases the demand for luxurious interiors, further increasing the India luxury interior design market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Market Growth Rate 2025-2033 | 6.30% |

India Luxury Interior Design Market Trends:

Growing Preference for Personalization and Bespoke Designs

One of the country's significant trends is the growing desire for bespoke and personalized interiors that respond to personal tastes and lifestyles. High-net-worth individuals and homeowners are no longer content with stock solutions. Rather, they want customized environments that echo their personalities, cultural affinity, and taste in aesthetics. This encompasses hand-crafted furniture, personally selected materials, and carefully curated artwork that infuses a singular narrative into each room. The need for uniqueness is fueling collaboration between clients and interior designers on a far more profound scale, with several among them choosing to collaborate hand-in-hand with boutique studios or celebrated designers to make their homes truly unique. Cultural influence is also important, with numerous clients weaving traditional Indian craftsmanship, such as master wood carvings or hand-woven fabrics, into modern environments. The outcome is a fusion of international luxury and local authenticity that characterizes contemporary Indian grandeur.

To get more information on this market, Request Sample

Fusion of Global Styles with Indian Elements

Another dominant trend in India’s luxury interior design sector is the fusion of global design styles with indigenous Indian elements. While many affluent Indians are inspired by international aesthetics—such as Scandinavian minimalism, Italian modernism, or French classicism—they are increasingly integrating local materials, art forms, and architectural motifs into their interiors. This global-local blend creates a sophisticated yet culturally rooted ambiance. For instance, a minimalist marble kitchen might sit adjacent to a living room adorned with Rajasthani jharokhas or hand-painted Pichwai artwork. Designers are creatively merging traditional Indian color palettes, textures, and motifs with sleek, contemporary lines to cater to a clientele that values both heritage and innovation. This trend highlights a deeper appreciation for India’s artisanal legacy and a conscious effort to sustain it within modern, luxury contexts. It also reflects a larger movement toward cultural authenticity in luxury living, where heritage becomes a mark of refinement rather than a contrast to modernity.

Technology and Sustainability in Luxury Interiors

Technology and sustainability are also becoming significant factors influencing the India luxury interior design market growth. Customers today are looking beyond aesthetics to include functionality, wellness, and environmental consciousness in their living spaces. Smart home features—like automated lighting, climate control, and security systems—are now standard expectations in high-end interiors. While these elements enhance convenience and efficiency, they also add a layer of sophistication. At the same time, sustainability has emerged as a core design principle, with increasing use of eco-friendly materials, energy-efficient solutions, and responsibly sourced furnishings. Luxury consumers are more aware of their environmental footprint and are actively seeking ways to make ethical choices without compromising on elegance. Designers are responding with innovations such as reclaimed wood furniture, natural fiber textiles, and energy-saving lighting schemes. This integration of technology and sustainability reflects a holistic approach to luxury—one that prioritizes comfort, innovation, and responsibility in equal measure.

India Luxury Interior Design Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, material, style, distribution channel, and application.

Type Insights:

- Newly Decorated

- Repeated Decorated

- Renovation

The report has provided a detailed breakup and analysis of the market based on the type. This includes newly decorated, repeated decorated, and renovation.

Material Insights:

- Textiles

- Wood

- Metals

- Glass

- Ceramics

- Plastics

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes textiles, wood, metals, glass, ceramics, plastics, and others.

Style Insights:

- Modern

- Traditional

- Rustic

- Vintage

- Classical

- Others

The report has provided a detailed breakup and analysis of the market based on the style. This includes modern, traditional, rustic, vintage, classical, and others.

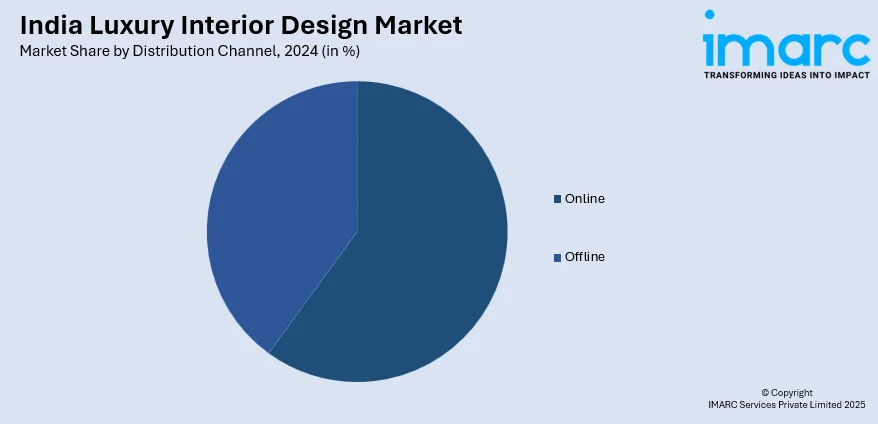

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Application Insights:

- Residential

- Commercial

- Hospitality

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, hospitality, retail, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Luxury Interior Design Market News:

- In March 2025, Gauri Khan extended her reach by partnering with Sussanne Khan’s The Charcoal Project (TCP). The third floor of TCP, located on HITEC City Road in Jubilee Hills, is home to Gauri Khan Designs (GKD), featuring upscale furniture and decor, comprising bedroom and living room arrangements with bespoke screens, hand-painted wall coverings, eye-catching mirrors, and modern lighting fixtures.

- In August 2024, India's top furniture brand, Durian, made its debut in God's Own Country, introducing its famous style and quality to Thiruvananthapuram. This signifies the brand's inaugural entry into Kerala, making high-end furniture more attainable than ever for locals. The new shop features a prime spot on Kesavadasapuram-Ulloor Road, encouraging customers to discover Durian's stunning furniture selections. The store, owned by Biju Thomas, Director of Thomson Group, officially commenced operations on July 24th, 2024.

India Luxury Interior Design Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Newly Decorated, Repeated Decorated, Renovation |

| Materials Covered | Textiles, Wood, Metals, Glass, Ceramics, Plastics, Others |

| Styles Covered | Modern, Traditional, Rustic, Vintage, Classical, Others |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Residential, Commercial, Hospitality, Retail, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India luxury interior design market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India luxury interior design market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India luxury interior design industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury interior design market in India was valued at USD 1.6 Billion in 2024.

The India luxury interior design market is projected to exhibit a CAGR of 6.30% during 2025-2033, reaching a value of USD 2.9 Billion by 2033.

The major key factors propelling the India luxury interior design market include surge in high-net-worth individuals seeking bespoke, premium living environments; rapid urbanization and luxury real estate development in major metros; and growing tech adoption—like AR/VR for immersive design—alongside a shift toward sustainability and global design trends, significantly enhancing India luxury interior design market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)