India Luxury Perfume Market Size, Share, Trends and Forecast by Price, Distribution Channel, End User, and Region, 2025-2033

India Luxury Perfume Market Overview:

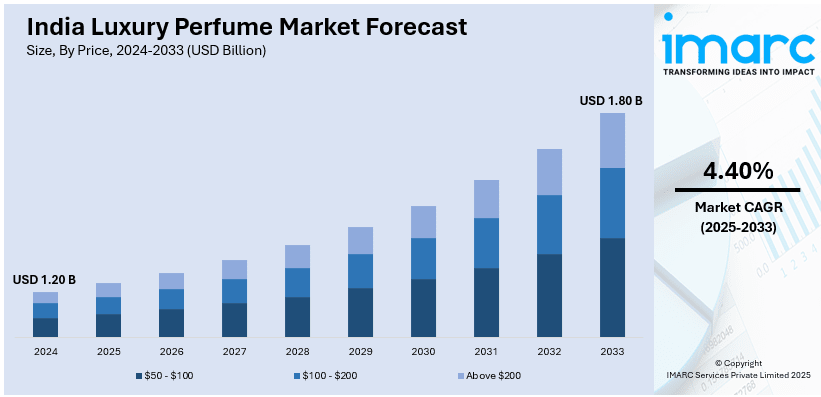

The India luxury perfume market size reached USD 1.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.80 Billion by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. The India luxury perfume market is driven by rising disposable incomes, increasing brand consciousness, greater exposure to global luxury trends through digital media and international travel, expanding retail presence of premium brands, and a greater preference for personalized, high-end fragrances that serve as status symbols and expressions of individuality.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.20 Billion |

| Market Forecast in 2033 | USD 1.80 Billion |

| Market Growth Rate 2025-2033 | 4.40% |

India Luxury Perfume Market Trends:

Economic Growth and Rising Disposable Incomes

India's strong economic growth has played an important role in the development of its luxury fragrance market. The country's Gross Domestic Product (GDP) has been continuously growing, with the result that the purchasing power of its population has surged. This economic boom has especially favorably impacted the middle and upper-middle classes, who have had more disposable incomes to spend on luxury items, including fragrances. India's GDP expanded at a rate of 8.7% in the fiscal year 2021-2022, as per the Ministry of Statistics and Programme Implementation. This has found expression in expanding disposable income levels, allowing consumers to spend more on discretionary products. The Annual Survey of Industries 2020-21 noted that the manufacturing industry, encompassing the production of luxury items, recorded impressive progress, which suggests an upsurge in demand for such products. This influx of disposable income has created a change in buying behavior, as more people engage in luxury and premium products as a form of self-expression and status symbol.

To get more information on this market, Request Sample

Influence of Western Lifestyle and Fashion Trends

Globalization of media and the availability of digital platforms have made Indian consumers aware of Western lifestyles and fashion trends, influencing their purchasing habits to a great extent. The urge to adopt Western brands producing luxury perfumes is further creating a positive market outlook. The market research of the Ministry of Tourism suggests that international travel by Indians has been significantly on the rise, which has exposed them to international cultures and high-end products. Domestic consumption patterns have been impacted by this exposure, with consumers demanding products that represent their international exposure and aspirations. Also, the Indian luxury market is an area of concern for multinational companies looking to get a foot into emerging economies. According to the Ministry of Commerce and Industry, foreign direct investment (FDI) into the retailing segment, covering luxury items as well, has increased, thereby enabling international luxury perfume brands to open up operations in India. This has presented consumers with an even larger range of options, further enhancing the demand for luxury perfumes.

India Luxury Perfume Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on price, distribution channel, and end user.

Price Insights:

- $50 - $100

- $100 - $200

- Above $200

The report has provided a detailed breakup and analysis of the market based on the price. This includes $50-$100, $100-$200, and above $200.

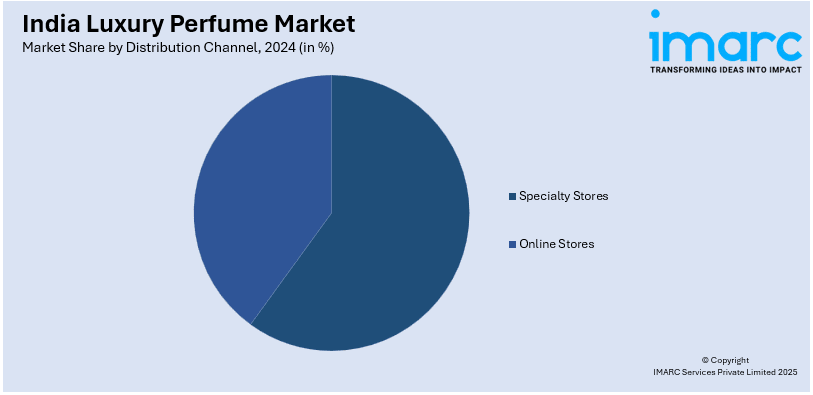

Distribution Channel Insights:

- Specialty Stores

- Online Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty stores and online stores.

End User Insights:

- Male

- Female

- Unisex

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes male, female, and unisex.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Luxury Perfume Market News:

- March 2025: Kilian Hennessey, the founder of French luxury brand Kilian Paris, is introducing his range of distinctive, long-lasting fragrances to India, striking a chord with India's strong tradition of scent. Hennessey perfumes draw their inspiration from many different things, including artwork, traveling experiences, and memories, and are labeled with descriptive names so that consumers can relate the smell to something that elicits an emotion.

- January 2025: Siienoi, a disruptive fragrance company, introduces three signature fragrances—Enchantress, Vampira, and Gaharu—hailing individuality and creating emotion. The launch enhances India's luxury fragrance market by presenting consumers with sophisticated, diverse alternatives, matching escalating demand for original and premium fragrance products. Siienoi's emphasis on elegance and sophistication upgrades the appeal of the market, pulling discerning shoppers seeking quality scents.

- December 2024: Siyaram Silk Mills entered Cadini Italy Perfumes in India with four different fragrances: Leonardo's Secret, Italian Renaissance, Roman Affair, and Sicilian Romance. This strategic entry diversifies their product range from textiles to other offerings, meeting the changing preferences of Indian consumers who are looking for high-quality perfumes. Such efforts from established players enhance the availability and popularity of luxury perfumes, thus driving India's luxury perfume market.

- November 2024: French luxury perfume house Diptyque launched its inaugural store in New Delhi's The Chanakya shopping center, seeking to deliver an exclusive sensory experience that is rooted in India's rich perfume culture. The launch is a sign of growing appetite for upmarket perfumes among Indian consumers and increases the country's luxury perfume market by providing more varied options.

India Luxury Perfume Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Prices Covered | $50 - $100, $100 - $200, Above $200 |

| Distribution Channels Covered | Specialty Stores, Online Stores |

| End Users Covered | Male, Female, Unisex |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India luxury perfume market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India luxury perfume market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India luxury perfume industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India luxury perfume market was valued at USD 1.20 Billion in 2024.

The India luxury perfume market is projected to exhibit a CAGR of 4.40% during 2025-2033, reaching a value of USD 1.80 Billion by 2033.

The market is driven by rising disposable incomes, expanding retail presence of premium brands, increasing brand consciousness, greater exposure to global luxury trends through digital media and international travel, as well as a greater preference for personalized, high-end fragrances that serve as status symbols and expressions of individuality.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)