India Luxury Sanitary Fixtures and Fittings Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, End User, and Region, 2025-2033

India Luxury Sanitary Fixtures and Fittings Market Overview:

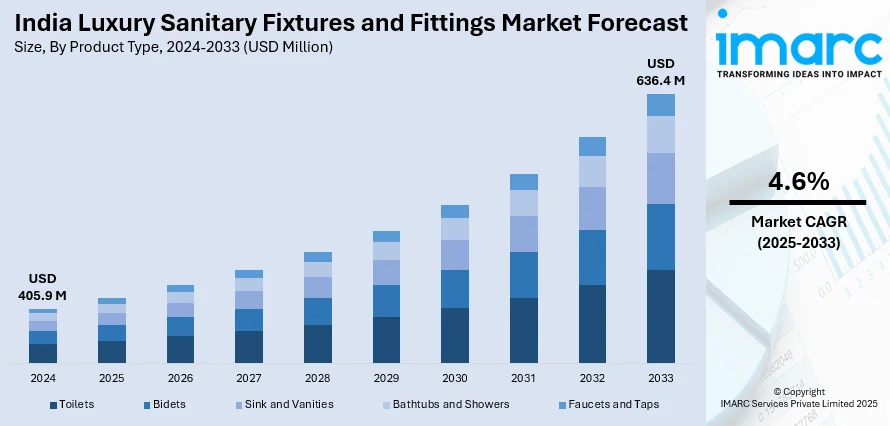

The India luxury sanitary fixtures and fittings market size reached USD 405.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 636.4 Million by 2033, exhibiting a growth rate (CAGR) of 4.6% during 2025-2033. The market is fueled by growing disposable incomes, expanding urbanization, and enhancing demand for premium lifestyle products. The boom in housing and commercial construction, particularly in cities, drives demand for technologically superior and design-sensitive bathroom products. Government policies such as Smart Cities Mission and Swachh Bharat Abhiyan, increased awareness about hygiene and the use of intelligent, water-conserving technologies are impacting consumer decisions, driving consumers toward premium, long-lasting, and design-oriented sanitary fittings, which is further increasing the India luxury sanitary fixtures and fittings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 405.9 Million |

| Market Forecast in 2033 | USD 636.4 Million |

| Market Growth Rate 2025-2033 | 4.6% |

India Luxury Sanitary Fixtures and Fittings Market Trends:

Rising Affluence and Changing Consumer Trends

The expanding middle and upper-middle class populations in India have played a key role in changing consumption patterns in various lifestyle markets, including sanitation and home improvement. In 2021, the Pew Research Centre discovered that the Indian middle class shrank due to the COVID-19 pandemic. The Indian government’s Household Consumption Expenditure survey for 2022–23 showcased that rural nominal household consumption expenditure grew at an annual rate of 1.62% from 2004–05 to 2011–12, but only rose by 1.02% from 2011–12 to 2022–23. In urban regions, the associated growth rates were 1.85% and 1.12%. Hence, with rising disposable incomes and higher exposures to international trends, Indian consumers desire functionality in their sanitary ware along with refinement, innovation, and better comfort. The concept of the tastefully crafted bathroom is no longer exclusive to five-star hotels or high-end resorts—city dwelling residents today want to replicate similar experiences within their own homes. Consequently, there is growing demand for upscale fittings, such as designer faucets, rain showers, and wall-mounted WCs. Buyers are opting for brands with products that have upscale looks, high quality, and added features like touchless functionality or temperature control. Such tastes represent a remarkable change from previous preferences, in which functionality and cost had controlled buying decisions. This phenomenon testifies to a general change in the cultural value placed on form and luxury as well as utility in domestic space.

To get more information of this market, Request Sample

Rapid Urbanization and Real Estate Development

The rate of urbanization in India has generated an unprecedented level of demand for housing and commercial properties, most urgently in tier-1 and tier-2 cities. High-end residential and commercial property developers are increasingly incorporating high-end bathroom fittings as standard options to attract high-income buyers and lessees. Well-fitted luxurious bathrooms with intelligent fixtures are now regarded as essential differentiators in high-end apartments, hotels, and office buildings. In addition, high-rise living and gated communities have ramped up demand for uniform quality and design for sanitary installations. Interior designers and architects also contribute towards specifying high-end, branded fixtures that will match the general design and value proposition of contemporary buildings. This emphasis on integrated design and quality control has prompted builders to collaborate with luxury sanitaryware producers. With the evolution of the India luxury sanitary fixtures and fittings market growth, the use of designer and long-lasting sanitary fittings has become synonymous with providing a high-quality product to classy buyers.

Innovation, Branding, and Smart Technologies

Luxury sanitaryware companies are using innovation and smart technology as a tool to differentiate themselves in a competitive Indian market. Contemporary consumers are seeking products that are easy to use, sustainable, and exclusive. Attributes like motion-sensor faucets, high-tech toilets with automated cleaning, and digitally operated showers are increasingly in demand by consumers who appreciate convenience, cleanliness, and tech-savvy lifestyles. Furthermore, the marketing approaches of luxury sanitaryware companies also have an important role to play. Foreign and local brands both are concentrating on edited product experiences, in-store design consultation, and upscale showrooms to improve customer interactions. This branding is also suitable for the desire of Indian consumers who view such services as exclusive and prestigious. The use of green technologies and water conservation features also adds to the luxury appeal of fixtures, addressing eco-friendly consumers. Due to this, innovation-led offerings remain a key driver of India's luxury sanitary fixtures and fittings market growth.

India Luxury Sanitary Fixtures and Fittings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, distribution channel, and end user.

Product Type Insights:

- Toilets

- Bidets

- Sink and Vanities

- Bathtubs and Showers

- Faucets and Taps

The report has provided a detailed breakup and analysis of the market based on the product type. This includes toilets, bidets, sink and vanities, bathtubs and showers, and faucets and taps.

Material Type Insights:

- Porcelain

- Stainless Steel

- Glass

- Stone

- Plastic

The report has provided a detailed breakup and analysis of the market based on the material type. This includes porcelain, stainless steel, glass, stone, and plastic.

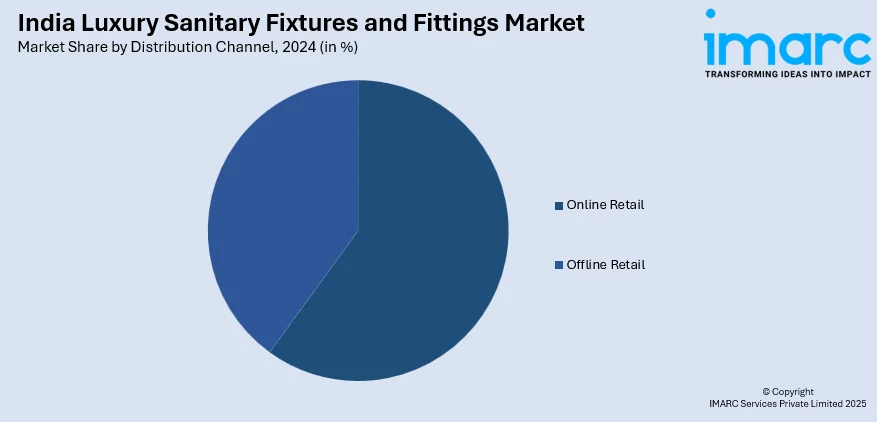

Distribution Channel Insights:

- Online Retail

- Offline Retail

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online retail and offline retail.

End User Insights:

- Residential

- Commercial

- Hospitality

- Healthcare

- Institutional

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, hospitality, healthcare, and institutional.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Luxury Sanitary Fixtures and Fittings Market News:

- In October 2024, Kohler, the esteemed worldwide leader in kitchen and bath solutions, launched its first Studio Kohler in India, marking a significant achievement in luxury and innovation. Located in the lively Banjara Hills area of Hyderabad, this highly anticipated venue aims to enhance bathroom design and fixtures, offering a blend of innovation and contemporary style.

- In May 2024, Hindware Limited, a leading bathroom products company, expanded its offerings by venturing into the quartz category, enhancing its presence in the tiles industry. With this introduction, Hindware expands its existing collection of premium tiles to elevate elegance and durability in the surface industry. Hindware recognizes the substantial growth opportunities and shifting consumer tastes impacting the Indian Quartz market. By introducing the Italian Quartz Collection, Hindware aims to capitalize on this expanding market, offering consumers a premium selection that effortlessly combines timeless sophistication with functional utility.

India Luxury Sanitary Fixtures and Fittings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Toilets, Bidets, Sink and Vanities, Bathtubs and Showers, Faucets and Taps |

| Material Types Covered | Porcelain, Stainless Steel, Glass, Stone, Plastic |

| Distribution Channels Covered | Online Retail, Offline Retail |

| End Users Covered | Residential, Commercial, Hospitality, Healthcare, Institutional |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India luxury sanitary fixtures and fittings market performed so far and how will it perform in the coming years?

- What is the breakup of the India luxury sanitary fixtures and fittings market on the basis of product type?

- What is the breakup of the India luxury sanitary fixtures and fittings market on the basis of material type?

- What is the breakup of the India luxury sanitary fixtures and fittings market on the basis of distribution channel?

- What is the breakup of the India luxury sanitary fixtures and fittings market on the basis of end user?

- What is the breakup of the India luxury sanitary fixtures and fittings market on the basis of region?

- What are the various stages in the value chain of the India luxury sanitary fixtures and fittings market?

- What are the key driving factors and challenges in the India luxury sanitary fixtures and fittings market?

- What is the structure of the India luxury sanitary fixtures and fittings market and who are the key players?

- What is the degree of competition in the India luxury sanitary fixtures and fittings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India luxury sanitary fixtures and fittings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India luxury sanitary fixtures and fittings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India luxury sanitary fixtures and fittings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)