India Machine Vision Systems Market Size, Share, Trends and Forecast by Component, Product, End User Industry, and Region, 2025-2033

India Machine Vision Systems Market Overview:

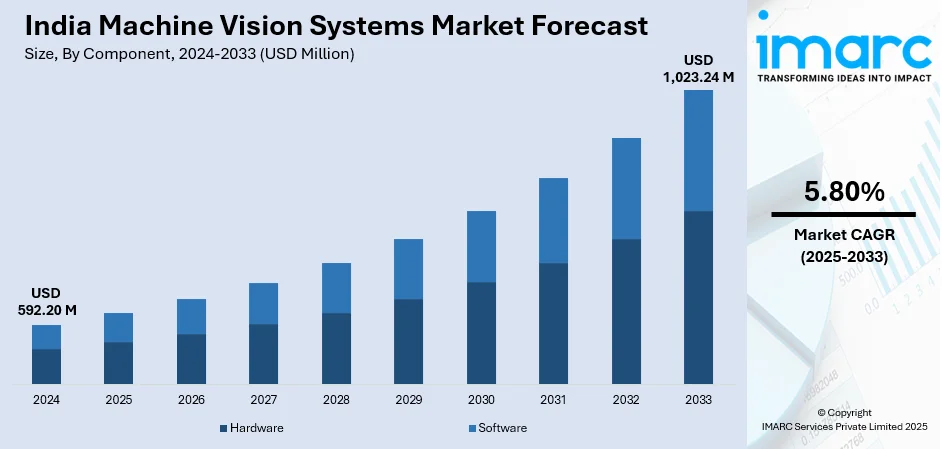

The India machine vision system market size reached USD 592.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,023.24 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is driven by government initiatives promoting AI and digitalization, along with the rapid adoption of Industry 4.0 technologies in manufacturing, enhancing automation, quality control, and efficiency, supported by substantial investments in AI-driven solutions and R&D hubs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 592.20 Million |

| Market Forecast in 2033 | USD 1,023.24 Million |

| Market Growth Rate 2025-2033 | 5.80% |

India Machine Vision Systems Market Trends:

Government Initiatives Promoting Artificial Intelligence and Digitalization

The Government of India has played a key role in propelling the use of machine vision systems through the promotion of artificial intelligence (AI) and digitalization. Programs such as 'Digital India' and 'Make in India' have established a conducive environment for cutting-edge technologies, which have fostered automation and innovation across sectors such as manufacturing, healthcare, and agriculture. As the Indian AI market is expected to touch USD 12,429.6 Million by 2033, the need for AI-driven solutions, such as machine vision systems, is increasing. These systems are crucial for quality control, defect detection, automation, and real-time monitoring and are imperative for India's growing industrial and technology industries. Government investments have allocated substantial investments for the adoption of AI. All this funding goes toward the development of high-performance computing infrastructure, AI development, local startups, and training workers, all of which are factors in the widespread implementation of machine vision systems. With India's transition towards Industry 4.0, all these efforts are likely to enhance productivity, improve accuracy, and enhance competitiveness in various sectors.

To get more information on this market, Request Sample

Adoption of Industry 4.0 Practices

India's speedy transition to Industry 4.0 is one of the major drivers for the use of machine vision systems in various industries. The convergence of cyber-physical systems, the Internet of Things (IoT), and big data analytics is revolutionizing manufacturing, making it smarter, more efficient, and heavily automated. To increase productivity and quality, machine vision technology is important for facilitating real-time monitoring, automated inspection, and data-driven decision-making. The Confederation of Indian Industry (CII), in association with KPMG, released a report called 'Industry 4.0 Adoption and Strategic Roadmap for Indian Manufacturing', to emphasize the significance of adopting smart manufacturing to further global competitiveness. The report points out that the Industry 4.0 market in India will be worth 17.4 Billion by 2033. This exponential growth is a result of the growing dependence on sophisticated automation technologies, of which machine vision is an integral part.

India Machine Vision Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, product, and end user industry.

Component Insights:

- Hardware

- Vision Systems

- Cameras

- Optics and Illumination Systems

- Frame Grabbers

- Others

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (vision systems, cameras, optics and illumination systems, frame grabbers, and others) and software.

Product Insights:

- PC-Based

- Smart Camera-Based

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes PC-based and smart camera-based.

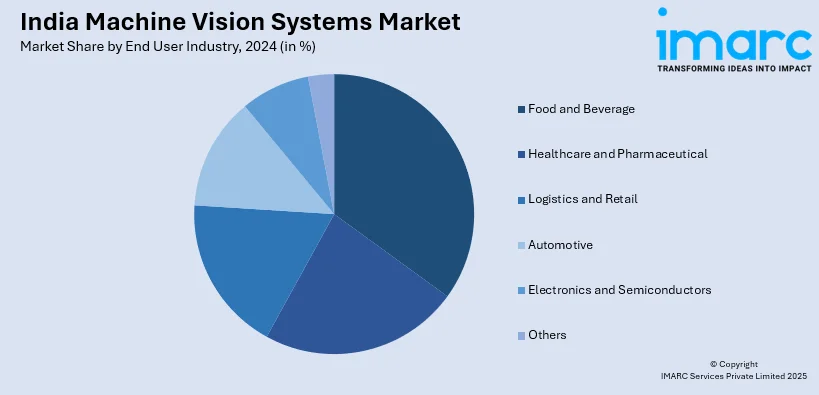

End User Industry Insights:

- Food and Beverage

- Healthcare and Pharmaceutical

- Logistics and Retail

- Automotive

- Electronics and Semiconductors

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes food and beverages, healthcare and pharmaceutical, logistics and retail, automotive, electronics and semiconductors, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Machine Vision Systems Market News:

- January 2025: Zebra Technologies acquired Photoneo to support its automation and 3D machine vision business. The purchase enhances its capabilities in industrial automation, facilitating higher-end imaging solutions for manufacturing and logistics. The innovation propels the India machine vision systems market by stimulating growth, enhancing productivity, and deepening the uptake of AI-powered vision technologies.

- August 2024: CynLr, an Indian deep-tech firm, created a visual object intelligence platform to allow robotic arms to recognize and handle unknown objects. This technology improves automation strength in manufacturing, propelling the use of machine vision systems in India. The firm launched a 13,000 sq. ft. R&D center in Bengaluru, with 16 robot research cells for cutting-edge robotics development.

India Machine Vision Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Products Covered | PC-Based, Smart Camera-Based |

| End User Industries Covered | Food and Beverages, Healthcare and Pharmaceutical, Logistics and Retail, Automotive, Electronics and Semiconductors, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India machine vision systems market performed so far and how will it perform in the coming years?

- What is the breakup of the India machine vision systems market on the basis of component?

- What is the breakup of the India machine vision systems market on the basis of product?

- What is the breakup of the India machine vision systems market on the basis of end user industry?

- What are the various stages in the value chain of the India machine vision systems market?

- What are the key driving factors and challenges in the India machine vision systems market?

- What is the structure of the India machine vision systems market and who are the key players?

- What is the degree of competition in the India machine vision systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India machine vision systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India machine vision systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India machine vision systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)