India Manufacturing Execution Systems Market Size, Share, Trends and Forecast by Solution, Deployment, Application, and Region, 2025-2033

India Manufacturing Execution Systems Market Overview:

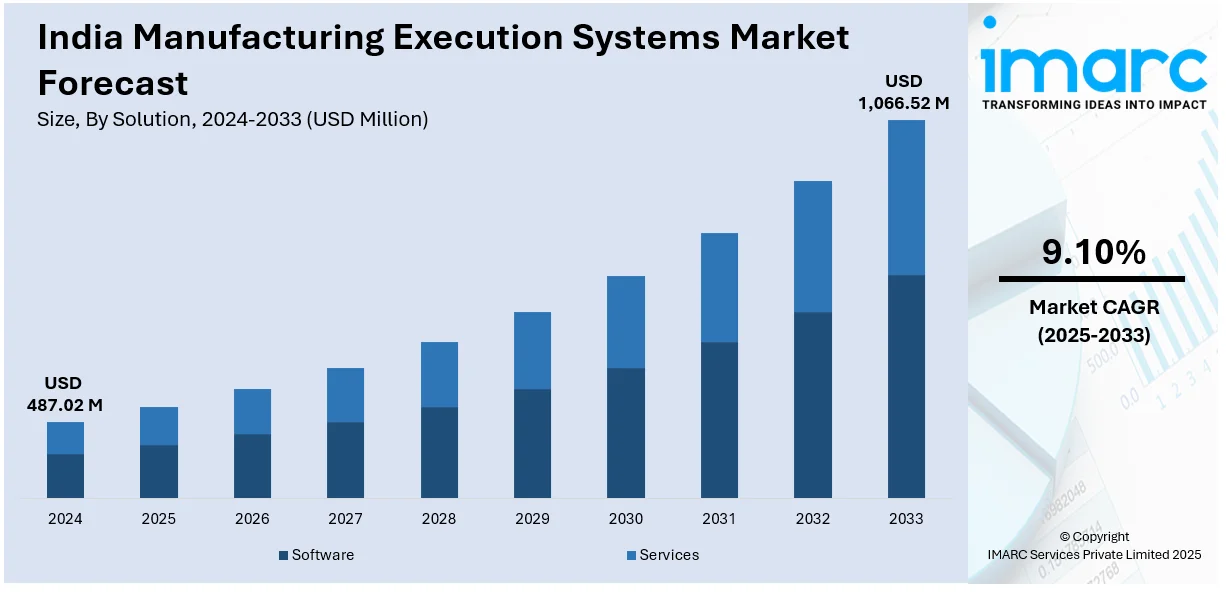

The India manufacturing execution systems market size reached USD 487.02 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,066.52 Million by 2033, exhibiting a growth rate (CAGR) of 9.10% during 2025-2033. The market is driven by increasing industrial automation, rising adoption of Industry 4.0, and growing demand for real-time production monitoring. Government initiatives like "Make in India" and smart manufacturing trends further boost MES adoption, enhancing efficiency, reducing downtime, and improving overall operational productivity across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 487.02 Million |

| Market Forecast in 2033 | USD 1,066.52 Million |

| Market Growth Rate 2025-2033 | 9.10% |

India Manufacturing Execution Systems Market Trends:

Growing Adoption of Industry 4.0 and Smart Manufacturing

The increasing emphasis on Industry 4.0 is driving the adoption of Manufacturing Execution Systems (MES) in India, aligning with the government’s Production Linked Incentive (PLI) scheme under "Make in India." As of June 2024, the PLI scheme has attracted ₹1.32 lakh crore (USD 16 billion) in investments, generating a manufacturing output of ₹10.90 lakh crore (USD 130 billion) and creating over 8.5 lakh jobs. Smart manufacturing industries are combining MES with IoT, AI, and cloud computing to make decisions in real-time and optimize efficiency. Digital twins, predictive analytics, and automation using AI optimize process control, reduce downtime, and optimize resource utilization. Seamless data exchange being the key, MES adoption is gaining momentum in automotive, pharmaceutical, and electronics industries, creating competitiveness and agility in a changing industrial environment.

To get more information on this market, Request Sample

Increasing Demand for Cloud-Based MES Solutions

The trend towards cloud-based MES solutions is building up in India as industries look for scalable, cost-effective, and agile deployment models. Cloud-based MES enables manufacturers to consolidate data, streamline collaboration, and gain real-time insights into production from remote environments. Small and medium-sized businesses (SMEs), especially, are embracing cloud MES to minimize IT infrastructure costs as well as enhance business efficiency. Integration with enterprise resource planning (ERP) and supply chain management (SCM) systems is facilitating smooth data synchronization across different functions. Furthermore, improved cybersecurity solutions and regulatory compliance frameworks are resolving issues related to data security, further boosting adoption. With increasing cloud adoption, MES providers are emphasizing the provision of subscription-based models to meet varied industry requirements.

Rising Implementation of AI and Advanced Analytics

Artificial intelligence (AI) and analytics are revolutionizing MES in India by providing predictive maintenance, process optimization, and anomaly detection features. More and more manufacturers are implementing AI-based MES to handle enormous production data, identify inefficiencies, and optimize operations in real time. Machine learning (ML) algorithms are used to forecast equipment failures, reduce downtime, and enhance product quality. AI-driven automation is also enabling adaptive manufacturing, where production systems adapt automatically to fluctuations in demand. Emergence of increased availability of industrial data and integration of MES platforms with AI is changing the decision-making processes, thus improving the whole response and agility. Hence, companies are deploying AI-based MES solutions to secure competitive advantage within a fast-changing industrial environment.

India Manufacturing Execution Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on solution, deployment and application.

Solution Insights:

- Software

- Services

- Professional Services

- Strategic Advisory

- Administrative Services

- Marketing Services

- Managed Services

- System Integration

- Maintenance and Support

- Data Analytics

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes software, services (professional services: strategic advisory, administrative services, marketing services), (managed services: system integration, maintenance and support, data analytics)

Deployment Insights:

- On-premise

- Cloud-based

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premises, and cloud-based.

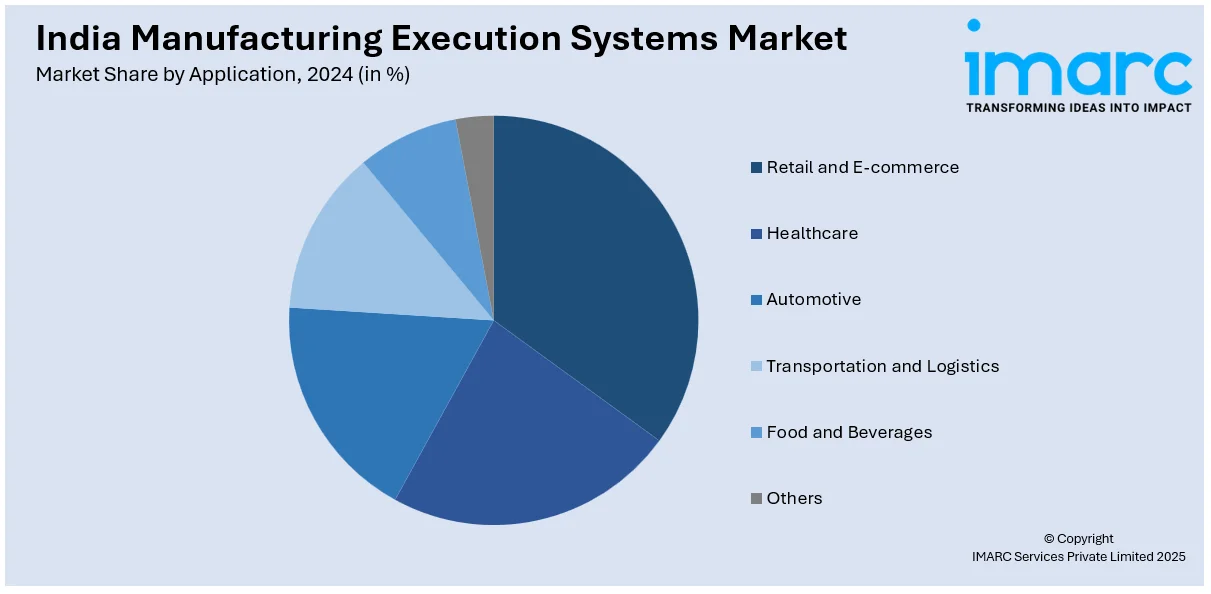

Application Insights:

- Retail and E-commerce

- Healthcare

- Automotive

- Transportation and Logistics

- Food and Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes retail and e-commerce, healthcare, automotive, transportation and logistics, food and beverages, and others

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Manufacturing Execution Systems Market News:

- In January 2025, ITC signed an MoU with India's DPIIT to develop digital platforms for Manufacturing Execution Systems (MES) and renewable energy solutions. This strategic partnership aims to boost entrepreneurship and innovation by leveraging ITC’s market expertise. The initiative focuses on integrating energy storage and sustainability solutions, supporting startups, and enhancing manufacturing efficiency while aligning with India’s industrial and clean energy goals.

- In May 2024, AVEVA expanded its CONNECT platform by launching a hybrid cloud Manufacturing Execution System (MES). This solution enables manufacturers to manage production data in the cloud, enhancing supply chain agility and enterprise-wide visibility. By leveraging AI, machine learning, and data visualization, it helps optimize operational performance and sustainability. The system breaks data silos, allowing companies to contextualize and enrich production data for improved efficiency and decision-making across their networks.

India Manufacturing Execution Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Deployments Covered | On-Premises, Cloud-based |

| Applications Covered | Retail and E-commerce, Healthcare, Automotive, Transportation and Logistics, Food and Beverages, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India manufacturing execution systems market performed so far and how will it perform in the coming years?

- What is the breakup of the India manufacturing execution systems market on the basis of solution?

- What is the breakup of the India manufacturing execution systems market on the basis of deployment?

- What is the breakup of the India manufacturing execution systems market on the basis of application?

- What is the breakup of the India manufacturing execution systems market on the basis of region?

- What are the various stages in the value chain of the India manufacturing execution systems market?

- What are the key driving factors and challenges in the India manufacturing execution systems market?

- What is the structure of the India manufacturing execution systems market and who are the key players?

- What is the degree of competition in the India manufacturing execution systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India manufacturing execution systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India manufacturing execution systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India manufacturing execution systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)