India Marine Engines Market Size, Share, Trends and Forecast by Stroke, Product, Fuel Type, Ship Type, and Region, 2025-2033

India Marine Engines Market Overview:

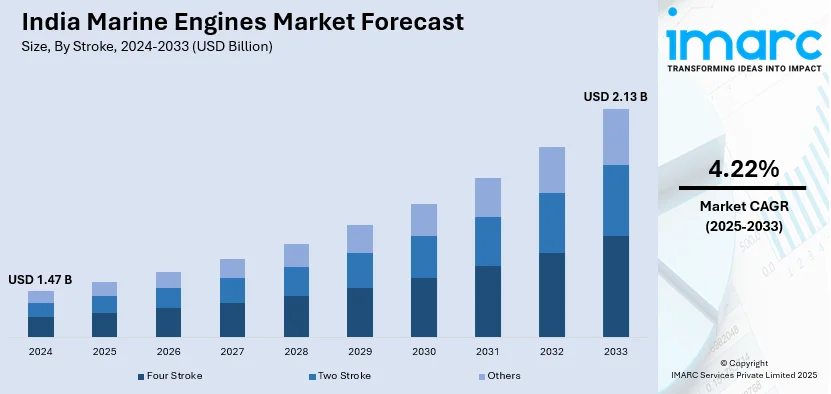

The India marine engines market size reached USD 1.47 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.13 Billion by 2033, exhibiting a growth rate (CAGR) of 4.22% during 2025-2033. The market is driven by expanding offshore oil and gas exploration, government initiatives like Sagarmala for port modernization, rising coastal and inland waterway transportation, increasing naval defence investments, and elevating demand for fuel-efficient and eco-friendly engines to support maritime trade, logistics, and strategic security enhancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.47 Billion |

| Market Forecast in 2033 | USD 2.13 Billion |

| Market Growth Rate 2025-2033 | 4.22% |

India Marine Engines Market Trends:

Expansion of Offshore Oil and Gas Exploration Activities

India's fast-growing energy demands have resulted in heavy emphasis being put on exploration of offshore oil and gas fields. India's offshore areas have large hydrocarbon reserves, hence there has been considerable government as well as private sector investment in exploration and extraction activities. Such growth in offshore activities requires an array of dedicated ships, like drilling rigs, offshore support vessels, and floating production storage and offloading (FPSO) vessels. Each of these ships heavily depends on high-tech marine engines that can operate efficiently within the demanding offshore environment. The policies of the Indian government, which support reducing reliance on foreign energy and expanding domestic production, further add to this trend. Through simplifying regulatory mechanisms and providing incentives, the government invites domestic and foreign players to invest in offshore exploration. The demand for durable and reliable marine engines has therefore increased, as they are instrumental to the operational success of offshore operations. This dynamic highlights the direct relationship between the development of offshore oil and gas exploration and the development of India's marine engines market.

To get more information on this market, Request Sample

Growth of Coastal and Inland Waterways Transportation

India's marine engines market is further spurred by the growing reliance on coastal and inland waterway transport as a substitute for road and railway freight. As the nation rapidly industrializes and urbanizes, the demand for cost-efficient and effective modes of transport has heightened. In an effort to decongest roads and railways, the Indian government has been actively encouraging waterway transport under such schemes as the Jal Marg Vikas Project (JMVP) and the Sagarmala Programme. In contrast to offshore oil and gas prospecting involving deep-sea operations, coastal and inland shipping involves short-distance carriage of passengers and cargo. Rivers like the Ganges, Brahmaputra, and Godavari are being upgraded as National Waterways to enable unencumbered movement of cargo. This trend has resulted in greater demand for barges' marine engines, ferries, passenger ships, and shallow-water cargo vessels. Furthermore, the private sector has appreciated the viability of inland and coastal shipping for transporting bulk cargo, which has generated further demand for fuel-efficient and eco-friendly marine engines.

India Marine Engines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on stroke, product, fuel type, and ship type.

Stroke Insights:

- Four Stroke

- Two Stroke

- Others

The report has provided a detailed breakup and analysis of the market based on the stroke. This includes four stroke, two stroke, and others.

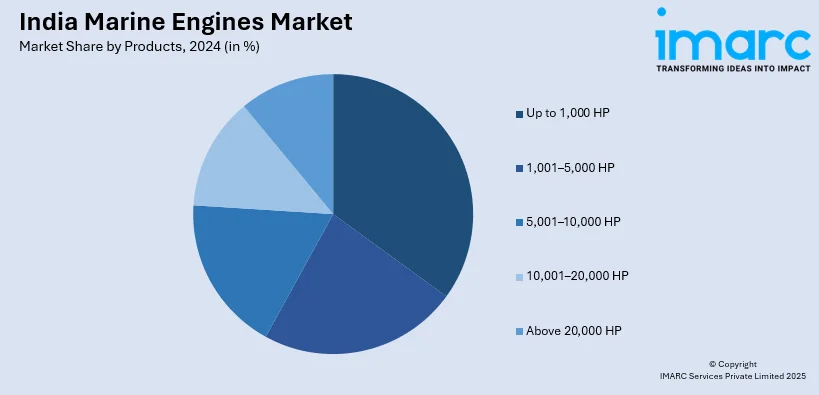

Products Insights:

- Up to 1,000 HP

- 1,001–5,000 HP

- 5,001–10,000 HP

- 10,001–20,000 HP

- Above 20,000 HP

A detailed breakup and analysis of the market based on the products have also been provided in the report. This includes Up to 1,000 HP, 1,001–5,000 HP, 5,001–10,000 HP, 10,001–20,000 HP, and above 20,000 HP.

Fuel Type Insights:

- Heavy Fuel Oil

- Intermediate Fuel Oil

- Others

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes heavy fuel oil, intermediate fuel oil, and others.

Ship Type Insights:

- Bulk Carriers

- General Cargo Ships

- Container Ships

- Ferries and Passenger Ships

- Oil Tankers

- Others

A detailed breakup and analysis of the market based on the ship type have also been provided in the report. This includes bulk carriers, general cargo ships, container ships, ferries and passenger ships, oil tankers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Marine Engines Market News:

- January 2025: The Ministry of Defence selected a joint venture between ThyssenKrupp Marine Systems (TKMS) and Mazagon Dock Shipbuilders Ltd (MDS) as the sole contender for a USD 5 billion submarine deal, aiming to strengthen its naval fleet. This project required advanced marine propulsion systems, boosting demand for high-performance marine engines.

- January 2025: India's Navy launched three domestically-built vessels: a submarine, a destroyer, and a frigate to enhance maritime security in the Indian Ocean. This expansion of the naval fleet has propelled the demand for advanced marine engines to power these new vessels.

India Marine Engines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Strokes Covered | Four Stroke, Two Stroke, Others |

| Products Covered | Up to 1,000 HP, 1,001–5,000 HP, 5,001–10,000 HP, 10,001–20,000 HP, Above 20,000 HP |

| Fuel Types Covered | Heavy Fuel Oil, Intermediate Fuel Oil, Others |

| Ship Types Covered | Bulk Carriers, General Cargo Ships, Container Ships, Ferries and Passenger Ships, Oil Tankers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India marine engines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India marine engines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India marine engines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The marine engines market in India was valued at USD 1.47 Billion in 2024.

The India marine engines market is projected to exhibit a (CAGR) of 4.22% during 2025-2033, reaching a value of USD 2.13 Billion by 2033.

The Indian market for marine engines is developing with growing maritime commerce, port infrastructure investment by the government, and development of the defense and fishing industries. Demand is also fueled by inland waterway modernization and increasing construction of commercial vessels. Fuel efficiency and environmental regulatory-compliant engine upgrades add to market development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)