India Meal Replacements Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

India Meal Replacements Market Overview:

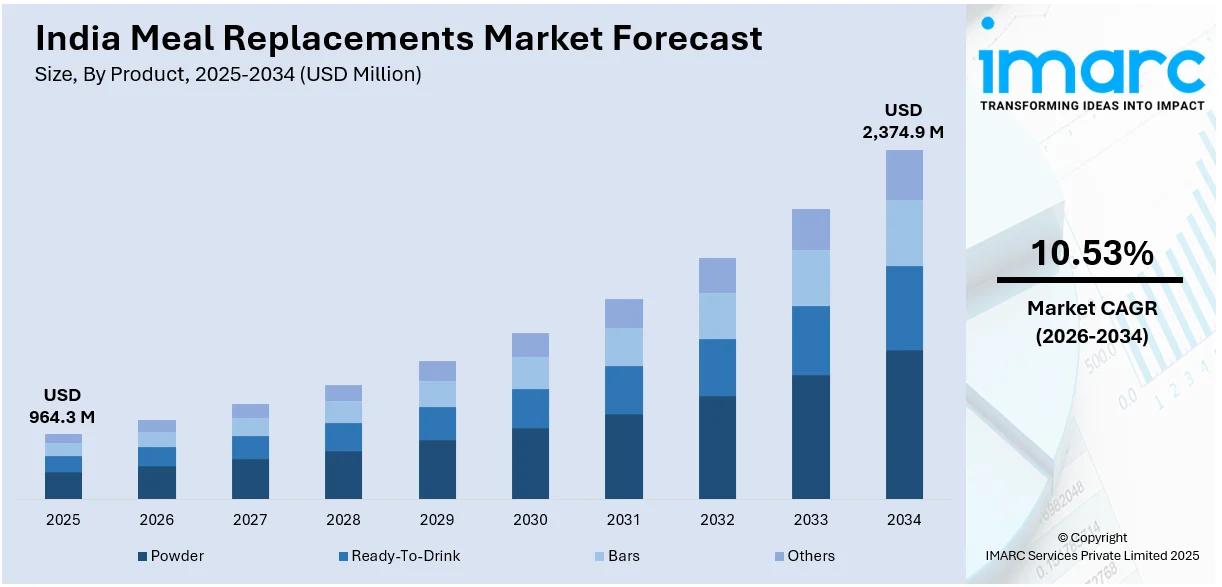

The India meal replacements market size reached USD 964.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,374.9 Million by 2034, exhibiting a growth rate (CAGR) of 10.53% during 2026-2034. The India meal replacements market is driven by rising health consciousness, rapid urbanization, higher disposable incomes, and a growing preference for convenient, nutritious meal alternatives, supported by innovations in functional foods, government initiatives promoting wellness, and the expanding availability of protein shakes, nutritional bars, and fortified ready-to-drink beverages.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 964.3 Million |

| Market Forecast in 2034 | USD 2,374.9 Million |

| Market Growth Rate (2026-2034) | 10.53% |

India Meal Replacements Market Trends:

Changing Lifestyles and Increasing Purchasing Power

India's fast urbanization and economic growth have resulted in significant changes in consumer lifestyles and spending power, which have a major impact on the meal replacement market. With rapid urbanization, more people are embracing busy lifestyles, and as a consequence, this has led to a rise in the demand for quick and convenient meals. Meal replacement foods, including ready-to-drink beverages, nutrition bars, and powdered foods, fit this requirement by providing balanced nutrition without the amount of time needed for regular meal preparation. This movement towards convenience is especially noted with middle-to-higher-income consumers who look for products that will fit into their hectic lifestyle. With rising disposable incomes, consumers are ready to spend on health and wellness products, including meal replacements that provide both nutrition and convenience. This is likely to continue and drive the long-term growth of the meal replacement products market in India.

To get more information on this market Request Sample

Growing Health Consciousness and Demand for Functional Foods

Another key driver of the meal replacement industry in India is growing health awareness among consumers and the resulting demand for functional foods. Consumers are becoming more concerned about balanced nutrition and are looking for products that not only curb hunger but also convey health benefits. Meal replacement products are frequently enriched with nutritional essentials, vitamins, and minerals, and therefore become a desired choice among health-aware consumers. The Indian functional foods and beverages market has experienced significant expansion, mirroring this change in consumer trends. The Indian market for fortified/functional packaged food is extremely concentrated, with the top three players accounting for a combined market share of 57.2% in 2021. In the fortified/functional beverage category, the market leader Unilever had a 51.9% market share, mainly because of its acquisition of well-known brands such as Horlicks and Boost. This dominance reflects the growing consumer preference for products that provide extra health benefits over and above basic nutrition. The rising prevalence of lifestyle disorders like obesity and diabetes has surged the demand for healthier meals as well. People are actively searching for meal substitutes that can contribute to weight loss and controlled caloric intake and are in keeping with their overall health objectives. This trend should spur innovation and segmentation in the meal replacement sector, providing targeted products based on individual health objectives and tastes.

India Meal Replacements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Powder

- Ready-To-Drink

- Bars

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes powder, ready-to-drink, bars, and others.

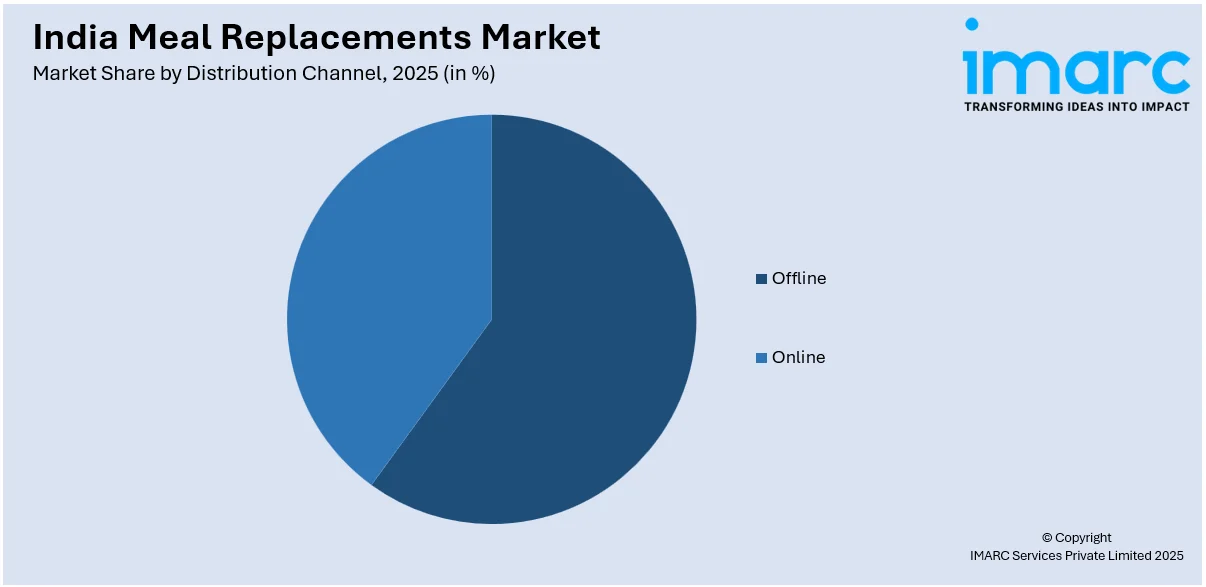

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Offline

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Others

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline (hypermarkets and supermarkets, convenience stores, specialty stores, and others) and online.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Meal Replacements Market News:

- March 2025: Marico introduced Saffola Cuppa Oats, a nutritious and fast four-minute snack ready when boiling water is added and is available in Magic Masala and Spicy Mexicana varieties. The product targets health-savvy individuals who are on the lookout for easy meal substitutes, thus pushing the growth of India's meal replacement market.

- October 2024: Milma unveiled Cashew Vita Powder, a high-nutrient health beverage in chocolate, pista, and vanilla flavor, with Kerala State Cashew Development Corporation and CFTRI, Mysuru. Cashew Vita Powder offers a long shelf-life and is a high-protein energy-intensive replacement to health beverages. With this, the India meal replacement industry is being augmented by introducing fortified cashew-based options among nutrition-savvy consumers.

India Meal Replacements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Powder, Ready-to-Drink, Bars, Others |

| Distribution Channels Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India meal replacements market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India meal replacements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India meal replacements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The meal replacements market in India was valued at USD 964.3 Million in 2025.

The India meal replacements market is projected to exhibit a CAGR of 10.53% during 2026-2034, reaching a value of USD 2,374.9 Million by 2034.

Busy urban routines, rising health consciousness, and a focus on weight management is driving the meal replacements market in India. Young professionals and fitness-focused individuals look for quick, nutritious alternatives to traditional meals. E-commerce growth and wider retail availability boost sales. Brands introduce new flavors and formats to attract users seeking balanced nutrition without spending extra time on preparation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)