India Meat Processing Market Size, Share, Trends and Forecast by Product, Equipment, Meat, Mode of Operation, and Region, 2025-2033

India Meat Processing Market Overview:

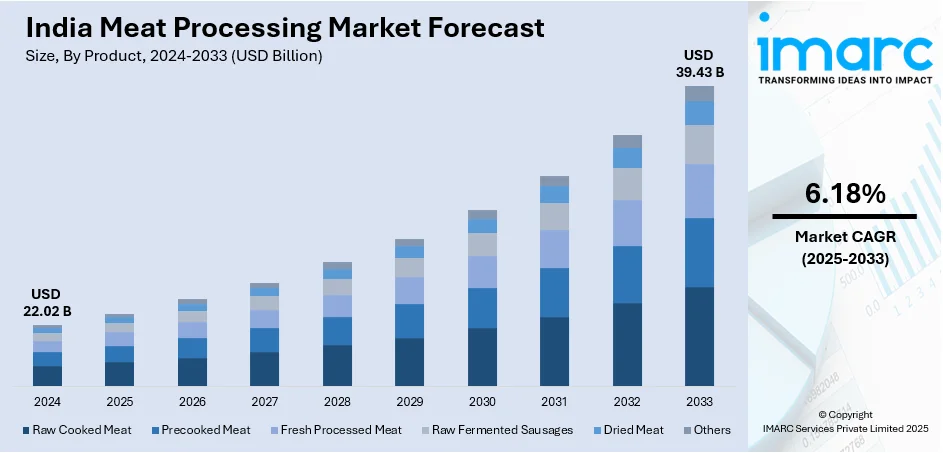

The India meat processing market size reached USD 22.02 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 39.43 Billion by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033. The market is driven by urbanization, increasing incomes, and shifting diet preferences toward protein-rich food products. The expansion of the organized food retail and food services sectors, government assistance in upgrading abattoirs and improving cold chain infrastructure are also supporting industry growth. Technological advancements in processing and packaging are improving the shelf life and quality of products, attracting health-conscious consumers. These opportunities in meat exports, especially halal meat, are fueling the India meat processing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.02 Billion |

| Market Forecast in 2033 | USD 39.43 Billion |

| Market Growth Rate 2025-2033 | 6.18% |

India Meat Processing Market Trends:

Growing Demand for Processed and Ready-to-Cook Meat Products

The Indian meat processing industry is witnessing a shift from consumer behavior toward meat products that are prepared and ready to cook. Urban consumers, particularly from major cities, are looking for convenience in meal preparation due to their busy life. This has generated a higher demand for products like marinated meat, kebabs, sausages, and pre-cooked curries. Changing consumption habits is coupled with increased awareness about health related to the nutritional content of protein diets. The convenience of easy availability of a large assortment of processed meat through supermarkets, online portals, and branded retail chains is driving demand too. Consumers are increasingly demanding more focus on hygiene, quality, and packaging safety—concerns that are being actively tackled by processed meat players. Improvements in spice blends, regional taste profiles, and shelf life have added value to the processed meat segment. The shift in this taste trend demonstrates a long-term shift toward convenient meat formats at home in India, particularly in the younger generation, which further contributes to the India meat processing market growth.

To get more information on this market, Request Sample

Expansion of Organized Retail and E-Commerce Platforms

The growth of e-commerce and organized retail in India is having a significant impact on market trends for meat processing. According to industry reports, the Indian e-commerce sector is expected to rise from USD 125 Billion in FY24 to USD 345 billion by FY30. With the spread of supermarkets, hypermarkets, and meat specialist retail chains, consumers find it easier to access hygienically processed, packaged meat products. Contemporary retail establishments take utmost care regarding cold chain preservation, quality checks, and traceability—requisites that give consumer confidence. On the other hand, electronic retailing websites are playing an important role in reaching an extended consumer base. Online meat delivery websites offering farm-to-fork models are becoming popular among semi-urban and urban regions. Majority of the websites are having subscription services, express delivery, and customization, offering personal consumer needs. Online platforms also allow brands to educate consumers regarding meat cuts, cooking time, and nutritional content, offering better engagement. The crossing of conventional retail and e-commerce is making things more convenient and designing consumer expectations around consistency, safety, and high-quality meat consumption.

Focus on Innovation, Quality Parameters, and Export Opportunities

Innovation and quality parameters are emerging as the major trends for the Indian meat processing sector. As consumers are becoming more aware, companies are spending money on new preservation, packaging, and processing technologies to support international food hygiene and safety norms. Vacuum packing, modified atmosphere packing, and processing line automation are gaining widespread popularity. There is growing demand for specialty meats, organic foods, and regional specialties for niche markets. At the same time, Indian meat processors are focusing on gaining international certifications and compliance with export rules in order to penetrate overseas markets, especially the Middle East and Southeast Asia. Demand for halal-certified and buffalo meat products continues to be high in these countries, and Indian companies are taking advantage of this through strategic exports. As local and foreign consumers increasingly appreciate traceability, responsible sourcing, and clean labeling, the meat processing business responds to these new conditions and expands its worldwide presence.

India Meat Processing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, equipment, meat, and mode of operation.

Product Insights:

- Raw Cooked Meat

- Precooked Meat

- Fresh Processed Meat

- Raw Fermented Sausages

- Dried Meat

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes raw cooked meat, precooked meat, fresh processed meat, raw fermented sausages, dried meat, and others.

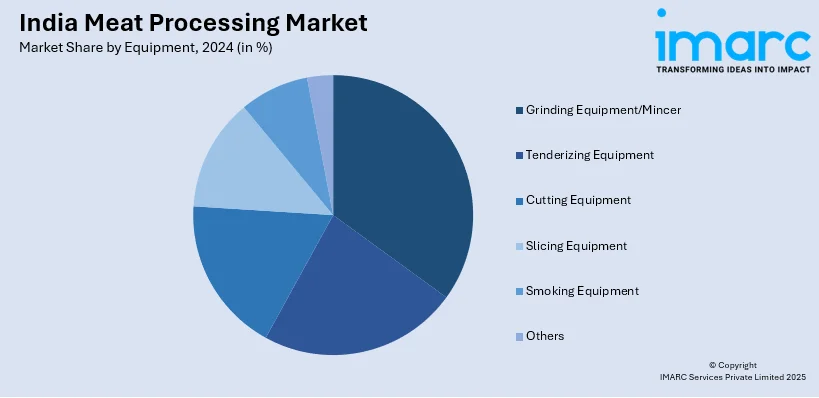

Equipment Insights:

- Grinding Equipment/Mincer

- Tenderizing Equipment

- Cutting Equipment

- Slicing Equipment

- Smoking Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes grinding equipment/mincer, tenderizing equipment, cutting equipment, slicing equipment, smoking equipment, and others.

Meat Insights:

- Beef

- Pork

- Mutton

- Others

The report has provided a detailed breakup and analysis of the market based on the meat. This includes beef, pork, mutton, and others.

Mode of Operation Insights:

- Manual

- Semi-Automatic

- Automatic

The report has provided a detailed breakup and analysis of the market based on the mode of operation. This includes manual, semi-automatic, and automatic.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Meat Processing Market News:

- In September 2024, Allana, the biggest frozen meat exporter in India, created a stir in the Indian poultry sector by investing USD 119 million in seven new processing plants, which include four in northern India, one in Maharashtra, another in Karnataka, and one in Tamil Nadu.

India Meat Processing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Raw Cooked Meat, Precooked Meat, Fresh Processed Meat, Raw Fermented Sausages, Dried Meat, Others |

| Equipments Covered | Grinding Equipment/Mincer, Tenderizing Equipment, Cutting Equipment, Slicing Equipment, Smoking Equipment, Others |

| Meats Covered | Beef, Pork, Mutton, Others |

| Mode of Operations Covered | Manual, Semi-Automatic, Automatic |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India meat processing market performed so far and how will it perform in the coming years?

- What is the breakup of the India meat processing market on the basis of product?

- What is the breakup of the India meat processing market on the basis of equipment?

- What is the breakup of the India meat processing market on the basis of meat?

- What is the breakup of the India meat processing market on the basis of mode of operation?

- What is the breakup of the India meat processing market on the basis of region?

- What are the various stages in the value chain of the India meat processing market?

- What are the key driving factors and challenges in the India meat processing market?

- What is the structure of the India meat processing market and who are the key players?

- What is the degree of competition in the India meat processing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India meat processing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India meat processing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India meat processing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)