India Medical Devices Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

India Medical Devices Market Summary:

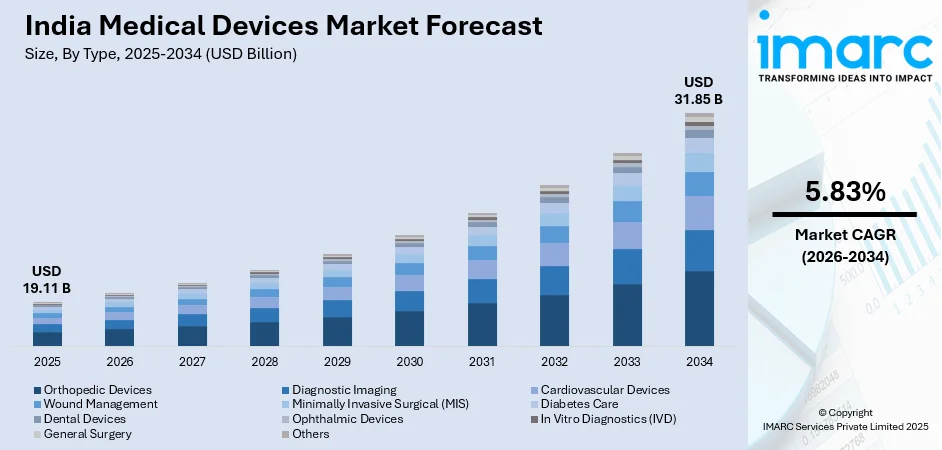

The India medical devices market size was valued at USD 19.11 Billion in 2025 and is projected to reach USD 31.85 Billion by 2034, growing at a compound annual growth rate of 5.83% from 2026-2034.

India's medical devices market is experiencing robust expansion driven by rising healthcare demands, increasing government investments in healthcare infrastructure, and advancements in medical technology. The expanding elderly population, growing prevalence of chronic diseases, and adoption of advanced diagnostic and therapeutic devices are key factors propelling market growth, positioning India as a significant player in the global medical devices industry.

Key Takeaways and Insights:

-

By Type: Orthopedic devices dominate the market with a share of 18% in 2025, driven by the rising incidence of musculoskeletal disorders and increasing demand for joint replacement surgeries among the aging population.

-

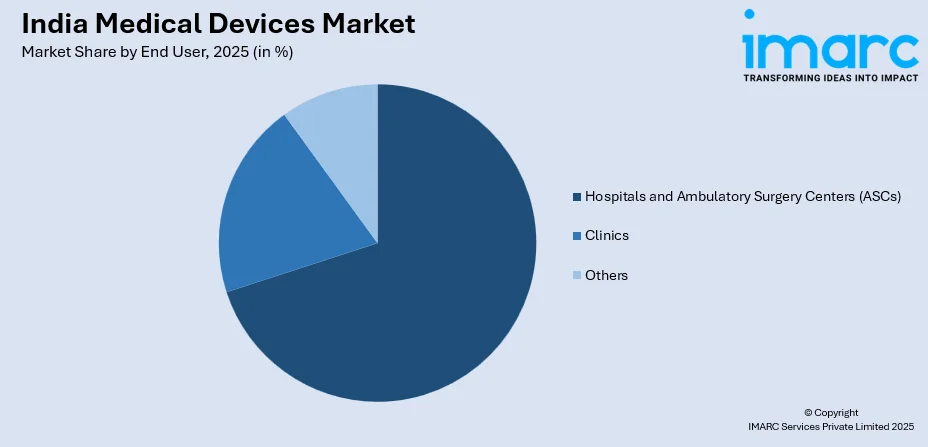

By End User: Hospitals and ambulatory surgery centers (ASCs) lead the market with a share of 70% in 2025, owing to their comprehensive medical infrastructure and increasing patient footfall requiring advanced medical equipment.

-

By Region: South India represents the largest segment with a market share of 34% in 2025, benefiting from well-established engineering clusters, export-oriented logistics, and presence of major healthcare institutions.

-

Key Players: Large global businesses and domestic producers compete in a variety of areas in the fiercely competitive Indian medical device market. To increase their market presence, industry participants concentrate on strategic alliances, product innovations, and manufacturing facility growth.

To get more information on this market Request Sample

The Indian medical devices market is undergoing significant transformation driven by strategic government initiatives and increasing healthcare investments. The Production-Linked Incentive scheme has attracted substantial investments, enabling domestic manufacturing of high-end medical equipment including MRI machines, CT scanners, and mammography systems. In November 2024, the government launched a 500 Crores scheme to strengthen the medical devices industry, focusing on manufacturing key components, skill development, and clinical research support. The establishment of medical device parks in Tamil Nadu, Himachal Pradesh, and Uttar Pradesh is creating an enabling ecosystem for domestic manufacturing and reducing import dependency. These policy interventions are positioning India as an emerging hub for affordable and quality medical device production, attracting both domestic and international manufacturers.

India Medical Devices Market Trends:

Digital Health Technology Integration

The Indian medical devices market is witnessing rapid adoption of digital health technologies including telemedicine platforms, remote patient monitoring systems, and artificial intelligence-powered diagnostic tools. With increasing smartphone penetration and internet connectivity, mobile health applications are enabling patients to access healthcare services from home. In May 2024, OMRON Healthcare partnered with AliveCor India to launch portable AI-based ECG monitoring devices, introducing OMRON COMPLETE that combines blood pressure and ECG monitoring for comprehensive cardiovascular health management.

Rising Demand for Portable and Home-Based Devices

The preference for personalized healthcare and cost-effective solutions is driving significant demand for portable and home-based medical devices across India. Devices such as portable glucose monitors, blood pressure cuffs, nebulizers, and wearable health trackers are gaining popularity as they enable patients to manage chronic conditions from home. The World Diabetes Day 2024 initiative highlighted India's urgent need for diabetes management solutions, creating substantial demand for portable monitoring equipment. In order to address discrepancies in diabetes care, "Breaking Barriers, Bridging Gaps" in 2024 also promotes an emphasis on inclusivity in healthcare by highlighting cooperation between governments, health organizations, and communities.

Expansion of Domestic Manufacturing Capabilities

India's medical devices sector is experiencing a manufacturing renaissance with increasing domestic production capabilities. In March 2024, under the PLI program, 13 new medical device facilities opened into business, increasing the capacity for imaging and cancer care equipment. Major multinational corporations are establishing innovation hubs in India, with Medtronic announcing a USD 350 Million investment in Hyderabad for its Engineering and Innovation Center, while Siemens Healthineers committed investments for R&D facilities in Bengaluru, signaling India's emergence as a global manufacturing hub.

Market Outlook 2026-2034:

The India medical devices market is poised for sustained growth driven by robust policy support, demographic shifts toward chronic disease prevalence, and substantial private-sector investments. India's historic 70–80% reliance on imports is progressively decreasing because to domestic manufacturing incentives, and the market for affordable, technologically advanced care facilities is growing. In order to enable local production of CT and MRI equipment, the government increased PLI budget allocations for the medical devices industry in March 2025, bringing the total investment to Rs. 1.97 Lakh Crores. The market generated a revenue of USD 19.11 Billion in 2025 and is projected to reach a revenue of USD 31.85 Billion by 2034, growing at a compound annual growth rate of 5.83% from 2026-2034.

India Medical Devices Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Orthopedic Devices |

18% |

|

End User |

Hospitals and Ambulatory Surgery Centers(ASCs) |

70% |

|

Region |

South India |

34% |

Type Insights:

- Orthopedic Devices

- Diagnostic Imaging

- Cardiovascular Devices

- Wound Management

- Minimally Invasive Surgical (MIS)

- Diabetes Care

- Dental Devices

- Ophthalmic Devices

- In Vitro Diagnostics (IVD)

- General Surgery

- Others

The orthopedic devices dominate with a market share of 18% of the total India medical devices market in 2025.

The orthopedic devices segment is experiencing substantial growth driven by the rising incidence of musculoskeletal disorders, road accidents, and occupational injuries across India. Rapid industrialization and urbanization have significantly accelerated trauma-induced fractures, creating strong demand for advanced fixation devices and orthopedic implants in healthcare facilities. The growing geriatric population, particularly individuals aged 60 and above who are especially vulnerable to chronic orthopedic conditions including osteoarthritis and osteoporosis, is fueling increasing demand for joint replacement surgeries and related medical treatment interventions.

Orthopedic technology advancements, such as robotic-assisted operations, AI-powered implant designs, and 3D-printed prosthetics, are significantly improving patient rehabilitation and surgical accuracy across healthcare facilities. In April 2025, In keeping with the segment's ongoing innovation trajectory, MicroPort Orthopedics Inc. announced the launch of its Evolution Medial-Pivot Knee system in India. This system is intended to provide superior flexion stability and anatomic motion for total knee replacement surgeries. These technological developments are enabling faster recovery times and better long-term outcomes for patients.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals and Ambulatory Surgery Centers (ASCs)

- Clinics

- Others

The hospitals and ambulatory surgery centers (ASCs) lead with a share of 70% of the total India medical devices market in 2025.

Hospitals and ambulatory surgery centers dominate the India medical devices market due to their comprehensive medical infrastructure and substantial patient volumes requiring advanced medical equipment. These facilities serve as primary healthcare delivery points where diagnostic, therapeutic, and monitoring devices are extensively utilized. The expansion of private hospital chains, including Apollo, Fortis, and Max Healthcare, has driven significant investments in state-of-the-art medical technology. World-class hospital groups are building high-end infrastructure to support India's growing medical tourism sector, which now contributes substantially to the healthcare market.

The government's emphasis on expanding healthcare infrastructure through programs like Ayushman Bharat and National Health Mission is significantly boosting demand for medical equipment across hospitals and clinics. According to government data, the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) is increasing the need for diagnostic and interventional devices while giving low-income families access to high-frequency and inexpensive life-saving operations.This initiative is particularly enhancing healthcare accessibility in tier-II and tier-III cities, driving adoption of advanced medical devices in previously underserved regions.

Region Insights:

- North India

- South India

- East India

- West India

South India exhibits a clear dominance with a 34% share of the total India medical devices market in 2025.

South India leads the India medical devices market, leveraging decades-old engineering clusters and export-oriented logistics through Chennai and Bengaluru ports. Common testing facilities are provided by the state-backed Tamil Nadu Medical Devices Park, which lowers entry hurdles for small manufacturers. Prominent hospital brands create early-adopter demand for cutting-edge technologies, while academic institutions like IIT Madras provide research skills. Growth is fueled by several states, which have a sizable senior population, excellent medical facilities, and great awareness of contemporary treatments.

The dominant regional market benefits from well-established healthcare ecosystems, robust medical tourism infrastructure, and technology-led innovations including robotic-assisted surgeries and 3D-printed implants. States like Karnataka, Tamil Nadu, and Kerala drive growth through high awareness about modern treatments and superior medical infrastructure. Bengaluru and Chennai serve as prominent hubs for advanced orthopedic surgeries and specialized medical interventions. Increasing insurance coverage, expanding private hospital networks, and supportive government initiatives continue driving sustained market expansion across the region.

Market Dynamics:

Growth Drivers:

Why is the India Medical Devices Market Growing?

Rising Prevalence of Chronic Diseases and Aging Population

The incidence of cardiovascular conditions is likewise increasing, encouraging wider deployment of high-throughput diagnostic imaging systems and interventional cardiology products. India's illness landscape is increasingly dominated by the rising prevalence of non-communicable diseases, which continuously raises the need for advanced equipment to identify, track, and treat chronic ailments. By 2045, the number of people with diabetes is expected to increase from about 77 million to over 134 million, increasing the need for insulin pumps, glucose monitors, and remote telemetry devices. High-throughput diagnostic imaging technologies and interventional cardiology devices are being deployed more widely due to the rising incidence of cardiovascular disorders. Urban lifestyles marked by sedentary habits and dietary shifts are accelerating obesity, hypertension, and related morbidities, all requiring continuous vital-sign tracking. India's elderly population aged 60 and above is expected to create substantial demand for healthcare solutions tailored to age-related conditions.

Government Initiatives and Policy Support

The Government of India initiated strategic initiatives to fuel the medical devices sector. The Production-Linked Incentive scheme has significantly driven investments, attracting substantial capital for manufacturing high-end medical equipment. The National Medical Devices Policy 2023 aims to expand India's market share substantially over the next 25 years while reducing import dependency. The Union Budget 2025-26 allocated Rs. 99,858 Crore to healthcare, reflecting strong policy commitment to boost innovation and infrastructure. Furthermore, the implementation of the National Single Window System has expedited regulatory clearances for medical device imports, improving compliance procedures. Medical device parks in Tamil Nadu, Himachal Pradesh, Madhya Pradesh, and Uttar Pradesh are providing common infrastructure and testing facilities, reducing manufacturing costs significantly.

Expanding Healthcare Infrastructure and Medical Tourism

India's healthcare infrastructure is expanding rapidly with significant investments from both public and private sectors in developing hospitals, diagnostic centers, and specialty care facilities. The expansion of private hospital chains across metro and tier-II cities has driven substantial investments in state-of-the-art medical technology. The affordability of medical procedures combined with availability of advanced medical facilities is attracting global patients, demanding development of healthcare facilities equipped with cutting-edge equipment. Public-private partnerships are accelerating healthcare infrastructure development, with collaborations leading to establishment of advanced healthcare facilities particularly in underserved regions.

Market Restraints:

What Challenges the India Medical Devices Market is Facing?

High Import Dependency

India remains heavily dependent on imports for advanced medical devices with medical devices being imported from countries like the United States, China, Germany, Netherlands, and Singapore. This reliance results in high procurement costs and exposure to supply chain disruptions. Advanced devices like MRI scanners, pacemakers, and high-end diagnostic equipment are predominantly sourced from abroad, limiting the local market's ability to scale quickly and impacting affordability.

Regulatory Complexity and Approval Delays

India's medical device industry faces significant regulatory challenges concerning product approvals and compliance with standards. Delays in obtaining approvals from regulatory authorities can slow down the entry of new devices into the market. The regulatory landscape remains complex with evolving requirements, creating barriers for both domestic manufacturers and international companies seeking market access.

Shortage of Skilled Healthcare Professionals

The need for highly qualified personnel to operate, maintain, and oversee this complex machinery has grown since the introduction of sophisticated medical gadgets. However, India faces a significant shortage of skilled professionals including surgeons, clinical technicians, and radiologists, particularly in tier-III cities and rural areas. This shortage affects device utilization rates and leads to underutilization of advanced technologies.

Competitive Landscape:

The India medical devices market exhibits a highly competitive landscape characterized by the presence of large multinational corporations, mid-sized firms, and emerging domestic manufacturers. The market structure reflects a diverse mix of players competing across various product segments and price points. Competition is intensifying as global companies recognize India as an important growth market and boost their research and development initiatives within the country. Key competitive strategies include establishing local manufacturing facilities to reduce costs, forming strategic partnerships with hospitals and distribution networks, and investing in innovation centers for product development tailored to Indian market requirements. The Production-Linked Incentive scheme is attracting fresh investments, encouraging both domestic and international players to localize production and enhance their competitive positioning in this rapidly expanding market.

Recent Developments:

-

July 2025: In order to increase its global medical device portfolio in lower-limb orthopedics, Zydus Lifesciences announced intentions to pay EUR 256.8 Million acquiring an 85.6% share in the French medical devices company known as Amplitude Surgical.

India Medical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Orthopedic Devices, Diagnostic Imaging, Cardiovascular Devices, Wound Management, Minimally Invasive Surgical (MIS), Diabetes Care, Dental Devices, Ophthalmic Devices, In Vitro Diagnostics (IVD), General Surgery, Others |

| End Users Covered | Hospitals and Ambulatory Surgery Centers (ASCs), Clinics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India medical devices market size was valued at USD 19.11 Billion in 2025.

The India medical devices market is expected to grow at a compound annual growth rate of 5.83% from 2026-2034 to reach USD 31.85 Billion by 2034.

Orthopedic devices held the largest share with 18% of the market in 2025, driven by the rising incidence of musculoskeletal disorders, aging population, and increasing demand for joint replacement surgeries.

Key factors driving the India medical devices market include rising healthcare demands, increasing government investments in healthcare infrastructure, advancements in medical technology, expanding elderly population, and growing prevalence of chronic diseases.

Major challenges include high import dependency of devices imported, regulatory complexity and approval delays, shortage of skilled healthcare professionals, limited healthcare infrastructure in rural areas, and price sensitivity in cost-conscious market segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)