India Medical Implants Market Size, Share, Trends and Forecast by Product, Material, and Region, 2025-2033

India Medical Implants Market Overview:

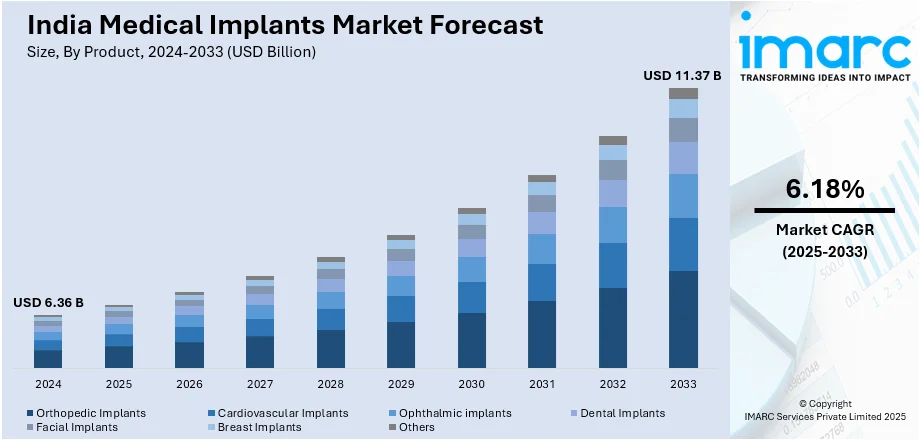

The India medical implants market size reached USD 6.36 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.37 Billion by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033. The market is growing due to rising demand for minimally invasive solutions, increasing accessibility to affordable surgical devices, and government initiatives promoting local manufacturing. Advancements in implant technology, expanding healthcare coverage, and growing awareness are driving market expansion, improving patient outcomes, and reducing treatment costs across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.36 Billion |

| Market Forecast in 2033 | USD 11.37 Billion |

| Market Growth Rate (2025-2033) | 6.18% |

India Medical Implants Market Trends:

Rising Adoption of Minimally Invasive Implants

The growing demand for minimally invasive medical implants is transforming India's healthcare industry. Patients and physicians are turning towards sophisticated, non-invasive procedures that shorten recovery time, lower surgical risks, and improve overall results. The trend is fueled by medical implant technology advances, which enable procedures to be more accurate and less painful. Minimally invasive implants, like needle-free drug delivery and transcatheter valve implantation, are gaining popularity because they enhance patient comfort and provide effective treatment. Additionally, growing awareness among patients about alternative treatment methods has fueled the demand for non-invasive medical solutions. In May 2024, Serum Institute of India (SII) invested in IntegriMedical, acquiring a 20% stake to advance its Needle-Free Injection System (N-FIS). This innovation in needle-free drug delivery enhances patient compliance, reduces needle-phobia, and strengthens India’s medical implants market, driving minimally invasive solutions and market expansion. Moreover, traditional surgical interventions are often associated with extended hospital stays and high treatment costs, prompting the medical industry to adopt minimally invasive alternatives. Additionally, the Indian government's push for advanced medical infrastructure and regulatory support for new implant technologies is accelerating this shift.

To get more information on this market, Request Sample

Expanding Access to Affordable Surgical Devices

There is an increasing demand for cost-effective medical implants in India due to improving healthcare access throughout the country. Most patients, especially in rural and disadvantaged regions, have financial constraints when it comes to accessing necessary surgical equipment. Government programs and health initiatives are responding to this by making medical implants more accessible and affordable. Policies to cut the price of surgical implants, combined with the growth of government-sponsored healthcare programs, have fortified India's medical device industry. Moreover, increased awareness of affordable treatment methods has prompted more patients to go for advanced surgical implants. In December 2024, India expanded access to medical implants under Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) and the AMRIT initiative, adding 300 surgical devices, including cardiovascular, anti-cancer, and anti-diabetic implants, to affordable healthcare programs. This increases market demand, improves accessibility, and lowers patients' out-of-pocket expenses across the country. Emphasis on affordability is also stimulating local manufacturing of medical devices, lowering reliance on foreign implants. With an increasing number of companies making local investments, the cost of implants will come down overall, covering a wider patient population. Government programs like Ayushman Bharat and PMBJP are making high-quality implants accessible at much lower prices, fostering equitable access to healthcare.

India Medical Implants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and material.

Product Insights:

- Orthopedic Implants

- Hip Orthopedic Device

- Joint Reconstruction

- Knee Orthopedic Devices

- Spine Orthopedic Devices

- Others

- Cardiovascular Implants

- Pacing devices

- Stents

- Structural Cardiac Implants

- Ophthalmic implants

- Intraocular lens

- Glaucoma Implants

- Dental Implants

- Facial Implants

- Breast Implants

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes orthopedic implants (hip orthopedic device, joint reconstruction, knee orthopedic devices, spine orthopedic devices, and others), cardiovascular implants (pacing devices, stents, and structural cardiac implants), ophthalmic implants (intraocular lens and glaucoma implants), dental implants, facial implants, breast implants, and others.

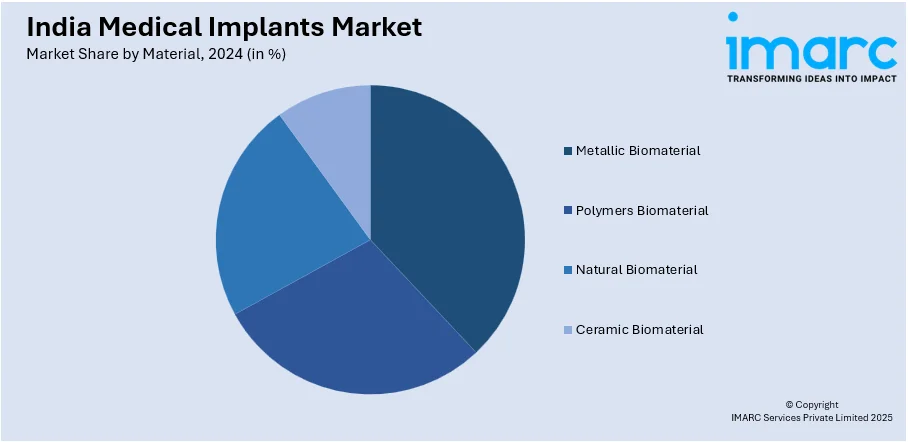

Material Insights:

- Metallic Biomaterial

- Polymers Biomaterial

- Natural Biomaterial

- Ceramic Biomaterial

The report has provided a detailed breakup and analysis of the market based on the material. This includes metallic biomaterial, polymers biomaterial, natural biomaterial, and ceramic biomaterial.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Medical Implants Market News:

- January 2025: Abbott launched Navitor Vision in India, an advanced TAVI/TAVR system for severe aortic stenosis patients at high surgical risk. Featuring enhanced visualization markers, it improves accuracy in valve deployment. This innovation strengthens India’s cardiac implant industry, thereby expanding minimally invasive treatment options and patient access.

- August 2024: Alkem MedTech partnered with Exactech to manufacture and market advanced hip and knee joint replacement implants in India. This collaboration strengthens domestic medical device manufacturing, aligns with India’s self-reliance initiatives, and expands access to high-quality orthopedic implants, boosting market growth and patient care.

India Medical Implants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Materials Covered | Metallic Biomaterial, Polymers Biomaterial, Natural Biomaterial, Ceramic Biomaterial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medical implants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medical implants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medical implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical implants market in the India was valued at USD 6.36 Billion in 2024.

The India medical implants market is projected to exhibit a CAGR of 6.18% during 2025-2033, reaching a value of USD 11.37 Billion by 2033.

Several key drivers are propelling the medical implants market in India, such as the growing incidence of orthopedic issues, an increasing elderly population, and rising demand for sophisticated surgical procedures. Expanding healthcare infrastructure, rising patient awareness, and improved insurance coverage are facilitating market growth. Additionally, adoption of technologically advanced implants and minimally invasive techniques is further boosting demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)