India Medical Robots Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

India Medical Robots Market Size and Share:

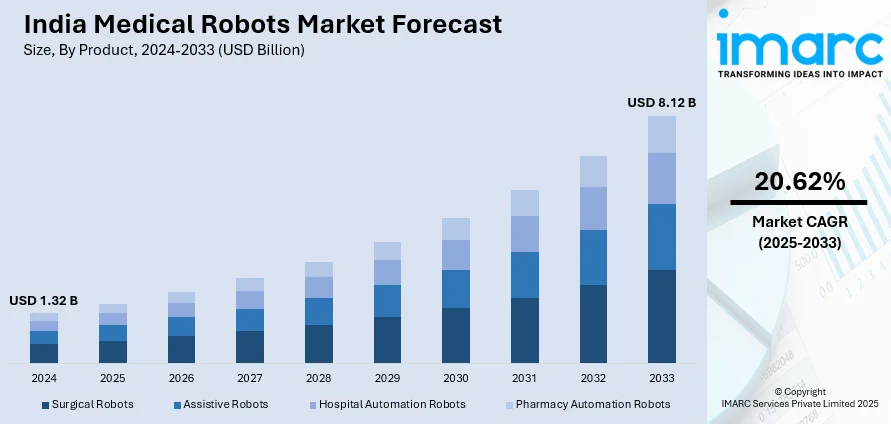

The India medical robots market size reached USD 1.32 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.12 Billion by 2033, exhibiting a growth rate (CAGR) of 20.62% during 2025-2033. The market is growing rapidly due to rising demand for minimally invasive surgeries, ongoing artificial intelligence (AI) advancements, increasing healthcare investments, growing aging population, workforce shortages, and government support, and surging adoption across surgical, rehabilitation, and pharmacy automation applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.32 Billion |

| Market Forecast in 2033 | USD 8.12 Billion |

| Market Growth Rate (2025-2033) | 20.62% |

India Medical Robots Market Trends:

Growing Adoption of AI and Automation in Surgical Robotics

The growing adoption of AI and automation features in medical robotics systems is boosting the India medical robots market share. AI surgical robots enable accurate surgical procedures, which decrease the chance of human mistakes and deliver better medical results for neurosurgical, orthopedic and laparoscopic procedures. Additionally, the robots get support from surgeons by evaluating data in real time and offering enhanced visualization features. This further enables robotic movements which produce superior accuracy and shorten recovery periods. Besides this, AI algorithms keep developing because they generate predictive analytics and create personalized treatment plans, which ultimately improve remote surgery efficiency. Moreover, robotic surgical system adoption by an increasing number of hospitals combined with expanding medical professional training programs continues to foster rapid implementation. For instance, in February 2025, Apollo Cancer Centre in Kolkata successfully performed India's first robotic-assisted excision of a rare prostatic stromal tumor, highlighting the growing implementation of robotic surgery in complex medical conditions. Furthermore, the combination of technology companies working with healthcare organizations drives AI-based robotic innovation. As a result, the Indian market is witnessing a greater adoption of AI-driven medical robotics because of government support for medical technology development and regulatory authorization for robotic surgical systems.

To get more information on this market, Request Sample

Expanding Use of Medical Robots in Rehabilitation and Elderly Care

The growing elderly population along with increased chronic disease cases is driving the India medical robots market growth, especially in the rehabilitation and elderly care. In line with this, medical robots in rehabilitation systems assist stroke and spinal cord injury patients and individuals who have musculoskeletal disorders by delivering precisely controlled movements that promote better motor abilities and increased mobility. Moreover, medical robots deliver designed therapy programs that match patient requirements, leading to better rehabilitation results. Concurrently, exoskeleton robots have become increasingly popular for aiding people with physical disabilities as they enable such users to restore their movements while maintaining independence. Besides this, the demand for elderly care robots is rising, especially in cities where both family structure shifts and staffing problems exist. These robots serve to track vital signs along with reminding patients about their medication schedules while delivering social interaction to patients. Apart from this, healthcare infrastructure improvement and decreasing costs of robotic solutions are boosting the adoption of rehabilitation and elderly care robots. For example, in 2024, Noble Hospital in Pune installed the SSI Mantra, a made-in-India surgical robot approved by the Central Drugs Standard Control Organisation (CDSCO), marking a significant step in adopting indigenous medical technology. This development, along with the increasing integration of robotics in post-acute care, is enhancing the India medical robots market outlook.

India Medical Robots Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Surgical Robots

- Assistive Robots

- Hospital Automation Robots

- Pharmacy Automation Robots

The report has provided a detailed breakup and analysis of the market based on the product. This includes surgical robots, assistive robots, hospital automation robots, and pharmacy automation robots.

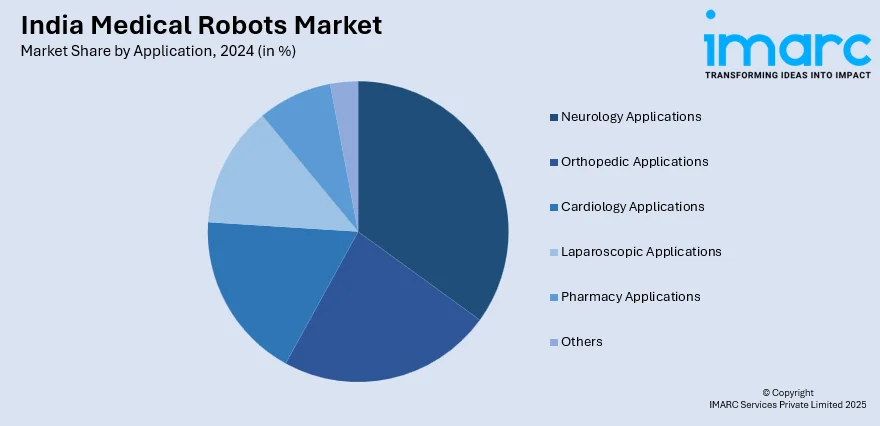

Application Insights:

- Neurology Applications

- Orthopedic Applications

- Cardiology Applications

- Laparoscopic Applications

- Pharmacy Applications

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes neurology applications, orthopedic applications, cardiology applications, laparoscopic applications, pharmacy applications, and others.

End User Insights:

- Hospitals

- Ambulatory Surgery Centers

- Rehabilitation Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, ambulatory surgery centers, rehabilitation centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Medical Robots Market News:

- In January 2025, SS Innovations International performed the world’s first robotic cardiac telesurgeries using its SSi Mantra 3 system. This groundbreaking achievement enhances remote surgical capabilities, expanding access to specialized cardiac care, particularly in underserved regions, and advancing the future of telemedicine in India.

- In December 2024, the All India Institute of Medical Sciences (AIIMS), New Delhi, signed a Memorandum of Understanding with Wipro GE Healthcare to establish an artificial intelligence (AI) Health Innovations Hub. This initiative focuses on integrating AI into healthcare, particularly in cardiology, oncology, and neurology, to improve diagnostic accuracy and treatment protocols.

India Medical Robots Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Surgical Robots, Assistive Robots, Hospital Automation Robots, Pharmacy Automation Robots |

| Applications Covered | Neurology Applications, Orthopedic Applications, Cardiology Applications, Laparoscopic Applications, Pharmacy Applications, Others |

| End Users Covered | Hospitals, Ambulatory Surgery Centers, Rehabilitation Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medical robots market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medical robots market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medical robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical robots market in India was valued at USD 1.32 Billion in 2024.

The India medical robots market is projected to exhibit a CAGR of 20.62% during 2025-2033, reaching a value of USD 8.12 Billion by 2033.

India medical robots market is experiencing rapid expansion, driven by growing demand for minimally invasive procedures, technological advancements in artificial intelligence-enabled robotic systems, and increased healthcare infrastructure investments. A rising elderly population with chronic conditions and workforce shortages in hospitals further fuel the adoption of surgical, rehabilitative, and logistics robots.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)