India Medicated Skincare Market Size, Share, Trends and Forecast by Skin Condition, Ingredient Type, Application Type, Distribution Channel, Product Features, and Region, 2025-2033

India Medicated Skincare Market Overview:

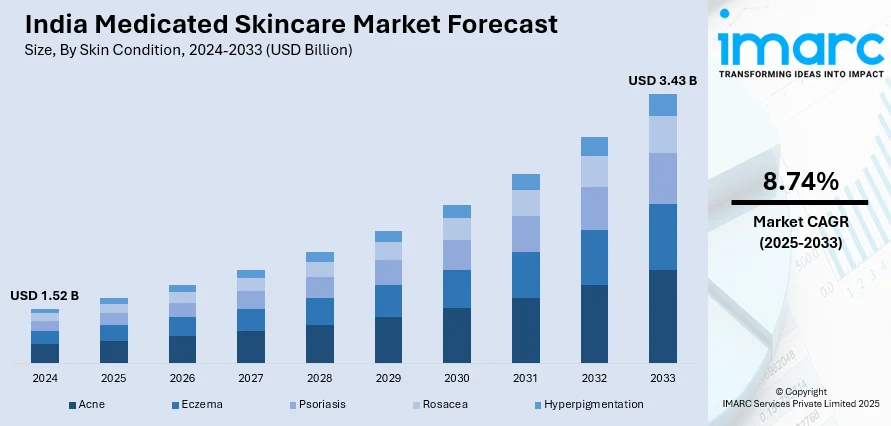

The India medicated skincare market size reached USD 1.52 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.43 Billion by 2033, exhibiting a growth rate (CAGR) of 8.74% during 2025-2033. The rising prevalence of skin disorders, increasing consumer awareness about dermatologist-recommended products, expansion of e-commerce and online dermatology consultations, and growing demand for clinically tested, natural, and sustainable skincare solutions are some of the factors propelling the India medicated skincare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.52 Billion |

| Market Forecast in 2033 | USD 3.43 Billion |

| Market Growth Rate (2025-2033) | 8.74% |

India Medicated Skincare Market Trends:

Increasing Consumer Awareness and Preference for Dermatologist-Recommended Products

Consumers in India are becoming more informed about skincare ingredients, formulations, and scientifically backed treatments which is creating a positive India medicated skincare market outlook. With social media, digital platforms, and influencer marketing, people are actively researching medicated skincare solutions that offer clinical efficacy and proven results. Dermatologist-recommended brands are gaining popularity as consumers prioritize safety, effectiveness, and long-term skin health. Additionally, the growing trend of preventive skincare encourages early treatment of skin concerns, boosting the demand for medicated sunscreens, anti-aging solutions, and acne treatments. Leading brands are focusing on education-based marketing strategies to attract and retain consumers in this evolving market. For instance, in February 2025, Alkem Laboratories, a prominent pharmaceutical firm located in Mumbai, revealed two strategic acquisitions to strengthen its foothold in the local market. Alkem entered a binding term sheet to purchase a complete stake in Adroit Biomed, a pharmaceutical firm concentrating on the skincare sector, for approximately Rs 140 crore. Additionally, Alkem's subsidiary Alkem MedTech has entered into a binding agreement to purchase 100% ownership of Bombay Ortho Industries, which produces orthopaedic implants, for approximately Rs 147 crore.

To get more information on this market, Request Sample

Expansion of E-Commerce and Online Dermatology Consultations

The rise of e-commerce platforms like Nykaa, Amazon, and Tata 1mg has made medicated skincare products more accessible across India, even in Tier 2 and Tier 3 cities. For instance, in January 2025, Obagi Medical, a world-famous brand in medical-grade skincare, officially entered the Indian market via a collaboration with Nykaa, the top beauty and lifestyle platform in India. The partnership signifies a significant step in introducing top-tier skincare products to the Indian market. Obagi Medical, with more than thirty years of experience, is well-known for its clinically validated products addressing skin issues such as aging, hyperpigmentation, and uneven skin tone. Consumers can easily purchase dermatologist-recommended brands, prescription-based treatments, and niche skincare solutions online. Additionally, telemedicine and online dermatology consultations have surged, allowing consumers to receive expert advice remotely and access personalized skincare regimens. The growing presence of direct-to-consumer (D2C) skincare brands further fuels the market by offering targeted solutions based on consumer concerns, thereby expanding the reach of medicated skincare products.

Rising Prevalence of Skin Disorders and Dermatological Issues

The increasing cases of acne, eczema, psoriasis, hyperpigmentation, and other skin conditions are driving demand for medicated skincare products in India. Factors like pollution, hormonal imbalances, stress, and lifestyle changes contribute to skin issues, leading consumers to seek dermatologist-recommended treatments. Additionally, rising awareness of skin health and a growing middle-class population willing to invest in skincare solutions are fueling India medicated skincare market growth. The demand for therapeutic creams, serums, and prescription-based skincare products is increasing, with pharmaceutical companies and dermatology brands expanding their offerings to cater to specific skin concerns and growing consumer needs. For instance, in October 2024, Bayer’s Consumer Health Division introduced Bepanthen, an internationally known skincare brand, in India. The launch aligns with the results of the 2024 Bepanthen Survey on Dry Skin, carried out by Ipsos in seven Indian cities, which indicates a widespread occurrence of dry skin issues and a notable lack of awareness among patients about how to manage these conditions.

India Medicated Skincare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on skin condition, ingredient type, application type, distribution channel, and product features.

Skin Condition Insights:

- Acne

- Eczema

- Psoriasis

- Rosacea

- Hyperpigmentation

The report has provided a detailed breakup and analysis of the market based on the skin condition. This includes acne, eczema, psoriasis, rosacea, and hyperpigmentation.

Ingredient Type Insights:

- Anti-Inflammatories

- Antibacterials

- Antifungals

- Antioxidants

- Moisturizers

The report has provided a detailed breakup and analysis of the market based on the ingredient type. This includes anti-inflammatories, antibacterials, antifungals, antioxidants, and moisturizers.

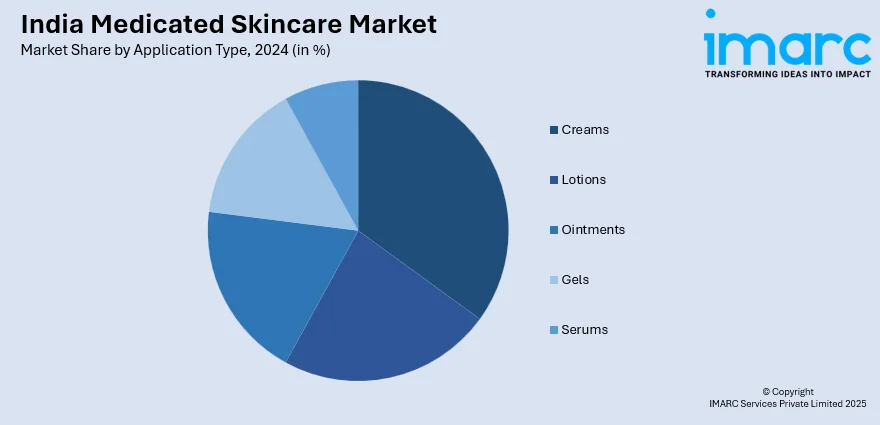

Application Type Insights:

- Creams

- Lotions

- Ointments

- Gels

- Serums

The report has provided a detailed breakup and analysis of the market based on the application type. This includes creams, lotions, ointments, gels, and serums.

Distribution Channel Insights:

- Over-The-Counter

- Prescription

- Online Retail

- Pharmacies

- Dermatologist Clinics

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes over-the-counter, prescription, online retail, pharmacies, and dermatologist clinics.

Product Features Insights:

- Hypoallergenic

- Non-Comedogenic

- Fragrance-Free

- Paraben-Free

- Cruelty-Free

A detailed breakup and analysis of the market based on the product features have also been provided in the report. This includes hypoallergenic, non-comedogenic, fragrance-free, paraben-free, and cruelty-free.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Medicated Skincare Market News:

- In December 2024, Hydrinity Accelerated Skin Science, the quickest expanding professional skincare brand in the US, revealed its new collaboration with Photonence, a prominent distributor and reliable partner in the healthcare sector, to promote its products in India. Hydrinity Accelerated Skin Science is presently available in 17 international markets and looks forward to expanding into India.

- In October 2024, Eucerin, a worldwide frontrunner in skincare for dermatological needs, officially introduced its products on Nykaa, one of the biggest beauty and wellness platforms in India, marking its debut in the Indian market.

India Medicated Skincare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Skin Conditions Covered | Acne, Eczema, Psoriasis, Rosacea, Hyperpigmentation |

| Ingredient Types Covered | Anti-inflammatories, Antibacterials, Antifungals, Antioxidants, Moisturizers |

| Application Types Covered | Creams, Lotions, Ointments, Gels, Serums |

| Distribution Channels Covered | Over-the-counter, Prescription, Online Retail, Pharmacies, Dermatologist Clinics |

| Product Features Covered | Hypoallergenic, Non-Comedogenic, Fragrance-Free, Paraben-Free, Cruelty-Free |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India medicated skincare market performed so far and how will it perform in the coming years?

- What is the breakup of the India medicated skincare market on the basis of skin condition?

- What is the breakup of the India medicated skincare market on the basis of ingredient type?

- What is the breakup of the India medicated skincare market on the basis of application type?

- What is the breakup of the India medicated skincare market on the basis of distribution channel?

- What is the breakup of the India medicated skincare market on the basis of product features?

- What is the breakup of the India medicated skincare market on the basis of regions?

- What are the various stages in the value chain of the India medicated skincare market?

- What are the key driving factors and challenges in the India medicated skincare?

- What is the structure of the India medicated skincare market and who are the key players?

- What is the degree of competition in the India medicated skincare market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medicated skincare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medicated skincare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medicated skincare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)