India Metal Casting Market Size, Share, Trends and Forecast by Process, Material Type, End Use, Component, Vehicle Type, Electric and Hybrid type, Application, and Region, 2026-2034

India Metal Casting Market Summary:

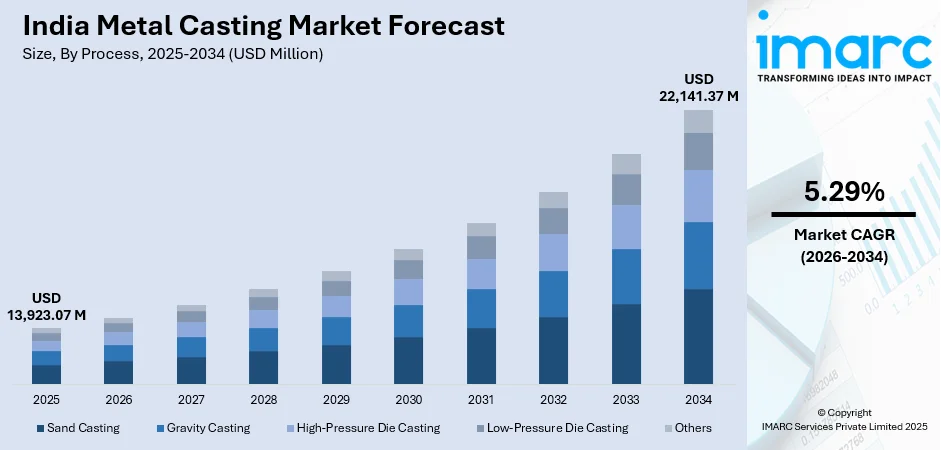

The India metal casting market size was valued at USD 13,923.07 Million in 2025 and sis projected to reach USD 22,141.37 Million by 2034, growing at a compound annual growth rate of 5.29% from 2026-2034.

The market is driven by the rapid expansion of domestic automotive manufacturing, rising infrastructure investments, and increasing demand for industrial machinery components. Government initiatives promoting indigenous production and the growing adoption of electric vehicles (EVs) are further accelerating growth. The country's competitive labor costs and availability of raw materials continue to attract investments in casting facilities. These factors collectively contribute to the expanding India metal casting market share.

Key Takeaways and Insights:

- By Process: Sand casting dominates the market with a share of 46% in 2025, driven by its cost-effectiveness for producing large and complex components and versatility in handling various metals.

- By Material Type: Cast iron leads the market with a share of 38% in 2025, owing to its favorable mechanical property profile, including excellent wear resistance and thermal conduction.

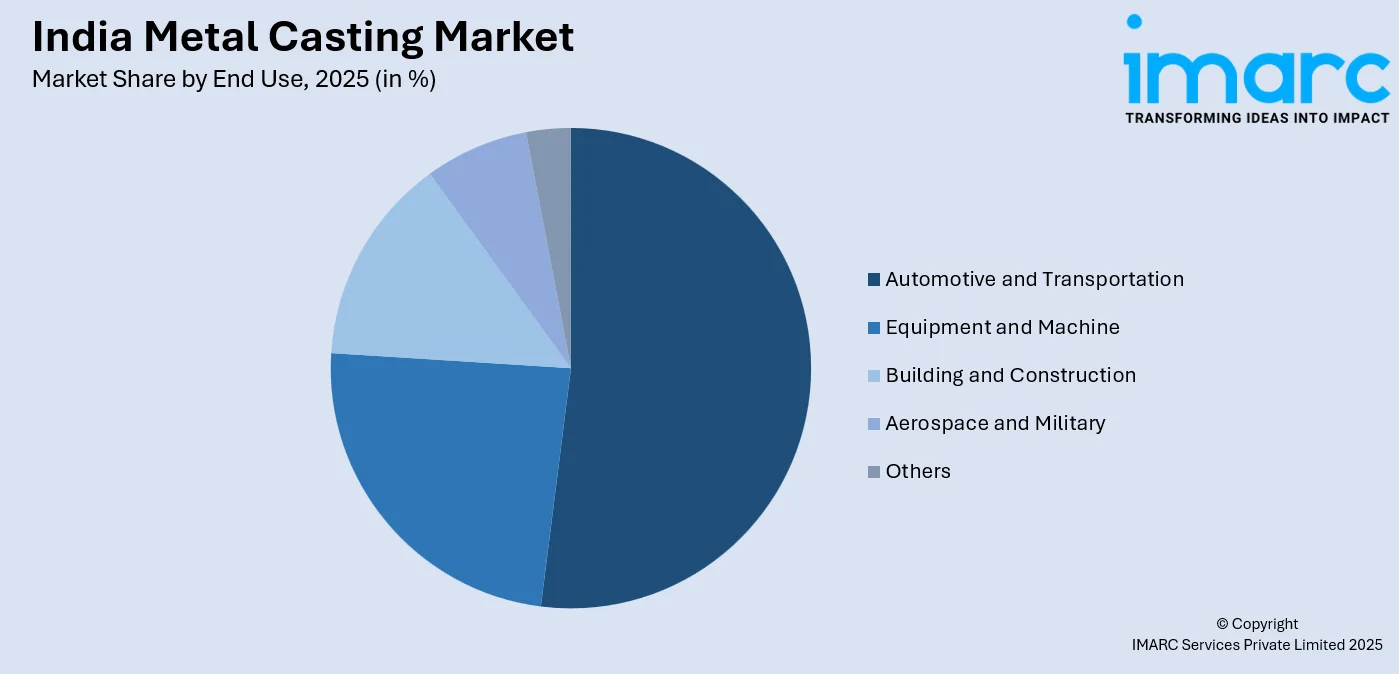

- By End Use: Automotive and transportation represents the largest segment with a market share of 52% in 2025, driven by the growing capacity expansion in automotive sector for manufacturing and accelerating demand for lightweight components in the transport sector.

- By Component: Cylinder head dominates the market with a share of 18% in 2025, owing to the critical role of cylinder heads in engine performance and rising fuel-efficient engine demand.

- By Vehicle Type: Passenger cars lead the market with a share of 64% in 2025, owing to rising disposable incomes, expanding middle-class population, and preference for personal mobility solutions.

- By Electric and Hybrid Type: Hybrid electric vehicles represent the largest segment with a market share of 48% in 2025, driven by the transitional phase of electrification, which requires traditional and new components for casting

- By Application: Engine parts dominate the market with a share of 44% in 2025, owing to fundamental cast component requirements in internal combustion engines and conventional powertrain prominence.

- By Region: West and Central India leads the market with a share of 34% in 2025, driven by concentration of major automotive manufacturing hubs in Maharashtra and Gujarat.

- Key Players: The India metal casting market exhibits a fragmented competitive landscape, with established domestic foundries competing alongside international manufacturers across various end-use segments. Market participants focus on technological upgrades, capacity expansions, and strategic partnerships to strengthen their positions while addressing evolving customer requirements for precision and quality.

To get more information on this market Request Sample

The India metal casting market is experiencing substantial growth driven by multiple interconnected factors transforming the industrial landscape. The automotive sector remains the primary demand driver, with expanding vehicle production capacities and the emergence of electric mobility creating diverse component requirements. As per source, in December 2025, Jaya Hind Industries announced a ₹200 Crore investment to expand its precision aluminium die-casting facility near Chennai, increasing capacity to 20,000 Tonnes per year and adding advanced manufacturing capabilities, reflecting rising industry confidence and capacity upgrades. Moreover, government initiatives under the Make in India program have incentivized domestic manufacturing, reduced import dependency and fostering local foundry development. Infrastructure development projects across railways, construction, and industrial equipment sectors generate sustained demand for cast metal products. Additionally, the aerospace and defense industries are increasingly sourcing domestically manufactured castings, further expanding market opportunities.

India Metal Casting Market Trends:

Adoption of Advanced Casting Technologies

The Indian metal casting industry is witnessing a significant shift toward advanced manufacturing technologies to enhance product quality and operational efficiency. Foundries are increasingly investing in automated molding systems, computer-aided design solutions, and simulation software to optimize casting processes. In October 2025, RHI Magnesita commissioned India’s first robotic caster system at JSW Vijayanagar, automating high-risk casting tasks and improving product quality and safety in steel casting operations. Additionally, the adoption of three-dimensional printing for pattern and mold making is enabling rapid prototyping capabilities.

Emphasis on Lightweight Material Solutions

The growing focus on fuel efficiency and emission reduction across transportation sectors is driving demand for lightweight casting solutions. Manufacturers are increasingly transitioning toward aluminum and magnesium alloys to replace traditional ferrous castings in automotive applications. In December 2025, Wheels India signed a technical pact with Japan’s Topy Industries to boost domestic aluminium alloy wheel casting capacity, expanding annual output toward 10 Lakh wheels per annum to cater to rising demand for lightweight EV and passenger vehicle components. Furthermore, this shift is particularly evident in passenger vehicle components where weight reduction directly impacts fuel economy and performance.

Sustainable Manufacturing Practices

Environmental sustainability is emerging as a central theme in the Indian metal casting sector as manufacturers respond to regulatory pressures and customer expectations. Foundries are implementing waste heat recovery systems, installing advanced pollution control equipment, and transitioning toward cleaner energy sources. As per sources in November 2025, CSIR-NIIST partnered with industry to convert 30 Tonnes per day of hazardous foundry sand into high-strength bricks, promoting foundry waste reuse and reducing landfill burden. Moreover, the recycling of metal scrap and foundry sand is becoming standard practice to minimize environmental footprint and reduce raw material costs.

Market Outlook 2026-2034:

The India metal casting market is projected to demonstrate robust revenue growth throughout the forecast period, supported by expanding automotive production, infrastructure investments, and industrial modernization initiatives. The market revenue is expected to benefit from increasing domestic vehicle sales, growing export opportunities, and rising demand from aerospace and defense sectors. The transition toward EVs will create new revenue streams through specialized component requirements. Government policies promoting manufacturing excellence and technological advancement will further strengthen market revenue potential, positioning India as a global casting manufacturing hub. The market generated a revenue of USD 13,923.07 Million in 2025 and is projected to reach a revenue of USD 22,141.37 Million by 2034, growing at a compound annual growth rate of 5.29% from 2026-2034.

India Metal Casting Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Process | Sand Casting | 46% |

| Material Type | Cast Iron | 38% |

| End Use | Automotive and Transportation | 52% |

| Component | Cylinder Head | 18% |

| Vehicle Type | Passenger Cars | 64% |

| Electric and Hybrid Type | Hybrid Electric Vehicles | 48% |

| Application | Engine Parts | 44% |

| Region | West and Central India | 34% |

Process Insights:

- Sand Casting

- Gravity Casting

- High-Pressure Die Casting

- Low-Pressure Die Casting

- Others

Sand casting dominates with a market share of 46% of the total India metal casting market in 2025.

Sand casting maintains its dominant position in the India metal casting market due to its inherent versatility and cost-effectiveness for producing large-scale components. This traditional casting method offers exceptional flexibility in accommodating various metal alloys and complex geometries without requiring expensive tooling investments. In April 2024, Gautam Casting Group installed a new automated sand plant with a high-pressure moulding line supplied by Savelli Machinery India at its Rajkot facility, significantly boosting sand casting productivity and mould throughput. The process remains particularly favorable for small to medium production volumes where economic considerations outweigh speed requirements.

The automotive and industrial machinery sectors rely heavily on sand casting for manufacturing engine blocks, cylinder heads, and heavy equipment components. The availability of abundant sand resources across India supports this segment's continued dominance in the market. Ongoing improvements in binder systems and molding techniques are enhancing dimensional accuracy and surface finish quality, ensuring sand casting remains competitive against alternative processes. Foundries continue investing in mechanized sand preparation and reclamation systems to improve productivity and environmental performance.

Material Type Insights:

- Cast Iron

- Aluminum

- Steel

- Zinc

- Magnesium

- Others

Cast iron leads with a share of 38% of the total India metal casting market in 2025.

Cast iron leads the material type segment due to its exceptional combination of mechanical strength, castability, and cost-effectiveness across various industrial applications. It provides superior wear resistance, excellent vibration damping, and thermal stability, which are critical for durable engine and machinery components. Its self-lubricating properties make it especially suitable for parts operating under high-friction and demanding conditions. These characteristics ensure that cast iron remains a preferred choice for components requiring reliability, longevity, and performance in challenging industrial environments.

The automotive industry extensively utilizes cast iron for engine blocks, brake components, and drivetrain parts where durability and thermal management are critical performance factors. Industrial machinery manufacturers prefer cast iron for its machinability and ability to absorb operational stresses during prolonged usage cycles. Despite the growing adoption of lightweight alternatives in certain applications, cast iron maintains strong demand in segments where strength and cost efficiency take precedence overweight considerations. Continuous metallurgical improvements enhance cast iron performance characteristics for evolving applications.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Automotive and Transportation

- Equipment and Machine

- Building and Construction

- Aerospace and Military

- Others

Automotive and transportation exhibits a clear dominance with a 52% share of the total India metal casting market in 2025.

The automotive and transportation commands the largest market share driven by India's position as a major global vehicle manufacturing hub serving domestic and international markets. The sector requires diverse casting components ranging from powertrain elements to structural parts, creating sustained demand across various casting processes and materials. According to reports, in December 2025, the Government of India disbursed over ₹1,350 Crore in incentives under the Production Linked Incentive (PLI) Scheme for Automobile & Auto Components, boosting localisation of advanced automotive technologies including cast parts.

The electrification of transportation is reshaping demand patterns within this segment, with growing requirements for battery enclosures, motor housings, and thermal management components. Both domestic consumption and export markets contribute to segment growth as Indian foundries serve global automotive supply chains efficiently. The presence of established automobile manufacturers and tier suppliers ensures consistent order flows for casting producers across all scales of operation. Strategic partnerships between automakers and foundries strengthen supply chain integration and quality assurance capabilities.

Component Insights:

- Alloy Wheels

- Clutch Casing

- Cylinder Head

- Cross Car Beam

- Crank Case

- Battery Housing

- Others

Cylinder head leads with a market share of 18% of the total India metal casting market in 2025.

Cylinder heads represent the leading component category within automotive casting applications due to their critical role in engine functionality and overall vehicle performance. These precision components require sophisticated casting techniques to achieve complex internal passages and tight dimensional tolerances essential for optimal combustion efficiency. As per sources, Endurance Technologies approved a ₹63 Crore capex for capacity addition in aluminium die-casting and machining of automotive components, including transmission and housings that support precision castings like cylinder heads.

Manufacturers invest significantly in process capabilities and quality systems to meet stringent specifications for cylinder head production across various engine configurations. The component's complexity creates barriers to entry, benefiting established suppliers with proven expertise and track records of consistent delivery performance. As internal combustion engines remain prevalent in the Indian market, cylinder head demand maintains strong momentum despite the gradual transition toward electric powertrains. Foundries continue developing advanced aluminum cylinder head capabilities to address lightweighting requirements in modern engine designs.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger cars dominate with a market share of 64% of the total India metal casting market in 2025.

Passenger cars dominate the vehicle type segment reflecting their overwhelming share of Indian automotive production and the substantial casting content per vehicle. Rising consumer prosperity, urbanization, and preference for personal mobility solutions drive consistent growth in passenger vehicle demand across market segments. In February 2025, Maruti Suzuki began commercial production at its new Kharkhoda passenger car plant in Haryana, expanding its manufacturing footprint and reinforcing casting component demand for its core vehicle lineup. Each passenger car requires numerous cast components across powertrain, chassis, and body applications, generating substantial casting volumes for domestic foundries.

The segment benefits from new model launches, platform expansions, and capacity additions by domestic and international automakers establishing manufacturing operations in India. Compact and mid-size vehicles particularly popular in the Indian market utilize diverse casting applications across multiple vehicle systems. The premiumization trend is also increasing aluminum casting content per vehicle as manufacturers incorporate lightweight solutions to enhance fuel efficiency and performance characteristics. Consumer preference for feature-rich vehicles drives demand for additional cast components in comfort and safety systems.

Electric and Hybrid Type Insights:

- Hybrid Electric Vehicles

- Battery Electric Vehicles

- Plug-In Hybrid Electric Vehicles

Hybrid electric vehicles lead with a share of 48% of the total India metal casting market in 2025.

Hybrid electric vehicles lead this segment as they represent the primary bridge technology in India's automotive electrification journey toward sustainable transportation solutions. These vehicles combine internal combustion engines with electric propulsion systems, requiring casting components for both powertrains simultaneously. According to reports, Toyota Kirloskar Motor captured an 81% share of India’s strong hybrid SUV and passenger vehicle market, driven by sales of models such as the Innova Hycross and Urban Cruiser Hyryder, underscoring growing HEV adoption. Moreover, the dual propulsion architecture creates incremental casting demand compared to conventional vehicles, benefiting foundries capable of serving diverse component requirements.

Consumer acceptance of hybrid electric vehicles is growing due to their ability to address range anxiety concerns while offering improved fuel efficiency and reduced emissions. Government incentives for electrified vehicles and expanding charging infrastructure support segment expansion across multiple vehicle categories. Foundries are adapting capabilities to serve hybrid vehicle requirements including specialized aluminum castings for power electronics cooling and lightweight structural components. The transitional nature of hybrid technology ensures sustained demand for both traditional ferrous castings and emerging lightweight component applications throughout the forecast period.

Application Insights:

- Body Assemblies

- Engine Parts

- Transmission Parts

- Others

Engine parts exhibit a clear dominance with a 44% share of the total India metal casting market in 2025.

Engine parts constitute the largest application segment reflecting the central importance of powertrain components in automotive casting demand across vehicle categories. This category encompasses diverse components including blocks, heads, manifolds, and various covers requiring different casting processes and materials tailored to specific functional requirements. As per sources, in December 2025, Jaya Hind Industries began a ₹200 Crore expansion of its Chennai die‑casting facility, adding high‑pressure machines that will produce critical engine cast components including blocks and housings for domestic and export automotive customers.

Despite the gradual transition toward electric mobility, internal combustion engines remain dominant in the Indian vehicle fleet, sustaining strong demand for engine castings. The aftermarket segment provides additional demand stability as replacement components serve the extensive installed vehicle base requiring maintenance and repair services. Manufacturers continue optimizing engine casting designs for weight reduction and improved thermal efficiency to meet evolving emission standards. The long service life of vehicles in India ensures continued aftermarket demand for engine replacement parts throughout extended operational periods.

Regional Insights:

- North India

- West and Central India

- South India

- East India

West and Central India dominates with a market share of 34% of the total India metal casting market in 2025.

West and Central India leads regional demand driven by the concentration of automotive and industrial manufacturing facilities across Maharashtra and Gujarat states. Major automobile plants, component suppliers, and foundry clusters operate throughout this region, creating integrated supply chain ecosystems supporting efficient production operations. Proximity to major ports facilitates both raw material imports and finished product exports, enhancing competitiveness in domestic and international markets. The region benefits from established industrial infrastructure developed over decades of manufacturing sector growth and investment.

The region benefits from established industrial infrastructure, skilled workforce availability, and supportive state government policies encouraging manufacturing investments and capacity expansions. Ongoing investments in manufacturing capacity expansions and technology upgrades reinforce regional leadership in serving major automotive and industrial customers. Strong connectivity through road, rail, and port networks ensures efficient logistics supporting just-in-time delivery requirements of major customers. Industrial clusters in Pune, Ahmedabad, and surrounding areas continue attracting new foundry investments and technology partnerships strengthening regional market position.

Market Dynamics:

Growth Drivers:

Why is the India Metal Casting Market Growing?

Expanding Automotive Manufacturing Ecosystem

The India metal casting market is experiencing significant growth driven by the continuous expansion of the domestic automotive manufacturing ecosystem serving global markets. The country has emerged as a preferred destination for global automakers establishing production facilities to serve both local and export markets efficiently. In November 2025, Toyota, Honda, and Suzuki collectively announced nearly $11 Billion in investments to expand vehicle production and supply chains in India, reinforcing the country’s role as a global automotive hub. Moreover, this expansion encompasses passenger vehicles, commercial vehicles, and two-wheelers, each requiring substantial casting components across multiple applications.

Government Policy Support for Manufacturing

Government initiatives promoting domestic manufacturing provide substantial impetus to the metal casting industry's growth trajectory across multiple segments. Programs emphasizing indigenous production have encouraged investments in foundry infrastructure and technology upgrades throughout the country. As per sources, in November 2025, the Government of India launched the third round of the Production Linked Incentive (PLI) Scheme for speciality steel with a ₹2,100 Crore outlay to attract investment in advanced steel and alloy production used in casting‑intensive sectors like automotive and defence. Furthermore, policy incentives for manufacturing investments, including tax benefits and land allocation support, attract both domestic and foreign capital inflows. The defense sector's focus on domestic procurement creates new market opportunities for specialized casting applications.

Infrastructure Development Acceleration

Accelerated infrastructure development across India generates sustained demand for metal castings serving construction and industrial equipment sectors nationwide. Massive investments in railways, highways, urban transit, and port facilities require diverse equipment incorporating cast components for structural applications. According to sources, the Union Ministry of Railways allocated Rs. 6,925 Crore for extensive rail infrastructure expansion in Chhattisgarh, marking over a 22‑fold increase in budgetary support and accelerating track and bridge works nationwide. Moreover, the power generation sector expansion including renewable energy installations creates demand for specialized castings across turbine and generator applications. Water management and irrigation projects utilize pumps and valves manufactured through casting processes. This infrastructure push extends across urban and rural regions, broadening geographic demand.

Market Restraints:

What Challenges the India Metal Casting Market is Facing?

Material Price Volatility

The metal casting industry faces persistent challenges from fluctuating prices of key raw materials including pig iron, scrap metals, and alloying elements. Price volatility complicates production cost management and margin maintenance, particularly for foundries operating under long-term supply contracts. Import dependency for certain specialty metals exposes manufacturers to currency fluctuations and supply disruptions affecting profitability.

Environmental Compliance Requirements

Stringent environmental regulations impose significant compliance burdens on metal casting operations requiring substantial capital investments in pollution control infrastructure. Foundries must implement advanced emission control systems, effluent treatment facilities, and waste management protocols to meet regulatory standards. Smaller foundries particularly struggle with compliance costs potentially threatening their operational viability and long-term market participation.

Skilled Workforce Shortages

The metal casting industry confronts growing difficulties in attracting and retaining skilled technical personnel essential for quality production operations. Younger workforce generations often prefer employment in sectors perceived as cleaner and more technologically advanced. The specialized knowledge required for metallurgical control, process optimization, and quality assurance takes considerable time to develop through practical experience.

Competitive Landscape:

The India metal casting market features a highly fragmented competitive structure characterized by numerous participants ranging from large integrated foundries to small-scale job shops. Established manufacturers differentiate through technological capabilities, quality certifications, and established customer relationships with major original equipment manufacturers. Competition intensifies as foundries upgrade facilities to capture growing demand from automotive and industrial sectors. Market participants increasingly focus on process automation, quality management systems, and sustainable manufacturing practices to strengthen competitive positioning. Strategic partnerships between foundries and technology providers are enabling capability enhancements. Geographic clustering of foundries in industrial regions creates both competitive pressure and collaborative opportunities.

Recent Developments:

- In August 2025, Gujarat-based aluminium extrusion manufacturer ANB Metal Cast launched its IPO, aiming to raise INR 49.92 Crore to expand its Rajkot facility, install new machinery, and enhance working capital, strengthening capabilities across automotive, solar, architecture, and industrial aluminium casting applications.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Sand Casting, Gravity Casting, High-Pressure Die Casting , Low-Pressure Die Casting , Others |

| Material Types Covered | Cast Iron, Aluminum, Steel, Zinc, Magnesium, Others |

| End Uses Covered | Automotive and Transportation, Equipment and Machine, Building and Construction, Aerospace and Military, Others |

| Component Covered | Alloy Wheels, Clutch Casing, Cylinder Head, Cross Car Beam, Crank Case, Battery Housing, Others |

| Vehicle TypesCovered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Electric and Hybrid Types Covered | Hybrid Electric Vehicles, Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles |

| Applications Covered | Body Assemblies, Engine Parts, Transmission Parts, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India metal casting market size was valued at USD 13,923.07 Million in 2025.

The India metal casting market is expected to grow at a compound annual growth rate of 5.29% from 2026-2034 to reach USD 22,141.37 Million by 2034.

Sand casting held the largest India metal casting market share, driven by its versatility in producing complex components across various sizes, cost-effectiveness for medium production volumes, and widespread adoption in automotive and industrial machinery applications.

Key factors driving the India metal casting market include expanding automotive manufacturing ecosystem, government policy support for domestic production, infrastructure development acceleration, growing EV adoption, and increasing demand from industrial machinery and aerospace sectors.

Major challenges include raw material price volatility affecting production costs, stringent environmental compliance requirements demanding capital investments, skilled workforce shortages in technical positions, energy cost fluctuations impacting operational expenses, and competition from alternative manufacturing technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)