India Metal Forging Market Size, Share, Trends and Forecast by Material, Technique, Installation Capacity, End User, and Region, 2025-2033

India Metal Forging Market Size and Share:

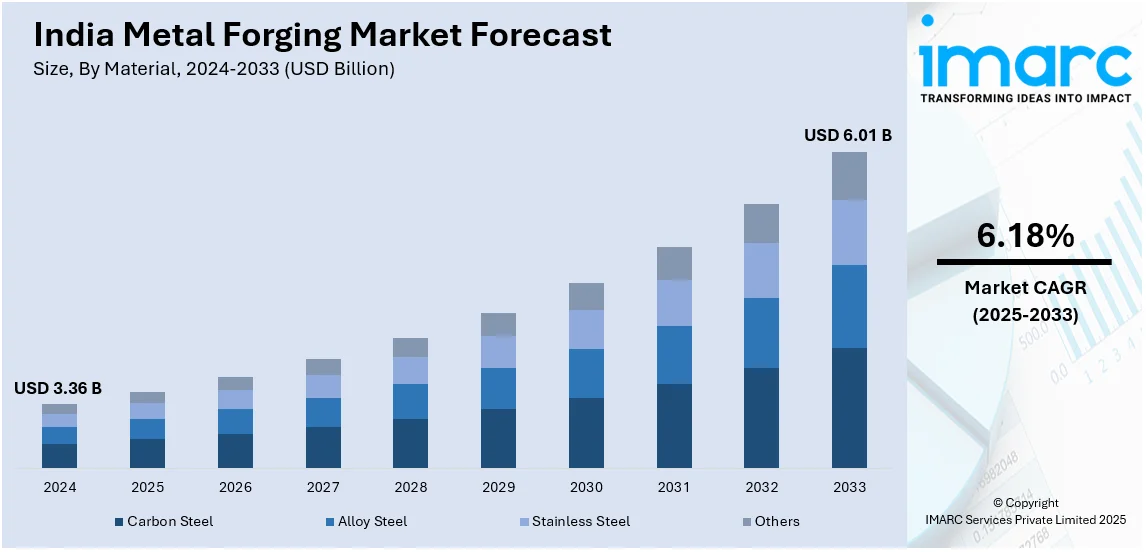

The India metal forging market size reached USD 3.36 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.01 Billion by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033. India's metal forging market is experiencing robust progress, propelled by escalating demand from key sectors such as automotive, aerospace, and defense, alongside technological advancements like precision forging and automation, which enhance efficiency and productivity, collectively driving the market's expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.36 Billion |

| Market Forecast in 2033 | USD 6.01 Billion |

| Market Growth Rate 2025-2033 | 6.18% |

India Metal Forging Market Trends:

Automotive Industry Demand

The automotive industry is a key driver of India's metal forging industry. Forged parts are an essential part of car production, employed in engines, transmissions, and other structural components because of their strength and durability. India's status as a global automotive hub has led to a rise in the demand for such parts. During the fiscal year 2021-22, India's automotive production was around 22.93 million vehicles, a sharp rise from the last year. This development indicates the growing need for forged metal components. According to the Society of Indian Automobile Manufacturers (SIAM), passenger vehicle sales upsurged by 13.24% in 2021-22 over 2020-21, indicating a strong recovery and substantial expansion of the automotive industry. The interest of the government in developing the infrastructure and such programs as the "Make in India" movement has further given a boost to the augmenting of the automotive sector. The Production Linked Incentive (PLI) program for the auto industry, involving an outlay of INR 57,042 crore, was launched with an aim to drive manufacturing capacities and investments. This programme is likely to create an estimated investment of more than INR 42,500 crore in the auto component and vehicle manufacturing sector within five years, thus escalating the demand for forged components. Also, the drive toward electric mobility has created new opportunities for the forging sector.

To get more information on this market, Request Sample

Government Initiatives and Policies

Proactive policies of the Indian government have played a significant role in pushing the metal forging industry to grow. The "Atmanirbhar Bharat" (Self-Reliant India) program focuses on self-reliance in production, promoting domestic manufacturing of products, including forgings. It has resulted in more investments being made in the manufacturing sector, promoting rise in the forging industry. The introduction of the Goods and Services Tax (GST) has made taxation simpler, eliminating complexities and expenses for manufacturers. Simplification has allowed forging companies to conduct operations more effectively, boosting their competitiveness. The focus by the government on infrastructure development at an investment of INR 111 lakh crore to be made under the National Infrastructure Pipeline (NIP) during the period 2019-2025 has also created a demand surge for machinery and equipment needed for construction that are largely based on forged products. This mega infrastructure push can be expected to significantly boost the development of the forging sector. Besides, the Micro, Small, and Medium Enterprises (MSME) sector, which contributes a significant portion of the forging industry, has been extensively supported. The Emergency Credit Line Guarantee Scheme (ECLGS), involving an overall outlay of INR 3 lakh crore, has provided much-needed liquidity to MSMEs, ensuring business continuity and expansion.

India Metal Forging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material, technique, installation capacity, and end-user.

Material Insights:

- Carbon Steel

- Alloy Steel

- Stainless Steel

- Others

The report has provided a detailed breakup and analysis of the market based on the materials. This includes carbon steel, alloy steel, stainless steel, and others.

Technique Insights:

- Close Die Forging

- Open Die Forging

- Ring Forging

A detailed breakup and analysis of the market based on the technique have also been provided in the report. This includes close die forging, open die forging, and ring forging.

Installation Capacity Insights:

- Small (100 MT to 12,500 MT)

- Medium (12,500 to 30,000 MT)

- Heavy (Above 30,000 MT)

A detailed breakup and analysis of the market based on installation capacity have also been provided in the report. This includes small (100 MT to 12,500 MT), medium (12,500 to 30,000 MT), and heavy (above 30,000 MT).

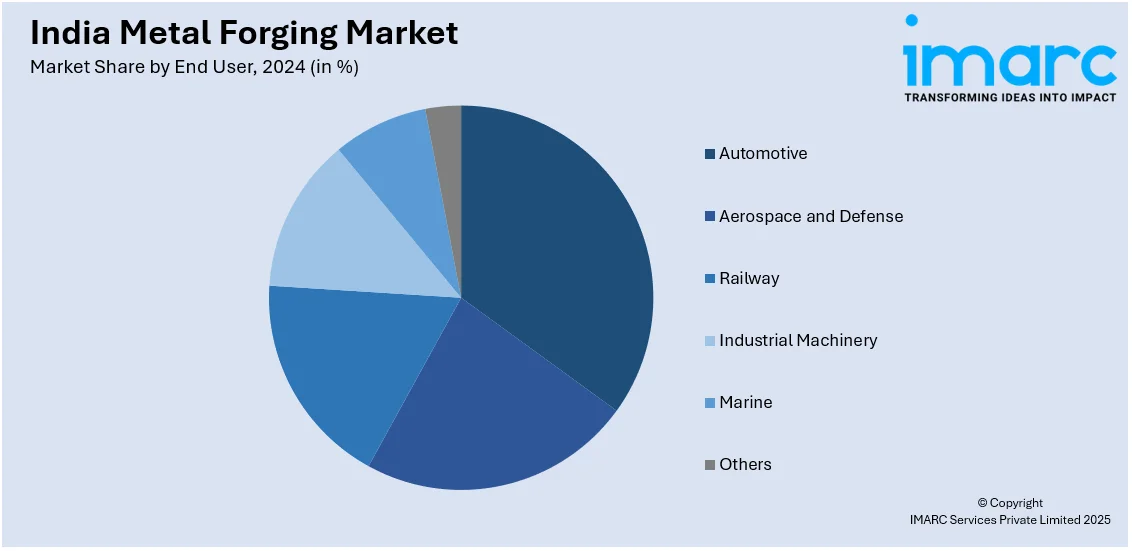

End User Insights:

- Automotive

- Aerospace and Defense

- Railway

- Industrial Machinery

- Marine

- Others

A detailed breakup and analysis of the market based on end user have also been provided in the report. This includes automotive, aerospace and defense, railway, industrial machinery, marine, and others.

Regional Insights:

- North India

- South Inia

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Metal Forging Market News:

- November 2024: 3D Monotech introduced Markforged FX10, the global first industrial 3D printer that prints both metal and high-end composite materials, into India. The technology allows makers to create high-performance parts from digital models in one step, rising production efficiency. With the inclusion of such cutting-edge additive manufacturing technologies, the Indian metal forging sector can enjoy quicker prototyping and less lead time, thus supporting market.

- June 2024: Hilton Metal Forging Ltd announced the commencement of production of domestic wagon axles for rail wagons under the "Make in India" and "AtmaNirbhar Bharat" initiative to minimize reliance on imports. The company clocked a growth of 32.7% in total revenue at INR 139.88 crore in FY2023-24 and intends to mobilize up to INR 100 crore through equity augmentation to fund expansion of business. These milestones will further build up domestic manufacturing capability, making the Indian metal forging industry even stronger.

India Metal Forging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Carbon Steel, Alloy Steel, Stainless Steel, Others |

| Techniques Covered | Close Die Forging, Open Die Forging, Ring Forging |

| Installation Capacities Covered | Small (100 MT to 12,500 MT), Medium (12,500 MT to 30,000 MT), Heavy (Above 30,000 MT) |

| End Users Covered | Automotive, Aerospace and Defense, Railway, Industrial Machinery, Marine, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India metal forging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India metal forging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India metal forging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal forging market in India was valued at USD 3.36 Billion in 2024.

The India metal forging market is projected to exhibit a CAGR of 6.18% during 2025-2033, reaching a value of USD 6.01 Billion by 2033.

Key factors driving the India metal forging market include the growing demand from automotive, aerospace, and industrial sectors, advancements in forging technologies, rising infrastructure development, and increasing investments in manufacturing capabilities. Additionally, the expansion of electric vehicles (EVs) and government initiatives supporting the manufacturing sector support the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)