India Metal Powder Market Size, Share, Trends and Forecast by Material, Technology, Application, and Region, 2025-2033

India Metal Powder Market Overview:

The India metal powder market size reached USD 305.86 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 510.38 Million by 2033, exhibiting a growth rate (CAGR) of 5.42% during 2025-2033. The rising demand in additive manufacturing, automotive lightweighting, and powder metallurgy applications are the factors propelling the growth of the market. Expanding applications in electronic components, aerospace, and defense, along with increasing adoption in sintered components and coatings, further accelerate market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 305.86 Million |

| Market Forecast in 2033 | USD 510.38 Million |

| Market Growth Rate 2025-2033 | 5.42% |

India Metal Powder Market Trends:

Advancing Powder Metallurgy Standardization

The powder metallurgy sector is putting more focus on innovation and standardization, encouraging industry-academic collaboration to improve material performance and manufacturing efficiency. Research institutes and regulatory organizations are actively working with industry professionals to develop metallurgical processes, assuring uniformity, dependability, and sustainability. Advanced approaches are being developed to improve material qualities, reduce production costs, and broaden applications in automotive, aerospace, and industrial machines. Standardized methods are supposed to improve quality control, maximize resource use, and encourage the use of cutting-edge materials. The integration of developing technology and knowledge-sharing platforms is accelerating the sector's growth by making precise manufacturing more accessible and scalable. Such programs are critical for harmonizing industry practices with rising global quality standards. For example, in September 2024, IIT Kanpur's Advanced Centre for Materials Science, in collaboration with the Bureau of Indian Standards and the Indian Institute of Metals, hosted a workshop on advancements in powder metallurgical processes. Industry experts, academicians, and researchers discussed innovations and the importance of standardization in powder metallurgy. The event included presentations from leading industry figures and a tour of IIT Kanpur's research facilities.

.webp)

To get more information on this market, Request Sample

Rising Investments in Powder Metallurgy Efficiency

Powder metallurgy production is experiencing advancements driven by increased investments in high-precision manufacturing technologies. Companies are adopting advanced compaction presses to improve consistency, optimize material usage, and enhance production efficiency. This shift is aimed at meeting growing demand for sintered components in automotive, aerospace, and industrial applications. With a focus on precision and scalability, manufacturers are expanding operations to cater to domestic and international markets. The adoption of automated and high-capacity compaction systems is improving product quality, reducing material waste, and enabling mass production of complex components. As industries seek cost-effective, durable, and high-performance metal parts, the push for advanced powder metallurgy solutions continues to strengthen, positioning manufacturers for long-term competitiveness and global expansion. For instance, in February 2024, SAP Parts, based in Maharashtra, India, installed a new compaction press to enhance powder metallurgy production at its Pune facility. The advanced press improves compaction consistency and boosts capacity. The company, known for mechanical face seals, also produces sintered components, bushings, and bearings, supplying markets in Europe and North America.

India Metal Powder Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material, technology, and application.

Material Insights:

- Ferrous

- Non-Ferrous

The report has provided a detailed breakup and analysis of the market based on the material. This includes ferrous and non-ferrous.

Technology Insights:

- Pressing and Sintering

- Metal Injection Molding

- Additive Manufacturing

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes pressing and sintering, metal injection molding, additive manufacturing, and others.

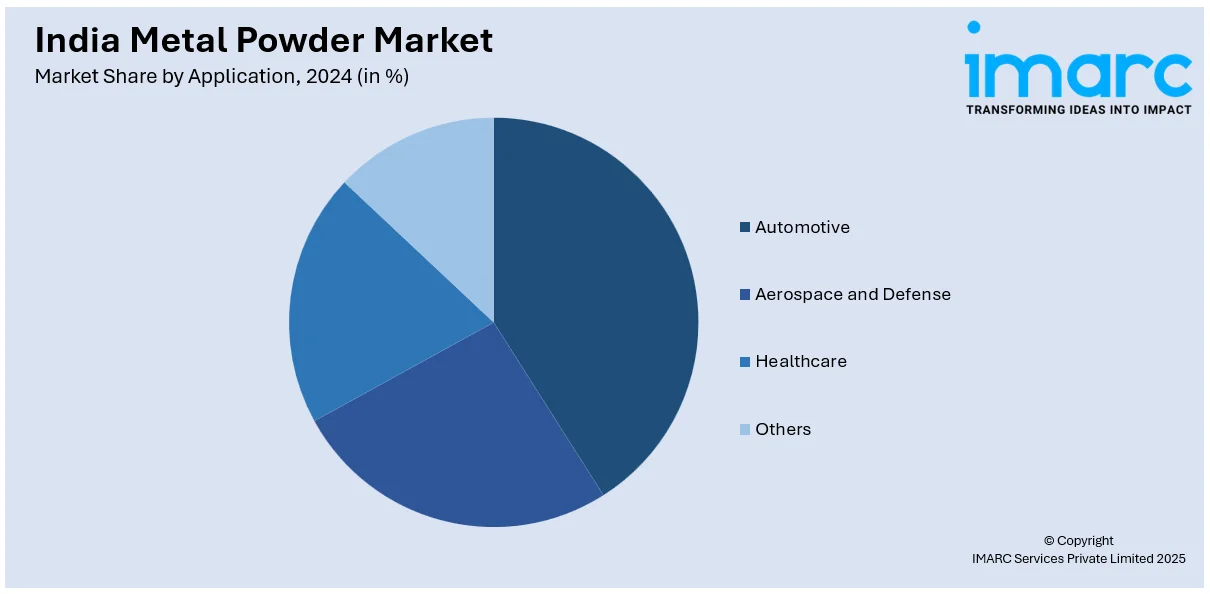

Application Insights:

- Automotive

- Aerospace and Defense

- Healthcare

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, aerospace and defense, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Metal Powder Market News:

- In December 2024, Monotech Systems Ltd, based in Chennai, India, unveiled the Markforged FX10 Additive Manufacturing machine. The FX10 features a modular build system, allowing users to switch between metal and composite build engines, and a build volume of 375 mm x 300 mm x 300 mm. It supports materials like 17-4PH and 316L stainless steels, aiming to enhance manufacturing productivity by producing strong, accurate tools and fixtures.

- In March 2024, Sandvik AB introduced Osprey C18150, a copper-based metal powder designed for high-temperature applications. This alloy maintains mechanical strength and high electrical and thermal conductivity at temperatures up to 500°C. It's suitable for additive manufacturing and metal injection molding processes, serving industries like aerospace and automotive.

India Metal Powder Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Ferrous, Non-Ferrous |

| Technologies Covered | Pressing and Sintering, Metal Injection Molding, Additive Manufacturing, Others |

| Applications Covered | Automotive, Aerospace and Defense, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India metal powder market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India metal powder market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India metal powder industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal powder market in India was valued at USD 305.86 Million in 2024.

The India metal powder market is projected to exhibit a (CAGR) of 5.42% during 2025-2033, reaching a value of USD 510.38 Million by 2033.

Demand for metal powder in India is amplifying as a result of the growth in additive manufacturing, automotive and aerospace manufacturing, and tooling for industry. Advances in metal manufacturing technology and precision engineering broaden applications. Incentives from the government for local manufacturing and the trend toward light, high-strength components also contribute to broad-based market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)