India Micro-Mobility Market Size, Share, Trends and Forecast by Type, Propulsion Type, Sharing Type, Speed, Age Group, Ownership, and Region, 2025-2033

India Micro-Mobility Market Overview:

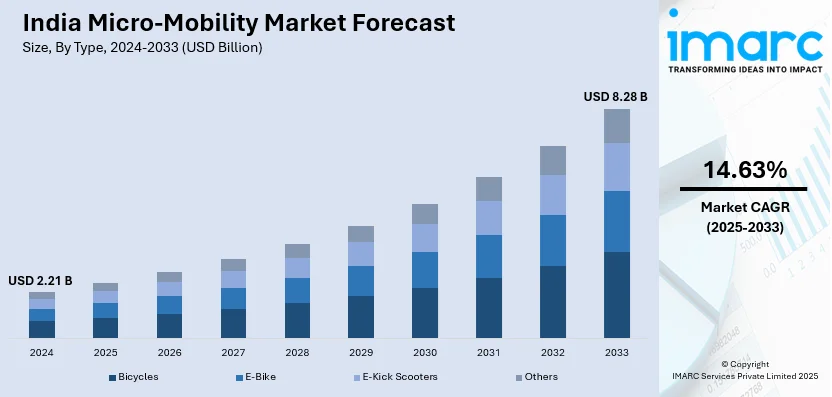

The India micro-mobility market size reached USD 2.21 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.28 Billion by 2033, exhibiting a growth rate (CAGR) of 14.63% during 2025-2033. The market is expanding due to rising urban congestion, government incentives and increasing adoption of electric two-wheelers. Moreover, rising traction of subscription-based and shared mobility models and growing demand in metro and Tier-2 cities is also contributing positively to the India micro-mobility market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.21 Billion |

| Market Forecast in 2033 | USD 8.28 Billion |

| Market Growth Rate (2025-2033) | 14.63% |

India Micro-Mobility Market Trends:

Rise of Subscription-Based Models

Subscription-based models are reshaping the India micro-mobility market by offering consumers cost-effective and flexible transportation options. Companies are introducing monthly, weekly, and pay-per-use rental plans for electric scooters and bicycles, eliminating the need for ownership while ensuring easy access to mobility. These models appeal to urban commuters looking for affordable and hassle-free alternatives to traditional vehicles. Zero-deposit, EMI-based plans, and maintenance-inclusive packages further enhance their attractiveness. Startups like Yulu, Bounce, and Rentkar are expanding their fleets to cater to this rising demand. For instance, in July 2024, Rentkar announced its plans to deploy 1,000 electric scooters with a zero-commitment, easy-service subscription model starting at Rs 3,990 per month. Customers can exchange scooters within 2 hours, ensuring reliable transportation without the downsides of ownership. This innovative model appeals to those seeking flexibility and cost-efficiency in the evolving EV market. The convenience of app-based bookings, coupled with widespread availability in metro cities, is driving adoption. Businesses are also integrating these solutions for employee mobility, reducing operational costs and carbon footprints. With increasing urbanization and government incentives promoting electric vehicle adoption, subscription-based micro-mobility is set to gain a larger India micro-mobility market share in the coming years.

To get more information on this market, Request Sample

Government Push for Electric Vehicles (EVs)

The Indian government is actively promoting electric vehicle (EV) adoption through initiatives like the Faster Adoption and Manufacturing of Electric Vehicles (FAME II) scheme and state-level incentives. FAME II provides subsidies on electric two-wheelers, reducing their upfront cost and making them more accessible to urban commuters. Additionally, several states, including Maharashtra, Delhi, and Tamil Nadu, offer tax exemptions, registration fee waivers, and direct purchase incentives to accelerate EV penetration. In addition to FAME II and state-level incentives, the Indian government has introduced new initiatives to further accelerate EV adoption. The PM E-DRIVE Scheme, launched on October 1, 2024, with a budget of Rs. 10,900 Crore, aims to boost electric vehicle sales, targeting 24.79 lakh e-2Ws and 3.2 lakh e-3Ws. It includes Rs. 500 Crore for e-ambulances, Rs. 500 Crore for e-trucks, and Rs. 4,391 Crore for 14,028 e-buses. These policies are boosting demand for electric scooters and bicycles, directly impacting the micro-mobility segment. Furthermore, the government’s push for charging infrastructure development and battery-swapping networks is enhancing convenience and range confidence among users. With rising fuel prices and stricter emission norms, businesses and consumers are increasingly shifting towards EV-based shared mobility solutions. This strong regulatory support is shaping a positive India micro-mobility market outlook, driving sustainable urban transport growth.

India Micro-Mobility Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, propulsion type, sharing type, speed, age group and ownership.

Type Insights:

- Bicycles

- E-Bike

- E-Kick Scooters

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes bicycles, e-bike, e-kick scooters and others.

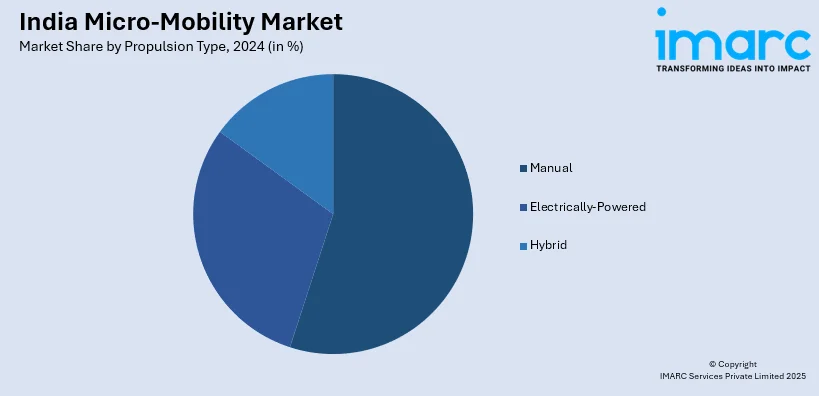

Propulsion Type Insights:

- Manual

- Electrically-Powered

- Hybrid

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes manual, electrically-powered and hybrid.

Sharing Type Insights:

- Docked

- Dock-Less

A detailed breakup and analysis of the market based on the sharing type have also been provided in the report. This includes docked and dock-less.

Speed Insights:

- Less than 25 Kmph

- Above 25 Kmph

A detailed breakup and analysis of the market based on the speed have also been provided in the report. This includes less than 25 kmph and above 25 kmph.

Age Group Insights:

- 15-34

- 35-54

- 55 and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 15-34, 35-54 and 55 and above.

Ownership Insights:

- Business-To-Business (B2B)

- Business-To-Consumer (B2C)

A detailed breakup and analysis of the market based on the ownership have also been provided in the report. This includes business-to-business (B2B), business-to-consumer (B2C).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Micro-Mobility Market News:

- In January 2025, Suzuki Motorcycle India launched its first electric scooter, e-Access, along with the GIXXER SF 250 Flex Fuel motorcycle and a new Access scooter. The e-Access features a 3.07 kWh battery with a range of 95 km, while the GIXXER model supports up to 85% ethanol fuel, promoting sustainability.

- In November 2024, Honda announced its plans to launch its first electric scooter in India, the Activa Electric. Teasers reveal a removable battery and charging options. The scooter may be available in two configurations: with a battery for home charging or without, utilizing a subscription model for battery swapping.

India Micro-Mobility Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Bicycles, E-Bike, E-Kick Scooters, Others |

| Propulsion Types Covered | Manual, Electrically-Powered, Hybrid |

| Sharing Types Covered | Docked, Dock-Less |

| Speeds Covered | Less than 25 Kmph, Above 25 Kmph |

| Age Groups Covered | 15-34, 35-54, 55 and Above |

| Ownerships Covered | Business-To-Business (B2B), Business-To-Consumer (B2C) |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India micro-mobility market performed so far and how will it perform in the coming years?

- What is the breakup of the India micro-mobility market on the basis of type?

- What is the breakup of the India micro-mobility market on the basis of propulsion type?

- What is the breakup of the India micro-mobility market on the basis of sharing type?

- What is the breakup of the India micro-mobility market on the basis of speed?

- What is the breakup of the India micro-mobility market on the basis of age group?

- What is the breakup of the India micro-mobility market on the basis of ownership?

- What is the breakup of the India micro-mobility market on the basis of region?

- What are the various stages in the value chain of the India micro-mobility market?

- What are the key driving factors and challenges in the India micro-mobility market?

- What is the structure of the India micro-mobility market and who are the key players?

- What is the degree of competition in the India micro-mobility market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India micro-mobility market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India micro-mobility market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India micro-mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)