India Microfinance Market Size, Share, Trends and Forecast by Provider Type, Purpose, Tenure, and Region, 2026-2034

India Microfinance Market Overview:

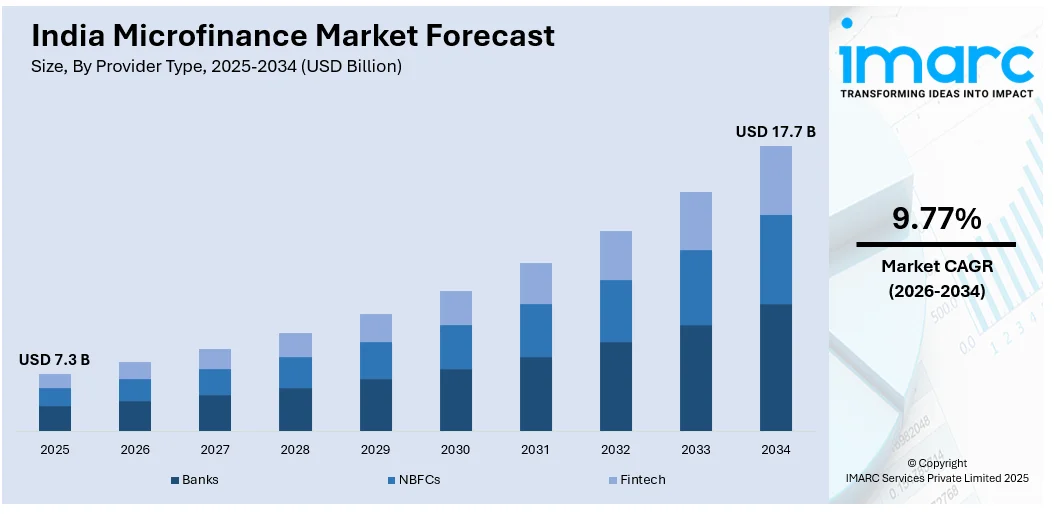

The India microfinance market size reached USD 7.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 17.7 Billion by 2034, exhibiting a growth rate (CAGR) of 9.77% during 2026-2034. The rising financial inclusion initiatives, strong government support through schemes and subsidies, increasing demand for credit in rural and semi-urban areas, and the proliferation of digital lending platforms. Additionally, the sector benefits from women-focused lending models and improved regulatory frameworks enhancing transparency and institutional growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.3 Billion |

| Market Forecast in 2034 | USD 17.7 Billion |

| Market Growth Rate 2026-2034 | 9.77% |

India Microfinance Market Trends:

Digital Transformation in Microfinance Operations

India’s microfinance sector has witnessed remarkable growth, expanding from ₹17,264 crore in 2012 to ₹3.93 lakh crore in 2024, reflecting a 2,100% increase over 12 years. This expansion is driven by rapid digital transformation across microfinance institutions, with the adoption of digital lending platforms, mobile banking apps, and AI-powered credit assessments streamlining loan disbursement and recovery. Fintech collaborations and biometric-enabled eKYC have lowered operational costs while improving financial inclusion in underserved rural areas. Digital repayment options like UPI and mobile wallets enhance customer convenience and repayment efficiency. These innovations enable faster onboarding, better credit monitoring, and compliance. The digital shift is helping MFIs scale operations, bridge access gaps, and strengthen India’s rural credit ecosystem, reinforcing financial inclusion and formalizing small-scale lending practices.

To get more information on this market Request Sample

Growing Focus on Women-Centric Lending

Women-centric lending is a key driver of India’s microfinance sector, with women accounting for 99% of the 8.67 crore active microfinance borrowers and a total loan portfolio of ₹4.43 lakh crore in 2024. Recognizing their role in household financial stability and community development, microfinance institutions (MFIs) are prioritizing credit access for women through self-help groups (SHGs) and joint liability groups (JLGs). These models increase economic independence, social empowerment, and financial inclusion in rural and semi-urban regions. Government initiatives such as the Deendayal Antyodaya Yojana and women's enterprise initiatives complement this trend. With the growth of gender-targeted microfinance, inclusive growth is being promoted, social capital is being enhanced, and economic inequalities in marginalized areas are being narrowed.

Increasing Regulatory Oversight and Industry Consolidation

Stronger regulation and structural mergers are sculpting India's developing microfinance sector. A unified regulatory landscape that covers all players providing microfinance loans was implemented by the Reserve Bank of India (RBI), driving a level field and protecting clients. Regulation that includes interest capping, loanee indebtedness, and regular disclosure norms is driving greater visibility and responsibility through institutions. This has resulted in more formalization of operations and less exploitative lending behavior. Furthermore, the market is also experiencing consolidation as smaller MFIs get acquired by larger ones or are transformed into Small Finance Banks (SFBs) to build stronger capital bases and increase services. Such consolidation is driving scalability, operation resilience, and enhanced service delivery throughout the microfinance value chain.

India Microfinance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on provider type, purpose, and tenure.

Provider Type Insights:

- Banks

- NBFCs

- Fintech

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes banks, NBFCs, and fintech.

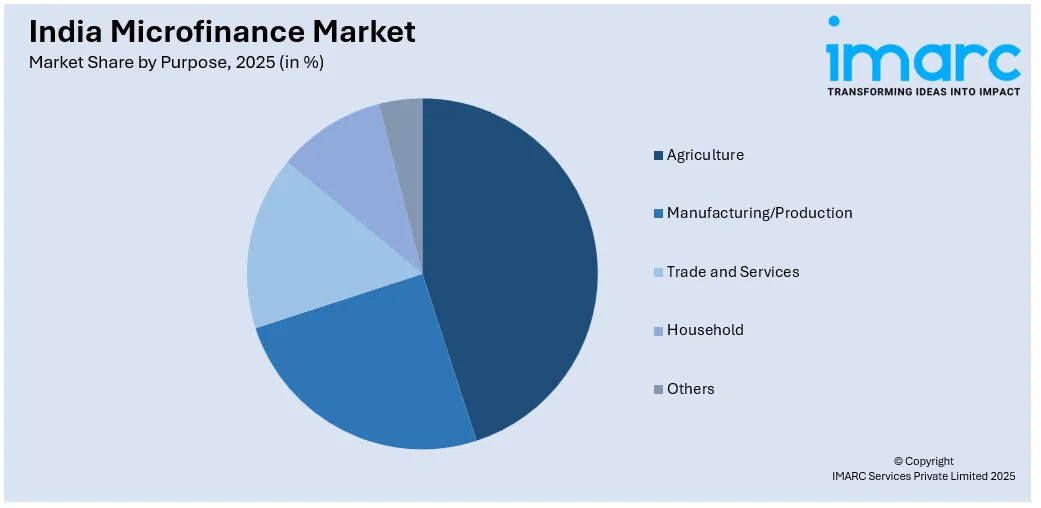

Purpose Insights:

Access the comprehensive market breakdown Request Sample

- Agriculture

- Manufacturing/Production

- Trade and Services

- Household

- Others

A detailed breakup and analysis of the market based on the purpose have also been provided in the report. This includes agriculture, manufacturing/production, trade and services, household, and others.

Tenure Insights:

- Less than 1 year

- 1-2 years

- More than 2 years

The report has provided a detailed breakup and analysis of the market based on the tenure. This includes less than 1 year, 1-2 years, and more than 2 years.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Microfinance Market News:

- In November 2024, Muthoot Microfin, a Kochi-based microfinance institution, commenced loan disbursals under a new co-lending partnership with the State Bank of India (SBI). SBI has sanctioned a ₹500 crore limit, to be disbursed in ₹100 crore tranches. The initiative aims to offer affordable credit to rural entrepreneurs, particularly women, to boost small businesses and promote financial inclusion across underserved regions through strengthened credit access and collaborative lending support.

- In August 2024, Kotak Mahindra Bank announced the merger of its wholly-owned subsidiaries, Sonata Finance and BSS Microfinance, under an approved scheme of amalgamation. Sonata will merge into BSS Microfinance on a going concern basis, subject to approvals from shareholders, creditors, NCLT, and other regulatory authorities. The bank noted that the combined net worth of both entities is less than 2% of its total net worth as of March 31, 2024.

India Microfinance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Provider Types Covered | Banks, NBFCs, Fintech |

| Purposes Covered | Agriculture, Manufacturing/Production, Trade and Services, Household, Others |

| Tenures Covered | Less than 1 year, 1-2 years, More than 2 years |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India microfinance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India microfinance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India microfinance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The microfinance market in India was valued at USD 7.3 Billion in 2025.

The India microfinance market is projected to exhibit a CAGR of 9.77% during 2026-2034, reaching a value of USD 17.7 Billion by 2034.

Key factors driving India’s microfinance market include growing demand for financial services among underserved rural populations, government-backed inclusion schemes like PMJDY and MUDRA, rising female entrepreneurship, digital lending innovations, supportive RBI regulations, increased NBFC-MFI participation, expanding credit access for MSMEs, and strong investor interest in socially impactful finance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)