India Microturbine Market Size, Share, Trends and Forecast by Application, Power Rating, End-User, and Region, 2025-2033

India Microturbine Market Overview:

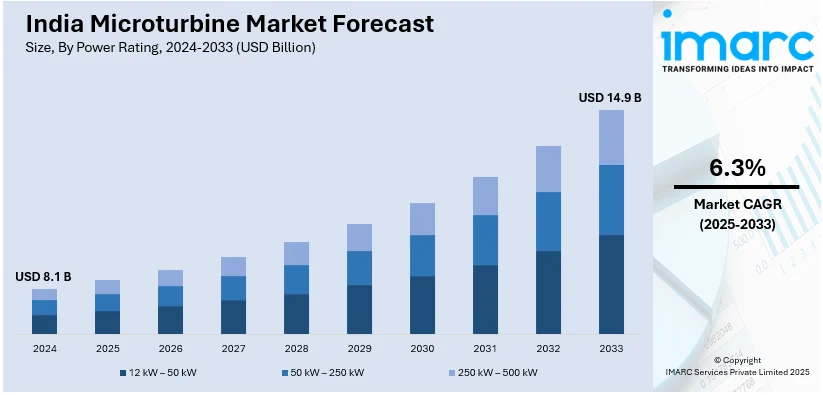

The India microturbine market size reached USD 8.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.3% during 2025-2033. The market is experiencing robust growth, fueled by an increasing industrial demand for decentralized and clean energy solutions. Furthermore, this trend is supported by significant investments and government policies promoting renewable energy and technological innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.1 Billion |

| Market Forecast in 2033 | USD 14.9 Billion |

| Market Growth Rate (2025-2033) | 6.3% |

India Microturbine Market Trends:

Increasing Demand from Industrial and Commercial Sectors

Industries and commercial establishments in India are increasingly adopting microturbines to address rising energy costs and grid instability. Manufacturing units, data centers, hotels, and healthcare facilities require uninterrupted power supply, making microturbines an attractive solution for reliable and cost-effective power generation. The rising focus on energy security and decentralized power systems is driving the installation of microturbines in industrial clusters. For instance, in October 2024, Hitachi Energy India announced plans to invest Rs 2,000 crore over the next four to five years to develop transmission and energy transition products. The investment aims to enhance capacity, supply chain, and digital flexibility as part of its 2030 strategy. Additionally, the expansion of smart cities and urban infrastructure projects is creating new opportunities for efficient, small-scale power solutions. Microturbines, with their compact design, high efficiency, and ability to operate in cogeneration mode, are increasingly being used to provide combined heat and power (CHP) solutions, further improving energy efficiency and operational cost savings for businesses.

To get more information on this market, Request Sample

Grwing Emphasis on Clean and Sustainable Energy Solutions

The shift toward clean energy solutions is driving the adoption of microturbines in India. Industries are under increasing pressure to reduce carbon emissions and improve energy efficiency, leading to greater investment in low-emission power technologies. In line with this, the Indian government’s focus on sustainability goals and emission reductions through initiatives is encouraging industries to explore decentralized, cleaner power generation. For instance, in 2023, the Government of India announced an investment of USD 68 billion in clean energy, with nearly half allocated to low-emissions power generation, including solar PV. Moreover, microturbines, known for their lower NOx emissions and ability to run on multiple fuels such as natural gas and biogas, are gaining traction in renewable energy integration. Additionally, advancements in hybrid power systems, where microturbines are combined with solar or wind energy, are further driving their adoption, enhancing efficiency and lowering environmental impact.

India Microturbine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application, power rating, and end-user.

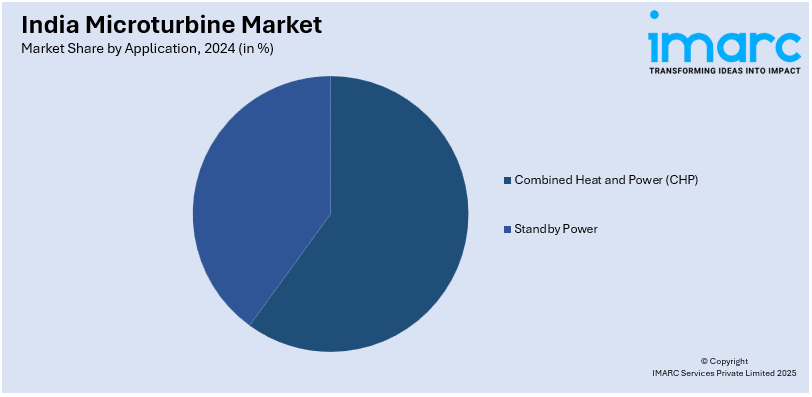

Application Insights:

- Combined Heat and Power (CHP)

- Standby Power

The report has provided a detailed breakup and analysis of the market based on the application. This includes combined heat and power (CHP) and standby power.

Power Rating Insights:

- 12 kW – 50 kW

- 50 kW – 250 kW

- 250 kW – 500 kW

A detailed breakup and analysis of the market based on the power rating have also been provided in the report. This includes 12 kW – 50 kW, 50 kW – 250 kW, and 250 kW – 500 kW.

End-User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Microturbine Market News:

- In January 2024, Aerostrovilos Energy, a startup based at IIT Madras, announced plans to develop India's first indigenous micro gas turbine for power generation. This venture seeks to reduce dependence on foreign technology and propel India towards sustainable energy solutions.

India Microturbine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Combined Heat and Power (CHP), Standby Power |

| Power Ratings Covered | 12 kW – 50 kW, 50 kW – 250 kW, 250 kW – 500 kW |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India microturbine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India microturbine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India microturbine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The microturbine market in India reached USD 8.1 Billion in 2024.

The India microturbine market is projected to exhibit a CAGR of 6.3% during 2025-2033, reaching a value of USD 14.9 Billion by 2033.

The market is driven by rising industrial demand for decentralized and clean energy, increasing investments in smart grids and urban infrastructure, government policies supporting renewable energy, and the shift toward low-emission power generation and hybrid energy systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)