India Minimally Invasive Surgical Devices Market Size, Share, Trends and Forecast by Type, Surgery Type, End User, and Region, 2026-2034

India Minimally Invasive Surgical Devices Market Overview:

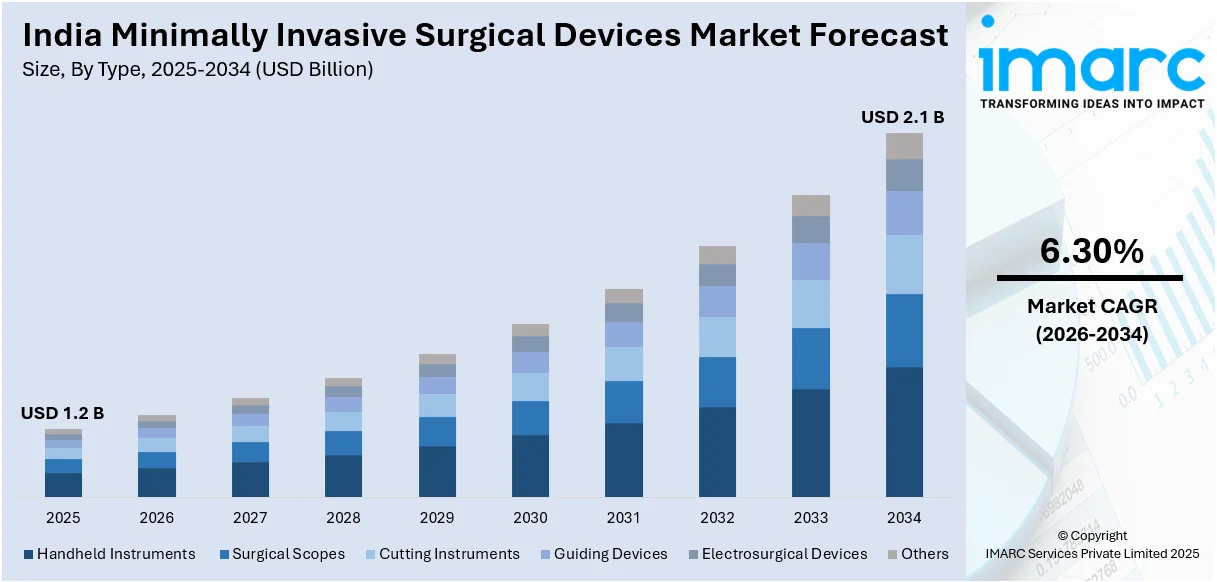

The India minimally invasive surgical devices market size reached USD 1.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.1 Billion by 2034, exhibiting a growth rate (CAGR) of 6.30% during 2026-2034. The escalating incidences of chronic diseases, aging population, expanding medical tourism sector, continuous technological advancements like robotic-assisted surgery, higher healthcare spending, improved hospital infrastructure, growing demand for shorter recovery times, shifting preferences towards minimally invasive procedures, and the rising adoption of advanced imaging and navigation systems are among the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2034 | USD 2.1 Billion |

| Market Growth Rate 2026-2034 | 6.30% |

India Minimally Invasive Surgical Devices Market Trends:

Rising Burden of Chronic Diseases and Aging Population

India is experiencing a rapid increase in the incidences of chronic diseases, such as cardiovascular diseases (CVDs), cancer, diabetes, and orthopedic disorders. This is a key driver for the minimally invasive surgical (MIS) devices market, as patients and healthcare professionals seek less invasive treatment methods. For example, India alone has about 5.8 million deaths every year because of non-communicable diseases (NCDs). Additionally, the instances of diseases such as coronary artery disease and osteoarthritis are on the rise. Such diseases mostly need to be treated surgically, and MIS methods are increasingly in favor owing to fewer post-operative complications, shorter hospital stays, and faster recovery periods compared to open surgery. Moreover, India's aging population is playing a huge role in propelling the demand for MIS devices. As per estimates, over 20.8% of India's population will be over 60 years of age by 2050, thus expanding the incidences of age-related conditions, such as degenerative bone disorders, hernias, and urological disorders.

To get more information on this market Request Sample

Expanding Medical Tourism and Technological Advancements

India has become a global medical tourism hub, with thousands of foreign patients coming to India for high-quality yet affordable healthcare services. India provides a huge cost benefit—surgical operations in India are often 60-80% cheaper than in Western countries without any compromise on quality. This low cost, along with the presence of highly experienced surgeons, has made India a destination of choice for complicated procedures, including those using minimally invasive methods. Many foreign patients travel to India for laparoscopic surgeries, robotic-assisted procedures, and minimally invasive orthopedic interventions, which are now widely available in top-tier hospitals across metropolitan cities. Technological advancements have further enhanced the development of India's MIS devices market. The incorporation of robotic surgery systems, artificial intelligence (AI), and 3D imaging has further elevated the precision and effectiveness of minimally invasive procedures. Innovations like single-incision laparoscopic surgery (SILS), endoscopic robotic-assisted surgeries, and advanced catheter-based interventions have augmented surgical results as well as diminished complications.

India Minimally Invasive Surgical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, surgery type, and end user.

Type Insights:

- Handheld Instruments

- Surgical Scopes

- Cutting Instruments

- Guiding Devices

- Electrosurgical Devices

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes handheld instruments, surgical scopes, cutting instruments, guiding devices, electrosurgical devices, and others.

Surgery Type Insights:

- Gastrointestinal

- Gynecology

- Urology

- Cardiovascular

- Others

A detailed breakup and analysis of the market based on the surgery type have also been provided in the report. This includes gastrointestinal, gynecology, urology, cardiovascular, and others.

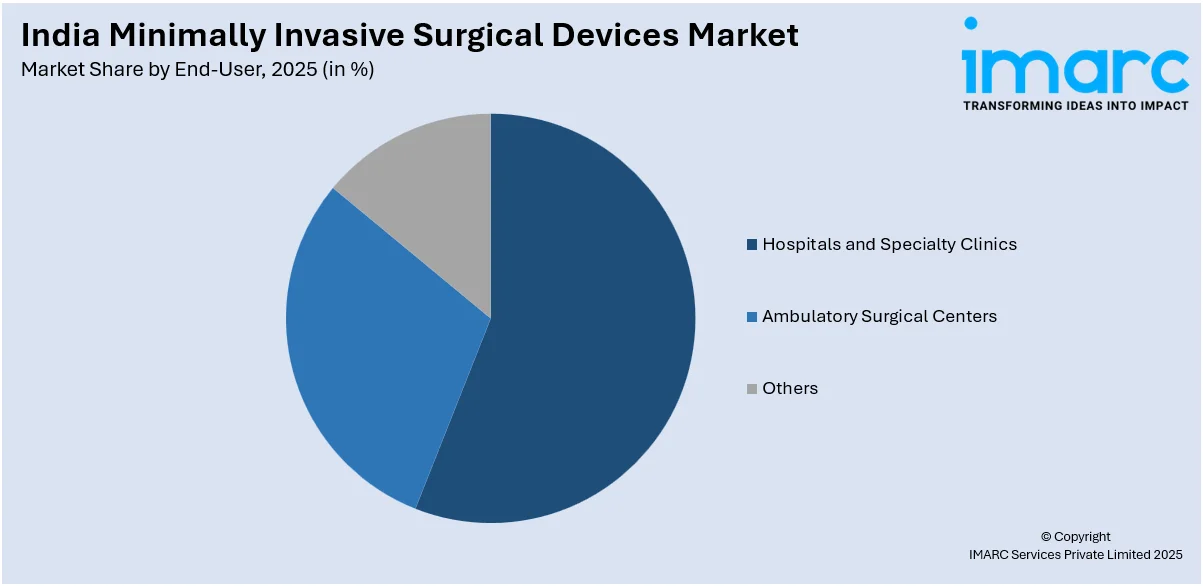

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals and Specialty Clinics

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and specialty clinics, ambulatory surgical centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Minimally Invasive Surgical Devices Market News:

- August 2024: Stryker launched InSpace, a biodegradable subacromial balloon implant in India for treating massive irreparable rotator cuff tears using a minimally invasive approach. This innovation reduces surgical complexity, improves patient recovery, and eliminates the need for sutures or fixation devices. The introduction of such advanced technology is expanding India's minimally invasive surgical devices market by propelling adoption of arthroscopic procedures and enhancing treatment efficiency.

- February 2024: Philips introduced LumiGuide, a 3D navigation system powered by Fiber Optic RealShape (FORS) technology, enabling real-time, radiation-free visualization of devices during minimally invasive surgeries. This innovation reduces procedure times and minimizes radiation exposure for patients and clinicians. The adoption of such advanced technologies in India enhances the precision and safety of minimally invasive procedures, thereby driving the growth of the country's minimally invasive surgical devices market.

India Minimally Invasive Surgical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Handheld Instruments, Surgical Scopes, Cutting Instruments, Guiding Devices, Electrosurgical Devices, Others |

| Surgery Types Covered | Gastrointestinal, Gynecology, Urology, Cardiovascular, Others |

| End Users Covered | Hospitals and Specialty Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India minimally invasive surgical devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India minimally invasive surgical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India minimally invasive surgical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Minimally Invasive Surgical Devices market in india was valued at USD 1.2 Billion in 2025.

The India minimally invasive surgical devices market is projected to exhibit a CAGR of 6.30% during 2026-2034, reaching a value of USD 2.1 Billion by 2034.

The India minimally invasive surgical devices market is expanding due to rising chronic diseases, aging population, medical tourism, technological advances like robotic-assisted surgery, higher healthcare spending, better hospital infrastructure, demand for shorter recovery times, and adoption of advanced imaging and navigation systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)