India Mobile Banking Market Size, Share, Trends and Forecast by Type, Platform, Deployment Type and Region, 2025-2033

India Mobile Banking Market Overview:

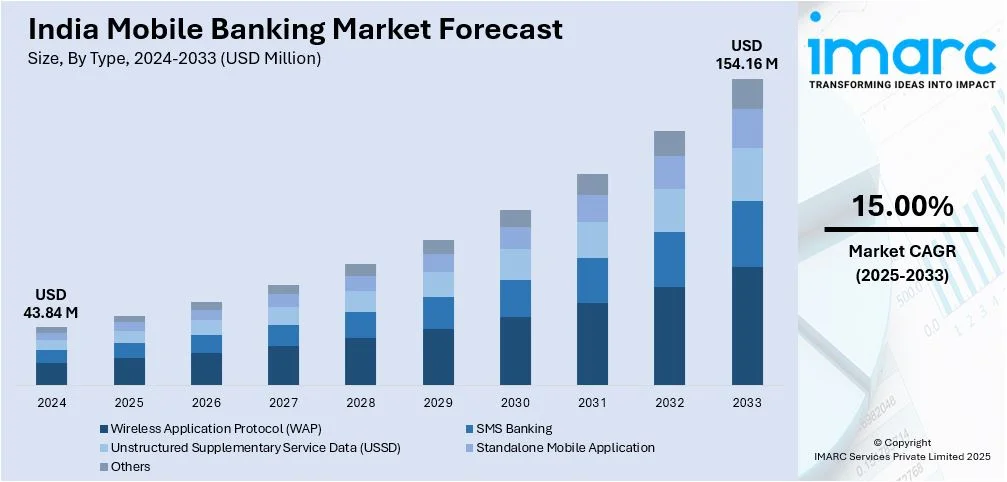

The India mobile banking market size reached USD 43.84 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 154.16 Million by 2033, exhibiting a growth rate (CAGR) of 15.00% during 2025-2033. Major factors driving the India mobile banking market share, include the rising smartphone penetration, enhanced internet connectivity, government programs encouraging digital finance, and the growth of digital payment services. Furthermore, the trend for convenience, security services, and the drive for financial inclusion are fueling the India mobile banking market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 43.84 Million |

| Market Forecast in 2033 | USD 154.16 Million |

| Market Growth Rate (2025-2033) | 15.00% |

India Mobile Banking Market Trends:

Growing Adoption of Digital Payment Solutions

One of the most prominent trends in the Indian mobile banking sector is the quick uptake of digital payment systems. Mobile banking applications have gone beyond basic transactions to provide a wide array of services, such as bill payments, peer-to-peer transfers, and investments. With the Indian government encouraging digital literacy and financial inclusion, efforts such as 'Digital India' and the introduction of the PMGDISHA (Pradhan Mantri Gramin Digital Saksharta Abhiyan) have opened the door to broader mobile banking adoption, even in rural regions. The emergence of mobile wallet services such as Paytm, PhonePe, and Google Pay has also further driven mobile banking adoption. Customers are more and more at ease with electronic payments because of the convenience, rapidity, and safety they provide. With the increase in smartphone penetration and internet connectivity across the nation, mobile banking is becoming the mode of choice for handling finances, revolutionizing the manner in which Indians interact with banking services. For instance, ICICI Bank recently revealed that more than one crore customers from other banks utilizing iMobile have seen a 26% increase in the total transaction value for this financial year up to the end of February 2024 (April-February), in comparison to the same timeframe last year. Throughout this time, the typical ticket size rose by 16%.

To get more information on this market, Request Sample

Integration of Artificial Intelligence and Chatbots

Another significant trend influencing the India mobile banking market outlook is the integration of Artificial Intelligence (AI) and chatbots. Financial institutions as well as fintech players are relying more on AI-based solutions for customer services as well as internal operational improvements. Chatbots driven by AI enable customers to conduct activities such as balance inquiring, funds transfers, as well as answer some basic queries all without having human intervention involved. This enhances user experience while lowering the banks' operational expenses considerably. According to industry reports, approximately 80% of banks in India already utilize chatbots that can interact in dialogue with human users. Apart from this, AI is also being utilized to offer customized financial guidance, enabling customers to make well-informed decisions about savings, loans, and investments. The growth of AI and machine learning in mobile banking is allowing banks to provide more intelligent, more efficient services, further fueling the growth of the mobile banking industry in India. With technology evolving further, the role of AI in mobile banking will grow, making it central to the future development of the market.

India Mobile Banking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, platform, and deployment type.

Type Insights:

- Wireless Application Protocol (WAP)

- SMS Banking

- Unstructured Supplementary Service Data (USSD)

- Standalone Mobile Application

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes wireless application protocol (WAP), SMS banking, unstructured supplementary service data (USSD), standalone mobile application, and others.

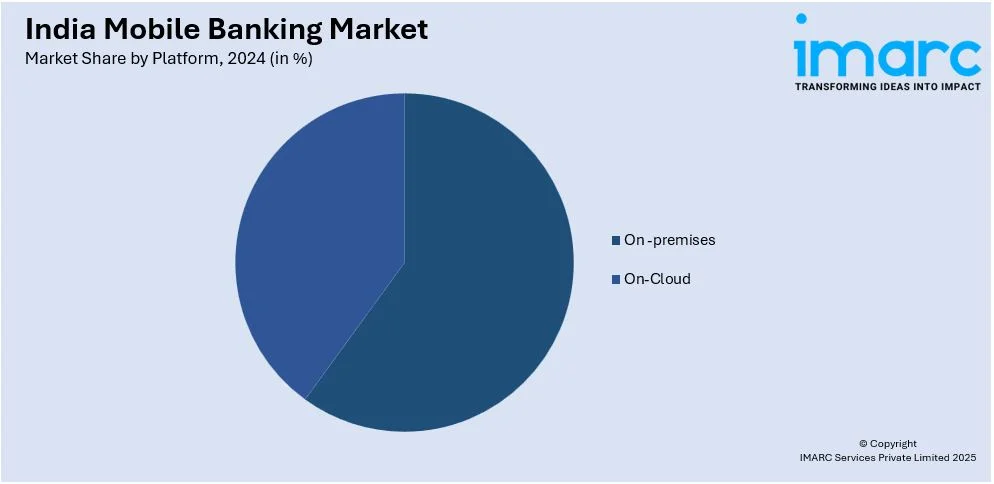

Platform Insights:

- On -premises

- On-Cloud

The report has provided a detailed breakup and analysis of the market based on the platform. This includes on- premises, and on-cloud.

Deployment Type Insights:

- iOS

- Android

- Others

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes iOS, android, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mobile Banking Market News:

- In January 2024, HDFC Bank revised their security measures in their mobile banking application. These security measures will shield the bank’s customers from potential cyber threats. Nonetheless, to implement these security features, bank customers would have to store their bank registered number within the phone, among other requirements.

- In March 2024, ICICI Bank revealed that its retail mobile banking application, iMobile, has welcomed more than one crore customers from different banks. This major milestone occurs just over three years after ICICI Bank enabled the app for customers of various other banks. ICICI Bank was the first to introduce a mobile banking app in 2008, paving the way for digital banking in India. In December 2020, it was the first bank to ensure the app was interoperable by providing its services to clients of different banks.

India Mobile Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wireless Application Protocol (WAP), SMS Banking, Unstructured Supplementary Service Data (USSD), Standalone Mobile Application, Others |

| Platforms Covered | On -premises, On-Cloud |

| Deployment Types Covered | iOS, Android, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mobile banking market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mobile banking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile banking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India mobile banking market was valued at USD 43.84 Million in 2024.

The India mobile banking market is projected to exhibit a CAGR of 15.00% during 2025-2033, reaching a value of USD 154.16 Million by 2033.

The India mobile banking market is propelled by widespread smartphone adoption and affordable internet access, enabling seamless digital transactions across urban and rural areas. Government initiatives like the Digital India campaign and the JAM (Jan Dhan-Aadhaar-Mobile) trinity facilitate financial inclusion, linking bank accounts, Aadhaar, and mobile numbers, which is fueling market growth. The proliferation of digital payment platforms such as UPI, Paytm, and PhonePe, along with fintech innovations, further drive the adoption of mobile banking services nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)