India Molecular Sieves Market Size, Share, Trends and Forecast by Type, Material Type, Application, Shape, Size, End-Use Industry, and Region, 2025-2033

India Molecular Sieves Market Overview:

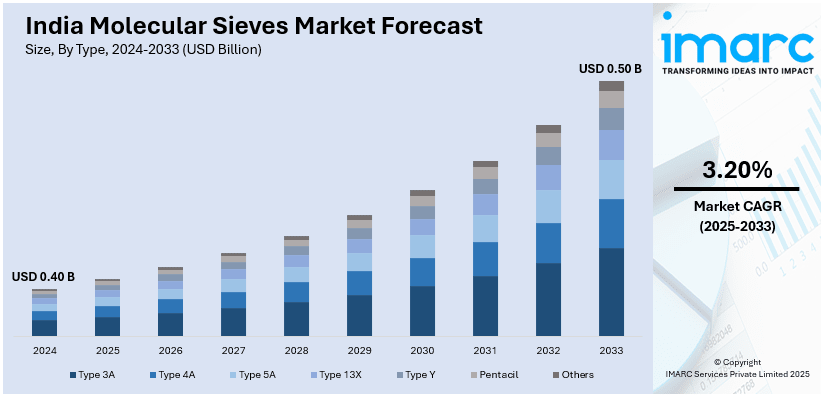

The India molecular sieves market size reached USD 0.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.50 Billion by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. The market is growing, driven by the rising demand in oil and gas refining, pharmaceuticals, and renewable energy. Additionally, an expanding LNG infrastructure, pharmaceutical production, and sustainability initiatives are boosting adoption, while technological advancements and strict regulations continue to strengthen applications in gas purification, moisture control, and biofuel production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.40 Billion |

| Market Forecast in 2033 | USD 0.50 Billion |

| Market Growth Rate 2025-2033 | 3.20% |

India Molecular Sieves Market Trends:

Growing Demand for Molecular Sieves in the Oil & Gas Industry

There is growing demand in the Indian oil and gas industry for molecular sieves, particularly for natural gas dehydration and refining and petrochemical processing applications. Molecular sieves are used extensively in the removal of water, impurities, and volatile organic compounds (VOCs) from natural gas and crude oil to achieve industrial purity specifications. The push by Indian authorities for domestically sourced gas exploration and increased refining capacity is contributing to the demand for other technologies for effective gas drying and purification separate from the use of molecular sieves. Additionally, the Indian government initiative to promote liquefied natural gas (LNG) terminals and associated pipeline infrastructure will also contribute to even greater utilization of molecular sieves within gas processing units. For instance, in February 2024, India’s Petronet LNG (PLL) announced a long-term LNG Sale & Purchase Agreement (SPA) with QatarEnergy for 7.5 MMTPA of LNG supply from 2028 to 2048. Additionally, the stringent environmental regulations on emissions and gas quality are compelling industries to invest in high-performance adsorption materials. As India's energy consumption continues to grow, the role of molecular sieves in gas separation, sulfur removal, and hydrocarbon purification is becoming increasingly significant, supporting sustainable and efficient energy production.

To get more information on this market, Request Sample

Rising Use of Molecular Sieves in Pharmaceutical and Healthcare Applications

The pharmaceutical and healthcare sectors in India are experiencing growing adoption of molecular sieves for applications such as drug formulation, oxygen purification, and packaging desiccants. With the increasing production of medicines, vaccines, and biologics, moisture control is critical to maintaining product stability and preventing degradation. Molecular sieves help extend the shelf life of pharmaceuticals by efficiently adsorbing excess moisture in packaging and storage environments. Additionally, the expanding medical oxygen market, driven by rising healthcare infrastructure investments, has boosted demand for molecular sieve-based oxygen concentrators, particularly in hospitals and homecare settings. Moreover, the government's initiatives to increase domestic pharmaceutical manufacturing under the Production Linked Incentive (PLI) scheme are further fueling the demand for high-purity molecular sieves. For instance, in August 2024, the Government of India (GOI) announced the approval of the PLI Scheme for domestic manufacturing of KSMs, Drug Intermediates, and APIs, with a ₹6,940 crore allocation to boost bulk drug production, reduce import dependence, and strengthen India’s pharmaceutical supply chain resilience. As India strengthens its role as a global pharmaceutical hub, molecular sieves will continue to play a vital role in quality control and product stability across the industry.

India Molecular Sieves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, material type, application, shape, size, and end-use industry.

Type Insights:

- Type 3A

- Type 4A

- Type 5A

- Type 13X

- Type Y

- Pentacil

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes type 3A, type 4A, type 5A, type 13X, type Y, pentacil, and others.

Material Type Insights:

- Carbon

- Clay

- Porous Glass

- Silica Gel

- Zeolite

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon, clay, porous glass, silica gel, zeolite, and others.

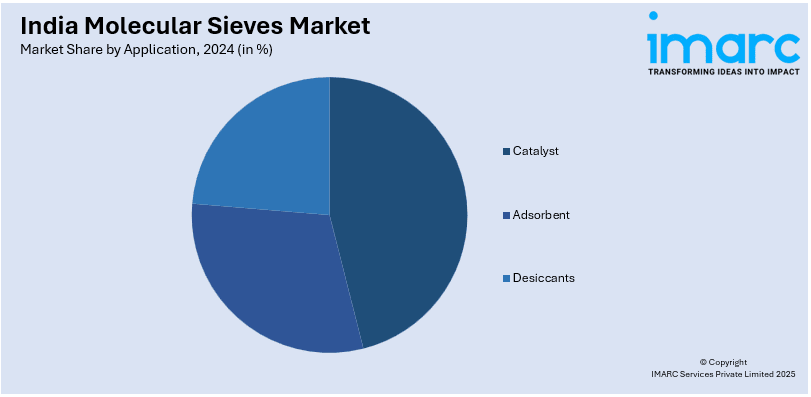

Application Insights:

- Catalyst

- Adsorbent

- Desiccants

The report has provided a detailed breakup and analysis of the market based on the application. This includes catalyst, adsorbent, and desiccants.

Shape Insights:

- Pelleted

- Beaded

- Powdered

A detailed breakup and analysis of the market based on the shape have also been provided in the report. This includes pelleted, beaded, and powdered.

Size Insights:

- Microporous

- Mesoporous

- Macroporous

The report has provided a detailed breakup and analysis of the market based on the size. This includes microporous, mesoporous, and macroporous.

End-Use Industry Insights:

- Oil and Gas Industry

- Agricultural Industry

- Chemical Industry

- Pharmaceutical Industry

- Water Treatment Industry

- Construction Industry

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes oil and gas industry, agricultural industry, chemical industry, pharmaceutical industry, water treatment industry, construction industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Molecular Sieves Market News:

- In April 2024, Zeochem, part of the CPH Chemie + Papier Group, announced the acquisition of Sorbead India and Swambe Chemicals. This acquisition enhances Zeochem’s presence in India’s chemicals and pharmaceutical markets, particularly in molecular sieves, under the new name Sorbchem India Pvt. Ltd.

India Molecular Sieves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Type 3A, Type 4A, Type 5A, Type 13X, Type Y, Pentacil, Others |

| Material Types Covered | Carbon, Clay, Porous Glass, Silica Gel, Zeolite, Others |

| Applications Covered | Catalyst, Adsorbent, Desiccants |

| Shapes Covered | Pelleted, Beaded, Powdered |

| Sizes Covered | Microporous, Mesoporous, Macroporous |

| End Use Industries Covered | Oil and Gas Industry, Agricultural Industry, Chemical Industry, Pharmaceutical Industry, Water Treatment Industry, Construction Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India molecular sieves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India molecular sieves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India molecular sieves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The molecular sieves market in India was valued at USD 0.40 Billion in 2024.

The India molecular sieves market is projected to exhibit a CAGR of 3.20% during 2025-2033, reaching a value of USD 0.50 Billion by 2033.

The key factors driving the India molecular sieves market include growing demand in oil & gas refining (especially for gas dehydration and purification), expanding pharmaceutical and healthcare use (moisture control in drugs and oxygen concentrators), industrial applications across petrochemicals, water treatment, and automotive, plus technological innovations and stricter environmental regulations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)