India Monoclonal Antibodies Market Size, Share, Trends and Forecast by Type, Application, Production, Biomanufacturing, End User and Region, 2025-2033

India Monoclonal Antibodies Market Size and Share:

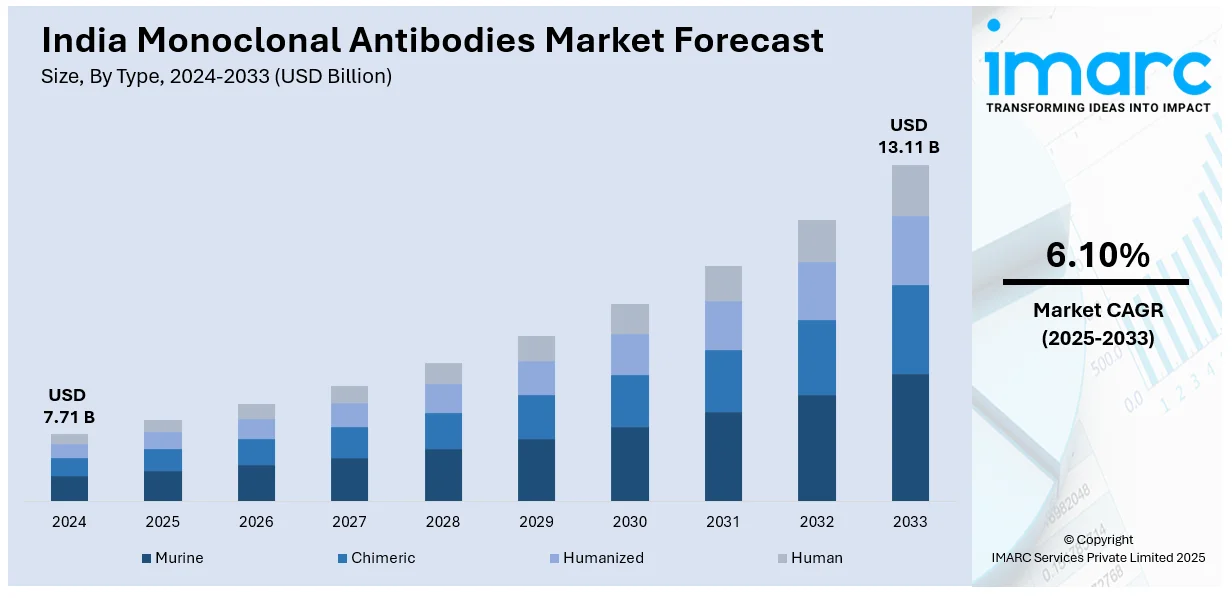

The India monoclonal antibodies market size reached USD 7.71 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.11 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The India monoclonal antibodies market share is fueled by rising chronic disease occurrences such as cancer and autoimmune diseases, healthcare awareness, biotechnology developments, and increased demand for targeted treatments. Also, government initiatives aimed at biotechnology research and enhancing healthcare infrastructure are fueling the India monoclonal antibodies market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.71 Billion |

| Market Forecast in 2033 | USD 13.11 Billion |

| Market Growth Rate (2025-2033) | 6.10% |

India Monoclonal Antibodies Market Trends:

Growing Adoption of Monoclonal Antibodies in Cancer Treatment

Among the most important trends influencing the India monoclonal antibodies (mAbs) market outlook is the growing use of monoclonal antibodies in the treatment of cancer. Cancer incidence in India has been consistently increasing, and the demand for efficient therapies has thus been on the rise. Monoclonal antibodies, due to their ability to target the specific cancer cells with minimal damage to the healthy tissue around them, have emerged as an indispensable component of cancer treatment regimens. The approval of several monoclonal antibodies like trastuzumab, rituximab, and pembrolizumab for use in cancer therapy has boosted their utilization and popularity in clinical settings. Further, the trend toward personalized medicine, which individualizes the therapies according to the needs of individual patients, has positioned monoclonal antibodies as an increasingly attractive choice. India is recognized for biopharma innovation, boasting 500 Active Pharmaceutical Ingredient (API) manufacturers and the highest count of FDA-approved facilities (665) beyond the United States. Additionally, 47% of generic prescriptions and 15 percent of biosimilar prescriptions filled in the United States come from Indian companies. With improving healthcare infrastructure and increasing availability of advanced treatment options, demand for monoclonal antibody-based cancer treatments will continue to surge, further fueling the Indian mAbs market.

To get more information on this market, Request Sample

Expansion of Biosimilar Monoclonal Antibodies

Another major trend in the India monoclonal antibodies market is the increasing use of biosimilars. Biosimilars are biologic therapeutic products very similar to an already approved reference product, providing a less expensive alternative to costly monoclonal antibodies. Being a world hub for biosimilars, many Indian pharmaceutical companies are increasingly developing and marketing biosimilars of monoclonal antibodies, thus making these treatments more affordable to patients. India has solidly positioned itself as the leading global manufacturer of generic medications. It is presently positioned third in pharmaceutical output by volume, with a CAGR of 9.43% over the last nine years. Indian biologics and biosimilars have increased from $6 billion in 2022 to an expected $12 billion by 2025, as the biopharmaceutical sector is set to duplicate its generics triumph. Government assistance to the market for biosimilars in the form of simplified regulatory frameworks and incentives for local manufacturers has resulted in enhanced competition and decreased prices. While healthcare expenses are still a key obstacle to therapy in India, the presence of affordable biosimilars has increased access to monoclonal antibody treatments. This is particularly significant for diseases like rheumatoid arthritis and cancer, for which long-term therapy is typical.

India Monoclonal Antibodies Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, application, production, biomanufacturing, and end user.

Type Insights:

- Murine

- Chimeric

- Humanized

- Human

The report has provided a detailed breakup and analysis of the market based on the type. This includes murine, chimeric, humanized, and human.

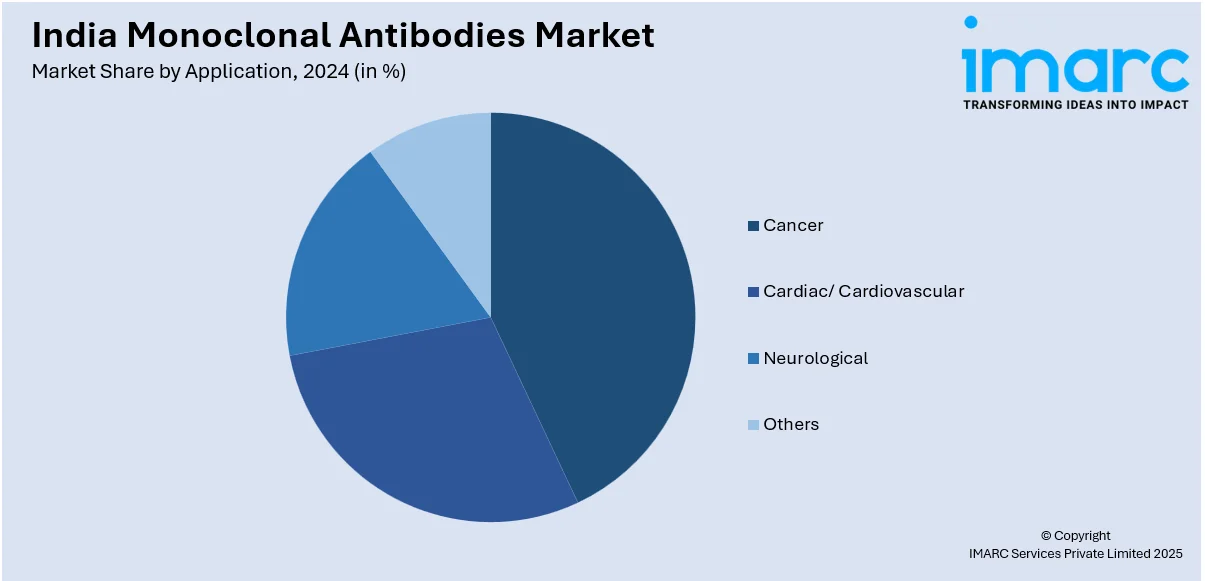

Application Insights:

- Cancer

- Cardiac/ Cardiovascular

- Neurological

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes cancer, cardiac/cardiovascular, neurological, and others.

Production Insights:

- In Vitro

- In Vivo

The report has provided a detailed breakup and analysis of the market based on the production. This includes in vitro, and in vivo.

Biomanufacturing Insights:

- Originator

- CMO

The report has provided a detailed breakup and analysis of the market based on the biomanufacturing. This includes originator, and CMO.

End User Insights:

- Hospitals

- Research Laboratories

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, research laboratories, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Monoclonal Antibodies Market News:

- In November 2024, major pharmaceutical company Dr Reddy’s Laboratories Ltd announced the launch of Toripalimab, the world’s first and sole immuno-oncology medication approved for treating nasopharyngeal carcinoma, a rare type of head and neck cancer, in India. By achieving this, India becomes the third nation globally, following China and the United States, to gain access to this advanced PD-1 (programmed cell death protein 1) inhibitor monoclonal antibody, which will be sold by Dr Reddy’s under the brand name Zytorvi in India.

- In March 2025, Dr. Reddy's Laboratories Ltd. and Alvotech, a worldwide biotech firm focused on creating and producing biosimilar medications for patients globally, revealed that the U.S. Food and Drug Administration (FDA) has acknowledged a 351(k) Biologic License Application (BLA) submission for AVT03, developed by Alvotech, which is a proposed biosimilar of Prolia® (denosumab) and Xgeva® (denosumab). AVT03 is a human monoclonal antibody and biosimilar option for Prolia® and Xgeva®, both of which contain denosumab but are offered in various forms.

- In March 2024, Roche Pharma India introduced Vabysmo (faricimab) for treating neovascular or “wet” age-related macular degeneration (nAMD) and diabetic macular edema (DME) in India. With this product, the pharmaceutical giant has entered the field of Ophthalmology. Neovascular AMD and DME are among the top causes of vision impairment globally.

India Monoclonal Antibodies Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Murine, Chimeric, Humanized, Human |

| Applications Covered | Cancer, Cardiac/ Cardiovascular, Neurological, Others |

| Productions Covered | In Vitro, In Vivo |

| Biomanufacturing Covered | Originator, CMO |

| End Users Covered | Hospitals, Research Laboratories, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India monoclonal antibodies market performed so far and how will it perform in the coming years?

- What is the breakup of the India monoclonal antibodies market on the basis of type?

- What is the breakup of the India monoclonal antibodies market on the basis of application?

- What is the breakup of the India monoclonal antibodies market on the basis of production?

- What is the breakup of the India monoclonal antibodies market on the basis of biomanufacturing?

- What is the breakup of the India monoclonal antibodies market on the basis of end user?

- What is the breakup of the India monoclonal antibodies market on the basis of region?

- What are the various stages in the value chain of the India monoclonal antibodies market?

- What are the key driving factors and challenges in the India monoclonal antibodies market?

- What is the structure of the India monoclonal antibodies market and who are the key players?

- What is the degree of competition in the India monoclonal antibodies market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India monoclonal antibodies market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India monoclonal antibodies market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India monoclonal antibodies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)