India Motor Insurance Market Size, Share, Trends and Forecast by Insurance Type, Application, Distribution Channel, and Region, 2025-2033

India Motor Insurance Market Overview:

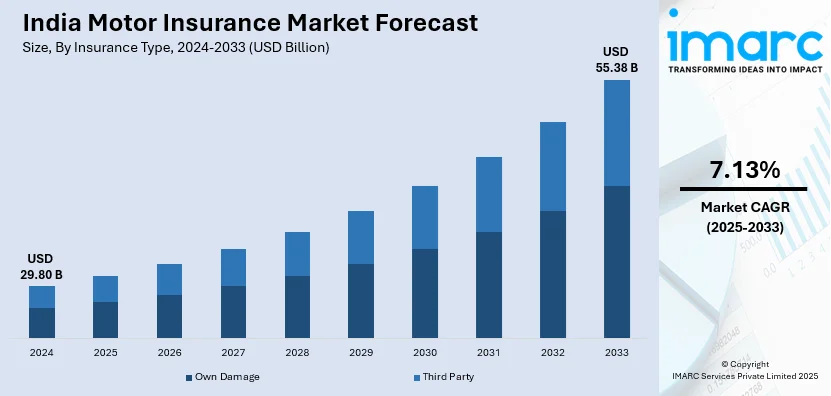

The India motor insurance market size reached USD 29.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 55.38 Billion by 2033, exhibiting a growth rate (CAGR) of 7.13% during 2025-2033. The market is driven by rising vehicle ownership, mandatory third-party insurance regulations, and increasing awareness of comprehensive coverage. Digitalization, fueled by tech adoption and insurtech innovations, enhances customer convenience. Additionally, the growing adoption of electric vehicles (EVs) creates demand for specialized insurance products, further propelling the India motor insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.80 Billion |

| Market Forecast in 2033 | USD 55.38 Billion |

| Market Growth Rate 2025-2033 | 7.13% |

India Motor Insurance Market Trends:

Rising Demand for Digital Insurance Platforms

The significant shift towards digitalization, driven by increasing internet penetration and smartphone usage is majorly driving the India motor insurance market growth. A report indicates that 84% of smartphone users in India examine their devices within 15 minutes of rising, dedicating 31% of their waking hours to smartphone usage. The duration of time spent on smartphones has increased significantly, rising from 2 hours in 2010 to 4.9 hours in 2023, with an average of 80 checks per day. Motor insurance consumption via online platforms is growing in popularity as consumers are now drawn to the ease, transparency, and quick processing of these platforms for their motor insurance policy purchase and management. Technology is helping insurers improve customer experiences by providing features such as immediate policy issuance, digital documentation, and real-time claim resolutions. Moreover, AI and ML implementation allows timely policy recommendations and dynamic pricing. This change has also been accelerated by the COVID-19 pandemic, with customers leaning more towards contactless interactions. Innovation is a key driver in this transformation, with insurtech startups taking the lead in bringing solutions such as usage-based insurance (UBI) and telematics. This shift in the insurance landscape means that legacy insurers are either partnering with technology companies or building their own digital assets to stay competitive in this changing landscape.

To get more information on this market, Request Sample

Growing Adoption of Electric Vehicle (EV) Insurance

With the Indian government's push towards electric vehicles (EVs) to reduce carbon emissions, the market is adapting to cater to this emerging segment. Therefore, this is creating a positive India motor Insurance market outlook. According to a research report by the IMARC Group, the India electric vehicles market value was USD 2,361.0 Million in 2024. The market is also expected to reach USD 164,420.4 Million by 2033, at a rate of 57.23% CAGR between 2025 and 2033. EVs have unique coverage needs, with specialized components such as batteries and charging systems that require tailored coverage options. Insurers are rolling out dedicated EV insurance to cover damage to the battery, the risk of charging, and other liabilities unique to EVs. This trend is also reinforced by falling prices for EVs and government incentives, including subsidies and tax breaks. Additionally, with the emergence of new EV manufacturers and charging infrastructure providers, there are new opportunities for insurers to partner and provide a more bundled offering. With the growing acceptance of EVs, the need for customized insurance will see exponential growth, thus making it one of the most important growth levers for Indian motor insurance. Among other things, insurers are exploring data-based ways to price risk and set premiums on EVs so that profitability remains sustainable in this niche market.

India Motor Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on insurance type, application, and distribution channel.

Insurance Type Insights:

- Own Damage

- Third Party

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes own damage and third party.

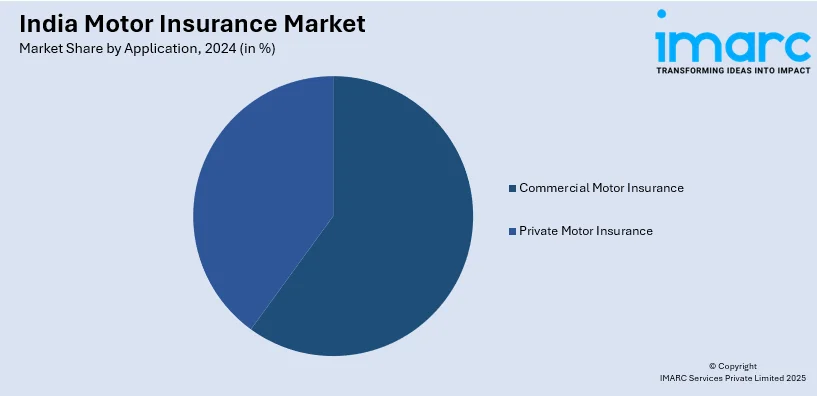

Application Insights:

- Commercial Motor Insurance

- Private Motor Insurance

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial motor insurance and private motor insurance.

Distribution Channel Insights:

- Individual Agents

- Brokers

- Banks

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes individual agents, brokers, banks, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Motor Insurance Market News:

- December 17, 2024: Bajaj Allianz General Insurance launched two innovative motor insurance add-ons, Eco Assure – Repair Protection and Named Driver Cover, in India. Eco Assure has an environmentally friendly perspective on the repairs it does use sustainably sourced parts, while Named Driver Cover is designed for those wanting a flexible cover for vehicles driven by nominated individuals. The demands of such products not only cater to the growing demand for personalized and eco-friendly insurance solutions but also enhance customer convenience and safety of vehicles in India.

- August 8, 2024: Zuno General Insurance launched its revolutionary Usage-Based Insurance (UBI) feature, "Pay How You Drive" (PHYD) which offers savings of 30% on motor insurance premiums based on one’s driving habits. Using mobile telematics from within the Zuno app, the system assesses driving performance and creates a Zuno Driving Quotient (ZDQ). This innovative strategy empowers customers with increased control over their insurance costs, representing a significant departure from conventional premium structures in the Indian motor insurance sector.

India Motor Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Own Damage, Third Party |

| Applications Covered | Commercial Motor Insurance, Private Motor Insurance |

| Distribution Channels Covered | Individual Agents, Brokers, Banks, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India motor insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India motor insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India motor insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The motor insurance market in India was valued at USD 29.80 Billion in 2024.

The India motor insurance market is projected to exhibit a CAGR of 7.13% during 2025-2033, reaching a value of USD 55.38 Billion by 2033.

Government policies that enforce motor insurance as a legal requirement for vehicle registration and use play a key role in strengthening the market. Additionally, the growing awareness among vehicle owners about the benefits of comprehensive insurance for protection against theft, accidents, and natural disasters is supporting the market expansion. The availability of digital platforms for easy policy comparison, purchase, and renewal has further increased customer convenience and participation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)