India Mutual Funds Market Size, Share, Trends and Forecast by Asset Class/Scheme Type, Source of Funds, and Region, 2025-2033

India Mutual Funds Market Overview:

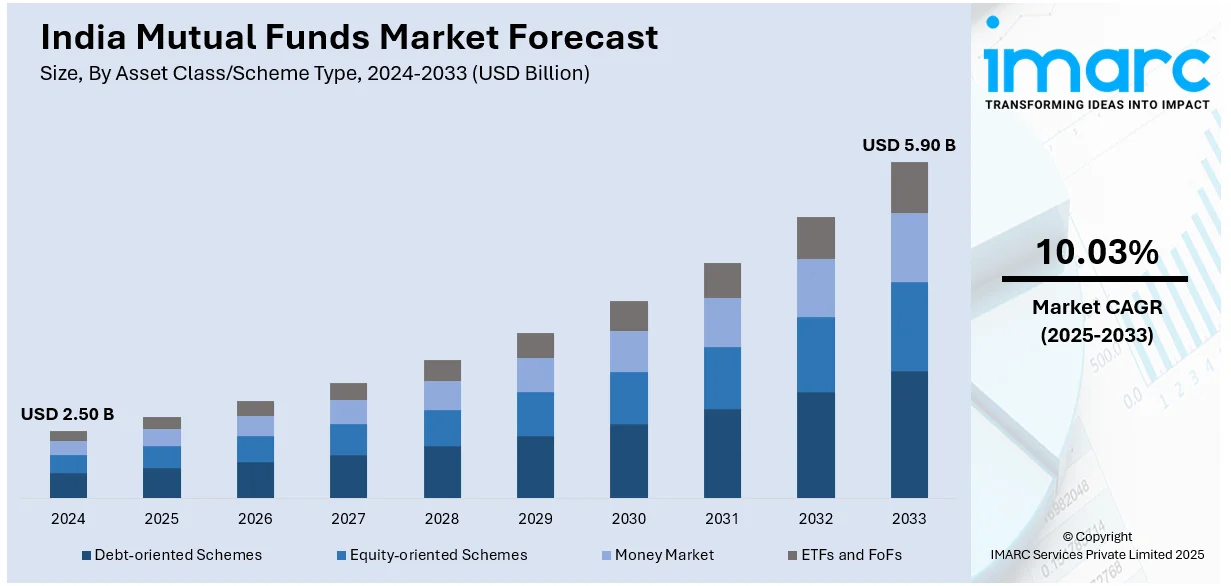

The India mutual funds market size reached USD 2.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.90 Billion by 2033, exhibiting a growth rate (CAGR) of 10.03% during 2025-2033. The growing financial literacy, increasing disposable incomes, rising participation from retail investors, digital adoption in investment platforms, favorable regulatory policies, expansion of systematic investment plans (SIPs), and a shift towards equity-oriented schemes are expanding of the India mutual funds market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.50 Billion |

| Market Forecast in 2033 | USD 5.90 Billion |

| Market Growth Rate 2025-2033 | 10.03% |

India Mutual Funds Market Trends:

Rise of Passive Investing Through Index Funds and ETFs

The India mutual funds market growth is driven by a significant shift toward passive investing, with growing investor preference for index funds and exchange-traded funds (ETFs). Moreover, the increasing awareness regarding low-cost investment options, better market efficiency, and the underperformance of actively managed funds compared to benchmark indices are positively impacting the market. In addition to this, institutional investors and retail participants alike are recognizing the benefits of passive funds, which offer diversified exposure at minimal expense ratios. Additionally, regulatory initiatives by the Securities and Exchange Board of India (SEBI) promoting transparency and investor education further fuel this transition. For instance, new rules for registered intermediaries advertising on social media platforms were released by the Securities and Exchange Board of India (SEBI) on March 24, 2025. These intermediaries must now use the email addresses and mobile numbers provided on SEBI's SI Portal to register on websites such as Google and Meta. This measure aims to enhance verification procedures, minimize fraudulent activities, and build investor confidence in the securities market. By prohibiting misleading advertisements and ensuring authentic representation of mutual fund products, SEBI's regulations are fostering a more transparent and trustworthy investment environment. Moreover, the rise of systematic investment plans (SIPs) in ETFs, combined with increased stock market participation, is expected to strengthen the passive investing trend. As more asset management companies (AMCs) launch innovative passive products, the market is poised for exponential growth in the coming years, reshaping the investment landscape in India.

To get more information on this market, Request Sample

Increase in Retail Participation Through SIPs and Digital Platforms

Retail participation in the Indian mutual funds market has increased, largely due to the growing popularity of systematic investment plans (SIPs) and the expansion of digital investment platforms. With increased financial literacy and easy access to investment options through mobile applications, more investors are entering the market, contributing to consistent inflows in mutual funds. Monthly SIP inflows have reached record highs, reflecting a shift in investor behavior toward disciplined, long-term wealth creation. Additionally, fintech innovations and online investment platforms are simplifying the investment process, enabling seamless transactions, real-time tracking, and automated portfolio management. On June 25, 2024, HDFC Bank introduced 'SmartWealth,' a digital investment platform designed to simplify and enhance the investment experience for its customers. This platform offers a comprehensive suite of investment products, including mutual funds, fixed deposits, and insurance, enabling users to manage their portfolios seamlessly. SmartWealth features personalized investment recommendations based on individual financial goals and risk profiles, ensuring tailored advice for each user. Such innovations are democratizing wealth management and empowering retail investors with the tools and insights needed to optimize their portfolios. The convenience of digital onboarding and implementation of government initiatives to promote financial inclusion further strengthens retail investor participation. This democratization of investing is thereby positively impacting the India mutual funds market outlook, making it an essential vehicle for wealth accumulation, even in smaller cities and rural areas.

India Mutual Funds Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on asset class/scheme type and source of funds.

Asset Class/Scheme Type Insights:

- Debt-oriented Schemes

- Equity-oriented Schemes

- Money Market

- ETFs and FoFs

The report has provided a detailed breakup and analysis of the market based on the asset class/scheme type. This includes debt-oriented schemes, equity-oriented schemes, money market, and ETFs and FoFs.

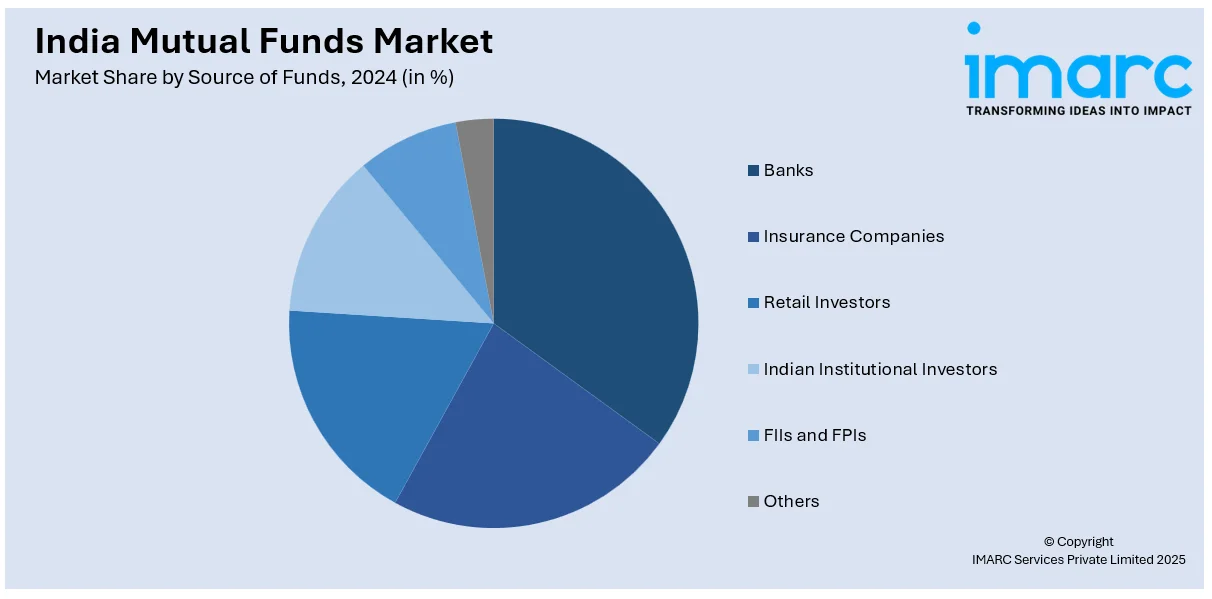

Source of Funds Insights:

- Banks

- Insurance Companies

- Retail Investors

- Indian Institutional Investors

- FIIs and FPIs

- Others

A detailed breakup and analysis of the market based on the source of funds have also been provided in the report. This includes banks, insurance companies, retail investors, Indian institutional investors, FIIs and FPIs, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Mutual Funds Market News:

- On February 6, 2025, the Nippon India Active Momentum Fund is an open-ended equity plan created by Nippon India Mutual Fund with the goal of producing long-term capital growth. With a continuous sale and repurchase starting on March 6, the New Fund Offer (NFO) is planned to take place from February 10 to February 24. To find high-potential investment opportunities, this fund uses a multifactor quantitative approach that manages volatility and dynamically adjusts to market cycles.

- On February 21, 2025, the 'Chhoti SIP Tarun Yojana Mitra' project was launched by the Association of Mutual Funds in India (AMFI) to encourage young investors to participate in small-scale Systematic Investment Plans (SIPs). By providing accessible entry points into mutual fund investments, this initiative seeks to improve financial literacy and promote disciplined investing practices. It is anticipated that AMFI's effort will increase the number of investors and encourage young people in India to save regularly.

India Mutual Funds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Asset Classes/Scheme Types Covered | Debt-oriented Schemes, Equity-oriented Schemes, Money Market, ETFs, FoFs |

| Source of Funds Covered | Banks, Insurance Companies, Retail Investors, Indian Institutional Investors, FIIs and FPIs, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mutual funds market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mutual funds market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mutual funds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mutual funds market in India was valued at USD 2.50 Billion in 2024.

The India mutual funds market is projected to exhibit a CAGR of 10.03% during 2025-2033, reaching a value of USD 5.90 Billion by 2033.

India’s mutual fund market growth is driven by rising financial literacy and disposable incomes, widespread digital and fintech adoption (including UPI and mobile apps), booming retail and SIP inflows, expanding penetration in B30 cities, regulatory support including ELSS tax incentives, and strong domestic investor confidence.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)