India N-Butanol Market Size, Share, Trends and Forecast by Grade, Application, and Region, 2025-2033

India N-Butanol Market Size and Share:

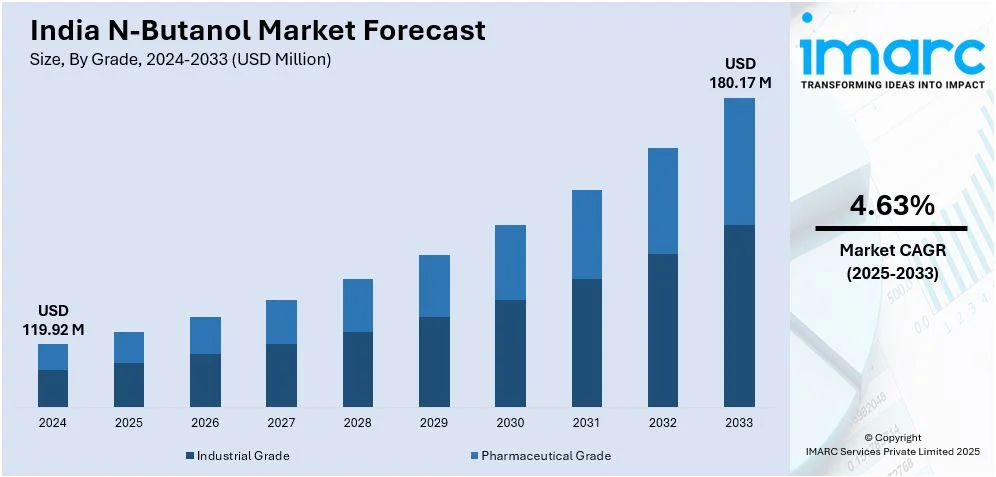

The India N-butanol market size reached USD 119.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 180.17 Million by 2033, exhibiting a growth rate (CAGR) of 4.63% during 2025-2033. The market is witnessing significant growth, driven by the shift towards bio-based n-butanol production and rising demand for n-butanol in the coatings and paints industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 119.92 Million |

| Market Forecast in 2033 | USD 180.17 Million |

| Market Growth Rate 2025-2033 | 4.63% |

India N-Butanol Market Trends:

Shift Towards Bio-Based N-Butanol Production

One of the prominent trends in the N-butanol market is the heightened shift towards bio-based N-butanol, particularly with the increasing global emphasis on sustainability and the need to wean dependence on fossil fuels. N-butanol has traditionally been produced from petrochemical sources, raising concerns over environmental impact and resource depletion. In contrast, the rapidly growing need for environmentally and renewable alternatives has allowed bio-based N-butanol from renewable feedstocks such as plant biomass to gain traction. For instance, in December 2024, Godavari Biorefineries partnered with Catalyxx Inc. for exclusive rights to produce 30,000 tons of biobutanol. In phase one, it will build a facility producing 15,000 Tons annually, advancing sustainability efforts. This transition is supported by advancements in biotechnology and fermentation processes, which have improved the efficiency and economic viability of bio-based N-butanol production. Additionally, governments and regulatory bodies across the globe are imposing stricter environmental regulations and encouraging the use of renewable chemicals, which has accelerated demand for bio-based products. The increased use of bio-based N-butanol aligns with the global drive toward a circular economy, reducing carbon footprints and promoting the use of renewable resources in chemical manufacturing. Furthermore, bio-based N-butanol is positioned as a safer and more sustainable alternative in applications such as coatings, solvents, and plastics, where traditional N-butanol is commonly used. As the market for sustainable chemicals expands, bio-based N-butanol is expected to see significant growth, providing manufacturers with new opportunities to meet consumer demand for greener solutions.

To get more information on this market, Request Sample

Rising Demand for N-Butanol in Coatings and Paints Industry

Another key trend influencing the N-butanol market is the growing demand for its use in the coatings and paints industry, driven by global urbanization, infrastructure development, and increased consumer demand for high-performance coatings. N-butanol serves as an essential solvent in the production of coatings and paints due to its ability to improve the flow, leveling, and drying properties of these products. With the expansion of industries such as automotive, construction, and manufacturing, the need for durable, high-quality paints and coatings has risen significantly. For instance, the Indian paints industry, worth 1,110 Billion INR in FY24, is set for significant growth, expected to reach 2,640 Billion INR by FY33, as per ACMIIL's latest report. Additionally, the trend toward more sophisticated, durable coatings that can withstand harsh environmental conditions further boosts the demand for N-butanol. The automotive sector, in particular, has witnessed a rise in the need for advanced coatings that offer long-lasting protection and aesthetic appeal. In the construction industry, the demand for protective coatings for buildings and infrastructure, such as bridges and roads, is also increasing. Furthermore, the growing consumer interest in home improvement and DIY projects has contributed to the increased demand for paints and coatings. As industries prioritize high-performance coatings for both functional and aesthetic purposes, N-butanol continues to play a crucial role in enhancing the quality and performance of these products, driving further market growth.

India N-Butanol Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on grade and application.

Grade Insights:

- Industrial Grade

- Pharmaceutical Grade

The report has provided a detailed breakup and analysis of the market based on the grade. This includes industrial grade and pharmaceutical grade.

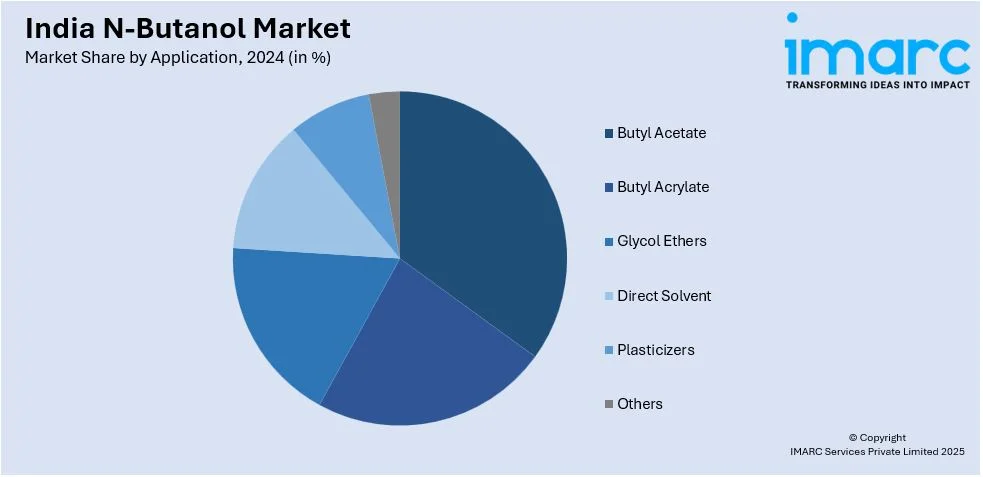

Application Insights:

- Butyl Acetate

- Butyl Acrylate

- Glycol Ethers

- Direct Solvent

- Plasticizers

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes butyl acetate, butyl acrylate, glycol ethers, direct solvent, plasticizers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major India al markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India N-Butanol Market News:

- In August 2023, Indian Oil Corporation Limited (IOCL) awarded a USD 100 Million EPC contract to thyssenkrupp Industrial Solutions India for a 60 KTPA Poly Butadiene Rubber Plant at Panipat. tkIS India is also executing IOCL’s n-Butanol and Catalytic Dewaxing projects on an EPC basis at Gujarat Refinery.

India N-Butanol Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grades Covered | Industrial Grade, Pharmaceutical Grade |

| Applications Covered | Butyl Acetate, Butyl Acrylate, Glycol Ethers, Direct Solvent, Plasticizers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India N-butanol market performed so far and how will it perform in the coming years?

- What is the breakup of the India N-butanol market on the basis of grade?

- What is the breakup of the India N-butanol market on the basis of application?

- What is the breakup of the India N-butanol market on the basis of region?

- What are the various stages in the value chain of the India N-butanol market?

- What are the key driving factors and challenges in the India N-butanol?

- What is the structure of the India N-butanol market and who are the key players?

- What is the degree of competition in the India N-butanol market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India N-butanol market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India N-butanol market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India N-butanol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)