India Nano Coatings Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

India Nano Coatings Market Overview:

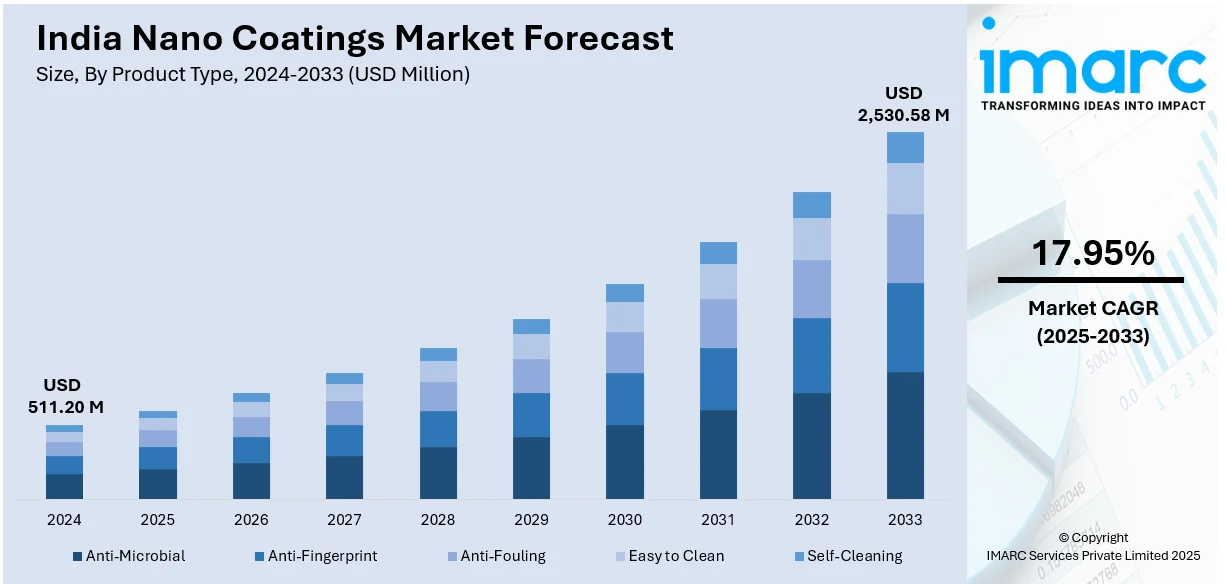

The India nano coatings market size reached USD 511.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,530.58 Million by 2033, exhibiting a growth rate (CAGR) of 17.95% during 2025-2033. The increasing demand for nano coatings in India is driven by their role in enhancing energy efficiency, durability, and sustainability across renewable energy systems and climate-responsive infrastructure, with innovations improving performance, reducing maintenance costs, and supporting long-term environmental and economic benefits.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 511.20 Million |

| Market Forecast in 2033 | USD 2,530.58 Million |

| Market Growth Rate (2025-2033) | 17.95% |

India Nano Coatings Market Trends:

Increasing Use in the Renewable Energy Sector

The growing installation of renewable energy systems is boosting the need for advanced nano coatings that improve efficiency, durability, and long-lasting sustainability. Energy generation facilities function under various and often tough environmental circumstances, and nano coatings offer crucial defense against elements like moisture, dust, ultraviolet (UV) rays, and temperature changes. Their properties that resist reflection and repel water enhance light absorption in solar panels, while coatings that resist corrosion and erosion prolong the lifespan of wind turbine blades and their support structures. Incorporating these advanced coatings into renewable energy systems lowers maintenance expenses and improves operational efficiency, thereby making large-scale implementation more financially feasible. As India is focusing on increasing renewable energy capacity to achieve sustainability objectives, there is higher importance placed on material advancements that enhance energy conversion efficiency and guarantee lasting performance reliability. Continued studies on nanomaterials are augmenting coating characteristics, resulting in better energy output and decreased performance decline. Government initiatives supporting the growth of renewable energy and innovations in nano coatings are generating significant market prospects. As the demand rises to enhance energy production while reducing environmental effects, nano coatings are crucial in boosting efficiency and maintaining the durability of renewable energy systems. In 2023, Indian startup Trinano Technologies introduced a nanocoating for solar modules that increased power output by up to 4% and reduced temperature by 3°C. The coating enhanced light trapping, anti-reflection, and self-cleaning properties while reducing maintenance costs. It was tested and shown to improve panel performance and longevity, with a return on investment in about two years.

To get more information on this market, Request Sample

Rising Demand for Energy-Efficient and Climate-Responsive Coatings

The heightened emphasis on energy efficiency and sustainable infrastructure is boosting the need for innovative nano coatings that manage heat transfer and enhance thermal insulation. With changes in energy prices and growing environmental issues, industries and commercial sectors are looking for ways to reduce energy use while ensuring peak performance. Nano coatings intended for heat reduction assist in decreasing cooling needs by obstructing surplus solar radiation, lessening the burden on air conditioning units, and improving overall energy efficiency. These coatings enhance indoor comfort by stabilizing temperatures, minimizing glare, and protecting materials from deterioration due to extended heat exposure. Advancements in nanomaterials are facilitating the creation of coatings that possess greater durability, self-cleaning abilities, and improved optical clarity, thus making them appropriate for multiple uses. Government initiatives encouraging green building certifications and eco-friendly construction methods additionally facilitate the use of energy-efficient nano coatings. As sectors focus on lowering operational expenses and ensuring long-term sustainability, advancements in nano coatings are becoming increasingly popular as a viable and efficient answer for climate-adaptive infrastructure. The transition to sustainable technologies and enhanced building efficiency is generating chances for additional progress in thermal management innovations. In 2023, HeatCure launched India's first Japanese nanotechnology coating designed to block heat from glass surfaces. The coating reduced solar heat gain by 4 to 10°C and helped save 15-20% in electricity utilization. This innovative solution aimed to improve energy efficiency and comfort in buildings while also contributing to sustainability.

India Nano Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Anti-Microbial

- Anti-Fingerprint

- Anti-Fouling

- Easy to Clean

- Self-Cleaning

The report has provided a detailed breakup and analysis of the market based on the product type. This includes anti-microbial, anti-fingerprint, anti-fouling, easy to clean, and self-cleaning.

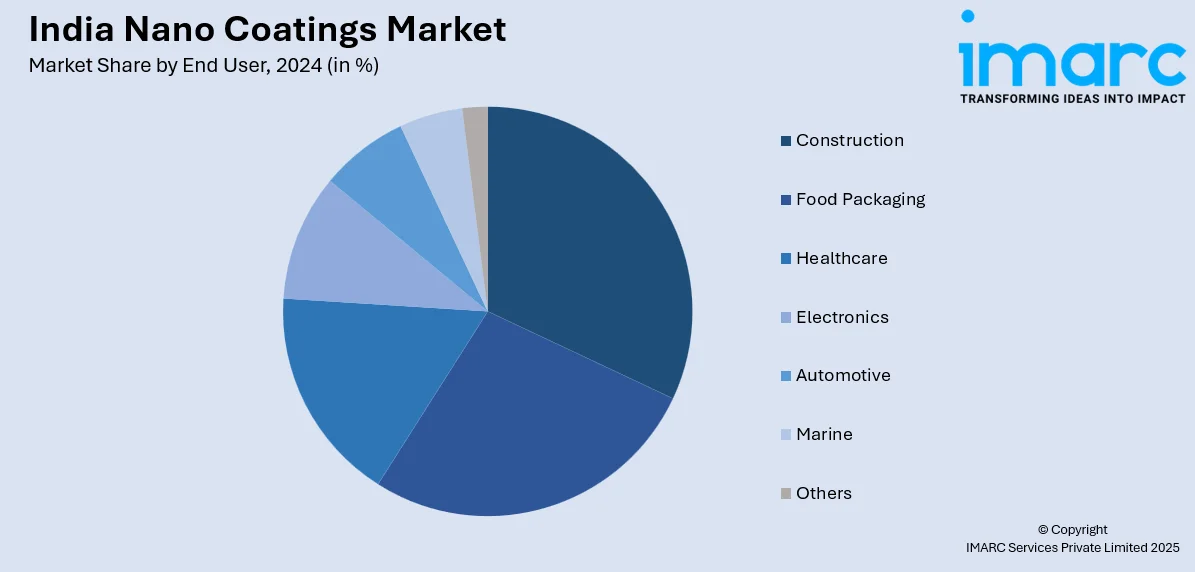

End User Insights:

- Construction

- Food Packaging

- Healthcare

- Electronics

- Automotive

- Marine

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes construction, food packaging, healthcare, electronics, automotive, marine, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Nano Coatings Market News:

- In March 2025, Pellucere Technologies opened its first nano coatings manufacturing facility in Chakan, Maharashtra, India. The facility will produce 8,500 metric tons of nano coatings annually, supporting industries like solar, automotive, and architecture.

- In June 2024, Hyundai launched a Nano Coating Film to reduce in-car temperatures by up to 12.33°C. The film blocked solar heat while maintaining clear visibility. Hyundai planned to expand this technology to India, especially in hot climates.

India Nano Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Anti-Microbial, Anti-Fingerprint, Anti-Fouling, Easy to Clean, Self-Cleaning |

| End Users Covered | Construction, Food Packaging, Healthcare, Electronics, Automotive, Marine, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India nano coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India nano coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India nano coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The nano coatings market in India was valued at USD 511.20 Million in 2024.

The India nano coatings market is projected to exhibit a CAGR of 17.95% during 2025-2033, reaching a value of USD 2,530.58 Million by 2033.

The market is driven by demand for enhanced surface protection, improved resistance to corrosion, and increased durability across various end-use sectors. Rising interest in functional coatings with self-cleaning or antibacterial properties supports adoption. The market also benefits from developments in nanotechnology, growing product innovation, and the need for lightweight, high-performance coatings in industrial and consumer applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)