India Natural Food Flavors Market Size, Share, Trends and Forecast by Source, Flavor Type, Application, and Region, 2025-2033

India Natural Food Flavors Market Overview:

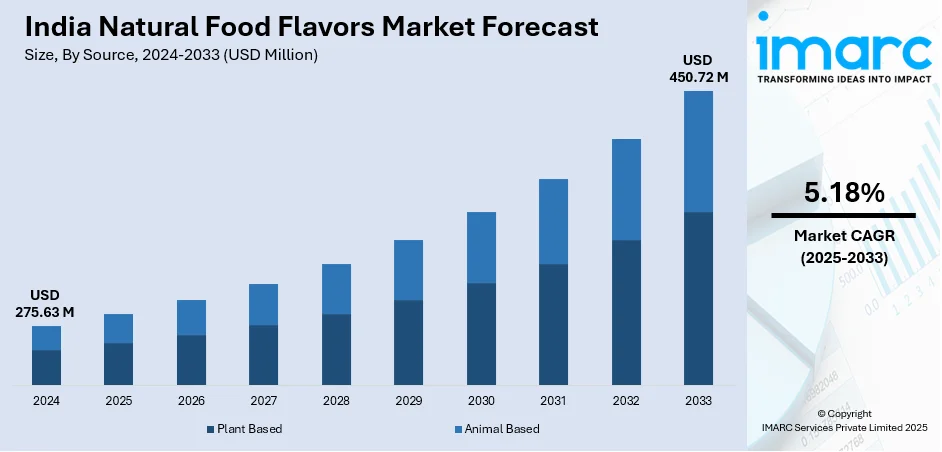

The India natural food flavors market size reached USD 275.63 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 450.72 Million by 2033, exhibiting a growth rate (CAGR) of 5.18% during 2025-20333. The India natural food flavors market share is expanding, driven by the rising consumption of ready-to-eat (RTE) meals and flavored beverages, encouraging companies to offer healthier and more appealing options, along with the increasing implementation of stricter government policies that aim to reduce synthetic additives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 275.63 Million |

| Market Forecast in 2033 | USD 450.72 Million |

| Market Growth Rate (2025-2033) | 5.18% |

India Natural Food Flavors Market Trends:

Growing applications in food and beverage (F&B) industry

The increasing applications in the F&B industry are impelling the India natural food flavors market growth. People are becoming health-conscious and preferring natural flavors over artificial additives due to concerns about synthetic chemicals and their potential health risks. The high demand for packaged food items, dairy products, bakery items, and beverages has encouraged companies to enhance taste and aroma using natural extracts, essential oils, and fruit-based flavors. Additionally, the growing trend of functional and fortified food items, such as protein-enriched snacks and immunity-boosting drinks, further promotes the adoption of natural flavors. Food producers are also investing in research and innovations to create authentic and regional flavors that cater to Indian consumer preferences. The increasing sales of RTE meals and flavored beverages further support this shift, as companies seek to offer healthier and more appealing options. In February 2025, PepsiCo, the well-known F&B brand, announced that the volume of its convenience food product segment increased by 2%, mainly driven by double-digit growth in India. The beverage segment's volume rose by 1%. With fast-paced urbanization activities and changing dietary habits, the demand for natural food flavors is rising, making them an essential component in F&B formulations while meeting consumer expectations for taste, quality, and health benefits.

To get more information on this market, Request Sample

Rise in government regulations about food safety

An increase in government regulations about food safety is offering a favorable India natural food flavors market outlook. As per the information provided on the official website of the Government of India, in 2024, the Indian Parliament passed the ‘The Food Safety and Standards (Amendment) Bill’. The Central Government would create a council named ‘the Nutrition Council’ to oversee the marketing and sale of food items that contribute to obesity in children. The Food Safety and Standards Authority of India (FSSAI) executes stringent guidelines on the use of artificial flavors, preservatives, and chemicals in food items, encouraging companies to shift towards clean-label ingredients. These regulations ensure better transparency, improving consumer trust in naturally flavored products. Additionally, increased monitoring of food production and labeling practices motivates manufacturers to adhere to higher safety standards, driving the demand for natural food flavors. Government initiatives promoting organic and health-conscious food choices further fuel the market growth. With the increasing concerns about food adulteration and health risks linked to artificial additives, food producers focus on using plant-based and organic flavors to meet regulatory requirements. As these laws evolve, businesses wager on research and development (R&D) activities to introduce innovative natural flavors that comply with safety standards while maintaining product appeal.

India Natural Food Flavors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on source, flavor type, and application.

Source Insights:

- Plant Based

- Animal Based

The report has provided a detailed breakup and analysis of the market based on the sources. This includes plant based and animal based.

Flavor Type Insights:

- Fruit and Flavor

- Vegetable Flavor

- Herb and Spice Flavor

- Dairy Flavor

- Others

A detailed breakup and analysis of the market based on the flavor types have also been provided in the report. This includes fruit and flavor, vegetable flavor, herb and spice flavor, dairy flavor, and others.

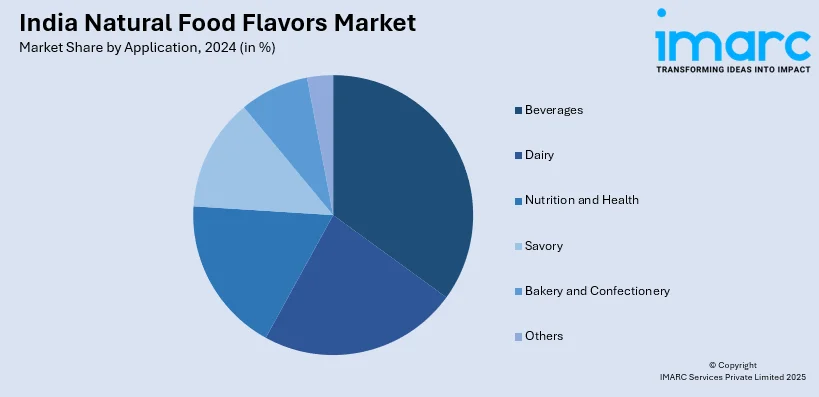

Application Insights:

- Beverages

- Dairy

- Nutrition and Health

- Savory

- Bakery and Confectionery

- Others

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes beverages, dairy, nutrition and health, savory, bakery and confectionery, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Natural Food Flavors Market News:

- In January 2025, MorningWale, a prominent firm in the organic food sector, unveiled its new product line, 'Flavors of Kashmir'. This unique collection offered the finest organic savors directly obtained from the rich Kashmir Valley. With saffron and Kashmiri garlic, along with walnuts and almonds, these components were inculcated to offer the exquisite culinary legacy of Kashmir while promoting health and wellness.

- In September 2024, the 18th edition of Food Ingredients (FI) India, which took place in Bengaluru, provided an outstanding opportunity for F&B brands to examine new market trends, groundbreaking innovations, and advanced technologies while highlighting their creative products. Keva Flavours presented their innovative herbal juice drinks that combined natural fruit flavors with functional components sourced from pomegranate peel (Puniblock), amla (Indian Gooseberry) extract, and grape skin and seeds (Vitisdefy).

India Natural Food Flavors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Plant Based, Animal Based |

| Flavor Types Covered | Fruit and Flavor, Vegetable Flavor, Herb and Spice Flavor, Dairy Flavor, Others |

| Applications Covered | Beverages, Dairy, Nutrition and Health, Savory, Bakery and Confectionery, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India natural food flavors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India natural food flavors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India natural food flavors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The natural food flavors market in India was valued at USD 275.63 Million in 2024.

The India natural food flavors market is projected to exhibit a CAGR of 5.18% during 2025-2033, reaching a value of USD 450.72 Million by 2033.

The India natural food flavors market is driven by rising health consciousness, growing demand for clean-label and organic products, and increased awareness about food safety. Expanding processed food and beverage sectors, along with shifting consumer preferences toward plant-based and minimally processed ingredients, further support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)