India Non-Electric Kitchen Appliances Market Size, Share, Trends and Forecast by Product Type, Sales Channel, and Region, 2025-2033

India Non-Electric Kitchen Appliances Market Overview:

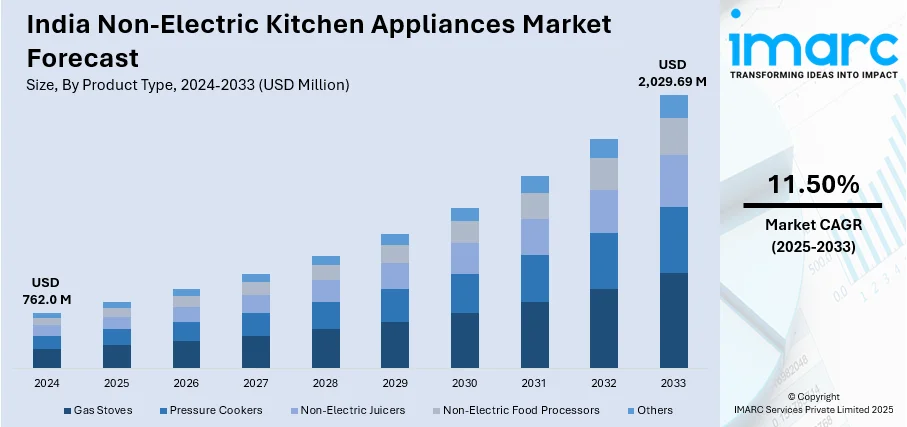

The India non-electric kitchen appliances market size reached USD 762.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,029.69 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The market is growing with increasing consumer demand for inexpensive, energy-free cooking options spurred by rural requirements, sustainability sentiments, and expanding interest in ancient and manual cooking utensils promising durability, efficacy, and simplicity while minimizing their dependence on electricity and contemporary computerized systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 762.0 Million |

| Market Forecast in 2033 | USD 2,029.69 Million |

| Market Growth Rate 2025-2033 | 11.50% |

India Non-Electric Kitchen Appliances Market Trends:

Rising Preference for Traditional and Sustainable Cooking Methods

Indian consumers are moving in large numbers to traditional and sustainable cooking, hence the increased need for non-electric kitchen appliances. Traditional cookware like cast iron, clay pots, and brass utensils is on the rise because they can add flavors without the chemical coatings used in contemporary cookware. Traditional manual grinding devices, such as sil batta (grinder stone) and chakki (hand mill) are also gaining popularity as individuals opt for healthier, less processed foods. Those who look after their health eat slow-cooked food more frequently, using more handi-type pots, pressure cookers, and wood stoves for fuel. Sustainability is the main driver behind this change with consumers opting for sustainable, durable materials that generate less waste. For example, in December 2024, Tramontina introduced the Aeion Pressure Cooker and Pressure Pan in India with tri-ply steel, toxin-free construction, and safety features, appealing to Indian kitchens of today with gas and induction compatibility for convenient cooking. Further, growing recognition of zero-energy devices, including solar cookers and tandoors, further adds momentum to this trend. This resurgence of traditional cooking techniques is also being spurred by food bloggers and culinary experts encouraging authentic regional cuisine throughout India.

To get more information on this market, Request Sample

Growth in Rural and Off-Grid Demand

Non-electric cooking appliances remain essential in rural India, where the supply of electricity is erratic or unreliable. Gas-based stoves, kerosene stoves, and biomass cookers are major cooking mediums in most households. For instance, in August 2023, TTK Prestige introduced the Svachh Perfect stainless steel gas stove with liftable burners, tri-pin brass burners, and auto ignition, improving cleaning ease and fuel efficiency for Indian consumers. Moreover, hand-powered kitchen utensils, including mechanical dough kneaders, manual grinders, and non-electric blenders, are commonly used because they are long-lasting and economical. Government programs subsidizing clean cooking fuel using LPG have further fueled the requirement for energy-saving gas stoves and pressure cookers. Off-grid villages now see solar-driven and fuel-conserving stoves as viable means to minimize use of wood and charcoal. Rural farmers and village-level food producers prefer manual cooking appliances since no maintenance charges are involved and it lasts longer. The cost-effectiveness and usability of these devices guarantee their consistent demand, which is why non-electric kitchen devices are an important category in the rural and semi-urban regions of India.

Expanding Popularity of Outdoor and Camping Appliances

The increasing popularity of outdoor cooking and adventure travel has created a demand for non-electric kitchen appliances for camping, trekking, and picnics. Customers are highly spending money on portable gas stoves, charcoal grills, mechanical coffee makers, and insulated food storage products that provide convenience without electricity. Urban consumers are also on the lookout for backup kitchen gadgets like hand-cranked juicers, mechanical choppers, and stovetop toasters to keep meal preparation unaffected during power cuts or crises. Interest in non-electric, reusable cookware produced from bamboo, clay, and stainless steel has amplified due to the growth in eco-tourism and sustainable travel. Off-grid kitchen solutions like solar cookers and firewood stoves are also attracting the attention of survivalists and minimalists. Both practical consumers and weekend travelers are suited by these devices, ensuring a consistent, standalone method of preparation that confirms the viability of non-electric equipment in contemporary India.

India Non-Electric Kitchen Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and sales channel.

Product Type Insights:

- Gas Stoves

- Pressure Cookers

- Non-Electric Juicers

- Non-Electric Food Processors

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes gas stoves, pressure cookers, non-electric juicers, non-electric food processors, and others.

Sales Channel Insights:

- Supermarkets/Hypermarkets

- Multi-Branded Stores

- Online

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets/hypermarkets, multi-branded stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Non-Electric Kitchen Appliances Market News:

- In September 2024, Bharat Petroleum launched the Bharat Hi-Star PNG Stove with a target of cutting piped natural gas (PNG) consumption by 20-25% and increasing efficiency by 10-15%. BPCL's R&D centre created the stove that supports India's net-zero aspirations and will be sold across the country under the Beyond LPG program.

India Non-Electric Kitchen Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Gas Stoves, Pressure Cookers, Non-Electric Juicers, Non-Electric Food Processors, Others |

| Sales Channels Covered | Supermarkets/Hypermarkets, Multi-Branded Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India non-electric kitchen appliances market performed so far and how will it perform in the coming years?

- What is the breakup of the India non-electric kitchen appliances market on the basis of product type?

- What is the breakup of the India non-electric kitchen appliances market on the basis of sales channel?

- What is the breakup of the India non-electric kitchen appliances market on the basis of region?

- What are the various stages in the value chain of the India non-electric kitchen appliances market?

- What are the key driving factors and challenges in the India non-electric kitchen appliances?

- What is the structure of the India non-electric kitchen appliances market and who are the key players?

- What is the degree of competition in the India non-electric kitchen appliances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India non-electric kitchen appliances market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India non-electric kitchen appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India non-electric kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)