India Non-Ferrous Scrap Recycling Market Size, Share, Trends, and Forecast by Metal, Sector, and Region, 2025-2033

India Non-Ferrous Scrap Recycling Market Overview:

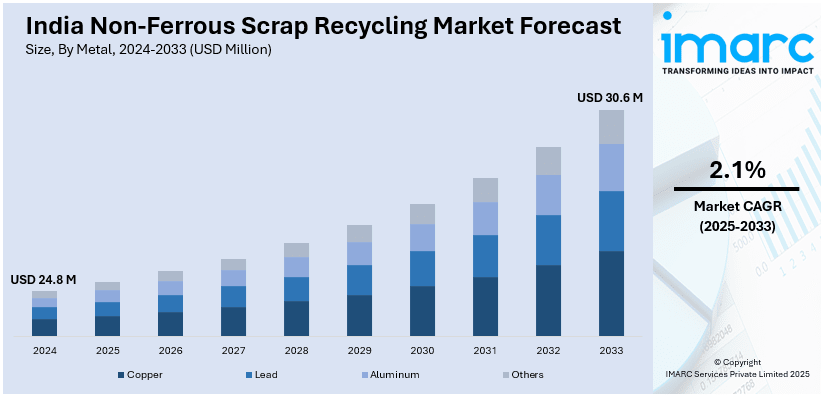

The India non-ferrous scrap recycling market size reached USD 24.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 30.6 Million by 2033, exhibiting a growth rate (CAGR) of 2.1% during 2025-2033. The rising industrialization, government regulations on sustainable waste management, increasing demand for secondary raw materials in manufacturing, cost benefits over virgin metals, and advancements in recycling technologies enhancing efficiency and recovery rates across aluminum, copper, and zinc sectors are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.8 Million |

| Market Forecast in 2033 | USD 30.6 Million |

| Market Growth Rate 2025-2033 | 2.1% |

India Non-Ferrous Scrap Recycling Market Trends:

Strengthening Recycling Mandates in Metal Manufacturing

India is advancing its commitment to sustainability by introducing mandatory recycled content requirements for non-ferrous metals. Future production of aluminum, copper, and zinc will incorporate minimum recycled material, with targets set to increase progressively. This initiative aims to reduce reliance on virgin resources, lower energy consumption, and enhance circular economy practices. Manufacturers must also adopt extended producer responsibility (EPR) frameworks, ensuring efficient scrap collection, processing, and reintegration into supply chains. The shift is expected to drive investments in domestic recycling infrastructure, improve material recovery rates, and reduce industrial carbon footprints. With growing demand for sustainable manufacturing, these policies position India as a leader in responsible metal production while aligning with global environmental commitments and resource efficiency goals. For example, in August 2024, the Indian government announced that, starting in the 2027-28 fiscal year, all new non-ferrous metal products must contain at least 5% recycled content. This mandate applies to metals such as aluminum, copper, and zinc. The policy aims to increase recycled content over time, reaching 10% for aluminum, 20% for copper, and 25% for zinc. Producers are also required to implement extended producer responsibility (EPR) frameworks to manage scrap metals sustainably.

To get more information on this market, Request Sample

Growing Focus on International Scrap Trade Regulations

India is strengthening its role in the global scrap recycling sector by aligning with evolving international waste shipment policies. Regulatory shifts in key export markets are prompting efforts to secure approvals for continued imports of non-ferrous scrap. This reflects the industry's dependence on global material flows and the necessity of compliance with updated environmental and trade regulations. As industrial demand for recycled metals rises, ensuring uninterrupted access to high-quality scrap is becoming a priority. Policymakers and industry leaders are working toward maintaining supply chains while meeting stricter sustainability standards. These efforts are shaping the market, encouraging investments in processing infrastructure, and reinforcing India’s position as a key player in the circular economy for non-ferrous metals. For instance, in January 2025, India sought European Commission approval to import scrap under the EU's revised Waste Shipment Regulation, as announced by the president of the Material Recycling Association of India, at the International Material Recycling Conference in Jaipur.

India Non-Ferrous Scrap Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on metal and sector.

Metal Insights:

- Copper

- Lead

- Aluminum

- Others

The report has provided a detailed breakup and analysis of the market based on the metal. This includes copper, lead, aluminum, and others.

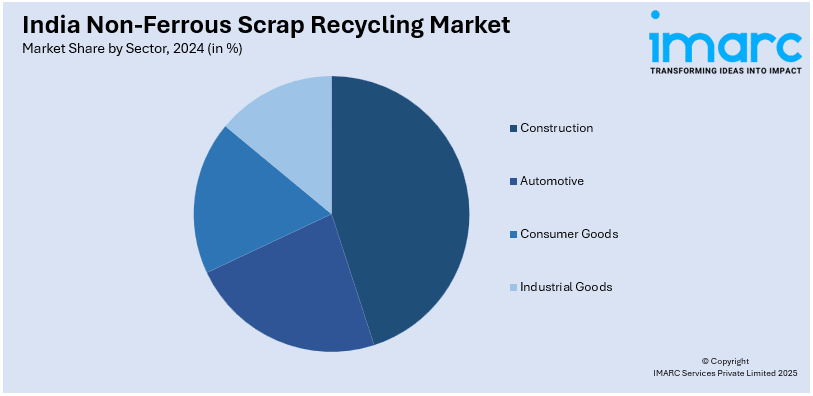

Sector Insights:

- Construction

- Automotive

- Consumer Goods

- Industrial Goods

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes construction, automotive, consumer goods, and industrial goods.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Non-Ferrous Scrap Recycling Market News:

- In February 2025, the Naval Dockyard in Visakhapatnam launched a modern scrap metal processing facility to enhance the efficiency of metal scrap segregation and processing. This initiative aims to reduce the carbon footprint associated with major repair and maintenance work on ships and submarines. The facility is equipped with a jib crane to ensure worker safety and enables the segregation of ferrous and non-ferrous metals, compacting them into dense bales for safe handling, transportation, and storage.

- In January 2025, the 12th International Material Recycling Conference (IMRC), organized by the Material Recycling Association of India (MRAI), took place from January 28 to 30, at Novotel Jaipur Convention Centre. The event highlighted India's commitment to sustainable recycling, aligning with India's Mission LiFE initiative. In a significant policy shift, the Union Budget 2025 announced the removal of basic customs duty on non-ferrous scrap materials, including lead, zinc, copper, brass, and lithium-ion battery scrap.

India Non-Ferrous Scrap Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Metals Covered | Copper, Lead, Aluminum, Others |

| Sectors Covered | Construction, Automotive, Consumer Goods, Industrial Goods |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India non-ferrous scrap recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India non-ferrous scrap recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India non-ferrous scrap recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The non-ferrous scrap recycling market in India was valued at USD 24.8 Million in 2024.

The India non-ferrous scrap recycling market is projected to exhibit a CAGR of 2.1% during 2025-2033, reaching a value of USD 30.6 Million by 2033.

Rising environmental concerns are encouraging the use of recycled materials to reduce mining and energy utilization. Government regulations aimed at promoting recycling practices and resource conservation are further supporting the market expansion. The growing focus on cost-effective production methods is also motivating manufacturers to employ scrap instead of virgin metals.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)