India Offshore Wind Power Market Size, Share, Trends and Forecast by Installation, Water Depth, Capacity, and Region, 2025-2033

India Offshore Wind Power Market Size and Share:

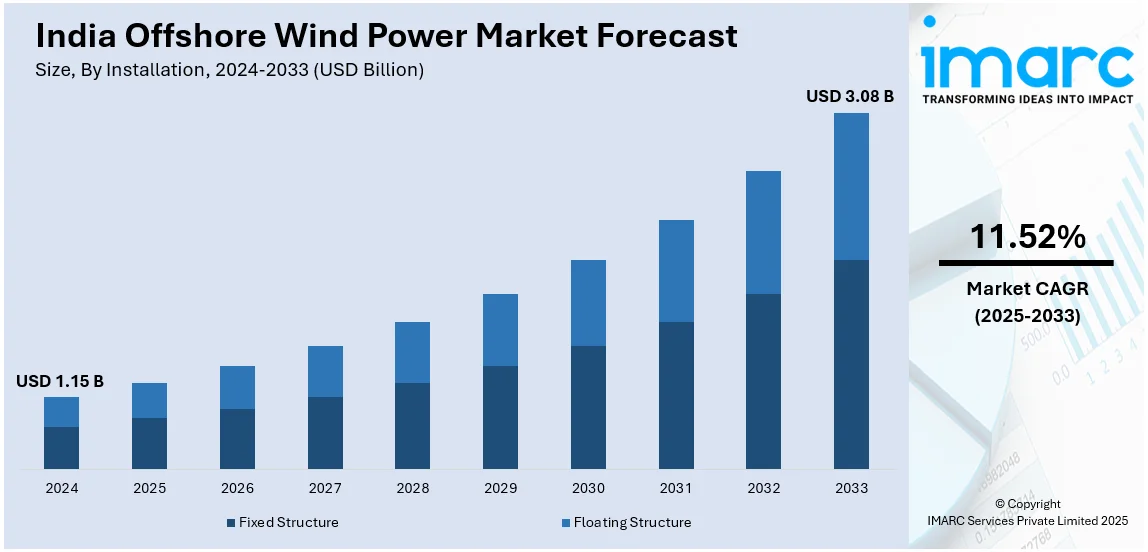

The India offshore wind power market size reached USD 1.15 Billion in 2024. The market is expected to reach USD 3.08 Billion by 2033, exhibiting a growth rate (CAGR) of 11.52% during 2025-2033. The market growth is attributed to implementation of favorable government initiatives, technological advancements, increasing energy demand, favorable policies, international collaborations, growing focus on renewable energy targets and declining costs of offshore wind turbines.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of installation, the market has been divided into fixed structure and floating structure.

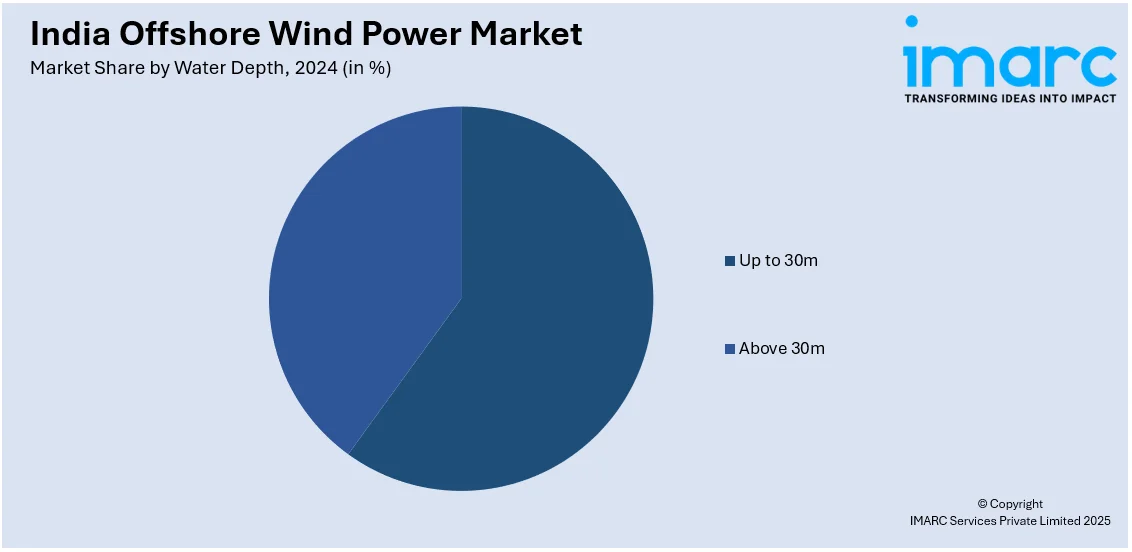

- On the basis of water depth, the market has been divided into up to 30m and above 30m.

- On the basis of capacity, the market has been divided into up to 3MW, 3MW to 5MW, and above 5MW.

Market Size and Forecast:

- 2024 Market Size: USD 1.15 Billion

- 2033 Projected Market Size: USD 3.08 Billion

- CAGR (2025-2033): 11.52%

India Offshore Wind Power Market Trends:

Government Support and Policy Framework

The extensive government support and strategic policy frameworks are positively influencing the India offshore wind power market outlook. As per an industry report, by 2030, the Ministry of New and Renewable Energy (MNRE) aims to have 30 GW of offshore wind power installed, with a specific focus on the coastal states of Tamil Nadu and Gujarat. The government is also making constant efforts to establish a regulatory framework that is conducive to offshore wind development. This includes the identification of suitable locations, simplification of the permitting process, and the introduction of financial incentives to encourage investment. The government is also developing auction mechanisms to assign offshore wind capacity, ensuring long-term project viability. These policy initiatives are aimed at minimizing risks for developers and making offshore wind an integral part of India's renewable energy mix. In addition, cooperation with international agencies is assisting India in adopting global best practices and enhancing efficiency in offshore wind installations. Regulatory clarity and supportive policies are likely to drive project deployment, bringing offshore wind closer to commercialization and integration into the national grid.

To get more information on this market, Request Sample

Progress in Offshore Wind Technology

Technological advancements are rapidly enhancing the feasibility of offshore wind energy in India, driving economic growth. A report published on February 17, 2025, highlights Tamil Nadu’s immense potential, estimating that offshore wind development could contribute up to EUR 72 Billion (about USD 75.4 Billion) to economic growth and generate 805,000 jobs in the manufacturing supply chain by 2030. The forecast is in line with India's ambitious target of achieving 37 GW of offshore wind capacity by the same year. One of the key drivers of progress in offshore wind power is innovation in turbine technology, foundation design, and grid integration, all of which are reducing costs and improving energy efficiency. The development of larger turbines with improved capacity factors is allowing offshore wind farms to deliver more power from fewer installations, making projects economically viable. In addition, floating offshore wind technology is allowing installation in deeper waters where winds are stronger and more consistent, improving efficiency and reliability in power output. At the same time, innovation in subsea cable technology is improving transmission infrastructure, delivering efficient transmission of energy to onshore grids with minimal loss. All these technological advancements are contributing to India offshore wind power market growth.

Emergence of Floating Wind Technology

In India, one of the most promising trends in the offshore wind energy sector is the increasing use of floating wind technology. In contrast to fixed-bottom turbines, which use the seabed, floating wind platforms can be installed in deeper waters, in areas where conventional installation techniques are not viable. India's extensive coastline features regions of deeper water, particularly off the west coast, which present new opportunities for offshore wind farms. Floating turbines are increasingly being perceived as a way to tap these untapped resources and allow India to increase its offshore wind capacity many times beyond the shallow coastal areas. The development of the technology is reducing cost and enhancing efficiency and thus making it more feasible for commercial-scale developments. This, in turn, is expanding the offshore wind power industry size in India. Besides, the combination of floating wind farms with other renewable energy sources like solar power increases the reliability of energy production and provides grid stability. As it evolves, this technology should be a major contributor in achieving India's ambitious offshore wind targets and enabling large-scale deployment in otherwise inaccessibility areas.

Growth Drivers in the India Offshore Wind Power Market:

The market is expanding rapidly, driven by robust policy guidance and regulatory backing. The prime driver is the government's 2030 vision to achieve 30 GW of offshore wind capacity, which offers long-term clarity to developers as well as investors. Along with this target comes supportable measures that invite domestic and foreign players to participate. Technological advancements have also proved to be a significant factor propelling offshore wind power industry growth in India. Advances in turbine design are making more capacity and efficiency possible, and floating wind technology is making possible projects in deeper waters that were once out of reach. The combination of falling turbine costs and improved efficiency is making offshore projects economically feasible at scale. Global partnerships are also helping by introducing cutting-edge technical expertise, investment, and operating experience. Collectively, these factors are accelerating the development of offshore wind as a critical contributor to India's renewable energy portfolio and long-term decarbonization strategy.

Opportunities in the India Offshore Wind Power Market:

India's extensive coastline, stretching about 7,600 kilometers, presents one of the most promising opportunities for offshore wind development in Asia. Studies estimate the technical potential at approximately 140 GW, which creates significant room for large-scale projects over the coming decades. In addition to direct power production, offshore wind holds distinctive potential when integrated with other energy solutions. Coupling with green hydrogen manufacturing is one such area, whereby electricity from wind can be utilized in electrolyzers to advance industrial use and clean fuel objectives. Hybrid renewable ventures, combining offshore wind with solar or onshore wind, have the potential to improve grid stability and maximize output. On the industrial front, the government's emphasis on production-linked incentives will assist in localizing the manufacturing of turbines, foundations, and supporting equipment.

Challenges in the India Offshore Wind Power Market:

The offshore wind power industry in India has significant challenges slowing its development pace. A major concern is the high initial capital, which makes it cost-intensive compared to other renewables. Marine installation procedures increase complexity due to the use of specialized equipment, logistics, and lengthy construction periods. The current domestic production capacity of offshore-specific items in India is low, thus placing the country in a position of dependence on imports and foreign expertise. Such dependence not only raises the cost of projects but also extends project timelines. Lack of technical expertise in the domain of offshore-specific items among professional’s limits industry growth. Processes for regulation are another impediment, since several approvals, such as environmental clearances, may be necessary, creating long delays. These joint financial, technical, and procedural barriers pose significant risks for developers.

India Offshore Wind Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on installation, water depth, and capacity.

Installation Insights:

- Fixed Structure

- Floating Structure

The report has provided a detailed breakup and analysis of the market based on the installation. This includes fixed structure and floating structure.

Water Depth Insights:

- Up to 30m

- Above 30m

A detailed breakup and analysis of the market based on the water depth have also been provided in the report. This includes up to 30m and above 30m.

Capacity Insights:

- Up to 3MW

- 3MW to 5MW

- Above 5MW

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes up to 3MW, 3MW to 5MW, and above 5MW.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- June 2025: India’s government plans to issue tenders for 4 GW of offshore wind energy capacity in the states of Gujarat and Tamil Nadu, as announced by the Minister for New & Renewable Energy. The move comes alongside a 53% increase in this year’s renewable energy budget to INR 26,549 crore, with special focus on integrating wind with solar and storage to achieve round-the-clock supply, upgrading grids, and boosting domestic manufacturing in the wind energy value chain.

- September 2024: The Ministry of New & Renewable Energy (MNRE) announced a Viability Gap Funding (VGF) scheme worth INR 6,853 Crore to support the commissioning of 1,000 MW of offshore wind energy projects in India by fiscal year 2031-32. Solar Energy Corporation of India (SECI) will serve as the implementing agency, and projects will be awarded via a competitive bidding process under the MNRE’s scheme guidelines.

- September 2024: The Solar Energy Corporation of India (SECI) issued a Request for Selection (RfS) for a 500 MW ISTS-connected offshore wind power project in the Gulf of Khambhat, Gujarat. Under the project, bidders are eligible for Viability Gap Funding (VGF) support up to INR 8.128 crore per MW, to be disbursed in four phases tied to foundation works, partial and full commissioning, and after one year of operation.

India Offshore Wind Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Fixed Structure, Floating Structure |

| Water Depths Covered | Up to 30m, Above 30m |

| Capacities Covered | Up to 3MW, 3MW to 5MW, Above 5MW |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India offshore wind power market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India offshore wind power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India offshore wind power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India offshore wind power market size reached USD 1.15 Billion in 2024.

The India offshore wind power market is expected to reach USD 3.08 Billion by 2033, exhibiting a CAGR of 11.52% during 2025-2033.

Growth is fueled by increasing government initiatives to expand renewable energy capacity, favorable policies and incentives for offshore wind projects, and technological advancements reducing costs. Rising energy demand, commitments to reduce carbon emissions, and India’s extensive coastline offering high wind potential also contribute significantly. Additionally, growing investments from private and international players support the rapid development of offshore wind infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)