India Olive Oil Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region, 2026-2034

Market Overview:

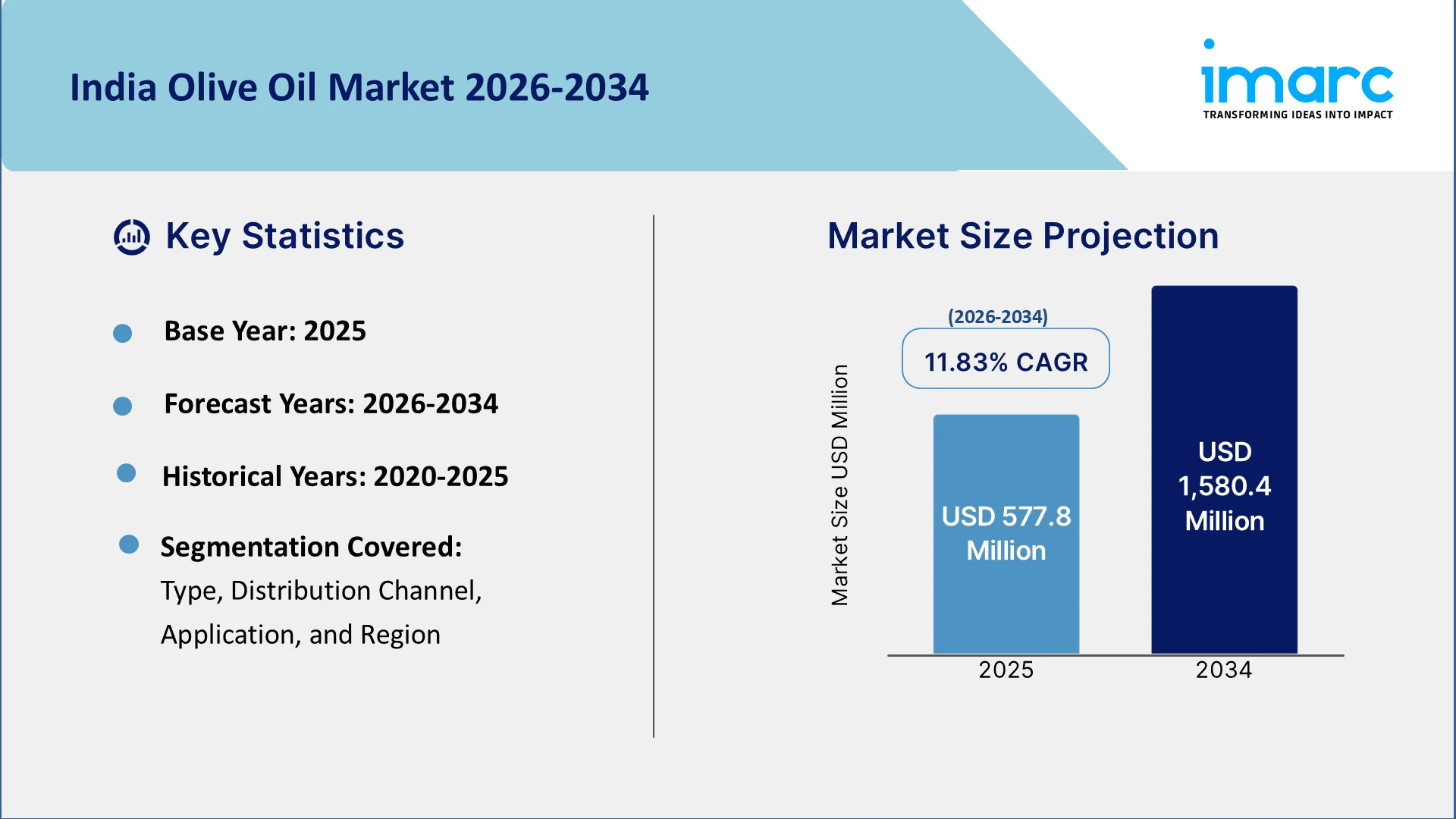

The India olive oil market size reached USD 577.8 Million in 2025. The market is expected to reach USD 1,580.4 Million by 2034, exhibiting a growth rate (CAGR) of 11.83% during 2026-2034. The market growth is attributed to rising dietary preferences towards healthier options, growing awareness of health benefits and culinary versatility, increasing adoption in traditional and modern Indian cuisine, high content of monounsaturated fats and antioxidants, and diversification of product offerings including imported and locally produced options.

To get more information on the market, Request Sample

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of type, the market has been divided into virgin olive oil, refined olive oil, extra virgin olive oil, olive pomace oil, and others.

- On the basis of distribution channel, the market has been divided into supermarkets and hypermarkets, convenience stores, online stores, and others.

- On the basis of application, the market has been divided into food and beverage, pharmaceuticals, cosmetics, and others.

Market Size and Forecast:

- 2025 Market Size: USD 577.8 Million

- 2034 Projected Market Size: USD 1,580.4 Million

- CAGR (2026-2034): 11.83%

Olive oil, a natural oil derived from the fruit of the olive tree (Olea europaea), is renowned for its rich taste, versatility, and numerous health advantages. The extraction process involves pressing and refining olives, resulting in various grades such as extra virgin, virgin, and regular. Extra virgin olive oil, considered the top quality variant, is obtained through cold pressing, retaining the highest level of flavor and nutritional value. Currently, olive oil finds extensive application in cooking, salad dressings, and marinades, and its significant monounsaturated fat content has been associated with promoting heart health and other potential wellness benefits.

The India olive oil market is experiencing a notable surge in popularity and consumption, reflecting a growing awareness of its health benefits and culinary versatility. In this country, the olive oil market offers various grades, including extra virgin, virgin, and regular olive oil, which is acting as another significant growth-inducing factor. Additionally, olive oil has become a preferred choice in Indian kitchens, being widely used in cooking, salad dressings, and marinades, thereby positively influencing the market growth across the country. Besides this, its distinctive taste adds depth to a variety of dishes, and its versatility has contributed to its increased adoption in traditional and modern Indian cuisine. Moreover, the health benefits associated with olive oil have played a significant role in driving the growth of olive oil market in India. Apart from this, the high content of monounsaturated fats, antioxidants, and anti-inflammatory properties present in olive oil are linked to improved heart health and other wellness benefits. Furthermore, the Indian olive oil market is witnessing not only an increase in consumer demand but also a diversification of product offerings, including imported and locally produced options. In addition to this, with a rising focus on healthy eating habits, the India olive oil market is expected to continue its upward trajectory, providing consumers with a flavorful and health-conscious choice in their culinary endeavors.

India Olive Oil Market Trends:

Rising Health Awareness and Premium Product Demand

The Indian consumer market is witnessing a dramatic shift in the direction of health-conscious consumption, with olive oil becoming a premium kitchen medium. Urban consumers, especially millennials and Gen Z, are willing to pay premium rates for extra virgin olive oil because of its perceived healthy benefits over conventional cooking oils. Furthermore, this shift is largely led by mounting awareness about the health advantages of monounsaturated fats and antioxidants inherent in olive oil. This is increasing the olive oil demand in India. The growth of social media influencers and health professionals who endorse Mediterranean diets has also boosted this trend. Marketing initiatives by olive oil companies focusing on the cardiovascular benefits, anti-inflammatory effects, and cancer-preventing antioxidants have struck a chord among health-aware Indian buyers, fueling recurring market expansion.

Digital Commerce and E-commerce Penetration

The Indian digital revolution has dramatically reshaped the distribution of olive oil, with e-commerce channels emerging as important distribution channels. Online shopping giants such as Amazon, Flipkart, and niche food websites are observing a significant rise in olive oil sales, especially during health-oriented promotional activities. Home delivery convenience, extensive product knowledge, customer reviews, and competitive pricing have contributed to online purchasing becoming the most sought-after mode of shopping by customers. Direct-to-consumer brands are using online marketing tools, influencer associations, and subscription services to create brand awareness. This, in turn, is expanding the olive oil market size in India. The COVID-19 pandemic accelerated this trend as consumers sought safe shopping alternatives, and this behavioral shift appears to be permanent, with continued growth in online olive oil purchases.

Regional Flavor Innovation and Culinary Integration

Indian consumers are increasingly experimenting with olive oil in traditional recipes, leading to innovative culinary applications beyond Western cuisine. Area-wise differences in consumption patterns have appeared, with South Indian consumers using olive oil in classic dishes such as dals and vegetable curries. However, North Indian markets prefer olive oil in bread and grilled dishes. Food companies are introducing olive oil-flavored products specially designed for Indian tastes, including flavored varieties with herbs and spices. Celebrity chefs and television shows have been instrumental in illustrating creative uses of olive oil in Indian cooking, inviting consumers to venture beyond salad dressings and Continental foods.

Some of the other market trends including:

- Growing Use of Olive Oil for Hair Care: The beauty and personal care category presents opportunities for expanding olive oil usage beyond the food sector. Consumers in India are increasingly aware of olive oil's moisturizing and healing benefits for hair care, causing demand to grow in the cosmetics segment. Ayurvedic traditions of using natural oils complement olive oil's position as a high-end hair care ingredient.

- Low Affordability of Olive Oil to Restraint India Olive Oil Market: The high price of olive oil relative to traditional cooking oils is a major hurdle to mass acceptance and reduces olive oil consumption in India. Consumers from budget segments tend to choose traditional substitutes, capping market penetration across segments. Import duty and distribution costs also add to retail prices, pushing olive oil beyond the means of budget segments.

- Olive Farming's Influence on India Olive Oil Market: Homegrown olive production initiatives in Rajasthan and Himachal Pradesh are slowly curbing dependence on imports. Domestic production efforts target climate-resistant varieties suitable for Indian climates without compromising on quality. Indigenous olive farming development can significantly alter market dynamics by cutting prices and enhancing supply chain effectiveness.

- Increasing Production and Consumption: Olive oil production in India is gradually expanding, with government-backed initiatives in Rajasthan and other regions fostering domestic cultivation and processing. The country’s growing reliance on imports from leading producers such as Spain and Italy reflect rising consumer demand rather than limited supply. Consumption continues to increase steadily, supported by heightened health awareness, urban lifestyle shifts, and the strong preference for premium, heart-healthy cooking oils.

Growth Drivers of the India Olive Oil Market:

The market is experiencing robust growth driven by several key factors that reflect changing consumer preferences and lifestyle choices. The primary growth driver is the increasing health consciousness among Indian consumers, who are actively seeking alternatives to traditional cooking oils due to rising concerns about cardiovascular diseases, diabetes, and obesity. The nutra-medicinal benefits of olive oil in curing a wide range of ailments have augmented India olive oil market share, as consumers recognize its therapeutic properties, including anti-inflammatory effects, antioxidant benefits, and cholesterol-lowering capabilities. The demographic shift towards the middle class has allowed for the growth of the Indian Olive Oil Market, as rising disposable incomes enable consumers to afford premium cooking oils and adopt healthier dietary practices. Additionally, urbanization and exposure to global cuisine through travel, media, and international food chains have significantly influenced consumer preferences, creating a substantial market for olive oil as a cooking medium that aligns with modern lifestyle aspirations and health-conscious choices.

Opportunities in the India Olive Oil Market:

The India olive oil market presents numerous lucrative opportunities across various segments and consumer demographics, driven by evolving market dynamics and untapped potential. The expanding middle-class population and increasing urbanization create significant opportunities for market penetration, particularly in tier-2 and tier-3 cities, where awareness about olive oil benefits is still developing. The growing trend of healthy eating and wellness-focused lifestyles presents opportunities for premium and organic olive oil variants, especially among younger consumers who are willing to pay higher prices for quality products. Additionally, the increasing popularity of Mediterranean and Continental cuisines in India opens avenues for specialized olive oil products, flavored variants, and cooking-specific formulations. The digital transformation and e-commerce boom provide unprecedented opportunities for direct-to-consumer brands to reach previously inaccessible markets through innovative distribution models.

Market Challenges in the India Olive Oil Market:

According to the India olive oil market analysis, the market faces several significant challenges that could potentially hinder its growth trajectory and market penetration across different consumer segments. The primary challenge is the higher cost composition in comparison with other cooking oils, which has lowered the market penetration of the market, particularly among price-sensitive consumers who form a substantial portion of the Indian market. This price sensitivity is compounded by the lack of awareness about olive oil benefits among rural and semi-urban populations, where traditional cooking oils dominate due to cultural preferences and affordability factors. The limited local production capacity results in heavy dependence on imports, making the market vulnerable to international price fluctuations, currency exchange variations, and supply chain disruptions that can significantly impact product availability and pricing strategies for both importers and retailers.

India Olive Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, distribution channel, and application.

Type Insights:

- Virgin Olive Oil

- Refined Olive Oil

- Extra Virgin Olive Oil

- Olive Pomace Oil

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes virgin olive oil, refined olive oil, extra virgin olive oil, olive pomace oil, and others.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Application Insights:

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverage, pharmaceuticals, cosmetics, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In April 2025, Tata Simply Better, a brand under Tata Consumer Products, launched two new cold-pressed oil variants, Extra Virgin Olive Oil and Sesame Oil, targeting health-conscious consumers. The oils are marketed as clean-label, produced without heat or chemicals to preserve natural nutrients, and are suitable for diverse cooking styles. Packaged in 1-litre PET bottles, the launch reflects growing consumer demand for transparent, minimally processed edible oils that balance flavour with wellness.

- In January 2025, Borges India introduced two single-variety extra virgin olive oils—a “Fruity” variant made from Arbequina olives with a sweet, mild flavour, and a “Character” variant crafted from Picual olives offering a bold, intense taste with spicy notes. All products are cold-pressed, rich in monounsaturated fatty acids and antioxidants, and will be made available through Borges’ online and offline channels to meet the rising demand for premium, health-oriented foods in India.

India Olive Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Virgin Olive Oil, Refined Olive Oil, Extra Virgin Olive Oil, Olive Pomace Oil, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Applications Covered | Food and Beverage, Pharmaceuticals, Cosmetics, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India olive oil market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India olive oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India olive oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India olive oil market was valued at USD 577.8 Million in 2025.

The India olive oil market is projected to exhibit a CAGR of 11.83% during 2026-2034, reaching a value of USD 1,580.4 Million by 2034.

The India olive oil market is driven by rising health awareness, increasing preference for heart-friendly cooking oils, and growing urbanization. Expanding middle-class incomes and Western lifestyle influences also boost demand. The oil's versatility in cooking, skincare, and wellness further contributes to its rising popularity across health-conscious Indian consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)