Olive Oil Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region 2025-2033

Olive Oil Market Size, Share & Trends:

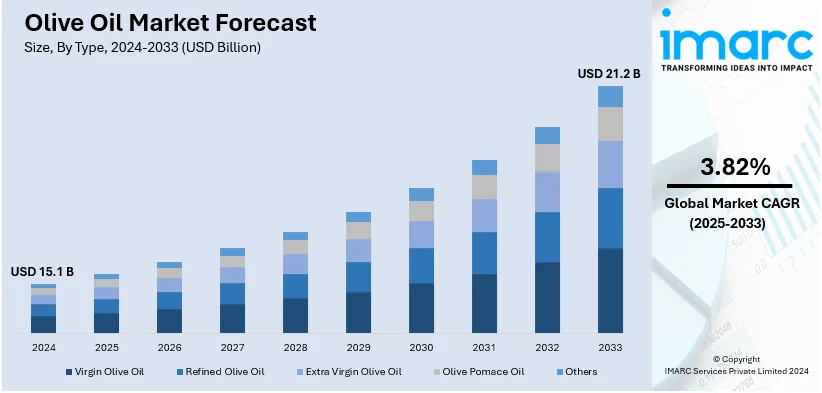

The global olive oil market size was valued at USD 15.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 21.2 Billion by 2033, exhibiting a (CAGR) of 3.82% during 2025-2033. The United States accounted for 85% of the olive oil market share in North America. The U.S has emerged as the second-largest consumer of olive oil globally, overtaking Spain for the first time in 2023, driven by increasing awareness of its health benefits, a shift towards Mediterranean dietary habits, and its versatility in culinary applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.1 Billion |

| Market Forecast in 2033 | USD 21.2 Billion |

| Market Growth Rate 2025-2033 | 3.82% |

The global olive oil market is driven by rising health consciousness among consumers and the increasing demand for natural and organic products. Along with this, the escalating adoption of olive oil in culinary and non-culinary applications due to its numerous health benefits, such as the reduced risk of heart disease and antioxidant properties is significantly supporting the market. According to the HF Stats 2024: Heart Failure Epidemiology and Outcomes Statistics, currently, about 6.7 Million Americans over the age of 20 live with heart failure. This is expected to increase to 8.7 Million by 2030, to 10.3 Million by 2040, and to a staggering 11.4 Million by 2050. An increase in the adoption of Mediterranean diets, particularly in Western countries, is further favoring the sales of olive oil globally. In addition to this, increasing product demand as an essential ingredient in the formulation of cosmetics and pharmaceuticals due to its hydrating and anti-inflammatory in quality is impelling the market. Moreover, technological advancements in oil extraction and efficient distribution channels augment the easy availability factors, which is propelling global growth. Some of the other factors contributing to the market include the growing number of eco-conscious buyers, inflating disposable income levels, and the rising awareness regarding the health benefits of extra virgin olive oil.

The United States stands out as a key market, driven by the emerging trend for healthy eating and increasing awareness of the health benefits of olive oil. In addition, the changing consumer preferences due to the popularity of the Mediterranean diet, which considerably features olive oil is providing an impetus to the market across the country. The increase in demand for natural and organic products is accelerating sales, especially for high-quality extra virgin olive oil. The U.S. market is also witnessing increased applications in gourmet cooking, with up-scale food offerings. Besides this, importing specialty oils is supporting product demand, and consumer education on quality and origin is contributing to the overall market growth. Furthermore, technological advancements in processing, along with sustainable practices by suppliers, are leading environmentally conscious consumers to opt for such products, which further favors steady market growth.

Olive Oil Market Trends:

Rising health and wellness trends

Olive oil, particularly extra virgin olive oil, is recognized for its composition of monounsaturated fats and antioxidants, which have been linked to various health benefits, including reduced risk of heart disease and inflammation. The growing emphasis on health and wellness among the masses has significantly influenced the olive oil industry. According to industry research, rising health and wellness trends are driving the growth of olive oil as a nutritious product. The global wellness industry, valued at USD 5.6 Trillion in 2024, is projected to reach USD 8.5 Trillion by 2027, presenting significant opportunities for businesses. As consumers increasingly prioritize healthier dietary choices, the reputation of olive oil as a heart-healthy cooking oil makes it a highly sought-after option for health-conscious individuals. This trend is further driven by the rising number of medical professionals and nutritional experts who recommend olive oil as an ideal substitute for less healthy fats in cooking and food preparation, thereby augmenting the olive oil market growth.

Increasing culinary diversity and authenticity

The global culinary landscape has expanded to incorporate a wide range of international and gourmet cuisines, many of which rely on olive oil for its distinct flavor and versatility. Olive oil is a fundamental ingredient in Mediterranean cooking, recognized for its role in enhancing flavors and textures. For instance, in July 2024, increasing culinary diversity and authenticity are driving olive oil consumption, as 75% of Americans cook at home regularly and 67% of millennials express a love for cooking. With the global spice market projected to reach USD 16.6 Billion by 2025, consumers are exploring new flavors, including olive oil, through recipes and meal kits. As consumers seek culinary experiences that align with cultural and gourmet trends, the market is responding by offering diverse products that cater to an array of culinary preferences. Moreover, the escalating demand for authenticity and genuine flavors has led to a rise in the use of high-quality extra virgin olive oil in traditional and innovative recipes alike, thereby propelling the market growth.

Sustainability and Organic Preferences

With the growing environmental awareness, consumers are increasingly drawn to products that align with sustainable and eco-friendly practices. Moreover, the rising focus of the olive oil industry on sustainable cultivation and production methods, such as organic farming and reduced chemical use, resonates with environmentally conscious consumers, thus propelling the market growth. According to food and agriculture organization, sustainability and organic preferences are driving the olive oil market, with organic agriculture now practiced in 188 countries, covering over 96 Million Hectares. In 2022, global organic food sales reached nearly 135 Billion euros, reflecting the increasing demand for sustainable, organic products. The appeal of responsibly sourced olive oil extends beyond its nutritional benefits, influencing purchasing decisions and contributing to a broader movement toward conscious consumption. Furthermore, the increasing emphasis on sustainability that satisfies consumer demand and promotes ethical and environmentally friendly practices within the olive oil market is driving the market further.

Olive Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global olive oil market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, distribution channel, application, and region.

Analysis by Type:

- Virgin Olive Oil

- Refined Olive Oil

- Extra Virgin Olive Oil

- Olive Pomace Oil

- Others

Virgin oil stands as the largest component in 2024, holding around 61.9% of the market. Virgin olive oil has excellent quality and uses. Since this is the purest form of olive oil, it is extracted from the olives by mechanical means without the use of chemicals or over-heating it, so that its natural flavor, aroma, and nutrients do not get compromised. Since it is healthy and has a rich flavor, virgin olive oil is an attractive option for customers seeking healthier cooking alternatives. It is a preferred choice for sautéing, drizzles, and making salad dressings. It distinguishes its characteristics, with the different flavor profiles and varieties depending on the olive cultivars and regional origins. These cater to the dynamic culinary preference and the demand for authentic, top-quality ingredients. Therefore, virgin olive oil has become increasingly popular, pushing its position at the forefront of the global market for olive oil.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with 56.8% of the market share in 2024. Supermarkets and hypermarkets are channel places driving the olive oil market since they are widely spread, convenient, and offer a wide range of products. Furthermore, a variety of grades, brands, and packaging sizes for olive oil are available in these retail stores, making them places for holistic purchasing. The wide retail outlet of supermarkets and hypermarkets gives the consumer easy access to a wide choice of olive oil for different tastes and pocketbooks. The shelf space of olive oil in supermarkets helps realize effective product visibility and comparison to assist consumers in making decisions.

Furthermore, presence of attractive promotions, discounts, and bundled offerings makes olive oil an inevitable product of households. Also, convenience shopping by finding olive oil alongside other grocery items consolidates shopping trips and encourages regular consumption. Overall, the widespread presence, availability, and product diversity of supermarkets and hypermarkets contribute a lot to the segment growth.

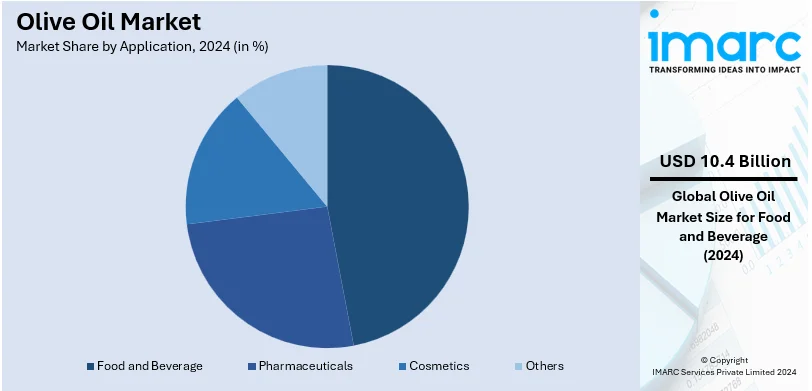

Analysis by Application:

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Others

Food and beverage lead the market with 68.8% of market share in 2024. The food and beverage industries are mostly dependent on olive oil for various uses in a different kind of cuisines and products. The flavour and health benefits give olive oil an edge as a desired ingredient in cooking, salad dressing, marinades, and baked good to add flavor while enhancing the nutritional value. An increase in the demand for Mediterranean and health diets emphasizes the popularity of olive oil for numerous culinary productions.

In addition, restaurants and cafes, as well as food manufacturers, use olive oil in abundance to create more varied menus and address consumer demands for natural premium items. The increase in gourmet and artisanal items also boosts the demand for high-quality extra virgin olive oils, especially in special foods and luxury brands. The relationship between olive oil and the food and beverage industry propels its sustained growth, influencing current trends and sharpening consumers' experiences.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

-

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

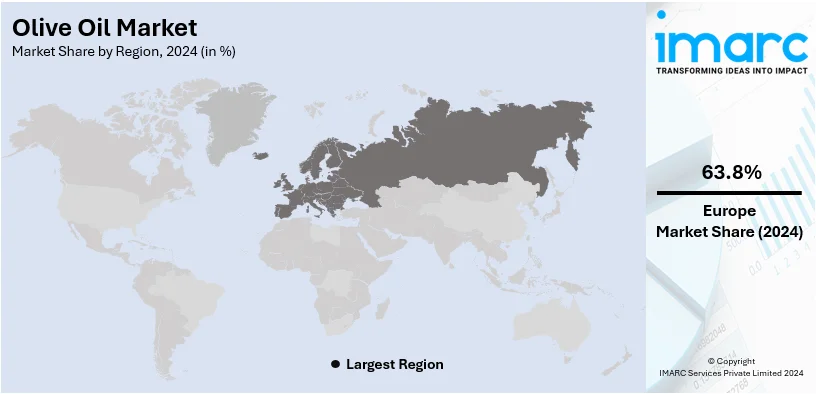

In 2024, Europe accounted for the largest market share of 63.8%. Europe accounted for the largest share of the market due to the region's rich history, traditional consumption patterns, and robust production capacity. The region also consists of countries like Spain, Italy, and Greece, which have a long history of olive oil production, and it is an important component of their culinary culture. Europe's cultural preference for olive oil added to its healthy eating and authentic flavor awareness continues to maintain strong domestic demand.

Furthermore, exports of olive oil from Europe feed into international supply chains, shaping the global trade balance. Such strict quality standards and geographic indications that feature the region improve consumer perception regarding the quality of European olive oils while enhancing the global reputation of excellence. History and impact on taste preference, market trends, and trade have resulted in Europe being ranked as one of the most prominent regional markets for olive oil.

Key Regional Takeaways:

United States Olive Oil Market Analysis

The United States accounted for 85% of the market share in North America. The United States has emerged as the second-largest consumer of olive oil globally, overtaking Spain for the first time in 2023. According to data from the European Commission, the U.S. Department of Agriculture, and the International Olive Council, the country's olive oil consumption reached an impressive 375,000 Tons in the same year. This growing preference for olive oil among U.S. consumers is driven by increasing awareness of its health benefits, a shift towards Mediterranean dietary habits, and its versatility in culinary applications. Consequently, this surge in demand is a major driver propelling the growth of the olive oil market in the U.S.

Moreover, the increasing adoption of olive oil in restaurants and foodservice operations, propelled by rising consumer demand and evolving culinary trends, is expected to drive further growth in consumption over the years to come. For instance, in 2024, Starbucks announced the launch of its olive oil infused Oleato beverages across US and Canada. The Oleato consists of two drinks namely an oat milk latte infused with the extra virgin olive oil and a new toffeenut iced shaken espresso with golden foam, which is vanilla sweet cream infused with extra virgin olive oil into a cold foam.

Asia Pacific Olive Oil Market Analysis

The Asia-Pacific region is witnessing a significant surge in olive oil consumption, driven by increasing awareness of its health benefits and targeted promotional campaigns. According to FAOSTAT, olive production in Asia rose sharply from 3 Million Metric Tons in 2021 to 5 Million Metric Tons in 2022, reflecting the growing demand for olives and their derivatives. Also, trade campaigns led by organizations like the International Olive Council and the Interprofessional Association of Spanish Olive Oil have further fueled the market. For instance, Spanish olive oil exports to China grew by 10.25% during the 2022 campaign, reaching 45,840 Metric Tons, according to the Interprofessional Association of Spanish Olive Oil.

Apart from this, despite the challenges posed by typhoons and unpredictable weather, five olive oil producers from Japan showcased resilience at the 2023 NYIOOC World Olive Oil Competition. The country was rewarded with five Gold and three Silver Awards, surpassing their previous achievements of two additional awards compared to the 2022 competition. This achievement highlights the region's growing expertise and competitiveness in the global olive oil industry. As Asian producers continue to gain international recognition, they are likely to inspire further investment and development in the Asia Pacific olive oil sector, driving both market growth and regional prestige.

Europe Olive Oil Market Analysis

Europe continues to dominate the global olive oil market, producing approximately 67% of the world’s olive oil, according to the European Commission. With around 4 Million Hectares dedicated to olive cultivation, primarily in Mediterranean countries, the region boasts a diverse mix of traditional, intensive, and super-intensive groves, ensuring consistent and high-quality production.

Consumption levels in Europe further underline its pivotal role in the olive oil market. According to data by the European Commission, Italy and Spain are the largest consumers within the EU, with annual consumption reaching approximately 500,000 Tons each. Greece stands out with the highest per capita consumption in the EU, at an impressive 12 Kg per person annually. Overall, the EU accounts for about 53% of global olive oil consumption, driven by its cultural significance, culinary preferences, and growing awareness of olive oil's health benefits. This robust production and consumption ecosystem solidifies Europe as a key driver of the global olive oil market.

Latin America Olive Oil Market Analysis

Latin America's olive oil market is experiencing rapid growth, supported by a surge in exports from key producing countries. According to Rural Rosario, an agricultural association in central Argentina, exports of virgin and extra virgin olive oil increased by an impressive 137% in the first ten months of 2023 compared to the same period in 2022, reaching a record-high of 30,567 Tons. This remarkable growth highlights the region’s expanding role in the global olive oil trade and underscores its potential for further market development.

The increase in exports is driven by a combination of rising global demand for premium-quality olive oil and efforts to enhance production capabilities. Coupled with favorable trade agreements, such as the EU-Mercosur deal, which reduces tariffs and improves market access, these trends are poised to bolster Latin America's position in the global olive oil market while driving regional growth.

Middle East and Africa Olive Oil Market Analysis

The olive oil market in the Middle East and Africa is witnessing robust growth, driven by increasing production, demand, and recognition for premium quality oils. In Tunisia, for instance, the price of extra virgin olive oil has more than doubled in a year, reflecting heightened global and regional demand. The 2023/24 crop year concluded with a production of 220,000 Tons, surpassing initial expectations, although still below the five-year average. This marks a significant recovery compared to the previous year's 180,000 Tons. Tunisian olive oils have also gained international acclaim, earning 26 awards at the 2024 NYIOOC World Olive Oil Competition, including 11 Gold and 15 Silver Awards, with a remarkable success rate of 72 percent. This steady rise in recognition, from a success rate of 20 percent in 2014 to 84 percent in 2022, underscores the region's growing reputation for high-quality olive oil production.

Meanwhile, in Turkey, surging demand for bulk olive oil has prompted the government to introduce a tax of USD 0.20 per kilo on exports, highlighting the strain on domestic supply due to increased international demand. These dynamics, combined with efforts to improve production capabilities and premium branding, are positioning the Middle East and Africa as key players in the global olive oil market.

Competitive Landscape:

The market is experiencing moderate growth as various key players in the industry are introducing innovative approaches to cater to evolving consumer preferences and enhance product quality. These innovations encompass sustainable and traceable supply chains and leveraging blockchain technology to provide transparent information about the origin and production process of olive oil. Additionally, advancements in packaging have led to the development of eco-friendly and UV-protected bottles, ensuring the preservation of olive oil's flavor and nutritional value and also enhancing the market value. Some producers are also embracing precision agriculture techniques, utilizing data-driven insights to optimize cultivation practices and yield. Such innovations collectively contribute to product differentiation, sustainability, and improved consumer experiences. We also expect the market to witness new entrants, consolidation of product portfolios, and a rise in strategic partnerships and collaborations amongst key players to drive healthy competition within the olive oil domain during the forecast period.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Artajo Oil

- Borges International Group, S.L.U.

- California Olive Ranch Inc.

- Cargill Incorporated

- Colavita SpA

- Conagra Brands Inc.

- Del Monte Foods Inc. (Del Monte Pacific Ltd.)

- Deoleo

- Domenico Manca S.p.a.

- EU Olive Oil Ltd.

- Gallo Worldwide

- Gruppo Salov

- Sovena Group

Latest News and Developments:

- In November 2024, olive oil prices, which surged by 50% in the EU and 150% in the UK since 2021 due to drought and inflation, are expected to halve soon, predicts Spain's Deoleo. Improved harvests for 2024-2025 may ease supply chain pressures. Spain, producing nearly half the world's olive oil, faced severe drought impacts.

- In September 2024, ACS journals research highlights innovative olive oil applications: upcycling olive waste to strengthen crude oil well cement, identifying anti-aging molecules like HvOle in olives for skincare, and using DNA sensors to detect oil adulteration. Additionally, stink bug infestations harm olive oil quality, affecting flavor and aroma.

- In May 2023, Salov S.p.A, a leading player in the oil sector, achieved a remarkable triumph alongside the distinguished Filippo Berio brand's extra virgin olive oils. Together, they emerged victorious at the Olive Oil Awards 2023 presented by the University of Applied Sciences - Institute for Food and Beverage Innovation ZHAW in Zurich, securing two awards that epitomize absolute prestige. This accomplishment stands as a testament to the exceptional expertise and dedication embodied by Salov S.p.A and the historic Filippo Berio brand. Their joint success underscores their commitment to excellence within the olive oil industry.

- In April 2022, Borges International Group renewed the Environmental Product Declaration (EPD) for their Olive Oil range, specifically for Extra Virgin Olive Oil that is packaged in glass bottles. This renewal showcases their commitment to environmental sustainability by delving beyond the mere carbon footprint measurement. Instead, the company employs a comprehensive approach that centers on analyzing the entire life cycle of the product.

- In Jan 2021, Del Monte Foods, Inc. made a significant move in the Indian market by introducing one-liter olive fruit oil pouches. This strategic launch aimed to provide consumers with an accessible and affordable option for incorporating healthy edible oil into their diets. By offering olive oil in convenient and cost-effective packaging, the company addressed the growing demand for healthier cooking alternatives among health-conscious Indian consumers.

Olive Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Virgin Olive Oil, Refined Olive Oil, Extra Virgin Olive Oil, Olive Pomace Oil, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Applications Covered | Food and Beverage, Pharmaceuticals, Cosmetics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Artajo Oil, Borges International Group, S.L.U., California Olive Ranch Inc., Cargill Incorporated, Colavita SpA, Conagra Brands Inc., Del Monte Foods Inc. (Del Monte Pacific Ltd.), Deoleo, Domenico Manca S.p.a., EU Olive Oil Ltd., Gallo Worldwide, Gruppo Salov, Sovena Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the olive oil market from 2019-2033.

- The olive oil market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the olive oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The olive oil market was valued at USD 15.1 Billion in 2024.

The olive oil market is projected to exhibit a CAGR of 3.82% during 2025-2033, reaching a value of USD 21.2 Billion by 2033.

The market is primarily driven by the rising health consciousness, escalating popularity of natural and organic products, the increasing use of Mediterranean diets, growing diversity in the culinary, and ongoing technological advancements in extraction and distribution channels.

Europe currently dominates the olive oil market, accounting for a share of over 63.8%, driven by its favorable Mediterranean climate, extensive olive cultivation, advanced processing facilities, rich culinary tradition, and strong export capabilities to global markets.

Some of the major players in the olive oil market include Artajo Oil, Borges International Group, S.L.U., California Olive Ranch Inc., Cargill Incorporated, Colavita SpA, Conagra Brands Inc., Del Monte Foods Inc. (Del Monte Pacific Ltd.), Deoleo, Domenico Manca S.p.a., EU Olive Oil Ltd., Gallo Worldwide, Gruppo Salov, and Sovena Group, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)