India On-The-Go Healthy Snacks Market Size, Share, Trends and Forecast by Product Type, Nutritional Content, Packaging Type, Distribution Channel, and Region, 2025-2033

India On-The-Go Healthy Snacks Market Overview:

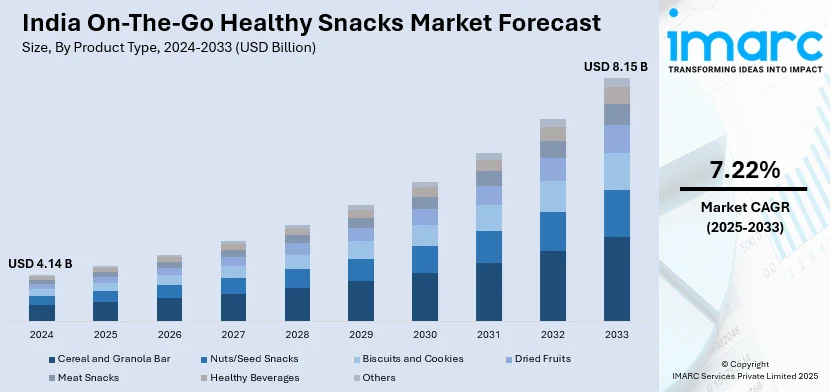

The India on-the-go healthy snacks market size reached USD 4.14 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.15 Billion by 2033, exhibiting a growth rate (CAGR) of 7.22% during 2025-2033. The market is driven by rising health consciousness, rapid urbanization, growing busy lifestyles, increasing disposable incomes, rising demand for convenient yet nutritious options, and growth in e-commerce and retail penetration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.14 Billion |

| Market Forecast in 2033 | USD 8.15 Billion |

| Market Growth Rate 2025-2033 | 7.22% |

India On-The-Go Healthy Snacks Market Trends:

Growing Demand for Protein-Rich and Functional Snacks

The Indian consumer market shows growing interest in protein-rich food items and functional nutrition that leads to increased demand for protein-based snack products with fortified ingredients. This trend develops because people have become more aware of health and fitness alongside balanced diets. In addition to this, the modern market demands snack bars with high protein content as well as nut-based mixes alongside plant-based protein snacks that deliver sustained energy together with essential nutrients. For instance, in November 2024, Origin Nutrition introduced Mojo Pops, a range of high-protein, compression-popped pea chips. Made from peas, lentils, maize, tapioca, chickpeas, spinach, and carrots, these chips cater to health-conscious consumers seeking nutritious snack options. The snack market also introduces new ingredients, such as quinoa and flaxseeds and plant proteins to serve vegetarians and flexitarians. Moreover, the consumer demand for gut health benefits through probiotic snacks and immune system support through turmeric and ashwagandha ingredients has expanded the snack product range. Besides this, the rise of urban consumer demand has prompted brands to introduce ready-to-eat (RTE) products that match the needs of fitness customers and working professionals alongside millennials. Furthermore, e-commerce along with direct-to-consumer (DTC) distribution channels help brands connect with specific health-conscious target segments by delivering personalized products and implementing targeted marketing approaches. This is significantly driving the India on-the-go healthy snacks market growth.

To get more information on this market, Request Sample

Clean-Label and Natural Ingredient Preferences

Clean-label natural and minimally processed snack products are becoming more popular in India because consumers now actively avoid artificial additives and preservatives in their snacks. This trend is boosting the India on-the-go healthy snacks market share. In line with this, more Indian consumers now carefully examine food ingredient lists because they want honest and genuine information about their food choices. Brands now develop snacks that contain no artificial colors and flavors or high-fructose corn syrup by focusing on natural ingredients, such as millets and traditional superfoods, dry fruits and seeds. For example, in April 2024, Agrimax Foods launched 'Bake&Co,' offering gluten-free, sugar-free, preservative-free millet-based cookies. Supported by India's PMFME scheme, it meets rising demand for healthy snacks with natural ingredients like oats, nuts, and jaggery. This reflects the industry's shift toward clean-label products, encouraging other brands to innovate with similar natural formulations. Concurrently, initiatives such as the International Year of Millets (2023) launched by the government have quickened the addition of millets to snack formulations. Furthermore, customers choose snacks that carry organic certifications and contain less sugar because it matches the worldwide trend toward eating mindfully. Apart from this, major companies who reformulate their products alongside new startups who introduce specialized clean-label offerings in the natural and healthy on-the-go snack market segment are significantly enhancing the India on-the-go healthy snacks market outlook.

India On-The-Go Healthy Snacks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, nutritional content, packaging type, and distribution channel.

Product Type Insights:

- Cereal and Granola Bar

- Nuts/Seed Snacks

- Biscuits and Cookies

- Dried Fruits

- Meat Snacks

- Healthy Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cereal and granola bar, nuts/seed snacks, biscuits and cookies, dried fruits, meat snacks, healthy beverages, and others.

Nutritional Content Insights:

- Gluten-Free

- Low-Fat

- Sugar-Free

- Others

A detailed breakup and analysis of the market based on the nutritional content have also been provided in the report. This includes gluten-free, low-fat, sugar-free, and others.

Packaging Type Insights:

- Boxes

- Pouches

- Wraps

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes boxes, pouches, wraps, and others.

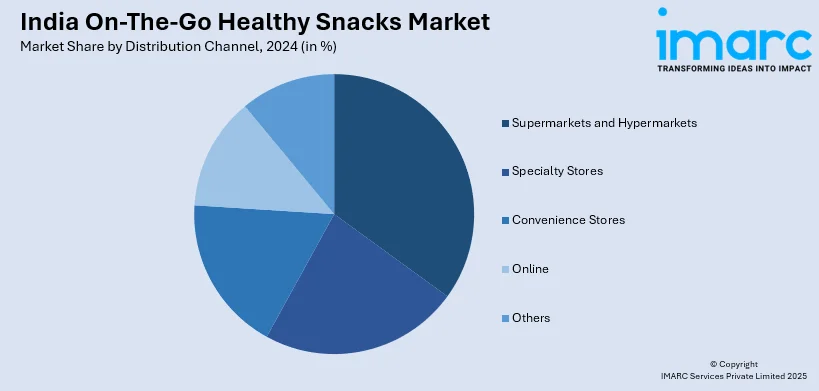

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India On-The-Go Healthy Snacks Market News:

- In September 2024, Kellogg's collaborated with local millet farmers in India to introduce a range of millet-based snack bars. This partnership not only supports sustainable agriculture but also corresponds with the growing consumerinterest in traditional grains, thereby enriching the healthy snacks segment.

- In June 2024, Cornitos, a prominent Indian snack brand, expanded its product line by launching multigrain nacho crisps. This initiative caters to health-conscious consumers seeking nutritious on-the-go snack options. By incorporating diverse grains, this expansion further addresses the growing demand for healthier alternatives in the snack industry.

India On-The-Go Healthy Snacks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cereal and Granola Bar, Nuts/Seed Snacks, Biscuits and Cookies, Dried Fruits, Meat Snacks, Healthy Beverages, Others |

| Nutritional Contents Covered | Gluten-Free, Low-Fat, Sugar-Free, Others |

| Packaging Types Covered | Boxes, Pouches, Wraps, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India on-the-go healthy snacks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India on-the-go healthy snacks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India on-the-go healthy snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The on-the-go healthy snacks market in India was valued at USD 4.14 Billion in 2024.

The India on-the-go healthy snacks market is projected to exhibit a (CAGR) of 7.22% during 2025-2033, reaching a value of USD 8.15 Billion by 2033.

India on-the-go healthy snacks market is fueled by higher health consciousness among consumers, fast-paced urban lives requiring easy-to-consume food, increasing disposable incomes, and a shifting preference towards healthier and low-calorie snacks. Furthermore, wider retail and e-commerce channels enable one-touch access, enhancing market growth and innovation in products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)