India Online Advertising Market Size, Share, Trends and Forecast by Type and Region 2025-2033

India Online Advertising Market Size and Share:

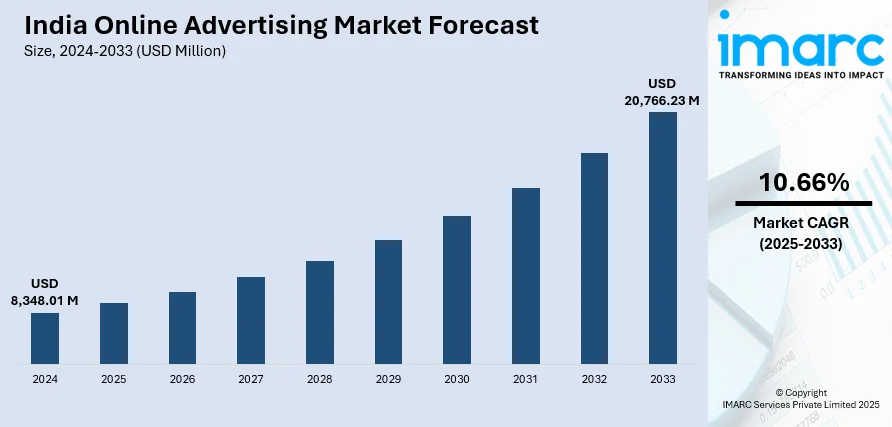

The India online advertising market size was valued at USD 8,348.01 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 20,766.23 Million by 2033, exhibiting a CAGR of 10.66% during 2025-2033. North India currently dominates the market, holding a significant market share of 33.2% in 2024. The market is propelled by the synergistic push of rising internet penetration, mass adoption of smartphones, and the surging need for local language content. Government initiatives driving digital literacy, coupled with the speedy rollout of digital payment systems, have further spurred the movement toward online channels. The growth of video and e-commerce websites, as well as social media platforms, also drives demand for targeted advertising solutions, which further drives the consistent growth of the India online advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8,348.01 Million |

| Market Forecast in 2033 | USD 20,766.23 Million |

| Market Growth Rate (2025-2033) | 10.66% |

One of the key drivers of India's digital ad market is the extensive roll-out of digital infrastructure, particularly in Tier II and Tier III towns. In contrast to most Western markets where internet penetration initially began with desktops, India's experience has been mobile-first. Low-cost smartphones and low-data-price plans have made it possible for consumers from all socio-economic tiers to get online for the first time through their mobile phones. This has revolutionized the way people consume, with people employing mobile devices as their main portal to news, entertainment, learning, and commerce. Being a mobile-first audience, advertising units specifically designed for smaller screens, like vertical videos, app-based banners, and push notifications, cut through to great effect. Additionally, India's distinctive cultural and linguistic diversity has stimulated the development of local content apps and platforms, pushing advertisers to go multilingual and localize their campaigns. This mobile-first, multilingual environment remains a key driver of India online advertising market growth in the country.

To get more information on this market, Request Sample

Government-initiated digital programs have been a driving force in the development of India's online advertising industry. Initiatives such as Digital India have worked toward the enhancement of internet penetration and digital literacy, particularly across rural and underprivileged sectors. These initiatives have led to an increased, digitally literate population that uses online services on a constant basis, making it simpler for brands to target and impact prospective buyers using digital media. Besides, the emergence of India-focused platforms such as BharatPe, Paytm, and local social apps has developed strong digital ecosystems anchored in local behavior and requirements. These platforms enable both financial transactions and social networking as well as provide targeted advertising opportunities with deep integration into daily user activity. As Indian customers increasingly use digital wallets, online banking, and government e-services, they become more comfortable and confident in digital settings. Trust is a bedrock from which more responsive and conversion-oriented online advertising will take place, specifically driving the sector in the direction of innovation in the Indian scenario.

India Online Advertising Market Trends:

Massive Potential of Online Advertisements

India's online advertising market is full of tremendous potential owing to the fast-developing digital infrastructure and a special demographic benefit. With a huge and young population that is becoming technologically aware at an accelerating pace, the nation offers conducive soil for advertisers who aim to create a digital presence. An industry report revealed that digital advertising captured 63% of e-commerce ad spend in India for 2024. In contrast to mature markets in which digital ad saturation becomes an issue, India is in its growing phase, indicating ample scope for innovation and growth. The diversity of the country—cultural, linguistic, and regional—also makes advertising strategies richer, enabling brands to try out hyper-targeted content customized for specific communities. From high-end brands seeking to tap into upscale metro residents to local merchants reaching out to small-town consumers, the possibilities are endless. The growth of influencer marketing, particularly through media like Instagram and YouTube, has allowed for brand consumers to reach out on a more intimate and interpersonal basis. This suggests an emergence of a dynamic marketplace with sustained growth potential for advertisers in the India online advertising market outlook.

Accelerating Digitalization and Expanding Online Population

India is experiencing a wave of digital acceleration driven by rising smartphone penetration, low-cost data plans, and widening rural reach. Internet connections in India increased by 285.53%, from 25.15 crore in March 2014 to 96.96 crore in June 2024, according to PIB. At 94.92 crore, broadband connections increased by 1452%, and 6.15 lakh villages are now covered by 4G. The outcome is a dramatic transformation in the way individuals consume and interact with content, shop, and engage with brands. Additionally, individuals from non-urban areas are also being incorporated online, for the first time, who are forming new audience categories that were not earlier reached. This online upsurge has given rise to increased demand for content in local languages and styles optimized for low-bandwidth settings. Consequently, advertisers are responding by creating more data-light, mobile-first, and vernacular-laden campaigns. Web platforms, such as e-commerce apps, video streaming platforms, and local social networks, are experiencing high usage from these emerging consumers. The various changing India online advertising market trends accelerated by digitalization presents a unique opportunity for brands to establish loyalty and trust by connecting with consumers at the beginning of their digital lives and transforming digital advertising into a pan-Indian phenomenon.

Significant Growth in Digital Platforms

With fast digital uptake by several socio-economic segments, the Indian online advertising market is growing consistently. While individuals are increasingly employing online media for communication and entertainment, they are also using it to buy, learn, bank, and seek medical attention. With more personal interactions online, marketers are using more sophisticated tools like artificial intelligence, programmatic buying, and behavioral targeting to make better connections with the desired audiences. One of the most prominent trends in India is the integration of commerce into content and social platforms. Digital platforms such as WhatsApp, Instagram, and even YouTube are being used as direct points of sale by small businesses and individual sellers. It is a combination of content and commerce that enables users to find products organically while they are viewing content, offering a seamless shopping experience. As per the India online advertising market forecast, this model is most ideal for India's mobile-first convenience-oriented consumer base and is changing the way brands think about digital advertising strategies.

India Online Advertising Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India online advertising market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type.

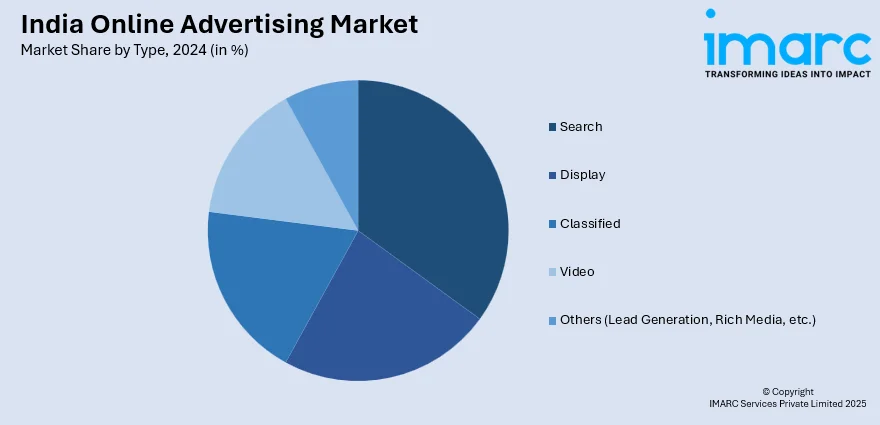

Analysis by Type:

- Search

- Display

- Classified

- Video

- Others (Lead Generation, Rich Media, etc.)

Search stands as the largest component in 2024, holding around 44.3% of the market. Search advertising is still the top segment in India's online advertising space, fueled by the rapidly expanding internet user base in the country and the rising search engine dependency for information, purchase, and services. Indian shoppers tend to initiate their online experience with a search, making it an imperative touchpoint for brands. Spaces like Google own this territory, presenting highly targeted and intent-based ad formats that are compatible with user searches. The pay-per-click (PPC) model also attracts all sizes of companies, including small and medium businesses looking for quantifiable returns on limited budgets. Another factor driving search advertising in India is the surging adoption of voice search and local language search, especially among mobile users in Tier II and Tier III cities. With increasing consumers opting for digital channels to discover and compare products, search ads enable brands to show up at decision points. This context relevance and high intent make search advertising a powerful and prevalent way.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

In 2024, North India accounted for the largest market share of 33.2%. North India is the strongest regional segment in India's online advertising industry owing to its high population density, solid urbanization, and fast-growing digital infrastructure. Major city clusters such as Delhi-NCR, Chandigarh, and Jaipur are technology-savvy and comprised of a cosmopolitan, consumerist population actively interacting with digital platforms. High digital literacy, increasing disposable incomes, and availability of smartphones and low-cost data have driven online consumption of content in urban and semi-urban markets. Moreover, North India is a prime location for such industries as education, retail, and real estate, which invest considerably in online advertising to target their intended marketplaces. Brands usually introduce region-specific campaigns in Hindi and other northern languages to communicate more effectively with regional users. The region's blend of business activity, cultural relevance, and online engagement makes it a prime target area for advertisers looking to maximize reach and performance.

Competitive Landscape:

Several major companies in India's digital ad space, such as Google, Meta (formerly Facebook), Amazon, and domestic powerhouses such as Reliance Jio and Tata Digital, are propelling expansion through a mix of technological advancements, localized initiatives, and investments in infrastructure. They are adapting their platforms to meet the diverse audience of India by providing support for local languages, mobile-centric formats, and low-data conditions. Google and Meta have played a crucial role in educating small and medium enterprises via digital literacy initiatives, allowing even the smallest firms to effectively advertise online. Amazon and Flipkart are incorporating sophisticated adtech in their platforms, enabling sellers to market products via performance-based advertising correlated with e-commerce actions. Reliance Jio has speed up digital penetration by making data affordable, thus broadening the base of users that advertisers can target. At the same time, newer Indian platforms such as ShareChat and Moj are promoting vernacular content and influencer-led marketing, engaging regional markets with culturally adapted campaigns. These firms are also investing in machine learning and AI to improve the targeting and measurement of advertising, getting campaigns more efficient and effective. Together, these initiatives are growing the market and creating an advertising climate that is specifically suited to India's economic model, technology adoption patterns, and cultural diversity.

The report provides a comprehensive analysis of the competitive landscape in the India online advertising market with detailed profiles of all major companies, including:

Latest News and Developments:

- June 2025: French lifestyle brand Kickers launched in India and appointed Team Pumpkin as its digital marketing agency. The agency’s Kolkata office will lead efforts to build brand awareness among Gen Z and millennials through digital-first storytelling, blending Kickers’ heritage with culturally relevant campaigns tailored for Indian consumers.

- April 2025: Meta launched new AI-powered ad tools to support India’s e-commerce and retail sectors. Features include omnichannel ads, influencer-integrated campaigns, and generative AI for catalog personalization. Brands like Zepto and Big Basket reported lower acquisition costs, improved click-through rates, and higher returns on ad spend using these innovations.

- April 2025: JioStar launched MegaBlast, India’s largest one-day ad takeover, reaching 365 million viewers across 84 TV channels and JioHotstar. Covering 10 languages and all regions, MegaBlast offers brands measurable impact and high visibility across both urban and rural markets through a single-day multimedia advertising blitz.

- April 2025: Spotify launched its Ad Exchange (SAX) in India after a successful pilot in North America. Integrated with Google DV360, The Trade Desk, and Magnite, SAX enables real-time programmatic ad buying, expanding advertiser access to Spotify’s 57 million monthly users and boosting campaign reach without increasing spend.

- February 2025: Digital influencer Nas Daily launched his marketing agency, 1000 Media, in India. Focused on authentic storytelling, the agency offers content creation, influencer marketing, and social media strategy, aiming to help Indian brands connect emotionally with audiences and expand globally, while contributing to local economic growth.

- November 2024: Dubai-based entrepreneur Gulrez Alam launched Logi5 in India, an adtech platform combining location intelligence, predictive analytics, and AI for hyper-targeted advertising. Aiming to reduce ad waste and improve engagement, Logi5 emphasizes user privacy, real-time data, and compliance while targeting sectors like retail, QSR, BFSI, and travel.

India Online Advertising Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Search, Display, Classified, Video, Others (Lead Generation, Rich Media, etc.) |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India online advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India online advertising market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India online advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India online advertising market was valued at USD 8,348.01 Million in 2024.

The India online advertising market is projected to exhibit a CAGR of 10.66% during 2025-2033, reaching a value of USD 20,766.23 Million by 2033.

The India online advertising market is driven by increasing internet and smartphone penetration, regional language content demand, mobile-first user behavior, and supportive government digital initiatives. The rise of local digital platforms and social commerce, along with improved digital literacy and real-time ad technologies, further fuels rapid growth across diverse consumer segments.

North India dominates the market due to online content consumption in urban and semi-urban markets fueled by high levels of digital literacy, rising disposable incomes, smartphone availability, and inexpensive data.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)