India Online Car Buying Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Category, and Region, 2026-2034

India Online Car Buying Market Summary:

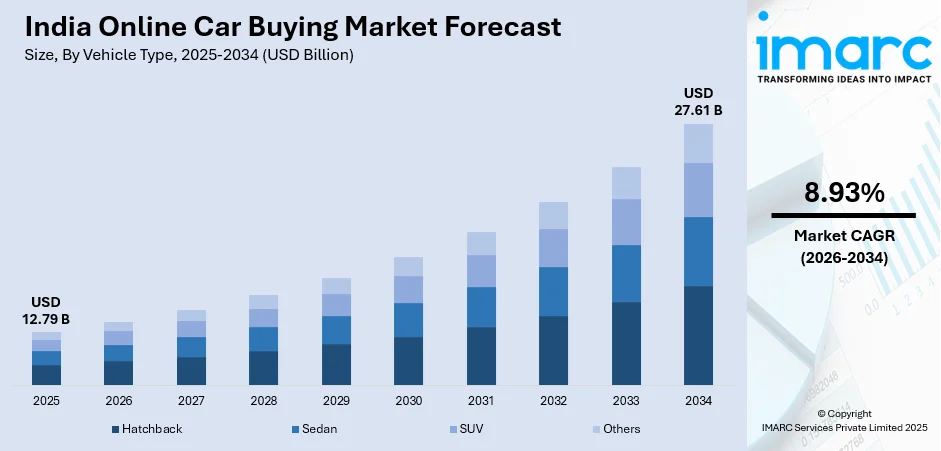

The India online car buying market size was valued at USD 12.79 Billion in 2025 and is projected to reach USD 27.61 Billion by 2034, growing at a compound annual growth rate of 8.93% from 2026-2034.

The market is experiencing robust expansion driven by rising smartphone penetration, increasing internet accessibility, and the growing consumer preference for contactless transactions in the post-pandemic era. The proliferation of digital payment infrastructure and enhanced logistics capabilities are enabling seamless vehicle delivery across urban and semi-urban regions, while integrated financing options and transparent pricing mechanisms are fostering greater trust in online platforms. Additionally, artificial intelligence (AI)-powered pricing engines, comprehensive vehicle inspection protocols, and real-time documentation support are addressing traditional pain points associated with used car transactions, thereby expanding the India online car buying market share.

Key Takeaways and Insights:

-

By Vehicle Type: Hatchback dominates the market with a share of 36% in 2025, driven by compact design, fuel efficiency, affordability, and suitability for congested Indian urban roads and parking constraints.

-

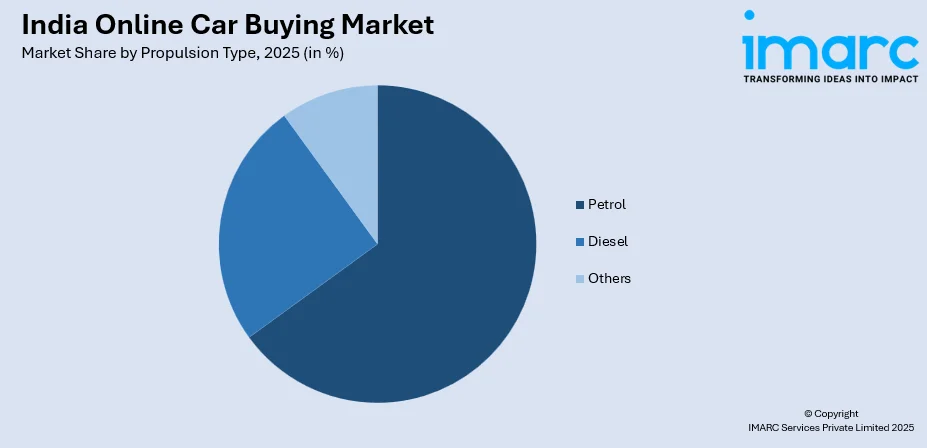

By Propulsion Type: Petrol lead the market with a share of 64% in 2025, supported by widespread refueling infrastructure, driver’s familiarity, lower acquisition costs, and extensive service network availability nationwide.

-

By Category: Pre-owned vehicle represents the largest segment with a market share of 55% in 2025, driven by affordability considerations, improved reliability through comprehensive inspections, and enhanced trust in organized digital platforms.

-

By Region: North India leads the market with a share of 29% in 2025, anchored by Delhi NCR's deep dealer networks, high per-capita income, and favorable government scrappage policy incentives.

-

Key Players: Platforms are improving trust through verified listings, inspections, service guarantees, and clearer pricing. Growth efforts include data-led matchmaking, immersive car views, instant finance and insurance approvals, flexible returns, faster documentation, and trials and delivery to reduce friction and close deals.

To get more information on this market Request Sample

The market is witnessing accelerated digitization as organized platforms erode traditional unorganized dealer dominance through transparent pricing, embedded financing, and warranty services that elevate consumer confidence. The shift toward omnichannel models blending digital convenience with physical touchpoints is reshaping the automotive retail landscape, with platforms offering doorstep test drives, hybrid documentation support, and flexible return policies. In March 2025, CARS24 launched its New Cars platform in India, aiming to streamline the car-buying process digitally by offering real on-road pricing and AI-powered video walkthroughs, marking a significant expansion beyond the pre-owned segment. Furthermore, the growing participation of women buyers, now representing 46 percent of purchases compared to 26 percent in 2024, reflects the market's broadening demographic appeal and the effectiveness of user-friendly digital interfaces.

India Online Car Buying Market Trends:

Omnichannel Integration Revolutionizing Customer Experience

The India online car buying market is transitioning toward an omnichannel model that seamlessly blends digital convenience with physical touchpoints to meet evolving consumer expectations. A major percent of customers prefer an omnichannel strategy in retail, beginning their car purchases online by comparing models, calculating EMIs, and scheduling test drives, while continuing to require offline support for final steps such as vehicle inspection, documentation, and delivery. Companies are adapting by integrating doorstep test drives, hybrid documentation support, and flexible return policies, with platforms offering local pickup, service aggregation, and warranty-backed options gaining competitive advantage. Financing options are increasingly integrated with omnichannel experiences, combining digital applications with in-person document verification to enhance customer convenience, improve accessibility, and ensure seamless transitions between online and offline interactions, thereby fostering greater trust and accelerating decision-making processes. In 2024, Volkswagen India collaborated with Government e Marketplace (GeM) to improve omnichannel presence in the country.

AI and Digital Transformation Enhancing Transparency

Digital platforms are revolutionizing the India online car buying market through advanced features such as AI-powered pricing engines, virtual vehicle inspections, and instant loan approvals that set new standards for convenience and transparency. Platforms are implementing comprehensive 300-point physical inspection protocols, real-time RC transfer tracking, and tech-enabled pre-delivery inspections to increase transparency and build consumer confidence. Furthermore, AI-driven customer engagement tools, including virtual showrooms and chatbot support, are enabling consumers to visualize and interact with vehicles remotely, while data analytics capabilities facilitate better buyer-seller matching and personalized recommendations that enhance the overall purchasing experience. IMARC Group predicts that the India chatbot market is projected to attain USD 1,465.2 Million by 2033.

Electric Vehicle (EV) Adoption Reshaping Market Dynamics

The EV segment is emerging as a transformative force in the India online car buying market, demonstrating exceptional growth momentum despite its current low base. Battery-electric vehicles are gaining prominence, driven by government incentives under schemes like FAME II and PM E-DRIVE that are prompting manufacturers to expand their electric vehicle offerings. On July 29, 2025, DPIIT entered into an MoU with EV manufacturer Ather Energy to enhance India’s EV and manufacturing startup ecosystem. The collaboration will assist deep-tech startups by providing mentorship and resources in fields such as battery technology, vehicle production, and renewable energy. Online platforms are capitalizing on this shift by offering specialized EV financing options, charging infrastructure guidance, and battery warranty programs, although the EV growth trajectory faces headwinds from resale value concerns, with 51 percent of EV owners considering switching to ICE vehicles due to charging anxiety and maintenance costs.

Market Outlook 2026-2034:

The India online car buying market is poised for sustained expansion as digital transformation accelerates and organized platforms capture increasing market share from traditional unorganized dealers. The market generated a revenue of USD 12.79 Billion in 2025 and is projected to reach a revenue of USD 27.61 Billion by 2034, growing at a compound annual growth rate of 8.93% from 2026-2034. The organized segment is expected to grow as digital-first strategies, transparent pricing mechanisms, and integrated financing solutions address traditional pain points.

India Online Car Buying Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Type |

Hatchback |

36% |

|

Propulsion Type |

Petrol |

64% |

|

Category |

Pre‑Owned Vehicle |

55% |

|

Region |

North India |

29% |

Vehicle Type Insights:

- Hatchback

- Sedan

- SUV

- Others

Hatchback dominates with a market share of 36% of the total India online car buying market in 2025.

Hatchbacks command significant market presence in the India online car buying market due to their versatility as entry-level mobility solutions that balance affordability with acceptable space and features, making them an appealing choice for first-time car buyers, young families, and budget-conscious consumers seeking practical transportation options. The segment benefits from competitive pricing strategies, premium features including touchscreen infotainment systems and advanced safety technologies, and ease of financing options that manufacturers have strategically developed to target the country's expanding middle-class population with accessible credit terms.

In November 2025, the Maruti Swift sold 19,733 units, registering 34 percent year-on-year growth and solidifying its position as the best-selling hatchback in India, demonstrating the enduring appeal of practical, fuel-efficient hatchbacks in both urban environments and Tier 2-3 cities where trust, reliability, and low maintenance costs heavily influence purchasing decisions among value-conscious buyers. In 2025, the Maruti Swift 2025 has officially arrived in the Indian market with a new character that combines sporty design, contemporary technology, and remarkable fuel economy. Tailored for city motorists and highway travelers, the new Swift emphasizes performance-oriented tuning while maintaining affordable running expenses. Featuring a turbo petrol engine variant, refreshed design aspects, and enhanced cabin functionalities, the 2025 model seeks to solidify its status as one of India's favorite hatchbacks.

Propulsion Type Insights:

Access the comprehensive market breakdown Request Sample

- Petrol

- Diesel

- Others

Petrol leads with a share of 64% of the total India online car buying market in 2025.

Petrol vehicles maintain market dominance in the India online car buying market, supported by the extensive fuel distribution infrastructure that makes refueling readily accessible even in remote locations across the country. The segment's strength is further reinforced by lower initial vehicle costs compared to alternative powertrains including diesel and electric variants, widespread consumer familiarity with petrol technology accumulated over decades of automotive usage, and the availability of diverse vehicle options across all price points from entry-level hatchbacks to premium SUVs catering to varied buyer preferences.

Moreover, recent technological advancements in petrol engines, particularly in fuel efficiency improvements through direct injection and turbocharging technologies, and emission reduction capabilities meeting BS-VI standards, have helped maintain their appeal among cost-conscious Indian car buyers who prioritize operational economics alongside environmental considerations. Apart from this, the extensive service network spanning urban centers and rural areas ensures accessible maintenance and repairs, further strengthening petrol vehicles' competitive position in the market.

Category Insights:

- Pre-Owned Vehicle

- New Vehicle

Pre-owned vehicle exhibits a clear dominance with a 55% share of the total India online car buying market in 2025.

Pre-owned vehicles dominate the India online car buying market as consumers discover significant value propositions that allow access to higher-end models and features without the steep depreciation associated with new vehicle purchases, which typically lose 15-20 percent value within the first year. The reliability of used cars has greatly improved due to comprehensive 200-300 point inspection protocols, professional refurbishments addressing mechanical and cosmetic issues, and warranty programs offered by organized platforms that provide peace of mind comparable to new car purchases.

Online platforms have introduced unprecedented transparency through detailed inspection reports documenting vehicle condition, vehicle history documentation revealing ownership records and accident details, and real-time pricing mechanisms that address traditional pain points in used car transactions. Women buyers now represent 46 percent of purchases and demonstrate strong preference for automatic hatchbacks and compact SUVs. The organized segment, currently at a significant percent of the used car market, is expanding rapidly.

Regional Insights:

- North India

- South India

- East India

- West India

North India leads with a share of 29% of the total India online car buying market in 2025.

North India generated 36.50 percent of the India used car market revenue in 2024, establishing the region as the dominant force in online car buying activities driven by Delhi-NCR's mature credit ecosystems, digital awareness, and extensive organizational retail presence spanning major dealerships and online platforms. The region benefits from favorable government policies including scrappage certificate benefits that reduce effective invoice prices and nudge vehicle owners toward newer models, while CNG vehicles occupy a particularly strong niche position in Delhi-NCR where regulatory support and established infrastructure drive adoption among cost-conscious consumers.

Delhi-NCR leads in female buyer participation at 48 percent, reflecting the region's progressive consumer demographics and the effectiveness of user-friendly digital platforms in attracting diverse customer segments through vernacular language support and personalized recommendations. The concentration of organized dealers, OEM-certified outlets, and technology platforms in cities like Delhi, Gurgaon, Noida, and Faridabad creates a comprehensive ecosystem for online car transactions. In 2025, buyers of electric cars and two-wheelers in Delhi could enjoy reduced prices as the state government plans to subsidize the acquisition of these environmentally friendly vehicles to combat air pollution. The government's draft electric vehicle (EV) policy includes the proposals, which will be available for public consultation in the upcoming two weeks.

Market Dynamics:

Growth Drivers:

Why is the India Online Car Buying Market Growing?

Increasing Smartphone Penetration and Internet Accessibility

The rapid proliferation of smartphone usage and expanding internet connectivity across India represent fundamental enablers of the online car buying market's growth trajectory. India boasts over 750 million smartphone users as of recent reports, with this number expected to reach 1 billion by 2026, providing the technological foundation for widespread adoption of digital automotive retail platforms. The increasing availability of affordable smartphones combined with declining data costs has democratized access to online marketplaces, enabling consumers in tier-2 and tier-3 cities to research vehicles, compare pricing, and initiate purchases through intuitive mobile applications. Regional language interfaces and localized content strategies are further expanding platform reach to non-English-speaking segments, while improved 4G coverage and emerging 5G networks are facilitating high-quality video walkthroughs, virtual showrooms, and real-time customer support that enhance the digital buying experience.

Growing Trust in Organized Platforms Through Transparency and Quality Assurance

User confidence in online car buying platforms has strengthened significantly as organized players introduce transparent pricing mechanisms, comprehensive vehicle inspections, and warranty programs that address historical concerns about used car quality and authenticity. Platforms like Spinny and CARS24 implement rigorous 200-300 point inspection protocols that evaluate mechanical condition, electrical systems, and cosmetic appearance, providing detailed reports that enable informed decision-making and reduce information asymmetry between buyers and sellers. In 2024, 55 percent of car buyers found the buying process very or completely transparent compared to only 28 percent in 2023, demonstrating rapid improvement in consumer perceptions and trust levels that are driving platform adoption across demographic segments and geographic regions.

Integrated Financing Options Improving Affordability and Accessibility

The integration of comprehensive financing solutions directly into online car buying platforms represents a crucial growth driver that addresses affordability barriers and expands the addressable customer base beyond cash buyers. Non-banking financial companies have emerged as dominant players with 51 percent market share in used car financing, offering flexible terms, faster processing, and alternative credit scoring models that evaluate vehicle condition and buyer profile rather than relying solely on traditional credit metrics. In March 2025, Spinny raised 170 million dollars specifically targeting NBFC expansion, providing the regulatory framework to finance its own customers and capture recurring revenue streams at materially higher margins than car sales.

Market Restraints:

What Challenges the India Online Car Buying Market is Facing?

Trust and Transparency Concerns Continue

Trust remains a core challenge despite visible platform improvements. Buyers still question the accuracy of vehicle condition reports, fear undisclosed repairs, and remain cautious about whether listed prices truly reflect market value. A long history of informal and fragmented offline car sales has shaped buyer behavior, making skepticism hard to erase. Differences in how buyers and sellers perceive transparency further widen this gap, often driven by inconsistent communication and limited standardization. To address this restraint, platforms must continue strengthening inspection credibility, improving disclosure clarity, and offering dependable post-sale support that reassures customers throughout the ownership journey.

Limited Scope for Physical Evaluation

The inability to physically inspect a vehicle before purchase remains a major restraint in online car buying. For many consumers, evaluating build quality, engine sound, ride comfort, and overall condition in person is a deeply ingrained habit. Online images, videos, and reports help but cannot fully replicate tactile assessment or face-to-face negotiation. This creates hesitation, especially for high-value purchases. While doorstep test drives and return policies reduce anxiety, most buyers still seek physical reassurance. As a result, platforms are pushed toward hybrid models that integrate digital convenience with offline validation.

Digital Infrastructure and Cybersecurity Risks

As online car buying grows, digital reliability and data security have become critical concerns. Platforms manage sensitive customer information, including identity documents, payment details, and ownership records, making them attractive targets for cyber threats. Any system failure or data breach can quickly erode trust and damage brand credibility. At the same time, uneven digital access and varying levels of user awareness add operational complexity. Heightened consumer sensitivity toward privacy has raised expectations around secure transactions and responsible data handling. Addressing this restraint requires continuous investment in cybersecurity, regulatory compliance, and resilient digital infrastructure.

Competitive Landscape:

The India online car buying market features intense competition among established unicorn startups and emerging players vying for market share through differentiated business models, technological innovation, and expansion strategies. Various international players are leading the organized segment with a comprehensive ecosystem spanning buying, selling, financing, and vehicle ownership services, supported by its dealer network across cities and AI-powered pricing engine analyzing transactions. They are also operating a full-stack direct-to-consumer model with complete control over vehicle sourcing, refurbishment, certification, and retail operations through its network of physical car hubs that blend online convenience with offline verification touchpoints. Key market players leverage its classifieds platform heritage and massive user base to connect buyers, sellers, and dealers, while diversifying across cars, bikes, electric vehicles, and rental services.

Recent Developments:

-

In May 2025, CRED enabled used car sales through strategic partnerships with CARS24 and Spinny, allowing CRED's premium credit card user base to discover and purchase pre-owned vehicles directly through the CRED app. This collaboration expands distribution channels for online car platforms while providing CRED members with exclusive offers and seamless payment integration.

India Online Car Buying Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, SUV, Others |

| Propulsion Types Covered | Petrol, Diesel, Others |

| Categories Covered | Pre-Owned Vehicle, New Vehicle |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India online car buying market size was valued at USD 12.79 Billion in 2025.

The India online car buying market is expected to grow at a compound annual growth rate of 8.93% from 2026-2034 to reach USD 27.61 Billion by 2034.

Hatchback dominates the market, accounting 36% market share, driven by their compact design and fuel efficiency that are well-suited to Indian urban environments and road conditions. The segment benefits from competitive pricing strategies, premium features including touchscreen infotainment systems and advanced safety technologies, and ease of financing options that manufacturers have strategically developed to target the country's expanding middle-class population with accessible credit terms.

The key drivers include increasing smartphone penetration and internet accessibility that enable digital commerce across urban and semi-urban regions, growing trust in organized platforms through transparency and quality assurance initiatives that address historical concerns about vehicle condition and pricing fairness, and integrated financing options that improve affordability by offering flexible credit terms and alternative scoring models that expand access beyond traditional bank financing constraints.

The major challenges include persistent trust and transparency concerns despite platform improvements, with only a small percent of buyers finding the process completely transparent as of 2024, limited ability to physically inspect vehicles before purchase that conflicts with traditional automotive retail expectations and necessitates hybrid omnichannel approaches, and digital infrastructure vulnerabilities including cybersecurity risks that have seen dealership attacks increase.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)