India Online Furniture Market Size, Share, Trends and Forecast by Raw Material, Product, Applications, and Region, 2025-2033

India Online Furniture Market Overview:

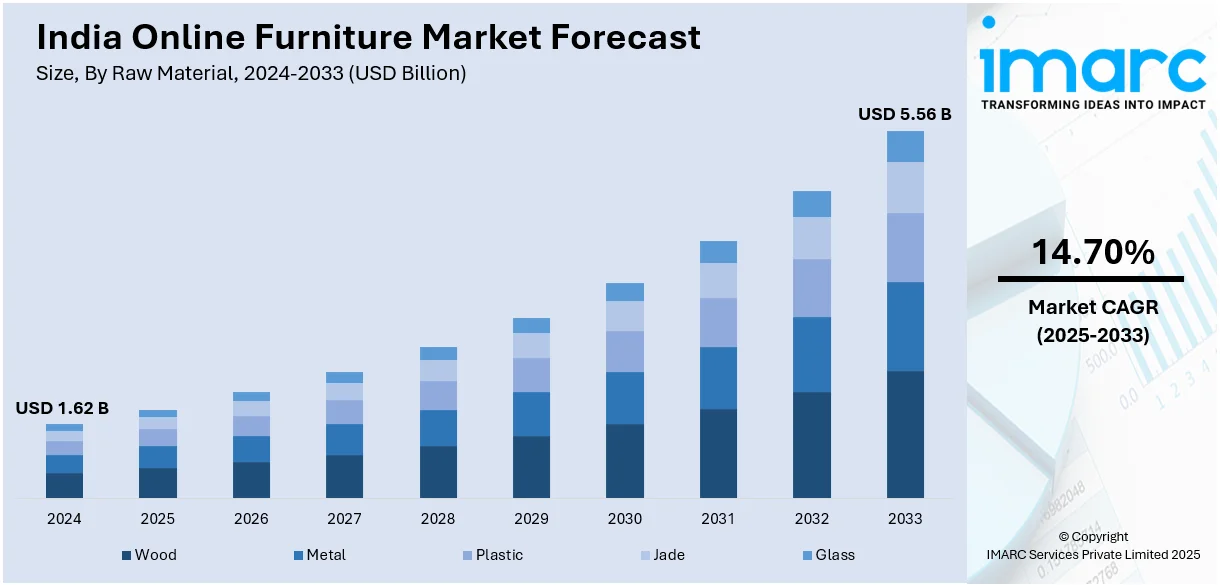

The India online furniture market size reached USD 1.62 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.56 Billion by 2033, exhibiting a growth rate (CAGR) of 14.70% during 2025-2033. The India online furniture market is driven by rising internet penetration, increasing smartphone adoption, convenience of e-commerce platforms, growing demand for customizable and affordable furniture, technological advancements like AR/VR, flexible payment options, and value-added services such as free delivery, easy returns, and assembly support, attracting a broader consumer base across urban and rural areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.62 Billion |

| Market Forecast in 2033 | USD 5.56 Billion |

| Market Growth Rate (2025-2033) | 14.70% |

India Online Furniture Market Trends:

Deepening Internet Penetration

The sudden surge in internet penetration in India has been a turning point in the growth of the online furniture market. As of January 2024, India had 751.5 million internet users, accounting for an internet penetration rate of 52.4% of the country's population. This large number of users has provided new opportunities for furniture retailers to access a larger base, bypassing geographical boundaries. The availability of low-cost smartphones and data plans has further fueled this trend, allowing consumers across different socio-economic segments to shop and buy products online. This mass digital connectivity has made it possible for consumers to navigate a multitude of online platforms, facilitating easy browsing, comparison, and buying of furniture without the limitations of visiting physical stores. In addition, the advent of regional language support and voice search functionality on e-commerce sites has aided online furniture shopping for consumers with different linguistic bases. Several sites now have vernacular interfaces that allow users who are not English-speaking to browse and shop seamlessly. This has been a major driver for the rising Tier 2 and Tier 3 city online furniture sales, where digital adoption is picking up pace.

To get more information on this market, Request Sample

Convenience Offered by Online Shopping Platforms

The ease of use offered by online shopping websites has been the key driver of the Indian online furniture market's growth. Customers can sit in the comfort of their homes and browse a large variety of furniture products, compare prices, read reviews, and make a well-informed buying decision without having to go to several physical stores. Such convenience is especially attractive to busy urban citizens, as it saves time and energy. Additionally, online stores provide value-added services like free shipping, easy returns, and assembly support, further improving the shopping experience. Access to comprehensive product information, ability to see furniture placed in their own environments using augmented reality software, and the option to customize have also added to the popularity of buying furniture online. These websites also offer innovative discounts and promotions, allowing quality furniture to be more within reach of a greater majority of people. In addition, the presence of convenient payment schemes like no-cost EMIs, digital wallets, and buy-now-pay-later has enabled high-quality furniture to be within reach of a wider range of consumers. These financial instruments remove the need for down payments, and thus more individuals are spending on quality and durable furniture without depleting their pockets. Further, customer-friendly policies like longer warranties and damage protection plans have established confidence in online furniture shopping. Most retailers now offer doorstep trials, wherein customers can return or exchange the product if they are not satisfied with it.

India Online Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on raw material, product, and applications.

Raw Material Insights:

- Wood

- Metal

- Plastic

- Jade

- Glass

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes wood, metal, plastic, jade, and glass.

Product Insights:

- Living Room Furniture

- Bedroom Furniture

- Office Furniture

- Kitchen Furniture

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes living room furniture, bedroom furniture, office furniture, kitchen furniture, and others.

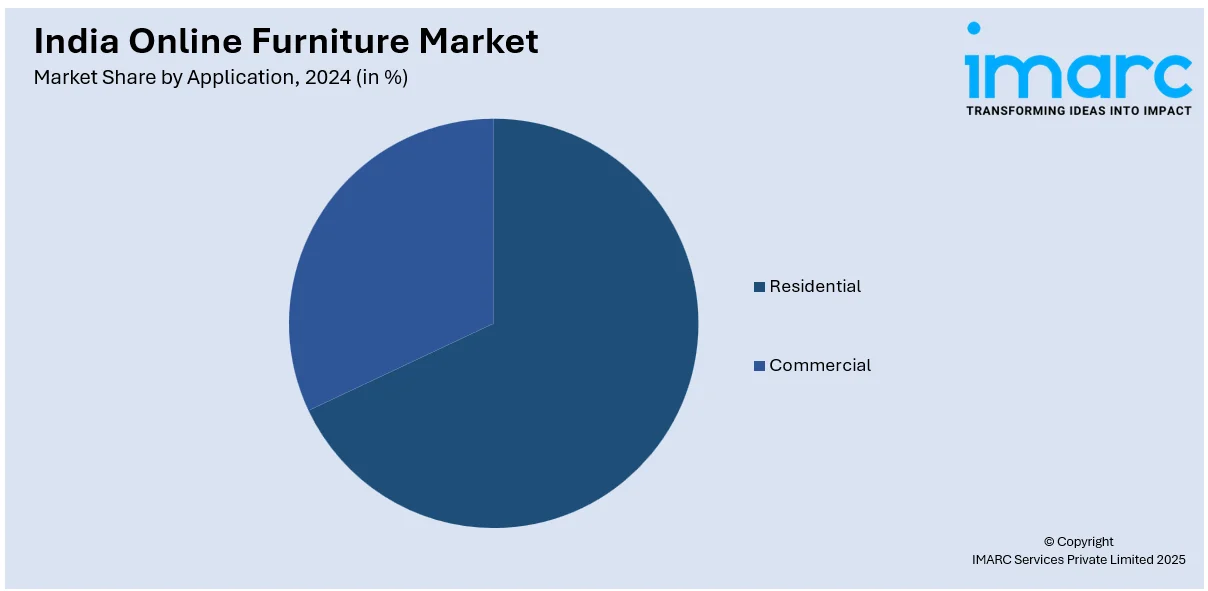

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Online Furniture Market News:

- February 2025: IKEA, the Swedish furniture retailer, began online selling in Delhi-National Capital Region (NCR) and nine other cities, such as Agra and Chandigarh, as part of its growth plan in North India. The company aims to launch full-size stores in Gurugram by 2026 and Noida by 2028. To aid this growth, IKEA has set up a 1.8 lakh square foot Customer Distribution Centre in Gurugram. With it being a name widely known throughout the world, IKEA entering the online shopping segment is certain to increase buyers' confidence to buy furniture on the internet and compel other shops to enhance their digital presence with further investment as part of the online furniture business in India's growing expansion.

- January 2025: Craft Paradise, an e-platform, is dedicated to innovation and enabling small and medium-sized enterprises (SMEs) in India's home furnishing and furniture industry. Through a digital marketplace, it allows local manufacturers and artisans access to a wider audience and thus expands their market presence. Not only does this enable SME development but also enhances the online furniture market with varied and distinct products that appeal to a larger customer base.

India Online Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Wood, Metal, Plastic, Jade, Glass |

| Products Covered | Living Room Furniture, Bedroom Furniture, Office Furniture, Kitchen Furniture, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India online furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India online furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India online furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India online furniture market was valued at USD 1.62 Billion in 2024.

The India online furniture market is projected to exhibit a CAGR of 14.70% during 2025-2033, reaching a value of USD 5.56 Billion by 2033.

Convenient home delivery services, increasing urbanization, and increased e-commerce use are driving the online furniture market in India. Consumers seek customizable, modern designs with competitive pricing. Improved digital visualization tools, augmented reality experiences, and flexible financing options further boost sales. Enhanced logistics and customer trust also accelerate online furniture purchases nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)