India Online Gifting Market Size, Share, Trends and Forecast by Product Type, Application and Region, 2026-2034

India Online Gifting Market Summary:

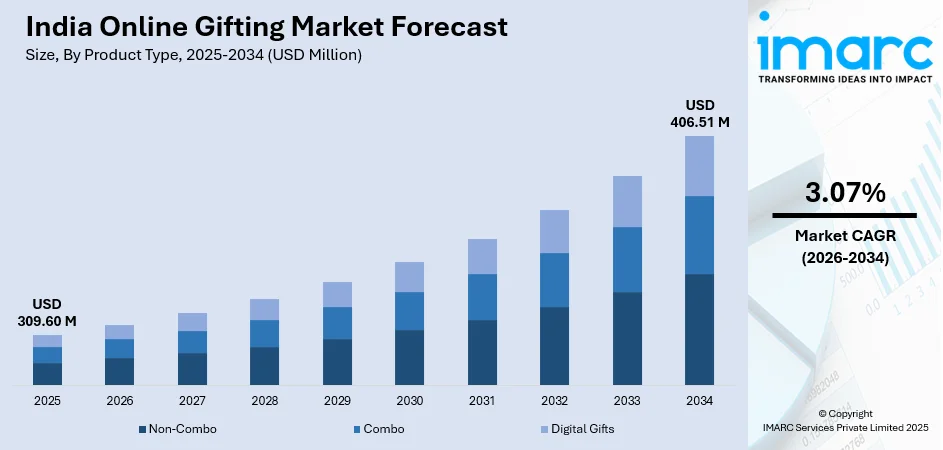

The India online gifting market size was valued at USD 309.60 Million in 2025 and is projected to reach USD 406.51 Million by 2034, growing at a compound annual growth rate of 3.07% from 2026-2034.

The market is propelled by increasing internet penetration, rising e-commerce adoption, and growing consumer preference for convenient shopping experiences. The proliferation of digital payment solutions, particularly UPI-based transactions, has streamlined online purchasing processes. India's rich cultural traditions of gift-giving during festivals, birthdays, and weddings continue to sustain strong demand. Additionally, the expansion of personalization options and same-day delivery services is enhancing customer satisfaction, driving the India online gifting market share.

Key Takeaways and Insights:

-

By Product Type: Non-combo dominates the market with a share of 38% in 2025, driven by consumer preference for individual gift items that offer greater flexibility and personalization options.

-

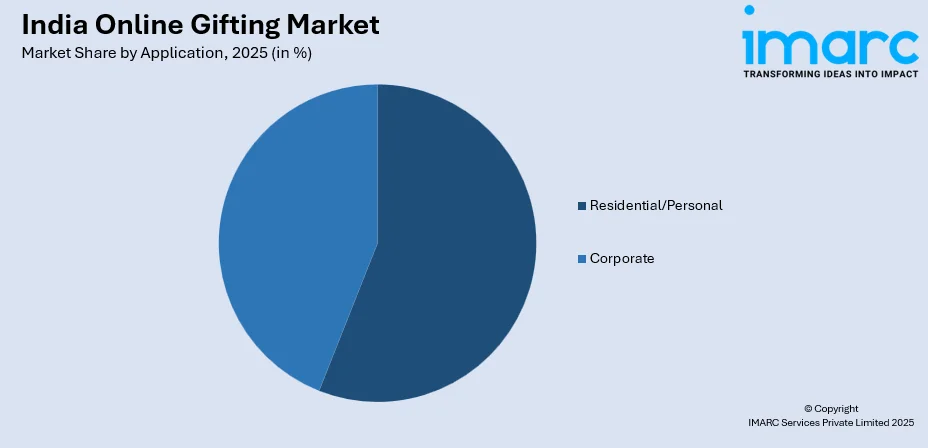

By Application: Residential/Personal leads the market with a share of 56% in 2025, fueled by the strong tradition of personal gift-giving during festivals and special occasions.

-

By Region: North India represents the largest segment with a market share of 29% in 2025, supported by high population density, urbanization, and strong e-commerce infrastructure.

-

Key Players: The India online gifting market exhibits moderate competitive intensity, characterized by the presence of both established e-commerce giants and specialized gifting platforms competing through personalization capabilities, delivery speed, and product variety.

To get more information on this market Request Sample

India's online gifting landscape is undergoing significant transformation as consumers increasingly embrace digital platforms for thoughtful gift purchases. The market benefits from India's robust digital payment ecosystem, with UPI processing transactions monthly in late 2024, facilitating seamless online purchases. In February 2024, IGP.com launched a 30-minute instant delivery service across 2,000 pin codes, demonstrating the industry's commitment to enhanced customer convenience. The convergence of cultural gifting traditions with technological innovation continues to reshape consumer expectations, with platforms offering AI-driven gift recommendations, extensive customization options, and experience-based gifting alternatives that cater to evolving preferences among younger demographics.

India Online Gifting Market Trends:

Rising Demand for Personalized and Customized Gifts

Consumer preferences are shifting away from traditional generic gifts toward customized products that convey deeper emotional connections. Engraved jewelry, personalized photo frames, custom message cards, and curated gift baskets are gaining significant traction. In October 2024, Bakingo launched premium Diwali hampers featuring a 'Make Your Own Hamper' option, enabling customers to personalize their festive gifts. The rise of digital printing and laser engraving technologies has expanded customization possibilities, while e-commerce platforms offer seamless personalization interfaces that enhance user experience.

Growing Popularity of Experience-Based Gifting

Experience gifts are emerging as a preferred alternative to physical products, particularly among younger urban consumers seeking memorable moments. Customers are increasingly opting to gift travel packages, concert tickets, spa vouchers, online courses, and adventure sports experiences. According to Paytm, travel bookings surged by 44% in 2024, largely driven by concert-related experiences. This shift reflects broader preferences for unique and meaningful experiences over material possessions, with online platforms simplifying the process of browsing, booking, and gifting experiential products.

Expansion of Digital Gifting and E-Gift Card Solutions

The market for digital gifts is growing quickly due to rising internet usage, the popularity of mobile payments, and the ease of immediate delivery. E-gift cards are becoming a preferred choice for both consumers and corporations, offering flexibility across major retail brands and entertainment services. In August 2024, Aditya Birla Capital Digital launched DigiGold Gifting on its platform, enabling seamless digital gold gifting. Virtual experiences, personalized video messages, and digital memberships are also gaining traction as consumers seek innovative gifting options that align with modern lifestyles.

Market Outlook 2026-2034:

The India online gifting market outlook remains positive, underpinned by favorable demographic trends, expanding digital infrastructure, and evolving consumer preferences toward convenient shopping experiences. Quick commerce integration is rapidly transforming delivery expectations, with leading platforms now offering ultra-fast 10-30-minute delivery services across major metropolitan areas. In February 2025, Flipkart Minutes launched its 'Rift to Gift' campaign emphasizing 10-minute gift delivery. The corporate gifting segment is expected to witness accelerated growth as businesses increasingly adopt digital gifting solutions for employee engagement and client appreciation. The market generated a revenue of USD 309.60 Million in 2025 and is projected to reach a revenue of USD 406.51 Million by 2034, growing at a compound annual growth rate of 3.07% from 2026-2034.c

India Online Gifting Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Non-Combo |

38% |

|

Application |

Residential/Personal |

56% |

|

Region |

North India |

29% |

Product Type Insights:

- Non-Combo

- Combo

- Digital Gifts

The non-combo dominates with a market share of 38% of the total India online gifting market in 2025.

The non-combo segment maintains its leading position due to consumer preferences for individual gift items offering enhanced flexibility and targeted personalization. Single-item gifts allow purchasers to select products precisely matching recipient preferences, budgets, and occasions. This segment encompasses diverse products including personalized accessories, customized apparel, engraved jewelry, and specialty items. The growth of direct-to-consumer brands has significantly expanded product variety, enabling consumers to access unique and exclusive offerings.

E-commerce platforms are leveraging AI-driven recommendation engines to help consumers navigate extensive product catalogs and identify appropriate gifts effortlessly. In January 2024, Etsy introduced 'Gift Mode,' a generative AI-powered feature providing personalized gift recommendations based on recipient profiles. The non-combo segment benefits from streamlined logistics and inventory management, enabling platforms to offer faster delivery options and maintain competitive pricing across individual product categories. This operational efficiency translates into cost savings that platforms can pass to consumers through attractive pricing strategies. Additionally, simplified inventory tracking allows for better demand forecasting and stock optimization, ensuring popular gift items remain consistently available during peak festive seasons.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential/Personal

- Corporate

The residential/personal leads with a share of 56% of the total India online gifting market in 2025.

The residential and personal gifting segment derives strength from India's deeply rooted cultural traditions of gift exchange during festivals, birthdays, anniversaries, and weddings. Occasions such as Diwali, Raksha Bandhan, and Eid drive substantial seasonal demand surges. The segment benefits from emotional purchasing behavior, with consumers willing to invest in meaningful, personalized gifts for family members and friends. Rising disposable incomes among the expanding middle class have enabled increased spending on premium gifting options.

Digital platforms have democratized access to diverse gifting options, enabling consumers in tier-2 and tier-3 cities to access premium products previously available only in metropolitan areas. In August 2024, FlowerAura launched an exclusive Rakhi collection featuring celebrity endorsements, demonstrating the segment's potential for branded marketing partnerships. The convenience of doorstep delivery and scheduled gift dispatch has particularly resonated with consumers managing long-distance relationships and time-constrained urban lifestyles. Such partnerships enable platforms to enhance brand visibility, build consumer trust, and drive higher engagement during peak festive occasions, ultimately strengthening market positioning within the competitive personal gifting landscape.

Regional Insights:

- North India

- South India

- East India

- West India

North India holds the largest share with 29% of the total India online gifting market in 2025.

North India's market leadership is driven by high population density across major states including Delhi NCR, Uttar Pradesh, Punjab, and Haryana, coupled with robust e-commerce infrastructure development. The region benefits from deeply rooted cultural traditions around festive gift-giving during Diwali, Raksha Bandhan, and Karva Chauth, alongside elaborate wedding celebrations generating consistent seasonal demand. Metropolitan centers like Delhi and Gurgaon serve as major e-commerce hubs with well-established logistics networks and warehousing facilities enabling rapid delivery services across the region.

The concentration of corporate headquarters in Delhi NCR contributes significantly to the B2B gifting segment, with companies increasingly adopting digital platforms for employee rewards, milestone recognition, and client appreciation programs. During the Great Indian Festival 2024, Amazon Business witnessed substantial growth in its corporate gifting store, reflecting rising enterprise demand. Meanwhile, expanding internet penetration in smaller towns across Uttar Pradesh, Rajasthan, and Haryana is broadening the addressable consumer base beyond traditional urban markets, unlocking new growth opportunities in tier-two and tier-three cities.

Market Dynamics:

Growth Drivers:

Why is the India Online Gifting Market Growing?

Rapid Expansion of Digital Payment Infrastructure

India's digital payment ecosystem has undergone transformative growth, creating a conducive environment for online gifting transactions. UPI has emerged as the dominant payment method of total digital payments in 2024. In October 2024, UPI processed a record 16.58 billion financial transactions worth INR 23.49 Lakh Crores, demonstrating unprecedented consumer adoption of digital payments. The International Monetary Fund recognized UPI as the world's largest retail fast-payment system by transaction volume in June 2025. The zero-merchant-discount-rate policy and government incentive schemes have accelerated merchant onboarding, with QR codes deployed to a number of merchants. This seamless payment infrastructure has removed friction from online purchasing, enabling instant and secure gift transactions.

Increasing Smartphone and Internet Penetration

India's expanding digital connectivity is creating new opportunities for online gifting platforms to reach previously underserved markets. The country has over 900 million internet users and 500 million smartphone users as of 2024, with continued growth projected through the decade. Rural internet adoption is accelerating, with tier-2 and tier-3 cities now accounting for approximately 60% of all online orders. The rollout of affordable 4G and 5G networks has enhanced mobile commerce accessibility across diverse geographic regions. E-commerce platforms are optimizing their applications for low-bandwidth environments and vernacular language interfaces to capture this expanding user base.

Strong Cultural Tradition of Gift-Giving

India's deeply ingrained cultural practices of gift exchange during festivals, weddings, and celebrations provide a stable foundation for market growth. The country hosts numerous gifting occasions throughout the year on various festive occasions and regional festivals, each generating concentrated demand periods. Wedding-related gifting remains a significant market segment, with elaborate gift-giving traditions spanning multiple ceremonies. The emotional value attached to gift-giving in Indian society encourages consumers to invest in quality products that convey thoughtfulness and care. The transition of traditional gifting practices to digital platforms is accelerating as younger generations embrace the convenience of online shopping.

Market Restraints:

What Challenges is the India Online Gifting Market Facing?

Logistical Complexities and Delivery Infrastructure Gaps

Despite improvements, last-mile delivery challenges persist, particularly in rural and semi-urban areas. Non-standardized addressing systems, poor road conditions in certain regions, and limited cold chain infrastructure for perishable gifts create operational constraints for online gifting platforms serving diverse geographic markets.

Cultural Diversity and Regional Preferences

India's vast cultural diversity presents challenges in developing universally appealing product assortments and marketing strategies. Gift preferences vary significantly across regions, religions, and communities, requiring platforms to maintain extensive localized inventories. Understanding and catering to diverse cultural sensitivities adds complexity to product curation and customer service operations.

Intense Competition and Price Sensitivity

The online gifting market is characterized by intense competition from both organized e-commerce players and fragmented local retailers. Price-sensitive consumers frequently compare offerings across platforms, pressuring profit margins. The presence of unorganized sellers offering lower-priced alternatives creates challenges for established platforms seeking to maintain quality standards while remaining competitively priced.

Competitive Landscape:

The India online gifting market exhibits a moderately fragmented competitive structure, with major e-commerce platforms, specialized gifting companies, and regional players vying for market share. Large platforms leverage extensive product catalogs, established logistics networks, and brand recognition to capture mainstream consumers. Specialized gifting platforms differentiate through personalization capabilities, curated product selections, and occasion-specific marketing. Quick commerce integration is emerging as a competitive differentiator, with platforms competing on delivery speed and convenience. Investment in AI-driven recommendation systems, seamless payment integrations, and mobile-optimized user experiences represents key competitive priorities. Strategic partnerships with local artisans and premium brands enable platforms to offer exclusive products that enhance customer loyalty.

India Online Gifting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Non-Combo, Combo, Digital Gifts |

| Applications Covered | Residential/Personal, Corporate |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India online gifting market size was valued at USD 309.60 Million in 2025.

The India online gifting market is expected to grow at a compound annual growth rate of 3.07% from 2026-2034 to reach USD 406.51 Million by 2034.

The non-combo dominated the market with a 38% share in 2025, driven by consumer preference for individual gift items offering greater flexibility, personalization options, and targeted product selection capabilities.

Key factors driving the India online gifting market include rapid expansion of digital payment infrastructure led by UPI, increasing smartphone and internet penetration, strong cultural traditions of gift-giving, and growing demand for personalized and experience-based gifting solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)