India Online Retail Market Size, Share, Trends and Forecast by Product Category, Payment Method, Sales Channel, and Region, 2025-2033

India Online Retail Market Overview:

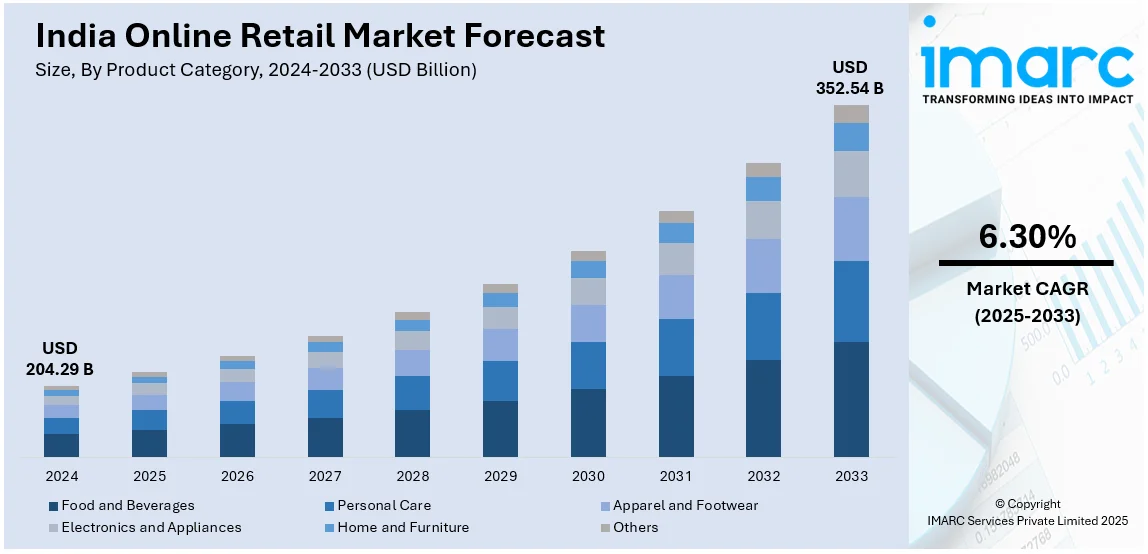

The India online retail market size reached USD 204.29 Billion in 2024. The market is projected to reach USD 352.54 Billion by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. Growth is driven by increasing internet penetration, technological advancements like augmented reality (AR) and artificial intelligence (AI), secure digital payments, and improved logistics.

Market Insights:

- The regional segmentation includes North India, South India, East India, and West India.

- The market is segmented by product category into food and beverages, personal care, apparel and footwear, electronics and appliances, home and furniture, and others.

- Based on payment method, the market includes cash on delivery (COD), digital payments, and EMI/BnPL.

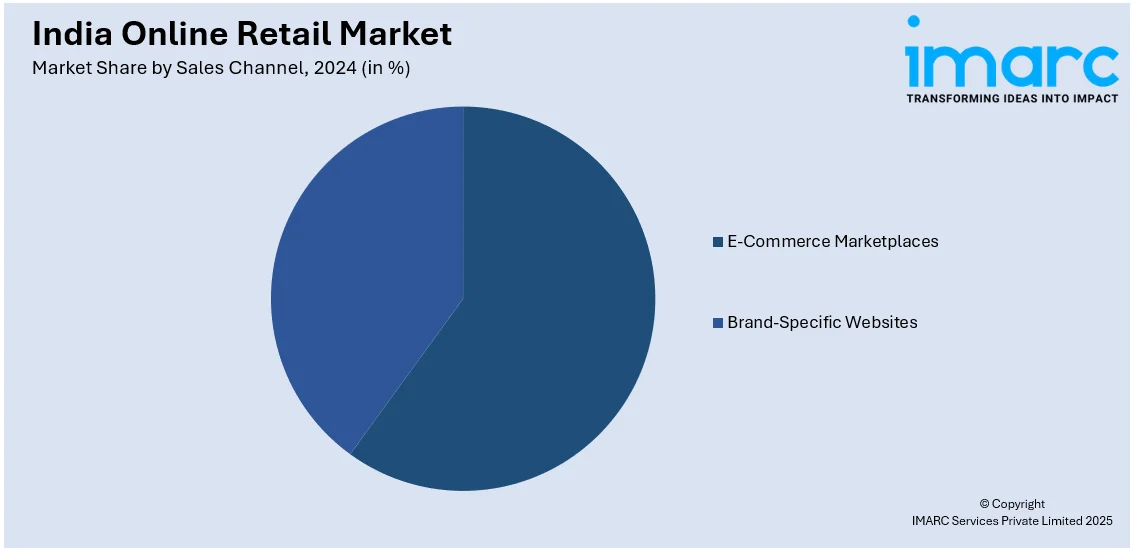

- The sales channel segmentation includes e-commerce marketplaces and brand-specific websites.

Market Size and Forecast:

- 2024 Market Size: USD 204.29 Billion

- 2033 Projected Market Size: USD 352.54 Billion

- CAGR (2025–2033): 6.30%

India Online Retail Market Trends:

Rising Internet Penetration

The growing internet penetration is significantly influencing the India online retail market outlook by expanding digital accessibility. Affordable smartphones and low-cost data plans are enabling millions of customers to explore e-commerce platforms. Increased connectivity is bridging the urban-rural divide, allowing retailers to reach previously untapped markets. Customers from tier-II and tier-III cities are rapidly adopting online shopping due to internet availability. According to a market report, India's internet user base is anticipated to exceed 900 million by 2025, fueled by the growing adoption of Indic languages in digital content. E-commerce platforms are leveraging this trend by localizing content and offering regional language support, as per the India online retail market research report. Improved internet speeds enhance browsing experiences, leading to higher engagement and seamless transactions on retail websites. The growing use of mobile applications simplifies product discovery, comparison, and secure digital payments. Social media platforms are also fostering online shopping through influencer-driven marketing and direct product promotions. Retailers are increasingly investing in digital advertising to target internet-savvy customers with personalized recommendations. Live-stream shopping and interactive experiences are gaining traction, catalyzing online retail sales, and in turn, also creating a positive impact on the online retail industry size in India.

To get more information on this market, Request Sample

Growing Technological Advancements

Technological enhancements are significantly driving the market share by enhancing customer experience and engagement. Artificial intelligence (AI) is enabling personalized recommendations, improving product discovery, and increasing customer satisfaction. For instance, in December 2024, Gurugram-based generative AI startup CurveAi launched DealSpy, India's first AI-powered shopping agent suite. DealSpy provides real-time assistance in discovering the best deals, prices, and offers across multiple online platforms through a WhatsApp bot, Chrome extension, and web store. Virtual reality (VR) and augmented reality (AR) are allowing shoppers to visualize products before making purchases. Chatbots and AI-driven assistants are providing instant support, resolving queries, and enhancing customer service efficiency. Machine learning (ML) algorithms are optimizing inventory management, reducing stockouts, and improving supply chain operations for retailers. Secure digital payment solutions including UPI and blockchain are ensuring safe, seamless, and faster transactions online. Automation in warehouses and logistics is streamlining order fulfillment, reducing delivery times, and enhancing operational efficiency. Voice search technology is simplifying shopping experiences, allowing users to browse and purchase products hands-free. Cloud computing is enabling e-commerce businesses to scale operations efficiently and manage high online traffic. Data analytics is helping retailers understand customer behavior, optimize pricing, and create targeted marketing campaigns. Live-stream shopping and interactive video content are increasing customer engagement, further bolstering the India online retail market growth.

Rapid Expansion of India’s Online Retail Market and Strong Future Outlook

According to the India online retail market forecast, the market is experiencing a rapid expansion, with a clear trajectory towards continued growth in the coming years. The market’s robust future outlook is bolstered by factors like the increasing shift of consumers to online shopping platforms, growing disposable incomes, and higher internet penetration in both urban and rural areas. The proliferation of mobile commerce is driving this trend further, as consumers now have convenient access to a wide range of products via smartphones. The growth of digital payments and Buy Now Pay Later (BNPL) services has significantly boosted consumer confidence in online transactions. The ongoing shift in consumer preferences, including the increasing demand for personalized products and hyper-local services, will continue to contribute to the expansion of the India online retail market. In addition, as e-commerce platforms increasingly adapt to local preferences and offer region-specific services, the online retail space is expected to see sustained double-digit growth in the coming decade.

Expansion in Tier-2/3 Cities and Changing Consumer Demographics

The influence of Gen Z, along with the rapid rise of hyper-value commerce, is reshaping the online retail industry in India, especially in Tier-2 and Tier-3 cities. The younger demographic is driving the demand for fast, affordable, and personalized online shopping experiences, while also demanding more sustainable and socially responsible brands. The expansion of e-commerce into these cities offers significant growth opportunities, as these regions have historically been underserved but are now embracing online retail due to improvements in internet connectivity and mobile accessibility. As these cities become increasingly connected, there is a rising demand for a variety of products, from fashion to electronics, and a greater need for efficient logistics to cater to this growing market. Retailers are increasingly focusing on creating localized offerings, promotional strategies, and optimized delivery systems to tap into this expanding consumer base.

India Online Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product category, payment method, and sales channel.

Product Category Insights:

- Food and Beverages

- Personal Care

- Apparel and Footwear

- Electronics and Appliances

- Home and Furniture

- Others

The report has provided a detailed breakup and analysis of the market based on the product category. This includes food and beverages, personal care, apparel and footwear, electronics and appliances, home and furniture, and others.

Payment Method Insights:

- Cash on Delivery (COD)

- Digital Payments

- EMI and Buy Now Pay Later (BNPL)

A detailed breakup and analysis of the market based on the payment method have also been provided in the report. This includes cash on delivery (COD), digital payments, and EMI and buy now pay later (BNPL).

Sales Channel Insights:

- E-Commerce Marketplaces

- Brand-Specific Websites

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes e-commerce marketplaces and brand-specific websites.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Online Retail Market News:

- In July 2025, Blinkit (now under Zomato) announced it would completely shift to an inventory-led model by September 1, 2025, mandating all marketplace sellers to convert or have their listings removed. The company’s operational revamp is in line with regulatory and FDI compliance. Earlier in 2025, Blinkit’s market share reached 40–46%, supported by over 1,000 “dark stores” and ambitions to double that figure by the end of the year.

- In April 2025, Flipkart's quick commerce business “Flipkart Minutes” announced plans to expand its dark store network from 300 to 800 mini-warehouses by the end of 2025, reflecting leadership intent to scale rapid delivery options across India.

- In February 2025, Shein returned to the Indian market through a strategic partnership with Reliance Retail, nearly five years after its 2020 ban. This collaboration led to the launch of the Shein India Fast Fashion app, available on Android and iOS, initially serving customers in New Delhi, Mumbai, and Bengaluru, with nationwide expansion plans.

- In February 2025, IKEA strengthened its presence in North India by introducing online delivery services across Delhi-NCR and nine other cities, providing access to its full range of over 7,000 products. This expansion precedes the launch of two major retail stores, one in Gurugram, Haryana, and another in Noida, Uttar Pradesh, both set to open by 2025.

- In January 2025, Swiggy announced that Instamart had expanded to 76 cities and would soon launch a standalone application for rapid grocery delivery. The company emphasized fast growth and signaled intentions for Instamart to surpass its core food delivery business in size, with positive reception driving category and geographic expansion.

- In September 2024, Amazon India announced the launch of three new Fulfillment Centers to boost its logistics network ahead of the festive season, supporting faster and more reliable deliveries nationwide. The company also created over 110,000 seasonal jobs and further reduced selling fees to benefit sellers during its flagship sales events.

India Online Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Categories Covered | Food and Beverages, Personal Care, Apparel and Footwear, Electronics and Appliances, Home and Furniture, Others |

| Payment Methods Covered | Cash on Delivery (COD), Digital Payments, EMI and Buy Now Pay Later (BNPL) |

| Sales Channels Covered | E-Commerce Marketplaces, Brand-Specific Websites |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India online retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India online retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India online retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India online retail market was valued at USD 204.29 Billion in 2024.

The India online retail market is projected to exhibit a CAGR of 6.30% during 2025-2033, reaching a value of USD 352.54 Billion by 2033.

The growing e-commerce infrastructure, growing smartphone usage, and rising internet penetration are driving the online retail business in India. Consumers value convenience, variety, and quick delivery. Digital payment adoption and targeted marketing enhance customer experience. Additionally, rural outreach, improved logistics, and seasonal sales events fuel rapid market growth nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)