India Oral Care Market Size, Share, Trends and Forecast by on Product Type, Application, Distribution Channel, and Region, 2026-2034

India Oral Care Market Overview:

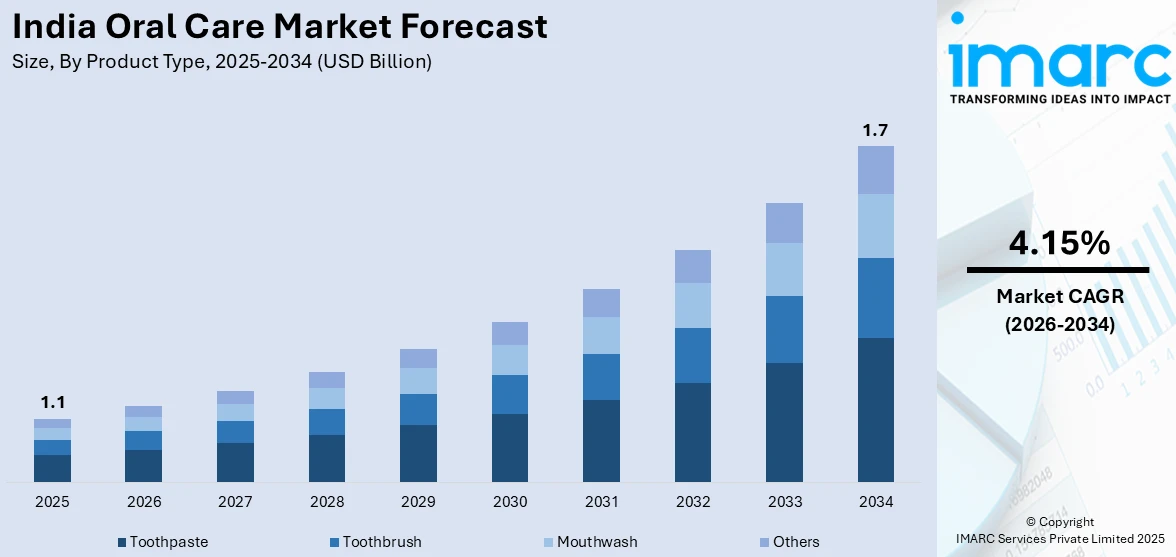

The India oral care market size reached USD 1.1 Billion in 2025. The market is expected to reach USD 1.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.15% during 2026-2034. The market growth is attributed to rising awareness about oral hygiene, growing demand for herbal and natural products, increasing adoption of premium and electric toothbrushes, innovations in product formulations and branding strategies.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of product type, the market has been divided into toothpaste, toothbrush, mouthwash, and others.

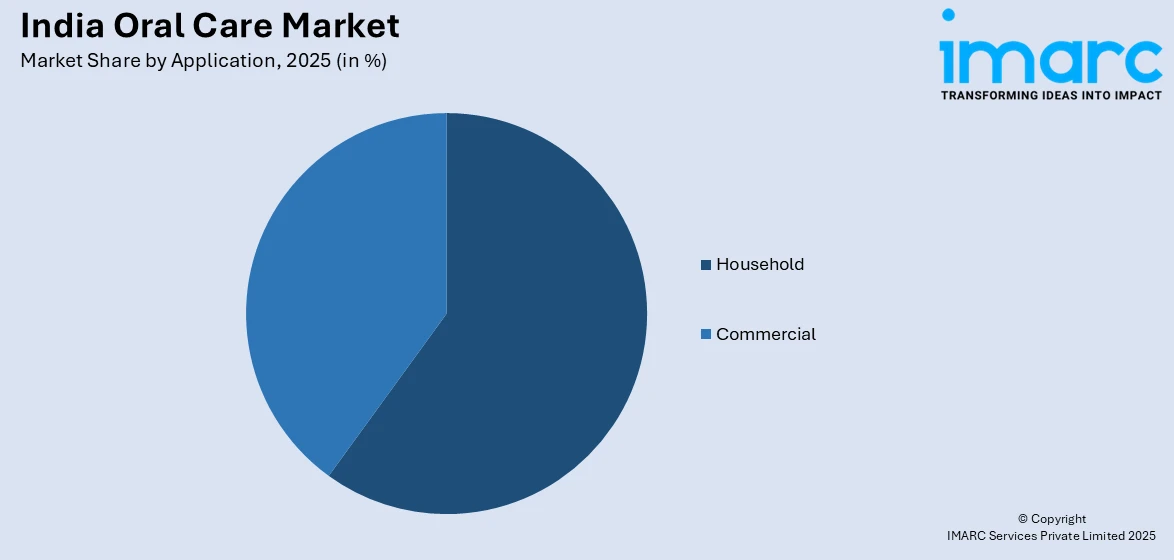

- On the basis of application, the market has been divided into household and commercial.

- On the basis of distribution channel, the market has been divided into hypermarkets and supermarkets, convenience stores, online sales channel, and others.

Market Size and Forecast:

- 2025 Market Size: USD 1.1 Billion

- 2034 Projected Market Size: USD 1.7 Billion

- CAGR (2026-2034): 4.15%

India Oral Care Market Trends:

Growing Demand for Herbal and Natural Products

The growing demand for herbal and natural products is shaping the India oral care market share as consumers increasingly prefer ayurvedic and chemical-free formulations. Traditional ingredients like neem, clove, charcoal and tulsi are gaining popularity due to their antibacterial, anti-inflammatory and whitening properties. Rising health awareness coupled with concerns over synthetic chemicals in oral care products is driving the shift toward herbal toothpaste, mouthwashes and tooth powders. Brands are expanding their portfolios with fluoride-free, SLS-free and preservative-free options to cater to this demand. For instance, in December 2024, Dabur India announced the launch of Dabur Herb'l Kids Toothpaste, designed free from harmful chemicals for children over 3 years of age. Available in strawberry flavor it features Iron Man and Elsa from Frozen promoting fun during brushing. This innovative product aims to protect enamel and encourage healthy oral care habits among kids.Government initiatives promoting ayurveda and natural wellness further boost India oral care market growth. The growing middle-class population and increasing disposable income also contribute to higher spending on premium herbal oral care products. With sustainability and clean-label trends gaining traction herbal oral care continues to strengthen its position across the country.

To get more information on this market Request Sample

Increasing Adoption of Electric and Smart Toothbrushes

The increasing adoption of electric and smart toothbrushes is transforming oral care habits as consumers seek advanced solutions for better dental hygiene. For instance, in July 2023, Perfora launched India’s first aluminium handle electric toothbrush promoting sustainability in oral care. The lightweight durable brush uses 70% less plastic and is fully recyclable. Featuring a 2-minute timer and interchangeable brush heads it aims to enhance oral hygiene while reducing environmental impact marking a significant advancement for the brand.These devices offer superior plaque removal, gum protection, and customizable brushing modes compared to manual toothbrushes. Smart toothbrushes with Bluetooth connectivity, AI-driven tracking, and pressure sensors provide real-time feedback, enhancing oral care routines. Growing awareness about oral health, rising disposable income, and the influence of digitalization are driving demand for these innovative products. Urban consumers, particularly millennials and professionals, are adopting electric toothbrushes for convenience and efficiency. Dental professionals also recommend them for improved oral hygiene, boosting market penetration. The expansion of e-commerce and increasing availability of global brands in India make these products more accessible. As technology integration in personal care continues to rise, the demand for electric and smart toothbrushes is expected to grow steadily. These factors are strengthening market expansion and consumer adoption, creating a positive India oral care market outlook.

Premium Product Portfolio Expansion and Brand Innovation

The market is experiencing a strong movement towards premium product categories as companies invest in creating high-end formulations and new packaging concepts. This, in turn, is providing a boost to the expansion of oral care industry size in India. Top brands are aggressively investing in research and development to develop differentiated products that meet niche consumer requirements, such as sensitivity relief, enamel protection, and high-tech whitening solutions. This trend is quite prominent in the urban markets where consumers are ready to pay premium prices for products that provide additional benefits and a superior user experience. The size of the oral care industry in India keeps growing as companies launch specialized products for various age groups, from children's formulations to senior-specific oral care products. Brand differentiation through positioning, celebrity, and focused marketing campaigns has become a key to market penetration and building consumer loyalty across various demographic groups.

Rural Market Penetration and Accessibility Enhancement

As per the India oral care market forecast, the rural market expansion is a major growth prospect for the oral care market, with businesses creating affordable product variants and creative distribution channels to serve underserved communities. The market analysis indicates that rural consumers are increasingly using contemporary oral care habits, shifting from conventional means to commercially produced products. Manufacturers are developing value-driven product lines with reduced packaging sizes and aggressive pricing to penetrate the oral care market for price-conscious rural consumers. The size of the oral care industry in India is being significantly fueled by government-driven oral health awareness in rural regions by way of healthcare initiatives and educational campaigns. Local language packaging, culturally acceptable messages, and tie-ups with rural healthcare providers are major strategies being adopted to gain confidence and stimulate uptake in these emerging regions.

Some of the other trends in the market include,

- Sustainable Packaging and Refillable Eco-Innovations: The market is seeing a transition towards environmentally friendly packaging, where companies are launching refillable toothpaste tubes and biodegradable toothbrushes. Consumers in urban areas are placing greater emphasis on sustainability, in addition to product performance. These innovations not only minimize plastic usage but also positively impact brand perception among India's environmentally conscious consumers.

- AI-Powered Personalization and AR Try-Ons: Artificial intelligence is making it possible to have customized oral care products in India, ranging from toothpaste formulas that are personalized to brushing routines suggested by AI. This is expanding the oral care market size in India. Augmented reality (AR) try-ons enable customers to see the teeth whitening effects or choose products for their smile virtually. The tech-embedded process is increasing consumer interaction and pushing premium oral care product adoption.

- Cultural and Local Flavor Integrations with Hypoallergenic Options: Indian consumers are increasingly interested in oral care products that incorporate local flavors such as clove, neem, and tulsi without being harsh on sensitive teeth. Brands are increasingly launching hypoallergenic versions to appeal to people with allergies or sensitive gums. This integration of cultural significance and safety enhances trust and product attractiveness in the diverse Indian market.

- Eco-Packaging, Digital Personalization, and Inclusivity: Indian leading oral care companies are addressing sustainability, digital connectivity, and universal product design inclusiveness at the same time. Environmentally friendly packaging, AI-driven personalization, and products for use across all age groups and sensitivities are being introduced. This integrated strategy mirrors the changing needs of Indian consumers who are now looking for efficacy, safety, and sustainability.

Growth Drivers of the India Oral Care Market:

The oral care industry growth in India is spurred by growing health awareness and improved disposable incomes of semi-urban and urban populations. The government efforts towards raising awareness levels of oral health by conducting public health campaigns and education programs are playing a key role in driving the market growth. The expanding middle-class consumer base with enhanced buying power is increasingly spending on high-end oral care products and innovative dental care solutions. Increased digital penetration and e-commerce have enhanced oral care products to consumers based in various geographic locations, ensuring market access and consumer convenience. Increased incidence of dental issues caused by lifestyle and dietary factors is translating into increased demand for expert oral care products and preventive measures. Advancements in product formulation, pack sizes, and brand strategies continue to bring in new consumer bases and propel category growth.

Opportunities in the India Oral Care Market:

The countryside market offers significant untapped potential for oral care businesses willing to create low-cost product lines and new distribution strategies aimed at price-conscious consumers. The increasing trend toward natural and herbal products offers significant potential for businesses to create ayurvedic and organic oral care solutions compatible with customary preferences, which is supporting the oral care industry in India. Combining digital health technologies and intelligent oral care products is a high-value opportunity to target tech-savvy urban consumers in pursuit of customized dental care solutions. Export markets are also opening up as Indian players create affordable products to compete on the global stage, with major growth opportunities in neighboring South Asian nations. Collaboration with dental specialists and hospitals presents possibilities for product endorsement and specialist endorsements that can move consumers towards trust and buying.

Challenges in the India Oral Care Market:

According to the India oral care market analysis, severe local and global brand competition causes price pressures and demands huge investments in marketing and brand differentiation strategies. Price sensitivity on the part of the consumer, especially in rural and semi-urban areas, restricts the acceptance of premium products and holds profit margins of manufacturers in check. Regulatory standards and quality require ongoing investment in manufacturing and certification, which drives operational costs up for market players. Distribution difficulties in accessing far-flung rural regions because of poor infrastructure and logistics networks constrain market penetration possibilities. Consumer education is still a major challenge since conventional oral hygiene habits and myths about contemporary products must be overcome by continuous awareness initiatives.

India Oral Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Toothpaste

- Toothbrush

- Mouthwash

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes toothpaste, toothbrush, mouthwash and others.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes household and commercial.

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Sales Channel

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience stores, online sales channel and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Oral Care Market News:

- In September 2025, Clove Oral Care introduced a new line of dentist-developed oral hygiene products, including toothpaste and toothbrushes, aimed at addressing common dental concerns such as sensitivity, enamel erosion, dry mouth, and pediatric oral health. The toothpaste variants are formulated with clean ingredients and are free from parabens, peroxide, and triclosan. Complementing these, the toothbrushes feature ultra-soft DuPont Tynex bristles and ergonomic designs to promote effective brushing techniques.

- In July 2025, Oracura, a Navi Mumbai-based oral care innovator, unveiled a smart toothbrush featuring seamless app integration, transforming daily brushing into a personalized, data-driven wellness experience. This device provides real-time insights into brushing habits, helping users optimize their technique and prevent issues like plaque buildup or gum disease. With a strong presence on e-commerce platforms, Oracura aims to redefine dental hygiene in India, aligning with the nation's growing demand for health-focused technology.

- In November 2024, Colgate-Palmolive (India) Limited launched the "Oral Health Movement," an AI-driven initiative aimed at enhancing oral health awareness and accessibility across India. The core of this movement is an AI-powered dental screening tool developed in collaboration with Logy.AI, enabling users to obtain a personalized dental report by scanning a QR code on Colgate products or dialing a dedicated helpline, followed by uploading images of their mouth via WhatsApp.

- In December 2024, Colgate-Palmolive India launched a new MaxFresh range, featuring heart-shaped cooling crystals and vibrant flavors like Watermelon Blast and Rainbow Fresh. Utilizing Ultrafreeze Technology for extended freshness, the range aims to enhance the oral care experience for millennials and Gen Z.

- In January 2024, Dr. Dento launched a new range of natural oral care products just in time for the festive season. Combining cutting-edge technology with ingredients like NHap and Aloe Vera, the collection includes electric toothbrushes, toothpaste, and mouthwash. The brand aims to enhance oral health while ensuring enjoyable experiences for users.

India Oral Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Toothpaste, Toothbrush, Mouthwash, Others |

| Applications Covered | Household, Commercial |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Online Sales Channel, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India oral care market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India oral care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India oral care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oral care market in India was valued at USD 1.1 Billion in 2025.

The India oral care market is projected to exhibit a CAGR of 4.15% during 2026-2034, reaching a value of USD 1.7 Billion by 2034.

The key factors driving India’s oral care market include rising awareness about dental hygiene and preventive care, growing demand for herbal/Ayurvedic products, expanding modern retail and e-commerce channels, urbanization with rising disposable incomes, and increased rural market outreach via government programs and clinics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)