India Organic Farming Market Size, Share, Trends and Forecast by Crop Type, Method and Region, 2025-2033

India Organic Farming Market Overview:

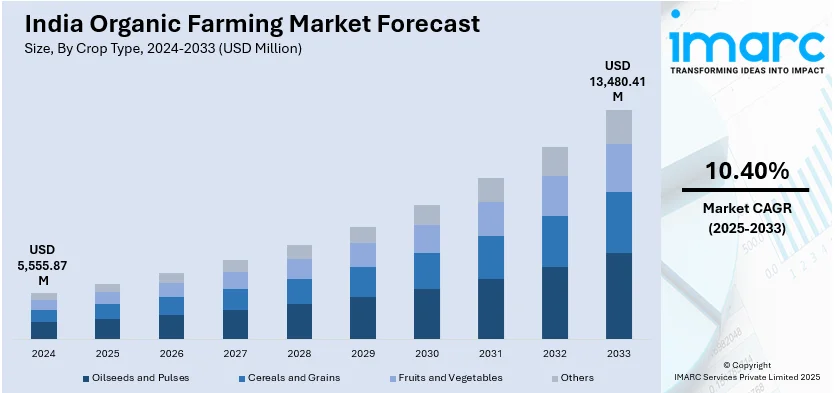

The India organic farming market size reached USD 5,555.87 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 13,480.41 Million by 2033, exhibiting a growth rate (CAGR) of 10.40% during 2025-2033. The market is moving with amplified demand from consumers for chemical-free vegetables, government actions, and foreign markets, driven by greater certification, policy action, and environmentally friendly agriculture, but being limited by excessive costs of production, inefficiency in supply chains, and inadequate awareness among farmers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,555.87 Million |

| Market Forecast in 2033 | USD 13,480.41 Million |

| Market Growth Rate 2025-2033 | 10.40% |

India Organic Farming Market Trends:

Rising Adoption of Bio-Fertilizers and Bio-Pesticides

India organic farming market is increasingly adopting bio-fertilizers and bio-pesticides to enhance soil health and minimize chemical residues in food. Farmers are applying microbial-based fertilizers, compost, and vermicompost to boost soil fertility while substituting synthetic chemicals. Government policies, such as subsidies on bio-inputs and specialized training programs, are driving this transition. For instance, in March 2024, The Indian government initiated National Mission on Natural Farming (NMNF) with the objective to improve soil quality and water holding capacity. This mission aims to promote natural farming practices, minimize the use of chemical fertilizers, and ensure sustainable agriculture practices. Moreover, bio-pesticides from neem, Bacillus thuringiensis, and pheromone traps are becoming popular as effective, environmentally friendly pest control measures. Increasing consumer interest in chemical-free foods is yet further motivating producers to use such inputs. Switching to bio-solutions is also promoting sustainable development goals through the enhancement of soil biodiversity, lowered water pollution, and preserved agricultural productivity levels for the longer term. Enhancements in the schemes of organic certifications and effectiveness tests on bios is reinforcing the business. With growing awareness and policy backing, bio-fertilizers and bio-pesticides are becoming an integral part of India's organic farming culture, promoting healthier crops and eco-friendly farming practices.

To get more information on this market, Request Sample

Expansion of Organic Farming Clusters

Organic clusters of farming are being encouraged by the Indian government and state agriculture departments to amplify production and provide a regular supply of organic produce. Financial assistance, training, and certification help are being given to clusters of farmers under different schemes. The clusters help small and marginal farmers to join, share facilities, and market their produce together. Organic clusters in states like Sikkim, Uttarakhand, and Madhya Pradesh are gaining advantage through this model, providing improved market linkages and price realization. Farmer Producer Organizations (FPOs) are instrumental in these clusters, simplifying the supply chain, minimizing input expenses, and assisting in certification compliance. The cluster model also improves traceability, an essential consideration for exports and domestic organic certification. Though this model promotes organic production, the limitations are poor infrastructure and market reach. Filling these gaps through digital platforms and policy interventions can make organic clusters more effective.

Growing Demand for Organic Dairy and Livestock Farming

Organic livestock and dairy farming in India are picking up steam with accelerating demand for chemical-free milk, eggs, and meat from consumers. This is fueled by fear of antibiotic residues and artificial growth promoters employed in traditional livestock farming. Organic dairy farming focuses on natural feed, chemical-free diet, and environmentally friendly animal husbandry. Increased availability of organic-certified feed for livestock and pasture management practices helps this industry boost its growth. Organic poultry rearing is also on the rise, with producers using free-range and antibiotic-free rearing techniques. Demand for organic animal produce is strongest in urban areas, where health-focused consumers seek out hormone-free and ethically sourced products. Despite this, higher organic feed and certification costs remain a hurdle for large-scale use. Strengthening value chains, enhancing certification systems, and raising consumer awareness will be central to large-scale organic dairy and livestock farming in India.

India Organic Farming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on crop type and method.

Crop Type Insights:

- Oilseeds and Pulses

- Cereals and Grains

- Fruits and Vegetables

- Others

The report has provided a detailed breakup and analysis of the market based on the crop type. This includes oilseeds and pulses, cereals and grains, fruits and vegetables, and others.

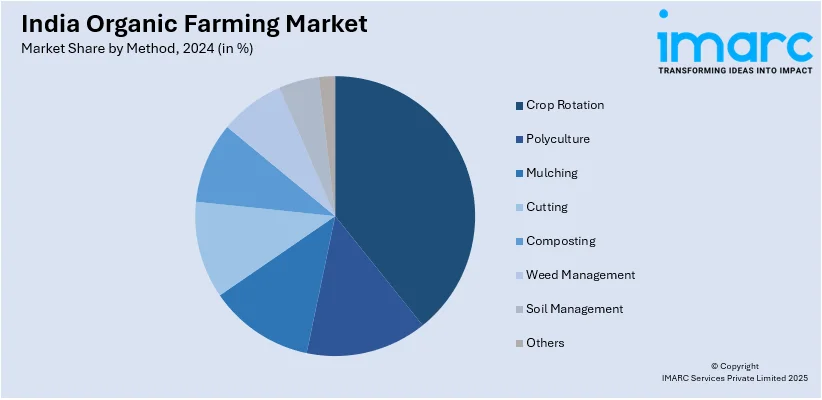

Method Insights:

- Crop Rotation

- Polyculture

- Mulching

- Cutting

- Composting

- Weed Management

- Soil Management

- Others

A detailed breakup and analysis of the market based on the method have also been provided in the report. This includes crop rotation, polyculture, mulching, cutting, composting, weed management, soil management, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Organic Farming Market News:

- In September 2024, Krishak Bharati Cooperative Limited (KRIBHCO) launched KRIBHCO Rhizosuper, a Novonesis technology-driven mycorrhizal biofertilizer to enrich soil fertility and nutrient absorption. It is made for small farmers to enhance microbial activity, plant growth, and phosphatic fertilizer efficiency, aligning with KRIBHCO's vision of sustainable agriculture.

- In May 2024, BioPrime AgriSolutions collaborated with Yara India to introduce Chiron, a SNIPR-based yield-enhancing biostimulant. Through this collaboration, crop resilience increases, flower-to-fruit conversion is enhanced, and farmers that experience climate unpredictability are helped.

India Organic Farming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Crop Types Covered | Oilseeds and Pulses, Cereals and Grains, Fruits and Vegetables, Others |

| Method Covered | Crop Rotation, Polyculture, Mulching, Cutting, Composting, Weed Management, Soil Management, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India organic farming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India organic farming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India organic farming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic farming market in India was valued at USD 5,555.87 Million in 2024.

The India organic farming market is projected to exhibit a (CAGR) of 10.40% during 2025-2033, reaching a value of USD 13,480.41 Million by 2033.

Demand for chemical-free fruits and vegetables and health and environmental awareness are driving growth in organic farming. Support from government programs, such as Paramparagat Krishi Vikas Yojana (PKVY) and growth in international demand for Indian organic exports complement market growth. Increased urban health awareness, availability of certification, and green farming practices induce farmers towards environmentally friendly cultivation practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)