India Organic Packaged Foods Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

India Organic Packaged Foods Market Overview:

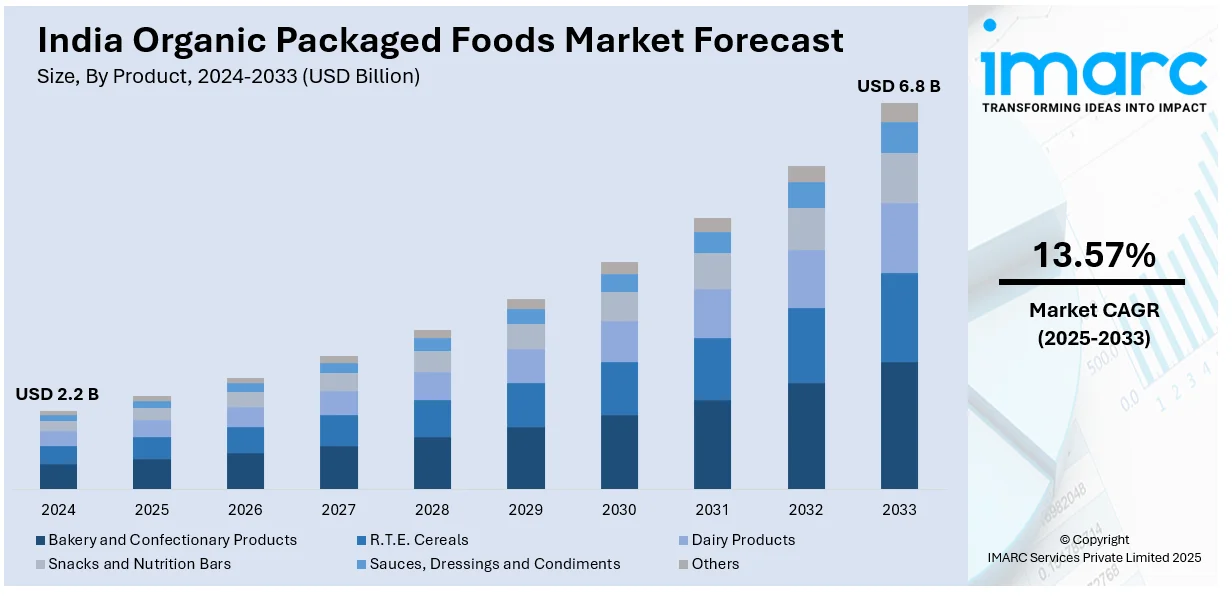

The India organic packaged foods market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.8 Billion by 2033, exhibiting a growth rate (CAGR) of 13.57% during 2025-2033. The market is growing strongly, spurred by accelerating demand from consumers for healthier and chemical-free foods. Increasing product variety, health awareness, and enhanced distribution channels fuel the market's strong performance and growth prospects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Market Growth Rate 2025-2033 | 13.57% |

India Organic Packaged Foods Market Trends:

Rising Health Consciousness and Clean Label Demand

India's organic packaged food market is observing strong growth as consumers increasingly become health conscious. The move towards healthier living is fueling demand for organic food that is free of synthetic chemicals, pesticides, and artificial additives. Clean labels emphasizing natural, non-GMO, and organic content are becoming an important purchase driver. Consumers are more aware about reading ingredient labels and recognizing the health benefits of what they eat. The trend is strong among urban millennials and young families who are putting nutrition and wellness first. The accelerating demand for organic snacks, cereals, ready-to-eat (RTE) meals, and baby food is a case in point. Social media, influencers, and nutritionists are also raising awareness and educating consumers on the positives of organic food. Consequently, the organic packaged food market will continue to grow and expand, diversifying to include more products in the coming years. For instance, in November 2023, NCOL's 'Bharat Organics' broadened its range to 20 organic items such as pulses, rice, and sugar. The project was set to increase organic farming and empower farmers through sharing profits.

To get more information on this market, Request Sample

Growth of E-commerce and Omnichannel Retailing

Omnichannel retailing and e-commerce are contributing a revolutionary impetus to India's organic packaged foods sector. With the convenience of online purchases combined with access to varied organic offerings, it is becoming more convenient for customers to have access to organic foods sitting in their living rooms. Most brands are not just using digital channels to drive sales but are also communicating with customers through meaningful content, recipes, and tips on healthy eating. Increased adoption of direct-to-consumer (DTC) models and subscription services provides consumers with ease of accessing fresh organic products. Omnichannel approaches, where online presence is fused with brick-and-mortar stores, are also on the rise. Such approaches increase product exposure and provide a hassle-free shopping experience. Digital marketing campaigns, influencer collaborations, and targeted promotions are also enhancing the reach of organic brands. As consumers and technology become more advanced, e-commerce should continue to be a major organic packaged food growth driver.

Innovation in Organic Food Products and Packaging

Product development and packaging innovation are a leading trend in India's organic packaged food industry. Brands are venturing into various organic product categories, ranging from superfood snacks and fortified cereals to ready-to-cook meal kits that respond to changing consumer tastes. There is an increasing emphasis on providing distinctive flavors and blending traditional Indian ingredients with international tastes. Besides product innovation, packaging is increasingly a value proposition element. Environmentally friendly packaging solutions, including biodegradable, recyclable, and minimalist packaging, are attracting environmentally aware consumers. Innovative packaging also involves elements that promote convenience, including resealable packaging and single-serve packages. Such innovation ensures product freshness and minimizes waste. As health and sustainability increasingly influence buying behavior, firms that focus on innovation in their products and packaging are likely to be at the forefront of the expanding organic market. For example, in January 2025, MorningWale expanded its organic food portfolio with the Flavours of Kashmir range, featuring premium organic products like saffron, Kashmiri garlic, walnuts, almonds, and Kahwa tea, emphasizing natural ingredients and sustainable sourcing.

India Organic Packaged Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Bakery and Confectionary Products

- R.T.E. Cereals

- Dairy Products

- Snacks and Nutrition Bars

- Sauces, Dressings and Condiments

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bakery and confectionary products, RTE cereals, dairy products, snacks and nutrition bars, sauces, dressings and condiments, and others.

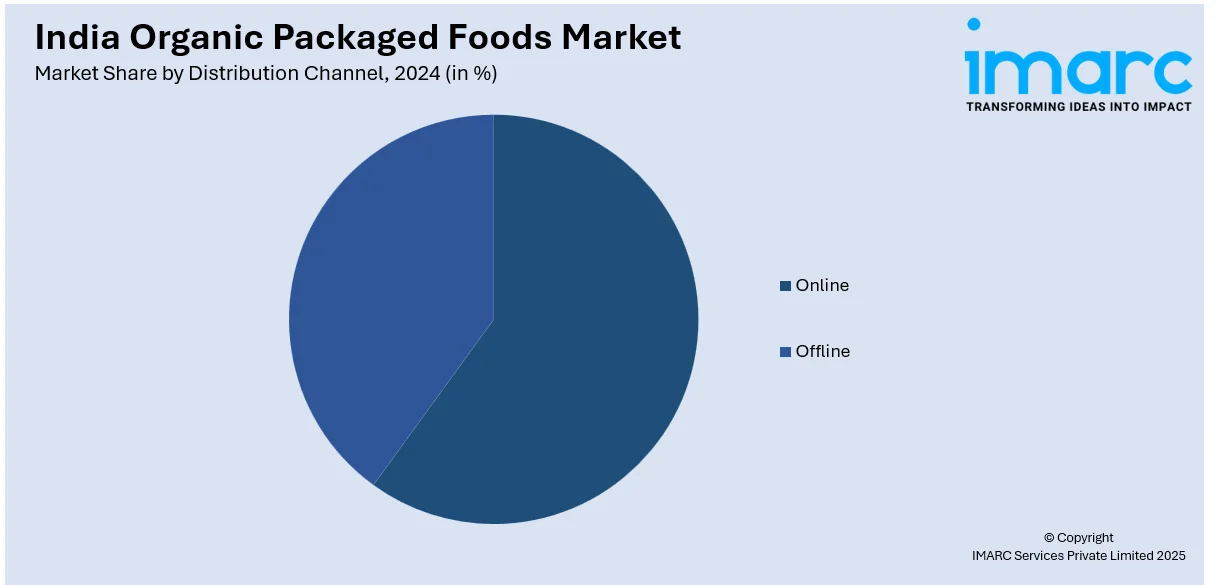

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Organic Packaged Foods Market News:

- In August 2024, Organic India introduced Organic Fiber and Ashwagandha Organic Gummies, its inaugural product launch into the gummy supplement category. The low-sugar, certified organic gummies provide prebiotic fiber and KSM-66® Ashwagandha extract.

- In April 2024, Organic India introduced two caffeine-free herbal latte blends—Spiced Turmeric Latte and Chocolate Moringa Latte—through its store shelves. These high-quality, certified organic, and Non-GMO Project Verified powders are easy to mix and fulfill the demand for healthy, delicious beverage solutions.

India Organic Packaged Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bakery and Confectionary Products, R.T.E. Cereals, Dairy Products, Snacks and Nutrition Bars, Sauces, Dressings and Condiments, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India organic packaged foods market performed so far and how will it perform in the coming years?

- What is the breakup of the India organic packaged foods market on the basis of product?

- What is the breakup of the India organic packaged foods market on the basis of distribution channel?

- What is the breakup of the India organic packaged foods market on the basis of region?

- What are the various stages in the value chain of the India organic packaged foods market?

- What are the key driving factors and challenges in the India organic packaged foods?

- What is the structure of the India organic packaged foods market and who are the key players?

- What is the degree of competition in the India organic packaged foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India organic packaged foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India organic packaged foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India organic packaged foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)