India Organic Snack Foods Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Flavors, and Region, 2025-2033

India Organic Snack Foods Market Overview:

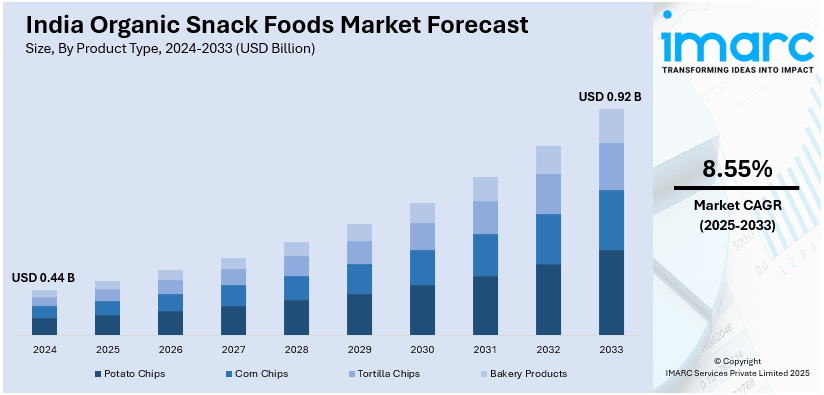

The India organic snack foods market size reached USD 0.44 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.92 Billion by 2033, exhibiting a growth rate (CAGR) of 8.55% during 2025-2033. The market is expanding due to rising health awareness, clean-label demand, and increasing disposable incomes. Key trends include plant-based, gluten-free, and minimally processed snacks. E-commerce and specialty stores drive sales, with major players focusing on innovative flavors and sustainable packaging.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.44 Billion |

| Market Forecast in 2033 | USD 0.92 Billion |

| Market Growth Rate 2025-2033 | 8.55% |

India Organic Snack Foods Market Trends:

Rising Consumer Preference for Clean-Label and Nutrient-Dense Snacks

The India organic snack foods market is witnessing a shift towards clean-label products as consumers increasingly seek transparency in ingredient sourcing and nutritional value. For instance, as per industry reports, India has emerged as one of the dominant nations in clean-label product manufacturing. During 2023, the country introduced around 5000 clean label products, accounting 13% of the global releases. Growing health consciousness, particularly among urban populations, is driving demand for snacks free from synthetic additives, artificial preservatives, and genetically modified ingredients. Manufacturers are responding by incorporating organic grains, seeds, nuts, and plant-based protein sources into snack formulations to cater to evolving dietary preferences. Additionally, the expansion of dietary trends such as veganism, gluten-free diets, and protein-rich snacking is influencing product innovation. For instance, as per industry reports, around 90% of customers consider climate impact when choosing food, with 64% willing to pay more. Besides, over 48% prefer foods influenced by concerns about animal cruelty during 2024. Brands are emphasizing functional benefits, including gut health support and immunity enhancement, through organic ingredients such as probiotics, turmeric, and superfoods. Regulatory support for organic certification and consumer awareness campaigns further contribute to market growth. The increasing availability of organic snack options across e-commerce platforms and premium retail channels is expected to accelerate market penetration in the coming years.

To get more information on this market, Request Sample

Expansion of E-Commerce and Direct-to-Consumer (DTC) Distribution Models

The digital transformation of India’s retail sector is significantly impacting the organic snack foods market, with e-commerce and direct-to-consumer (DTC) channels gaining prominence. For instance, as per IMARC Group, online grocery market across India is anticipated to growth to USD 96.3 Billion by the year 2033, with a 25.38% of the growth rate. The ease of online shopping, combined with escalating smartphone ownership as well as internet penetration, is facilitating customers to avail a wider range of organic snack products. Leading organic snack brands are leveraging online marketplaces such as Amazon, Flipkart, and specialty health food platforms to expand their reach beyond metropolitan areas. Additionally, DTC strategies are becoming crucial for organic food startups aiming to establish direct engagement with consumers and build brand loyalty. Subscription-based models, personalized product recommendations, and social media marketing are further strengthening consumer-brand interactions. The growing demand for premium organic snacks is also driving investment in cold chain logistics and eco-friendly packaging solutions to enhance product shelf life. This shift towards digital retail is expected to drive sustained market expansion, particularly among health-conscious millennial and Gen Z consumers.

India Organic Snack Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and flavors.

Product Type Insights:

- Potato Chips

- Corn Chips

- Tortilla Chips

- Bakery Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes potato chips, corn chips, tortilla chips, and bakery products.

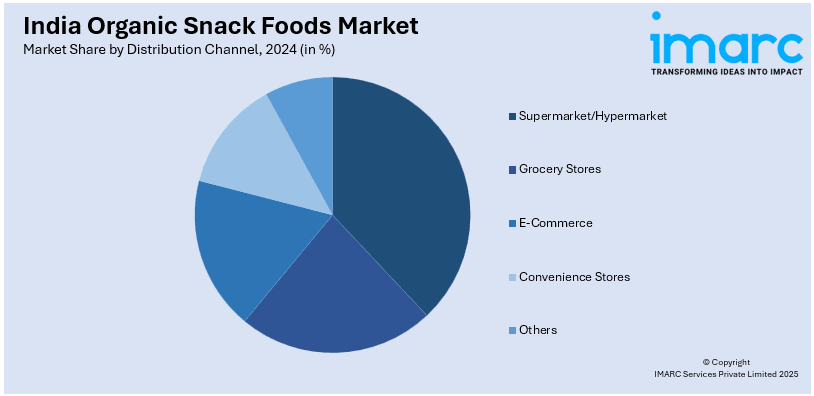

Distribution Channel Insights:

- Supermarket/Hypermarket

- Grocery Stores

- E-Commerce

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarket/hypermarket, grocery stores, e-commerce, convenience stores, and others.

Flavors Insights:

- Chocolate

- Vanilla

- Strawberry

- Others

A detailed breakup and analysis of the market based on the flavors have also been provided in the report. This includes chocolate, vanilla, strawberry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Organic Snack Foods Market News:

- In April 2024, Organic India announced to introduce two new varieties for its herbal latte line, encompassing Chocolate Moringa Latte superfood mix and Spiced Turmeric Latte golden milk mix. These latte powders are ready-to-mix with USDA organic certification and verified for non-GMO.

India Organic Snack Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Potato Chips, Corn Chips, Tortilla Chips, Bakery Products |

| Distribution Channels Covered | Supermarket/Hypermarket, Grocery Stores, E-Commerce, Convenience Stores, Others |

| Flavors Covered | Chocolate, Vanilla, Strawberry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India organic snack foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India organic snack foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India organic snack foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic snack foods market in India was valued at USD 0.44 Billion in 2024.

The India organic snack foods market is projected to exhibit a CAGR of 8.55% during 2025-2033, reaching a value of USD 0.92 Billion by 2033.

India’s organic snack foods market is driven by rising health awareness and preference for natural, chemical-free products. Increasing focus on sustainable farming and clean-label options attracts conscious consumers. Expanding online and retail availability improves access, while innovative flavors and formats cater to the growing demand for healthier yet convenient snacking alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)