India Packaged Beverages Market Size, Share, Trends and Forecast by Type, Packaging Type, Distribution Channel and Region, 2025-2033

India Packaged Beverages Market Overview:

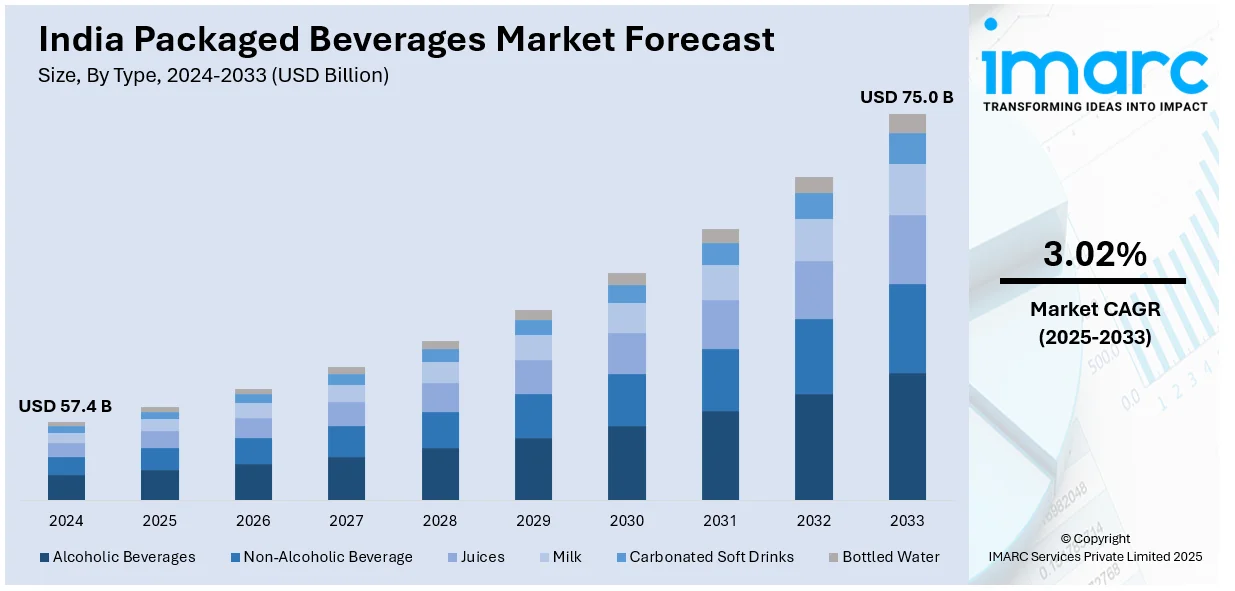

The India packaged beverages market size reached USD 57.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 75.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.02% during 2025-2033. The market is driven by rising urbanization, increasing disposable income, and shifting consumer preferences toward convenient, ready-to-drink options. Expanding retail networks, aggressive marketing strategies, and growing health-consciousness fuel demand for functional and natural beverages. Innovations in flavors, packaging, and sustainable practices further accelerate market growth across diverse demographics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 57.4 Billion |

| Market Forecast in 2033 | USD 75.0 Billion |

| Market Growth Rate 2025-2033 | 3.02% |

India Packaged Beverages Market Trends:

Shift Towards Health and Wellness Beverages

Indian consumers are increasingly looking towards health and wellness, pushing demand for functional drinks like fortified juices, probiotic beverages, and herbal infusions. Brands are introducing products with lower sugar content, natural ingredients, and fortified nutrients in response to increasing awareness of lifestyle disorders. Growth in Ayurveda-based beverages, plant-based beverages, and immunity-enhancing formulations is following the trend. Beverage companies are also utilizing clean-label branding, highlighting organic, non-GMO, and preservative-free products to gain the attention of health-conscious consumers. Furthermore, increasing fitness lifestyles and dietary needs are driving protein-based beverage demand and detox beverages. This movement is also underpinned by government campaigns pushing for healthier consumption habits, stimulating manufacturers to re-formulate with improved nutritional contents without compromising on affordability and flavor appeal.

To get more information on this market, Request Sample

Growth of Premium and Niche Beverages

The Indian packaged drinks market is seeing growing demand for premium and niche offerings as consumers look for distinctive flavors, exotic ingredients, and premium experiences. Growing disposable income and access to international trends through digital media have driven demand for gourmet teas, specialty coffee, cold-pressed juices, and artisanal drinks. Imported and organic drinks are also picking up, especially among urban consumers who are willing to pay a premium for quality and exclusivity. Further, the trend towards sparkling water, kombucha, and health specialty drinks indicates a greater move towards indulgence without sacrificing health. Industry players are differentiating products with innovative packaging, limited-series offerings, and customized experiences to appeal to changing tastes and amplify brand loyalty in a crowded market.

Expansion of Ready-to-Drink (RTD) Segment

Convenience-driven lifestyles and India's fast-paced urban environment are driving the surge in ready-to-drink (RTD) beverages. Consumers increasingly opt for on-the-go hydration, fueling demand for bottled iced teas, flavored milk, energy drinks, and cold brews. The RTD segment, covering soft drinks, energy drinks, and soda/mixers, saw a 42% year-on-year growth, while juices rose by 54%. Notably, iced tea, cold coffee, and water categories expanded by 74%, reflecting evolving preferences. The growing café culture and global beverage trends have boosted RTD popularity, especially among younger consumers. Brands are innovating with low-calorie and functional beverages to meet health-conscious demands. The rise of modern retail and e-commerce has enhanced accessibility, reinforcing the segment’s expansion. With a focus on convenience, portability, and extended shelf life, RTD beverages are reshaping India’s packaged beverage industry.

India Packaged Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, packaging type and distribution channel.

Type Insights:

- Alcoholic Beverages

- Non-Alcoholic Beverage

- Juices

- Milk

- Carbonated Soft Drinks

- Bottled Water

The report has provided a detailed breakup and analysis of the market based on the type. This includes alcoholic beverages, non-alcoholic beverage, juices, milk, carbonated soft drinks, and bottled water.

Packaging Type Insights:

- Cartons

- Cans

- Bottles

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes cartons, cans, bottles, and others.

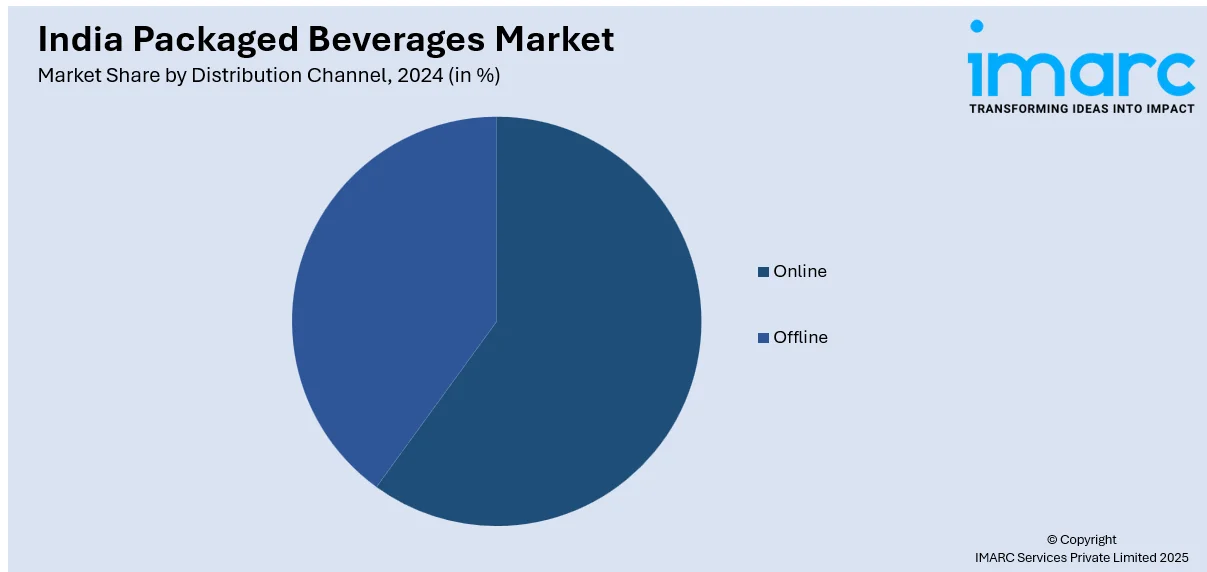

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Packaged Beverages Market News:

- In November 2024, Coca-Cola is set to launch its premium hydration brand “Vitaminwater” in India, targeting the non-sparkling segment. Expected by year-end, the rollout will focus on major cities, starting with the rapid trade channel. In the U.S., Vitaminwater comes in fruit-based flavors like “energy,” “refresh,” and “focus,” including sugar-free options. The move aligns with Coca-Cola’s strategy to expand its high-end beverage offerings in the Indian market.

- In June 2024, Coca-Cola India launched 100% recycled PET (rPET) bottles in its 250ml Affordable Small Sparkling Package (ASSP), starting in Orissa. Produced by Hindustan Coca-Cola Beverages (HCCBPL), this move strengthens the company’s commitment to sustainability. The ASSP format reduces emissions by 36%, and switching to rPET further cuts the carbon footprint by 66%. This initiative marks a significant step toward plastic circularity and a greener future for India’s beverage industry.

India Packaged Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Alcoholic Beverages, Non-Alcoholic Beverage, Juices, Milk, Carbonated Soft Drinks, Bottled Water |

| Packaging Types Covered | Cartons, Cans, Bottles, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India packaged beverages market performed so far and how will it perform in the coming years?

- What is the breakup of the India packaged beverages market on the basis of type?

- What is the breakup of the India packaged beverages market on the basis of packaging type?

- What is the breakup of the India packaged beverages market on the basis of distribution channel?

- What is the breakup of the India packaged beverages market on the basis of region?

- What are the various stages in the value chain of the India packaged beverages market?

- What are the key driving factors and challenges in the India packaged beverages?

- What is the structure of the India packaged beverages market and who are the key players?

- What is the degree of competition in the India packaged beverages market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India packaged beverages market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India packaged beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India packaged beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)