India Passenger Car Market Size, Share, Trends and Forecast by Vehicle Type, Fuel Type, Transmission Type, Price Segment, and Region, 2026-2034

India Passenger Car Market Summary:

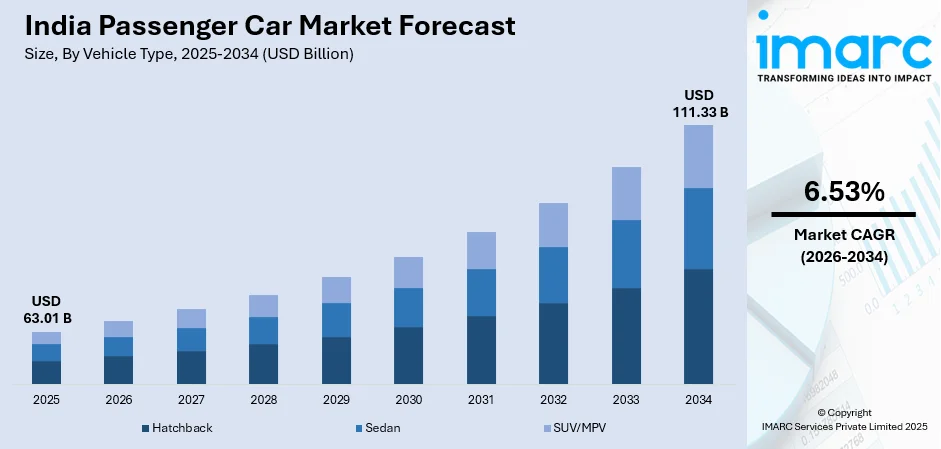

The India passenger car market size was valued at USD 63.01 Billion in 2025 and is projected to reach USD 111.33 Billion by 2034, growing at a compound annual growth rate of 6.53% from 2026-2034.

The India passenger car market is experiencing robust growth driven by rapid urbanization, rising disposable incomes among the expanding middle class, and enhanced road infrastructure developments across the country. Government initiatives including the Production-Linked Incentive scheme and Faster Adoption and Manufacturing of Electric Vehicles program are accelerating market expansion. Favorable financing options, attractive interest rates, and the proliferation of budget-friendly models tailored to local preferences are motivating first-time buyers. Manufacturers continue broadening their dealership networks while introducing feature-rich, fuel-efficient vehicles designed specifically for Indian consumers, collectively strengthening the India passenger car market share.

Key Takeaways and Insights:

-

By Vehicle Type: Hatchback dominates the market with a share of 48% in 2025, driven by compact sizing ideal for congested urban environments, affordable pricing, and superior fuel efficiency appealing to price-conscious consumers.

-

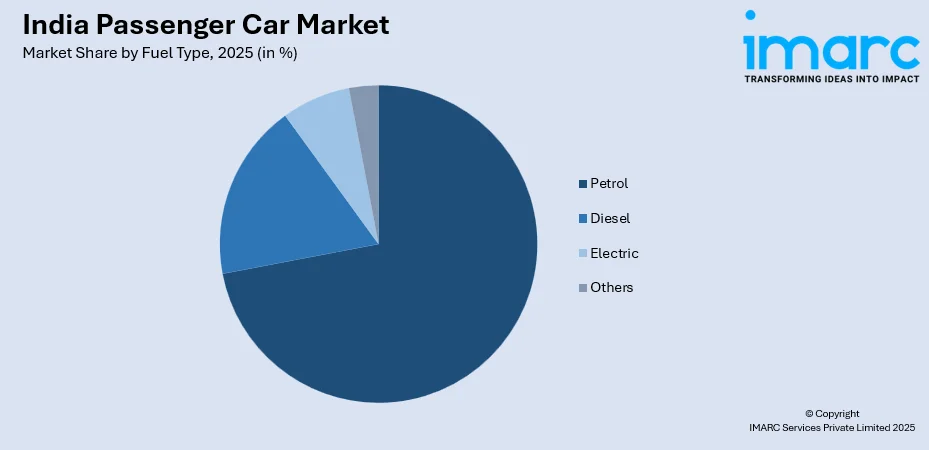

By Fuel Type: Petrol leads the market with a share of 72% in 2025, owing to extensive fuel distribution infrastructure, lower initial vehicle costs, and widespread consumer familiarity with petrol engine technology.

-

By Transmission Type: Manual represents the largest segment with a market share of 78% in 2025, attributed to lower acquisition costs, reduced maintenance expenses, and strong consumer preference particularly in semi-urban markets.

-

By Price Segment: Economy dominates with a share of 54% in 2025, reflecting price sensitivity among the growing middle-class population and first-time car buyers seeking value-oriented transportation solutions.

-

By Region: North India leads with a share of 31% in 2025, supported by high population density, improved road connectivity, and strong dealership networks across Delhi-NCR and surrounding states.

-

Key Players: The India passenger car market exhibits a fairly consolidated competitive structure, with few dominant manufacturers commanding an overwhelming majority of total market share. Domestic players leverage deep understanding of local preferences while international brands focus on localized offerings and competitive pricing strategies.

To get more information on this market Request Sample

The India passenger car market represents one of Asia's most dynamic automotive sectors, characterized by evolving consumer preferences toward fuel-efficient and technologically advanced vehicles. Customer demand is increasingly shifting toward compact SUVs and feature-rich hatchbacks, with buyers prioritizing connected car technology, enhanced safety features, and improved fuel economy. The market benefits from India's young demographic profile and projected population growth, creating sustained demand for personal mobility solutions. Government policies promoting vehicle scrappage and fleet modernization are accelerating replacement demand. In November 2024, Mahindra launched its BE 6e and XEV 9e electric SUVs at its flagship global premiere event in Chennai, introducing advanced electric origin architecture and setting new benchmarks in the premium electric vehicle segment.

India Passenger Car Market Trends:

Rising Dominance of Sport Utility Vehicles

Sport utility vehicles have emerged as the fastest-growing segment in India's passenger car market, commanding substantial market share in 2024. This shift is driven by consumer preferences for higher ground clearance, commanding driving positions, and versatile usage capabilities across urban and rural environments. Manufacturers are responding by launching feature-rich models across various price points, from compact entry-level SUVs to premium offerings incorporating electric and hybrid powertrains. The segment's growth trajectory reflects changing lifestyle aspirations among India's emerging middle class, with projections indicating continued expansion through the forecast period.

Accelerating Electric Vehicle Adoption

The hybrid and electric vehicle segment is experiencing remarkable growth, supported by increasing environmental consciousness and comprehensive government policies. The government's Vehicle Scrappage Policy targeting unfit vehicles and ambitious electrification targets are steering consumers toward cleaner alternatives. Expanding charging infrastructure across major cities and decreasing battery costs are improving accessibility for broader consumer segments. In January 2025, Maruti Suzuki unveiled its first electric vehicle, the e VITARA, at the Bharat Mobility Global Expo, offering a claimed range of over 500 kilometers and featuring advanced ADAS Level 2 capabilities. The company simultaneously announced partnerships with thirteen leading charge point operators to create seamless nationwide charging experiences.

Integration of Connected Car Technology

Advanced connectivity features are becoming standard expectations among Indian car buyers, with manufacturers integrating sophisticated infotainment systems, telematics platforms, and driver assistance technologies. Connected car platforms enable remote vehicle monitoring, real-time navigation, and over-the-air software updates that enhance ownership experiences. Safety-focused technologies including automatic emergency braking, lane departure warnings, and adaptive cruise control are increasingly available across mid-range segments. In October 2024, Qualcomm Technologies, Inc. revealed a multi-year collaboration with Google to enhance digital transformation in the automotive sector. Google AI, driven by the Snapdragon heterogeneous edge AI system-on-chip (SoC) and Qualcomm AI Hub, simplifies the deployment of AI models for vision, audio, and speech applications in the cockpit, supporting the introduction of this framework to develop Gen AI-enabled in-car experiences such as intuitive voice assistants, immersive maps, and real-time updates to meet driver needs.

Market Outlook 2026-2034:

The India passenger car market demonstrates strong growth potential underpinned by favorable demographic trends, rising urbanization, and continued economic expansion across diverse regions. With over forty percent of India's population projected to reside in cities by 2030, personal vehicle demand is expected to accelerate significantly as consumers seek convenient mobility solutions. Government infrastructure initiatives, including Bharatmala and Gati Shakti, are enhancing road connectivity nationwide, reducing travel times between major economic centers, and making car ownership increasingly desirable among the expanding middle-class population. The market generated a revenue of USD 63.01 Billion in 2025 and is projected to reach a revenue of USD 111.33 Billion by 2034, growing at a compound annual growth rate of 6.53% from 2026-2034.

India Passenger Car Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Vehicle Type | Hatchback | 48% |

| Fuel Type | Petrol | 72% |

| Transmission Type | Manual | 78% |

| Price Segment | Economy | 54% |

| Region | North India | 31% |

Vehicle Type Insights:

- Hatchback

- Sedan

- SUV/MPV

The hatchback dominates with a market share of 48% of the total India passenger car market in 2025.

Hatchbacks maintain their dominant position in the India passenger car market owing to their compact size ideally suited for navigating congested urban streets and limited parking spaces in metropolitan cities like Delhi, Mumbai, and Bangalore. These vehicles offer an optimal combination of affordability, fuel efficiency, and practicality that resonates strongly with first-time buyers and cost-conscious consumers. Budget-friendly pricing structures, lower ownership costs, and ease of maneuverability make hatchbacks particularly attractive to India's expanding middle-class population seeking reliable personal transportation without substantial financial burden.

The segment benefits from manufacturers' strategic focus on introducing feature-rich models incorporating modern amenities, improved safety standards, and enhanced fuel economy technologies that appeal to value-conscious consumers. Leading hatchback variants continue commanding strong consumer loyalty through competitive pricing strategies and extensive authorized service networks spanning urban and semi-urban markets. The availability of affordable spare parts, accessible maintenance options, and strong resale value further reinforces consumer preference for established models within this accessible entry-level vehicle category.

Fuel Type Insights:

Access the comprehensive market breakdown Request Sample

- Petrol

- Diesel

- Electric

- Others

The petrol leads with a share of 72% of the total India passenger car market in 2025.

Petrol-powered vehicles continue commanding the overwhelming majority of India's passenger car market, supported by well-established fuel distribution infrastructure spanning urban centers and rural areas alike. Lower initial acquisition costs compared to diesel and electric alternatives, combined with widespread consumer familiarity with petrol engine maintenance requirements, sustain strong preference for this fuel type. The extensive service network across both metropolitan and semi-urban regions ensures readily accessible repairs and maintenance, reinforcing consumer confidence in petrol vehicle ownership.

Recent advancements in petrol engine technology, particularly improvements in fuel efficiency and compliance with Bharat Stage VI emission norms, have significantly enhanced environmental performance while maintaining cost-effectiveness for everyday consumers. The segment also benefits from manufacturers offering diverse vehicle options across all price points, ranging from entry-level hatchbacks to premium sedans and sport utility vehicles. This extensive product portfolio enables consumers to select vehicles aligned with their specific lifestyle requirements, budgetary considerations, and performance expectations.

Transmission Type Insights:

- Automatic

- Manual

The manual holds the largest share with 78% of the total India passenger car market in 2025.

Manual transmission vehicles maintain substantial dominance in India's passenger car market, primarily driven by lower acquisition and maintenance costs that appeal to price-sensitive consumers. The significant price differential between manual and automatic variants, often ranging from fifty thousand to over two hundred thousand rupees, makes manual transmission the preferred choice for budget-conscious buyers. Additionally, manual vehicles typically demonstrate superior fuel efficiency in stop-and-go traffic conditions prevalent across Indian cities, further enhancing their economic appeal.

Consumer preference for manual transmission remains particularly strong in semi-urban and rural markets where automatic transmission awareness and servicing infrastructure continue developing gradually. The familiarity with manual gearboxes, lower maintenance costs, and widespread mechanic expertise reinforce this preference among price-sensitive buyers. However, automatic transmission adoption is increasing steadily in metropolitan areas, especially among premium segment buyers and urban professionals seeking enhanced driving convenience amid congested traffic conditions and demanding daily commutes.

Price Segment Insights:

- Economy

- Mid-Range

- Premium and Luxury

The economy holds the highest share with a 54% share of the total India passenger car market in 2025.

The economy car segment maintains clear market leadership, reflecting strong price sensitivity among India's expanding consumer base and the aspirational nature of car ownership for millions of middle-class households. Vehicles priced below ten lakh rupees dominate sales volumes, offering essential transportation needs with competitive feature sets and reliable performance. First-time car buyers graduating from two-wheelers constitute a significant proportion of economy segment purchases, prioritizing affordability and operational costs over premium features.

Manufacturers have strategically developed product portfolios addressing economy segment requirements, introducing models with competitive pricing, premium features, and ease of financing options targeting the country's middle-class population. The availability of attractive interest rates and flexible EMI structures through manufacturer-backed financing programs has significantly enhanced accessibility. Government announcements regarding GST rate reductions on certain vehicle categories in September 2025 further stimulated economy segment demand, with multiple manufacturers passing on price benefits to consumers.

Regional Insights:

- North India

- South India

- East India

- West India

North India dominates with a market share of 31% of the total India passenger car market in 2025.

North India leads the passenger car market driven by the National Capital Region's substantial population concentration, high urbanization rates, and robust economic activity across Delhi, Uttar Pradesh, Rajasthan, Punjab, and Haryana. The region benefits from extensive road infrastructure including national highways and expressways connecting major commercial centers, supporting both personal and commercial vehicle usage effectively. Government initiatives under Bharatmala Pariyojana continue enhancing connectivity, reducing travel times between key economic hubs and making private vehicle ownership increasingly attractive.

The North India passenger car market benefits from a well-established network of authorized dealerships, service centers, and financing institutions that facilitate seamless vehicle purchases across urban and semi-urban territories. Rising disposable incomes among the expanding middle-class population, coupled with improving road connectivity to tier-two and tier-three cities, continue driving demand growth. The region's diverse consumer base demonstrates strong preferences for both entry-level hatchbacks and premium sport utility vehicles.

Market Dynamics:

Growth Drivers:

Why is the India Passenger Car Market Growing?

Rapid Urbanization and Infrastructure Development

Urbanization is playing a critical role in India's passenger car market expansion, with projections indicating over forty percent of India's population will reside in cities by 2030. This demographic shift is creating increased demand for personal transportation solutions as individuals relocate to urban centers for employment and educational opportunities. The government is investing substantially in infrastructure projects including road widening, expressway construction, and smart city initiatives that enhance overall driving experiences and make car ownership increasingly desirable. Major infrastructure programs including Bharatmala Pariyojana and the PM Gati Shakti National Master Plan are accelerating highway development, reducing inter-city travel times, and improving last-mile connectivity across major urban clusters.

Rising Disposable Incomes and Expanding Middle Class

India's economic growth trajectory has created favorable conditions for passenger car market expansion, with rising household incomes enabling increased consumer spending on personal vehicles. The country's burgeoning middle class, with household incomes increasingly crossing the ten lakh rupees per annum threshold, demonstrates growing capacity for automobile purchases. Accessible financing options including attractive interest rates, extended loan tenures, and manufacturer-backed financing schemes have lowered entry barriers for first-time buyers. The combination of aspirational vehicle ownership among younger demographics, favorable lending conditions, and improving economic prosperity is sustaining demand momentum across all market segments.

Government Incentives and Policy Support

Government initiatives are substantially influencing market growth through targeted incentives and favorable regulatory frameworks. The Faster Adoption and Manufacturing of Electric Vehicles scheme provides subsidies for electric vehicle purchases and manufacturing incentives for battery production, accelerating India's transition toward sustainable mobility. The Production-Linked Incentive scheme is attracting foreign manufacturers while increasing domestic production capacity and reducing import dependency. Reduced GST rates on electric vehicles from 12% to 5%, along with state-level incentives including road tax exemptions and registration fee waivers, are improving vehicle affordability. The Vehicle Scrappage Policy targeting phaseout of aging vehicles is additionally stimulating replacement demand across consumer segments.

Market Restraints:

What Challenges the India Passenger Car Market is Facing?

High Total Ownership Costs

Elevated ownership costs including fuel expenses, mandatory insurance premiums, periodic maintenance requirements, and various government-imposed taxes present significant barriers for potential buyers. Registration fees, road taxes, and recurring compliance costs add substantially to overall vehicle expenditure beyond initial purchase prices. These cumulative financial obligations particularly impact price-sensitive consumer segments, limiting market expansion among first-time buyers.

Urban Congestion and Parking Constraints

Severe traffic congestion across major metropolitan areas and chronic shortage of adequate parking facilities in densely populated urban centers adversely affect vehicle ownership attractiveness. Extended commute times, fuel wastage during traffic jams, and difficulties finding parking spaces in commercial and residential districts create consumer hesitation. These infrastructure limitations discourage potential buyers despite rising disposable incomes.

Limited Electric Vehicle Charging Infrastructure

Inconsistent electric vehicle charging infrastructure availability across regions remains a significant impediment to accelerated adoption. While metropolitan areas are witnessing charging network expansion, inadequate coverage in semi-urban and rural territories limits consumer transition toward electric alternatives. Concerns regarding range anxiety and lengthy charging durations further discourage potential buyers despite favorable government incentive policies.

Competitive Landscape:

The India passenger car market exhibits a fairly consolidated competitive structure, with a handful of leading manufacturers commanding the majority of total market share. Domestic players leverage deep understanding of local consumer preferences, established nationwide distribution networks, and comprehensive after-sales service infrastructure to maintain leadership positions. International manufacturers have also successfully established substantial market presence through localized product offerings, competitive pricing strategies, and focused investments in production facilities. The market is witnessing intensified competition in the electric vehicle segment, with both established players and new entrants introducing advanced offerings to capture emerging demand opportunities.

Recent Developments:

-

December 2024: Honda introduced the third-generation Amaze in India with a refreshed exterior design, upgraded interior elements, and enhanced performance specifications to meet evolving preferences of Indian compact sedan buyers.

India Passenger Car Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Trillion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, SUV/MPV |

| Fuel Types Covered | Petrol, Diesel, Electric, Others |

| Transmission Types Covered | Automatic, Manual |

| Price Segments Covered | Economy, Mid-Range, Premium and Luxury |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India passenger car market size was valued at USD 63.01 Billion in 2025.

The India passenger car market is expected to grow at a compound annual growth rate of 6.53% from 2026-2034 to reach USD 111.33 Billion by 2034.

Hatchback dominated the market with 48% share in 2025, driven by compact sizing suited for urban environments, affordable pricing, superior fuel efficiency, and strong appeal among first-time buyers and cost-conscious consumers.

Key factors driving the India passenger car market include rapid urbanization and infrastructure development, rising disposable incomes among the expanding middle class, favorable government incentives including PLI and FAME schemes, and improving financing accessibility.

Major challenges include high total ownership costs encompassing fuel, insurance, and maintenance expenses, severe urban traffic congestion and parking constraints in metropolitan areas, and inconsistent electric vehicle charging infrastructure across regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)