India Passive Electronic Components Market Size, Share, Trends and Forecast by Type, End Use Industry, and Region, 2025-2033

India Passive Electronic Components Market Overview:

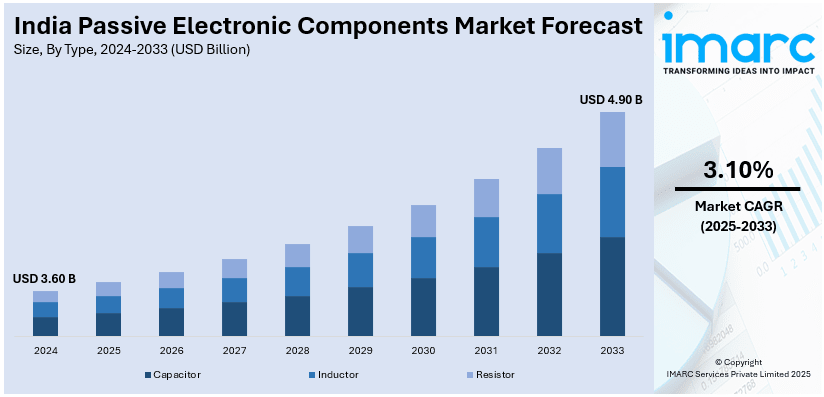

The India passive electronic components market size reached USD 3.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.90 Billion by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. Government initiatives such as the Production-Linked Incentive (PLI) scheme, rising demand for consumer electronics, expanding domestic manufacturing capabilities, substantial investments in semiconductor and component production, and the push for self-reliance under the "Make in India" initiative are key factors driving India's passive electronic components market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.60 Billion |

| Market Forecast in 2033 | USD 4.90 Billion |

| Market Growth Rate 2025-2033 | 3.10% |

India Passive Electronic Components Market Trends:

Rapid Growth of the Consumer Electronics Industry

One of the key drivers of the demand for passive electronic components in India is the rapid progress of the consumer electronics industry. India has become a major market for electronics products like smartphones, laptops, televisions, and wearable devices, which heavily depend on passive components such as resistors, capacitors, and inductors. As per the IMARC Group, the India consumer electronics market reached USD 152.59 Billion by 2033. With the increasing number of middle-class people and higher disposable incomes, the penetration of smart devices has accelerated, hence escalating demand for high-performance miniaturized passive components. The "Make in India" scheme initiated by the Indian government has also supported the local production of electronic items by making indigenous electronics manufacturing a favorite destination for the production of electronic components. The emergence of Internet of Things (IoT) devices and smart home technology further increases the need for passive components since these devices require efficient circuit designs that include different resistors, capacitors, and inductors to function smoothly.

To get more information on this market, Request Sample

Expansion of the Automotive and Industrial Sectors

The expanding automobile sector in India, especially the transition to electric vehicles (EVs), is another key trend driving the market for passive electronic components. EVs need sophisticated electronic systems to manage batteries, distribute power, and provide entertainment within the vehicle, all of which are reliant on passive components. Moreover, the use of Advanced Driver Assistance Systems (ADAS) and infotainment systems in newer vehicles raises the need for capacitors, transformers, and inductors. In addition to the automotive industry, industrial automation and intelligent manufacturing trends have also driven the need for passive electronic components. The development in Industry 4.0 technologies, such as robotics, machine learning, and automated production lines, necessitates strong electronic circuits for smooth operation. With more investments in infrastructure and automation, the need for high-reliability and durable passive components in India is on the rise, and it is a major driver of the industry.

India Passive Electronic Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and end use industry.

Type Insights:

- Capacitor

- Ceramic Capacitors

- Tantalum Capacitors

- Aluminum Electrolytic Capacitors

- Paper and Plastic Film Capacitors

- Supercapacitors

- Inductor

- Power

- Frequency

- Resistor

- Surface-Mounted Chips

- Network

- Wire wound

- Film/Oxide/Foil

- Carbon

The report has provided a detailed breakup and analysis of the market based on the type. This includes capacitor (ceramic capacitors, tantalum capacitors, aluminum electrolytic capacitors, paper and plastic film capacitors, and supercapacitors), inductor (power and frequency), and resistor (surface-mounted chips, network, wire wound, film/oxide/foil, and carbon).

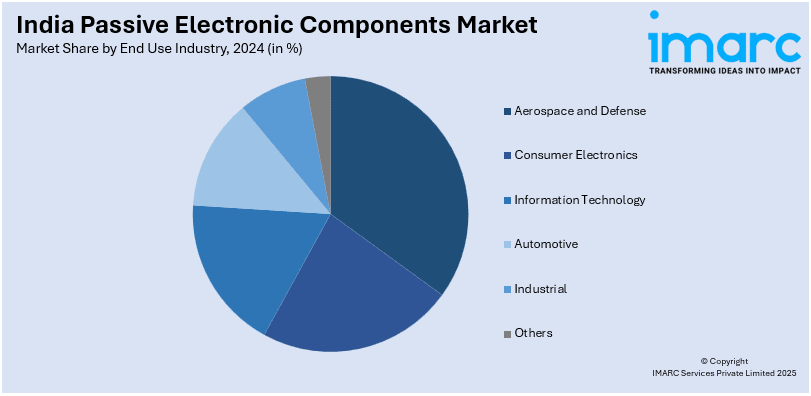

End Use Industry Insights:

- Aerospace and Defense

- Consumer Electronics

- Information Technology

- Automotive

- Industrial

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes aerospace and defense, consumer electronics, information technology, automotive, industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Passive Electronic Components Market News:

- November 2024: Keltron inaugurated India's first supercapacitor manufacturing unit at Kannur in Kerala. This new development augments indigenous manufacturing strengths, cutting imports of these important passive components. The setup augments India's role in the international electronics sector by developing indigenous capabilities for the production of high-tech electronic components.

- October 2024: A report by FICCI found that Taiwanese businesses had a USD 15 billion investment potential in India's EV and electronics sectors, with fields such as PCBs and passive devices. The investment opportunity will help augment the local production of passive electronic components. As a result, the additional manufacturing capability is likely to reinforce India's role in the global electronics value chain.

India Passive Electronic Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Use Industries Covered | Aerospace and Defense, Consumer Electronics, Information Technology, Automotive, Industrial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India passive electronic components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India passive electronic components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India passive electronic components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The passive electronic components market in India was valued at USD 3.60 Billion in 2024.

The India passive electronic components market is projected to exhibit a CAGR of 3.10% during 2025-2033, reaching a value of USD 4.90 Billion by 2033.

The India passive electronic components market is driven by rising demand from consumer electronics, automotive, and industrial automation sectors. Growth is fueled by the adoption of IoT, 5G, and smart devices, government initiatives promoting electronics manufacturing, and increasing need for compact, energy-efficient, and high-performance electronic components.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)