India Passive Optical Network Equipment Market Size, Share, Trends and Forecast by Component, Type, Application, End User, and Region, 2025-2033

India Passive Optical Network Equipment Market Overview:

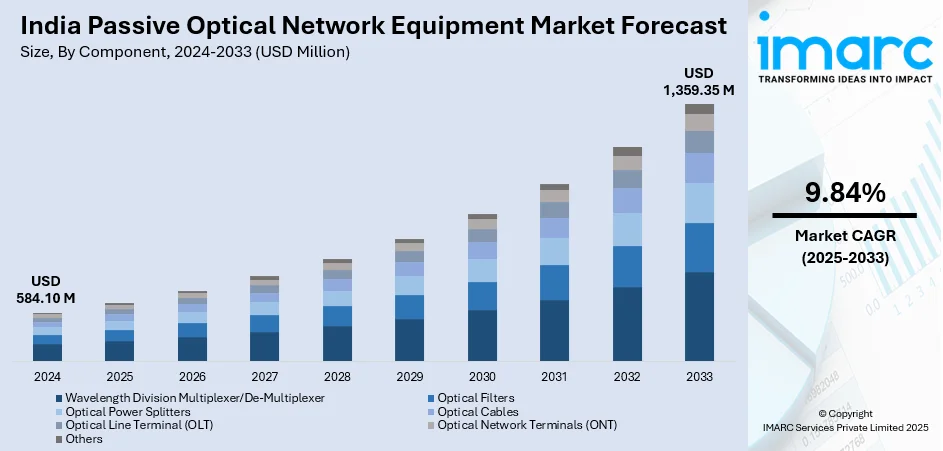

The India passive optical network equipment market size reached USD 584.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,359.35 Million by 2033, exhibiting a growth rate (CAGR) of 9.84% during 2025-2033. The India passive optical network (PON) Equipment market is driven by rising broadband penetration, rapid urbanization, increasing adoption of Fiber-to-the-Home (FTTH) services, smart city initiatives, expansion of data-intensive applications, growth in cloud computing, 5G rollout, government incentives like the PLI scheme, and localization of telecom equipment manufacturing by key players.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 584.10 Million |

| Market Forecast in 2033 | USD 1,359.35 Million |

| Market Growth Rate 2025-2033 | 9.84% |

India Passive Optical Network Equipment Market Trends:

Rising Demand for Green Network Solutions

With the pace of digitalization gaining momentum in India, there is a greater focus on energy-efficient and sustainable network infrastructures. Conventional network systems tend to be dependent largely on electrical parts, resulting in high energy consumption and carbon footprints. Conversely, Passive Optical Networks (PONs) implement the use of passive devices such as power-free optical splitters, thus saving energy and keeping the environment safe. Implementing PON technology fits the worldwide trend toward green practices, as it enables the building of low-carbon optical networks. By removing the need for active electronic components between the central office and end-users, PONs reduce not only power consumption but also heat generation, which indirectly minimizes cooling needs and operational expenses. Such energy efficiency is especially important for telecom operators seeking to achieve sustainability objectives and minimize operational expenses.

To get more information on this market, Request Sample

Rapid Urbanization and Smart City Development

India is experiencing rapid urbanization, with millions of rural migrants moving to cities in pursuit of better opportunities. As many as 40% of India's population is likely to be living in cities by 2030, putting huge pressure on infrastructure, including telecom networks. The urban transition is compelling telecom players to invest and upgrade their broadband infrastructure to provide high-speed and efficient connectivity in high-density urban areas. Furthermore, the Indian government's Smart Cities Mission to create more than 100 smart cities with integrated digital infrastructure has substantially raised the need for strong fiber-optic networks. Smart cities depend on sophisticated technologies like IoT (Internet of Things), AI-driven surveillance, self-driving traffic management, and real-time monitoring of public services all of which demand high-speed, low-latency connectivity. The capacity of fiber-optic networks to transmit data on a large scale with minimal signal loss makes them suitable for use in smart city applications, with seamless communication between urban management systems and smart devices.

India Passive Optical Network Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, type, application, and end user.

Component Insights:

- Wavelength Division Multiplexer/De-Multiplexer

- Optical Filters

- Optical Power Splitters

- Optical Cables

- Optical Line Terminal (OLT)

- Optical Network Terminals (ONT)

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes wavelength division multiplexer/de-multiplexer, optical filters, optical power splitters, optical cables, optical line terminal (OLT), optical network terminals (ONT), and others.

Type Insights:

- Gigabit Passive Optical Network (GPON)

- Ethernet Passive Optical Network (EPON)

- Next Generation Passive Optical Network (NG PON)

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes gigabit passive optical network (GPON), ethernet passive optical network (EPON), next generation passive optical network (NG PON), and others.

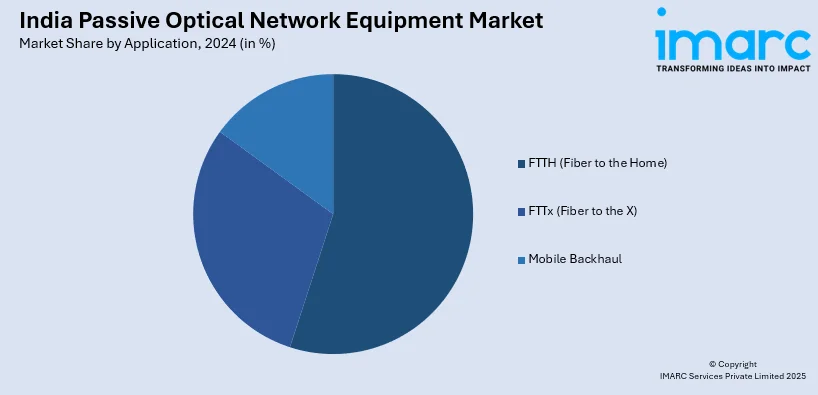

Application Insights:

- FTTH (Fiber to the Home)

- FTTx (Fiber to the X)

- Mobile Backhaul

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes FTTH (fiber to the home), FTTx (fiber to the X), and mobile backhaul.

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Passive Optical Network Equipment Market News:

- December 2024: The Department of Telecommunications (DoT) advocated for an expanded Production Linked Incentive (PLI) scheme to localize the manufacturing of telecom equipment and meet the rising export demand for 4G and 5G gear. This initiative led to significant import substitution, achieving 60% in telecom products and nearing self-reliance in Gigabit Passive Optical Network (GPON) equipment. Consequently, the increased domestic production of GPON gear bolstered India's Passive Optical Network Equipment market.

- November 2024: Dixon Technologies and Nokia collaborated to manufacture fixed broadband devices, including GPON, 5G FWA, and Mesh Wi-Fi, at a Noida facility with a capacity of up to 10 million units annually. This initiative addressed the escalating demand for high-speed broadband in India, driven by surge in adoption of Fiber to the Home (FTTH) and 5G technologies. By localizing production, the partnership enhanced the domestic supply chain, reduces reliance on imports, and stimulated the Passive Optical Network equipment market in India.

- October 2024: GX Group launched Wi-Fi routers and GPON ONTs made from recycled and biodegradable materials under its 'Ecoverse' initiative, aligning with India's climate action goals targeting net-zero carbon emissions by 2070. This development is driving the Indian Passive Optical Network Equipment market by introducing eco-friendly products that meet the propelling demand for sustainable telecom infrastructure.

India Passive Optical Network Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Wavelength Division Multiplexer/De-Multiplexer, Optical Filters, Optical Power Splitters, Optical Cables, Optical Line Terminal (OLT), Optical Network Terminals (ONT), Others |

| Types Covered | Gigabit Passive Optical Network (GPON), Ethernet Passive Optical Network (EPON), Next Generation Passive Optical Network (NG PON), Others |

| Applications Covered | FTTH (Fiber to the Home), FTTx (Fiber to the X), Mobile Backhaul |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India passive optical network equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the India passive optical network equipment market on the basis of component?

- What is the breakup of the India passive optical network equipment market on the basis of type?

- What is the breakup of the India passive optical network equipment market on the basis of application?

- What is the breakup of the India passive optical network equipment market on the basis of end user?

- What are the various stages in the value chain of the India passive optical network equipment market?

- What are the key driving factors and challenges in the India passive optical network equipment market?

- What is the structure of the India passive optical network equipment market and who are the key players?

- What is the degree of competition in the India passive optical network equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India passive optical network equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India passive optical network equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India passive optical network equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)