India Pay TV Market Size, Share, Trends and Forecast by Type, Technology Type, Application, and Region, 2025-2033

India Pay TV Market Size and Share:

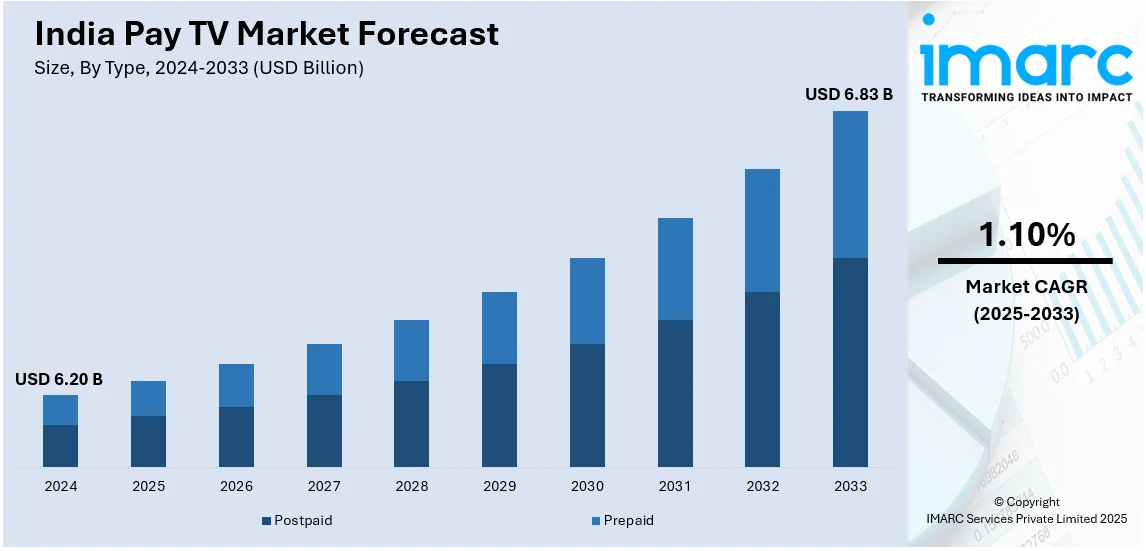

The India pay TV market size reached USD 6.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.83 Billion by 2033 exhibiting a growth rate (CAGR) of 1.10% during 2025-2033. The market is driven by strong regional content demand, bundled service offerings, rural viewership growth, government digitization initiatives, affordability of DTH services, expanding sports and live event broadcasts, and surging partnerships between broadcasters and telecom operators for integrated media consumption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.20 Billion |

| Market Forecast in 2033 | USD 6.83 Billion |

| Market Growth Rate (2025-2033) | 1.10% |

India Pay TV Market Trends:

Rising Competition from OTT Platforms

The India pay TV market growth is experiencing industry momentum from over-the-top (OTT) streaming platforms because Indian consumers now use smartphones and access affordable mobile data. People who live in urban regions prefer digital streaming because they enjoy easy access along with customizable plans and access to large content catalogs. Moreover, large OTT content providers Netflix and Amazon Prime Video along with Disney+ Hotstar are developing local programming which undercuts regular cable and DTH services. Additionally, Jio and Airtel along with other telecom providers are integrating streaming services into their broadband and mobile plans to speed up the loss of traditional pay TV customers. For instance, in November 2024, Disney and Reliance Industries completed an $8.5 billion merger, creating Jio Star, a media powerhouse with over 100 TV channels and 50 million streaming subscribers. This strategic consolidation is set to enhance content offerings and strengthen traditional pay TV by investing in innovative programming, ensuring that television remains a relevant and competitive entertainment medium. Also, the continuing development of fiber internet poses significant risks to future growth in pay TV subscriber numbers because satellite and cable TV continue to remain dominant in rural areas. As a result, of these changing consumer preferences, pay TV operators integrate OTT platforms, and provide hybrid set-top boxes and enhanced media services to maintain a subscriber base, which is boosting the India pay TV market share.

To get more information on this market, Request Sample

Growth of Regional and Vernacular Content

The India pay TV market has seen success due to regional and local content because native language entertainment continues to expand in popularity. In line with this, the Indian linguistic diversity which consists of more than 20 official languages helps boost the popularity of state-based channels throughout India. Concurrently, broadcasters dedicate substantial funds to create programming in local languages and show original productions as well as news broadcasts to build and maintain their viewer base. The channel sector is also expanding rapidly in Tamil, Telugu, Bengali, and Marathi languages throughout tier-2 and tier-3 cities because these areas have strong regional language preferences. Besides this, the expansion of content produced for hyperlocal tastes and cultural preferences about certain dialects drives up the number of people watching shows from their native regions. Additionally, government initiatives are promoting accessibility in television, as seen in the launch of Channel 31, India’s first 24x7 DTH channel for Indian Sign Language (ISL) in December 2024. It is operated by the National Council of Educational Research and Training (NCERT), which provides educational resources for hearing-impaired students, supporting inclusive education under the National Education Policy 2020. Furthermore, advertisers spend an increasing amount on regional networks precisely to enhance their marketing effectiveness toward local consumer sectors. Apart from this, pay TV providers boost their regional channel supply and develop personalized streaming packages to keep subscribers engaged in markets with multiple linguistic groups, thereby enhancing the India pay TV market outlook.

India Pay TV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, technology type and application.

Type Insights:

- Postpaid

- Prepaid

The report has provided a detailed breakup and analysis of the market based on the type. This includes postpaid and prepaid.

Technology Type Insights:

- Cable TV

- DTT and Satellite TV

- Internet Protocol Television (IPTV)

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes cable TV, DTT and satellite TV, and internet protocol television (IPTV).

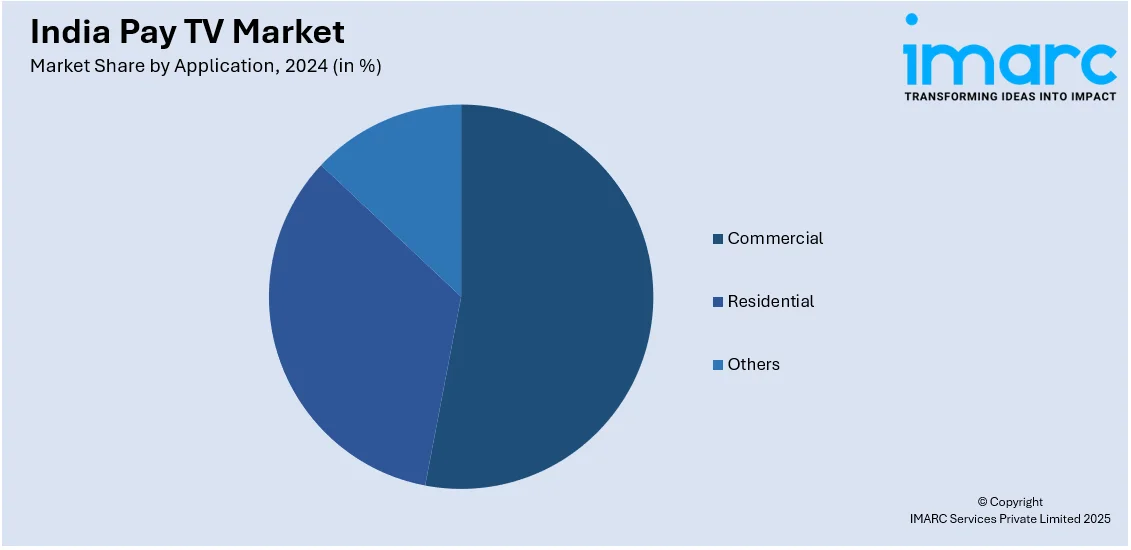

Application Insights:

- Commercial

- Residential

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial, residential, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pay TV Market News:

- In March 2025, Tata Sons received regulatory approval from the Competition Commission of India (CCI) to acquire an additional 10% stake in Tata Play, raising its ownership to 70%. This move strengthens Tata Sons' position in the pay TV sector, enhancing its ability to innovate and compete effectively.

- In November 2024, Sony India secured media rights for all Asian Cricket Council (ACC) tournaments until 2031, valued at $170 million. This deal allows Sony to broadcast major Asian cricket events, strengthening its sports content offerings and appealing to a broader audience.

India Pay TV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Postpaid, Prepaid |

| Technology Types Covered | Cable TV, DTT and Satellite TV, Internet Protocol Television (IPTV) |

| Applications Covered | Commercial, Residential, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pay TV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pay TV market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pay TV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pay TV market in India was valued at USD 6.20 Billion in 2024.

The India pay TV market is projected to exhibit a CAGR of 1.10% during 2025-2033, reaching a value of USD 6.83 Billion by 2033.

The growth of the India pay TV market is driven by rising disposable incomes, increased access to television services in rural and semi-urban areas, and strong demand for regional and entertainment content. The availability of affordable subscription packages, technological advancements in set-top boxes, and bundled service offerings with internet and mobile plans also support continued market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)