India Pectin Market Size, Share, Trends and Forecast by Raw Material, End Use, and Region, 2025-2033

India Pectin Market Overview:

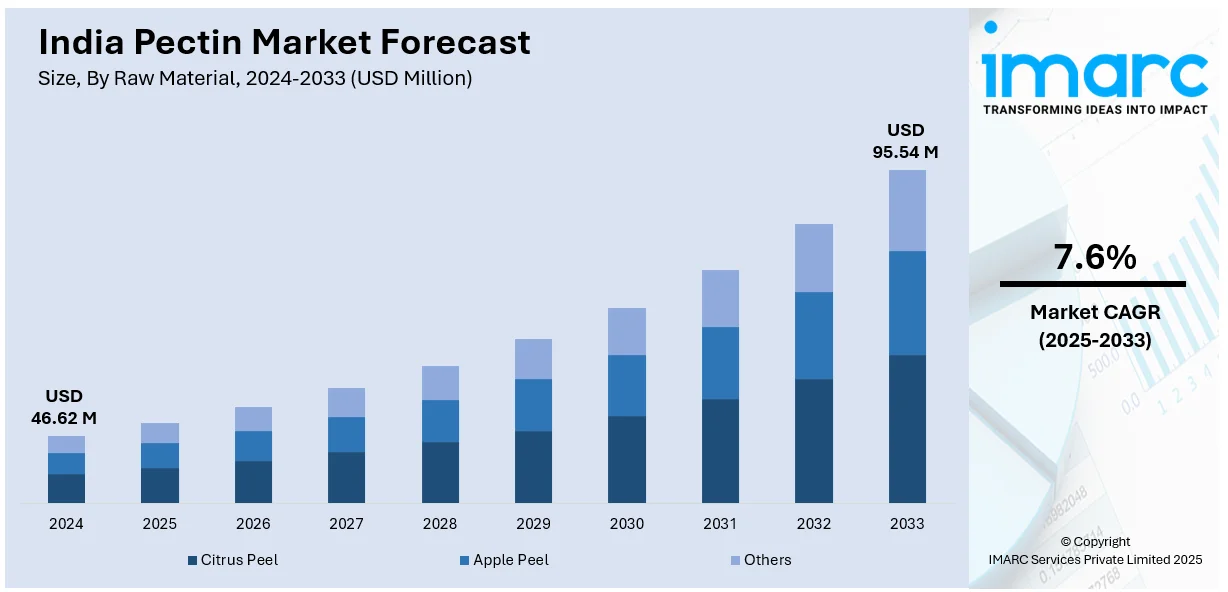

The India pectin market size reached USD 46.62 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 95.54 Million by 2033, exhibiting a growth rate (CAGR) of 7.6% during 2025-2033. The rising demand for natural thickeners in food and beverages, increasing consumption of jams and jellies, growing health consciousness, expanding pharmaceutical applications, clean-label trends, and a surge in processed food production are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 46.62 Million |

| Market Forecast in 2033 | USD 95.54 Million |

| Market Growth Rate (2025-2033) | 7.6% |

India Pectin Market Trends:

Expanding Use of Sustainable Pectin from Local Sources

The growing focus on plant-based alternatives is driving innovation in ingredient sourcing, particularly for pectin. Traditionally derived from citrus peels, the extraction of this stabilizer from fruit waste is gaining attention as a sustainable and cost-effective approach. Utilizing mango waste for production reduces import dependence and supports domestic supply chains, benefiting food processors seeking locally sourced thickeners and gelling agents. This development aligns with the increasing demand for natural, clean-label ingredients that enhance texture and shelf life without synthetic additives. The adoption of alternative pectin sources also contributes to waste reduction, reinforcing circular economy initiatives. As sustainability remains a priority, innovations in extraction methods and new applications for plant-based pectin are shaping the future of food formulations. For example, in November 2022, Mumbai-based Food and Inns announced its plans to introduce Tetra Pak Recart packaging in India, aiming to replace traditional tin cans. This move aligns with the country's sustainability goals and reflects a shift toward eco-friendly packaging solutions. Additionally, the company is exploring pectin production from mango waste, offering a plant-based gelatin alternative. This initiative could reduce reliance on imported pectin, benefiting the domestic market.

To get more information on this market, Request Sample

Growing Demand for Stabilizers in Traditional Dairy-Based Beverages

The increasing focus on enhancing the stability and texture of dairy-based drinks is driving the development of advanced stabilizing solutions. Formulations with high salt content, such as spiced buttermilk, often face challenges related to protein precipitation and texture inconsistency. Innovations in ingredient technology are addressing these concerns by ensuring uniform consistency and preventing sedimentation. As consumers prioritize traditional flavors alongside improved sensory experiences, solutions that maintain product authenticity while extending shelf life are gaining prominence. The shift toward clean-label, natural stabilizers is further shaping product formulations, with food manufacturers emphasizing quality without synthetic additives. The expansion of dairy product categories and the rising preference for ready-to-drink options reinforce the need for functional ingredients that enhance stability and overall drinking experience. For instance, in October 2021, CP Kelco introduced GENU Pectin YM-SAL 200, a stabilizer designed for India's popular salted buttermilk beverage. This pectin solution enhances protein stability in high-salt formulations, ensuring a smooth texture without sedimentation. It supports traditional taste preferences while improving product quality and shelf life.

India Pectin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on raw material and end use.

Raw Material Insights:

- Citrus Peel

- Apple Peel

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes citrus peel, apple peel, and others.

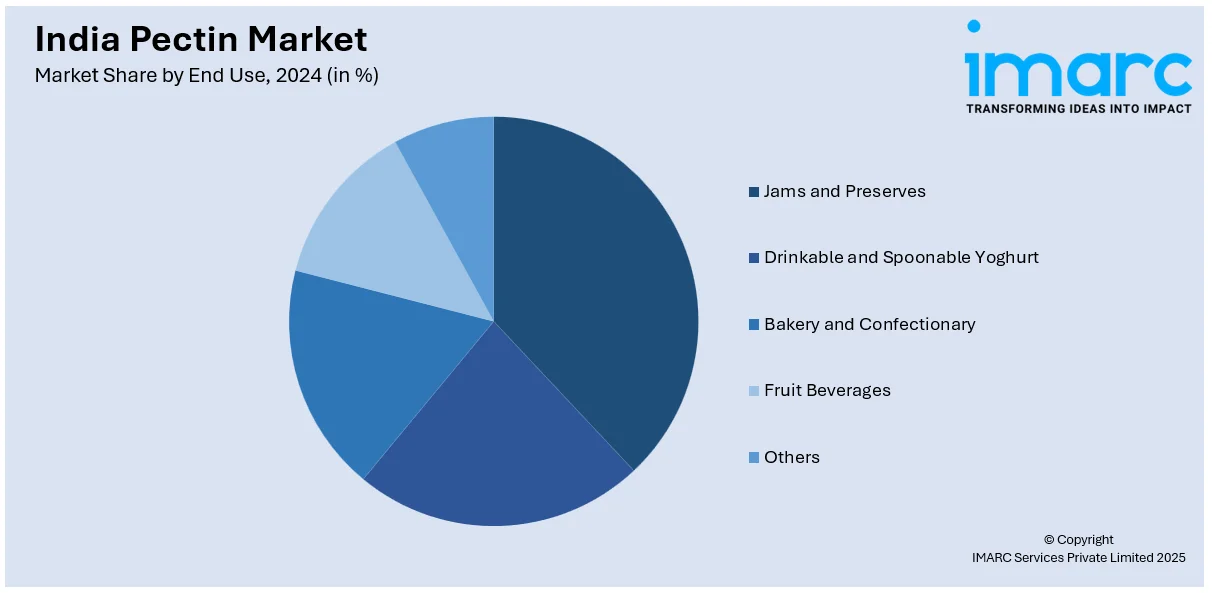

End Use Insights:

- Jams and Preserves

- Drinkable and Spoonable Yoghurt

- Bakery and Confectionary

- Fruit Beverages

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes jams and preserves, drinkable and spoonable yoghurt, bakery and confectionary, fruit beverages, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Pectin Market News:

- In September 2023, Cargill launched UniPECTINE LMC, a new range of low methoxyl conventional pectins, developed with proprietary technology to enhance texture in low-sugar and high-fruit jams, as well as bakery fruit fillings. This innovation aligns with consumer demand for sugar reduction and clean-label products.

India Pectin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Citrus Peel, Apple Peel, Others |

| End Uses Covered | Jams and Preserves, Drinkable and Spoonable Yoghurt, Bakery and Confectionary, Fruit Beverages, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India pectin market performed so far and how will it perform in the coming years?

- What is the breakup of the India pectin market on the basis of raw material?

- What is the breakup of the India pectin market on the basis of end use?

- What are the various stages in the value chain of the India pectin market?

- What are the key driving factors and challenges in the India pectin market?

- What is the structure of the India pectin market and who are the key players?

- What is the degree of competition in the India pectin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India pectin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India pectin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India pectin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)